Here cheif.... here is the bullish side of the coin it should make you happy..... I lie awake at night and feel bad

when you are not happy Don..... you deserve every happiness and blessing in the world... as do all our SI

friends..

this is from 6:45 AM this Monday on the My Market Laboratory thread

Message 31315975

Attention the TNX is running the show.... A close above 2.40% ....is fine...no big deal but the global macro

money managers will be watching to see how quickly or how slowly.... we get to 2.62, the Dec 15th high of

2016. If we meander around for 3 months below that level ....... put the accelerator on US equity prices and

global equity prices as we could rip ... really rip higher... like the good old days of 1998, 1999,

these are the best of times. A valid case can be made that the FED does not need to contract their balance

sheet at all. 4.6 Trillion.... give or take a few billion as to where it's at .... what is the problem with the FED

having a 4.6 Trillion dollar balance sheet. At the end of WWII , President Harry S Truman, was deeply concerned about how huge the US budget and the US budget deficit was compared to 1940, prior to the

USA involvement in WWII. But it did not represent a problem for the US Government, the FED or anyone

else. It was just a reset.

The balance sheets of the Major central banks can stay where they are ... why reduce them? the

Normalization of Interest rates and reduction of Central Bank balance sheets are 2 completely different

topics of discussion. We have had an expansion of Infrastructure spending, and other benefits of the

enhanced ability of the Government to provide services efficiently. That is as much technology upgrades and new technology, which is more powerful and cheaper at the same time.

The Era of Exponentiality..... So many people are suspicious of Bitcoin and the crytptocurrencies that Bitcoin could be at $20,000 or the $35,000 target ... that was presented here 4 weeks ago by a WS strategist.

Ethereum, I do believe is going to out perform Bitcoin on a % basis.

Darell Cronk of WFC is saying we are not at the Euphoria stage yet... but he feels we are closer than another

18 months of pure run and gun...... and GO, GO ,GO equity inflation.

stay tuned....... tax reform .. which should come will push US and global equity earnings higher...... People are not totally in the market ... and so their is plenty of dry powder yet to get deployed in the stock

market.

that is the bullish side of the case and we have gone up all year..... sector rotation yet...... you definitely

don't want to be in traditional retail stocks....... nor frightening legacy companies like GE, T many of the

media stocks have been lousy places to be especially Viacom.... Chipotle has had a 3 year debacle...

a $700 stock now down below $300.

NVDA,BABA, ALGN, MU, PYPL, FSLR.CAT, BIDU, ABBV,NRD, ISRG, BA, ADBE, HTHIY, TVEHY, TCTZF

GLNCY the SMH etf, the healthcare ETF have been huge outperformers......

this was OX's response to my post

siliconinvestor.com

and my reponse to his response....

siliconinvestor.com

-----------------------------------------------------------------------------------------------

This has been on My market lab thread head the past 3 or 4 weeks..........

The Strength of the rally has been broadly impressive, At the start of the year I was a very large advocate

that the Congress should not attempt to lead with a replacement of the ACA as it was the mathematically

hardest program to deal with, and should instead focus on a restructuring of the tax code, a 1 time

special time window where US companies could repatriate the 1.5 to 4 Trillion dollars that they hold

offshore back to the US at a 6.5% rate, which was what was done in the Reagan - Tip O'Neil compromise /

tax reform of 1986. Also that the administration focus on reducing and stream lining the overly cumbersome regulatory environment. Studies are coming out that the DJT administration has made significant inroads in

the reduction of federal regulatory overreach and that is one of the strong tail winds that the stockmarket

has experienced all year.

Now that the repeal of the ACA has been shelved, the US congress can focus on coming up with a

tax reform and simplification bill and one that makes the USA more competitive globally. Steve Liesman,

of CNBC had excellent statistics showing that Republicans are much more positive on the economy than

they were under the Obama administration, Democrats do not feel as strongly as Republicans that the

economy is more conducive towards business but the numbers have improved from the BHO admin.

And Independent voters have swung from a negative 16% view of economic prospects to a positive view

of 18% . In all 3 cases quite significant swings. This should not be underestimated

Beyond that we have a business friendly President and out last President was anti business. It makes a huge difference and as visibility regarding regulation and the significant and profound reduction in excess regulation, coupled with the probusiness initiative and the likelyhood of a Tax restructuring recurring and this explains why the US stock market and global indicies have performed so constructively.

The market rally several weeks ago was lead by the energy stocks, the material stocks, and small

capitalization stocks and has been broadening out recently as the SPX moved above it's upper Bollinger

Band for the first time since early July, and before that it was the 3 week of April that witnessed the BB

breaking above it's upper boundary. Very bullish price action.

The 5 year weekly SPX is also looking quite strong.. the weekly RSI has moved higher than the Peak momentum reading in July.... indicating momentum to the move.

On the SPX the Money Flow Index has been persistently strong and is in a buy signal on it's Moving average crossover system. the RSI has made a new momentum high for the rally . It is the first time we have had such strong reading since we reached 2400 on March 1st 2017. The move above the BB, suggests a higher high to come as does the new high in momentum on the ROC models and the RSI model. Also the Chaikin Money flow index has reached a new high for the year which is a powerful statement of how strong the accumulation on this rally is.

The RUT is also significant above it's upper Bollinger band , showing the momentum of the small cap rally.

The RSI on the 5 year daily chart is showing the greatest momentum on the daily chart in the last 5 year.. and is also the most extended above it's upper BB in the last 5 years.... Some are making a reasonably sounding argument that this powerful momentum is a moment of mass realization of the idea that the market can push on significantly higher.. In Elliott wave terms...... it's typically described as the 3rd of the 3rd of the 3rd type Elliott wave bull market action.

The NYSE index also has quite a number of very bullish attributes to it... they are described on the chart

below.

and for quite a number of Global Macro Asset managers, they have been commenting on how the US stockmarket has been at the higher end of the the price earnings, price sales, price to book ratio's. While

simultaneously pointing out that the Emerging Market PE's and other valuation metrics are still very, very cheap... even with the the rebound in prices the past 12 to 15 months.

Here is a weekly chart of EEM which is the most heavily owned Emerging Market ETF.

The notion of a melt-up in the market is actively being discussed. The market' s resilience during it's period of seasonal weakness is the type of time cycle action that will let the market be very strong as it holds up and advanced during a seasonally weak period.

We now have an equally unprecedented event transpiring with the Central banks now all attempting to

normalize their yield curves and normalized interest rates. It is completely unknown and unknowable

exactly how well or how poorly the various countries and central banks which have wildly dissimilar economic

conditions, values of their currencies, demographics, Debt to GDP levels, levels of economic

growth, wildly differing increases and potential bubbles in residential and commercial real

estate in their major hub cities. Think Vancouver, Sydney, Auckland Hong Kong even Swenden.

I am fairly certain that the Foreign Exchange relationships in the global currencies markets are going to be the hardest aspect that the Central Banks and the governments of the world will have to deal with as this

multiyear interest rate normalization transpires. The Interest rate differentials between the various key

currencies in the world especially the big 5, EUR, JPY, USD, GBP, YUAN.

The $64,000 question....... is how well will these central banks be able to be able to work in unison to

raise global interest rates and normalize the interest rate and structures of the yield curves around

the world.

Jeffrey Saut of Raymond James who is one of the more savvy market participants I know outlined a

distinctly bullish secular case for US and global equity prices. He stated, that bull markets have 3 stages.

The first leg of the long term multi year secular bull driven by supremely low interest rates started on 03/09/2007 and then topped in June 2015 again.... driven by super low interest rates..... into the February Crude oil crash lows where The Royal Bank of Scotland was saying to sell everything.

He now feels that we are in the early innings of the second stage of a idealized (possibly 18-21 year) secular bull market which will be driven by earnings growth....... the third Stage (in his scenario) will be another very speculative mania ala 1928-29 in the US, the late 1980's in Japan, and the .com and B2B Bubble Market of the late 1990s which peaked in March of 2000. after the FED had Y2K concerns ameliorated. (the very last flourish of the Y2K concern was that February 29th of 2000 was a leap year... there was some slight concern that it being a leap year in the new millennium might mess with the legacy COBOL computer.systems.

Jeff Saut has no idea when this second phase of the multiyear secular bull market will end and let us remember that this is one viewpoint.

The Future is always playing out so radically different than even the most prescient of our thought leaders envision, it is wise to remain flexible, have an asset allocation plan which is prudent for each individual and or course will be different.....adapt to market developments as they unfold

We shall let the Market Tell us WHAT THE MARKET WANTS TO DO.

FOOD FOR THOUGHT: the crosscurrents are as strong as ever between the deflationary nature of automation technological / machine learning / Deep Learning / AI autonomous driving, medical innovation etc on the one hand and the tremendous liquidity generation by the global CB's and the ever expanding ocean of cryptocurrencies now approaching 1000 in number. However the global market capitalization of the cryptocurrencies is still quite small... 137 Billion or so.

The 2% growth rate has been underwhelming. the numbers on Inflation in the US are still pretty tame as we

can see below.

And yet commodity prices particularly industrial commodities have risen this past year, the Baltic shipping rate national index is up substantially over the past number of months, the embedded inflation expectation

in 10 year US Treasury TIPS has increased significantly.

The out-performance of material stocks, energy stocks, small cap and industrial stocks all can be attributed

to sector rotation, however it also suggests that a sense that inflation is in the process of picking up. The

central statement that can be said is that GDP growth and these other inflationary signs have been

so far underwhelming.

As Jim Paulsen has pointed out though in the same interview as Jeffrey Saut on CNBC. We have an

entire generation of people who are now conditioned to expect extremely low interest rates and they are used to long term rates of 2% or so. This generation will be extremely shocked and amazed if long term interest rates were to revert to a 3.5 to 4% level, let alone the historical norm of possibly 5%.

Right now with interest rates we are in the real sweet spot where they are not too low and not too high,

and the sweet spot has the ability to propel the US stock market and the Emerging economy stock markets, that even with their rally the emerging markets have a P/E of around 10. while we have this window where

US rates are not too hot and not too cold but just right.... it is providing a very large tail wind for US

equities, September which seasonally is a very weak month proved to be a very strong month for stocks

this year. This is indicative of the very serious aspect that we have these very constructive and powerful,

structural reforms occurring in the US economy, the entire world senses that the US administration is

very pro business and that is globally reassuring for the international business climate and the psychological state of the Global 500 companies.

JJP

------------------------------------------------------------------------------------------------------------------------------------

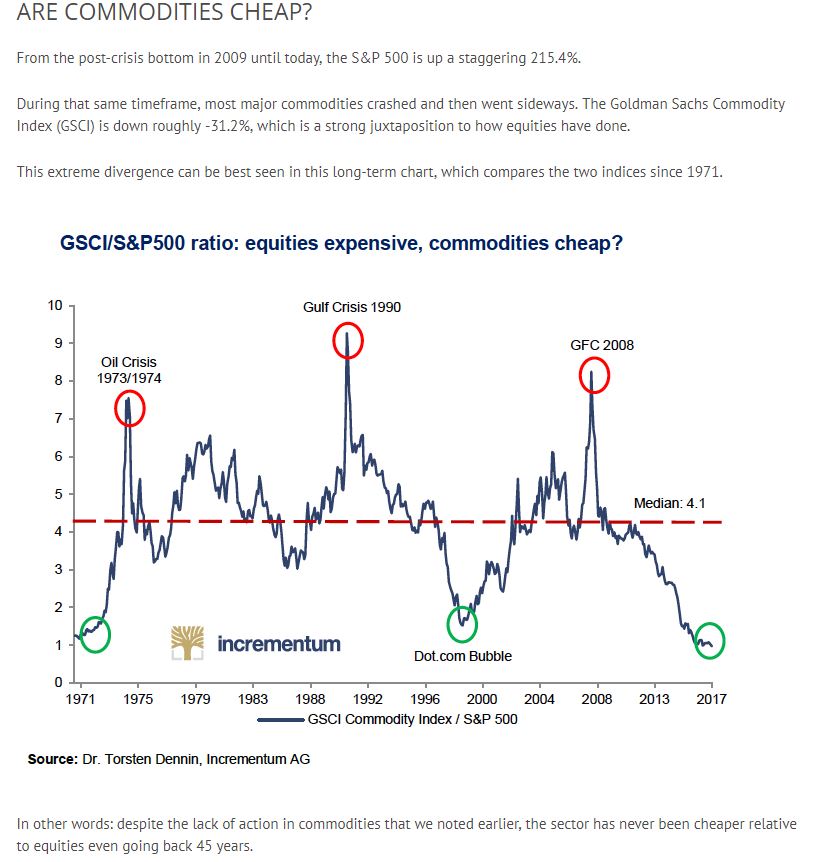

This is a VERY PROFOUND CHART...... In has Implications for Equity Prices, Commodity prices,

Interest Rate directions and also will be impacting the Major Currencies.

---------------------------------------------------------------

. |