The parabolic bubbles like BTC and the Cryptos are not played out yet nor is the overall risk asset rise.

as noted by

This was the back cover of my 1983 copy by Trader's press the well healed bear walking down the

street minding his business.

Lefevre pointed out that the best of breed "stock operators" know how to get prices vacillating up and

down on the way up to distribute a massive continy of common shares.

J Pierpont Morgan turned to the best floor operator to get create the proper market to get US Steel,

the very first billion dollar company IPO trading and distributed by the sellers of the assets....

Andrew Carnegie... got $750 million in cash as I recall. real money back in the day... and it was backed

by gold.

so the DJTA , a very small group of stocks is moving up very nicely.. way above the daily Bollinger band, however the Money Flow indicators are deteriorating, as is the CMF... it takes much much time to fully

distribute... I keep hear about what Buffett is selling... what have they been buying... and when was the

last time Berkshire had as much cash and near cash equivalents on hand?

that's a homework assignment.

the 5 year weekly DJTA with indicators.

DJTA 21 year monthly --

1 year of DJIA -- making new highs .... right now a triple momentum sell divergence, The Money Flow Index

Moving aver model and the Chaikin MF peaked in Oct.

this should be carry forward into 2018....

People want to short ROKU... short interest is super high... it can not go down..... ROKU should be

the most successful IPO of 2017..... by the time we reach year end.

TSLA burning cash like crazy..... but still why it is still in motion....

---------------------------------------------------------------------------------

Why Tesla's Valuation Remains 'Absurd' In The Face Of 'Eye-Watering' Losses

Nov. 29, 2017 1:08 PM ET

|

About: Tesla Motors (TSLA)

Tech Talker

Mid-cap, tech, short-term horizon, long-term horizon

seekingalpha.com

In 1996, there were 7,322 publically listed companies that traded on stock exchanges throughout America, and on average, 300 companies were listed per year in IPOs. Today, there are 3,671 publically traded companies with an average of around 100 IPOs per year since 2000. What could possibly explain such a steep decline of interest in public markets since the year 2000?

Companies were much less willing to go public for three main reasons.

First, the stock market crashes of the Dot-Com bubble and the Great Recession come to mind as an important psychological force. From February 2000 to September 2002 and from

October 2007 to February 2009,

the NASDAQ lost 77% of its value and 52% of its value respectively.

These steep declines changed the psychology of investors permanently: they became wary of long-term projections that never materialized during the bubbles, and demanded better financial disclosures. This brings me to the second reason companies are less willing to go public today, which is more intensive disclosure requirements set in the Sarbanes-Oxley Act of 2002.

Finally, as software and technology firms are on the rise, the thirst for capital which public markets provide has declined. In summation, companies are less willing to go public because investors force them to prioritize short-term performance over long-term performance, financial disclosure regulation has become more stringent, and more companies are involved in less capital-intensive business models. You can read more on this in this very informative article in The Economist: " Why the decline in the number of listed American firms matters."

A Note on Stock Market Bubbles

A lot of investing is done on the principle of an asset's fundamental performance. For companies, these fundamental metrics are profits, cash flows, book values, etc. Stock market bubbles form when expectations of fundamental performance are excessive. Bubbles pop when enough market participants realize this excess.

A war fought between two groups in a single country is called a civil war or a revolutionary war depending on its outcome. Similarly, a skyrocketing stock market or individual asset is called a bubble or a winner depending on if it subsequently plummets or not.

Many of today's high-flying stocks

To some market participants, these must be bubbles, but these bubbles haven't popped over very long periods of time (Tesla is going on 5 years of being "overvalued"). There is a mysterious force at play here that lead to the divergence of these stock valuations from their fundamentals and does not necessarily end in these stocks being bubbles.

The Art of The Story: Venture Capital for the Masses

Despite the developments of increased short-sightedness from investors and increased financial disclosures, some companies have managed to encourage investors to forgive dismal current financials in favor of a long-term story. The story is the underlying force that allows valuations of companies like Amazon, Netflix, and Tesla to be so divorced from their current fundamentals.

Most public companies that trade on stock exchanges, on the other hand, are bound by "fiduciary duty" to shareholders. The scope of "fiduciary duty" has become increasingly short-term as stocks move hundreds of basis points based on small surprises in earnings in one direction or the other.

As a result, the public markets are increasingly viewed as a disciplinary tool for management to produce short-term results, while private markets encourage smaller companies to take the long-term view. Venture capital, which focuses on financing small or start-up companies with long-term potential (read: companies that have a story), used to be a term that applied only to private markets.

Today, public companies that tell stories have allowed retail investors and small institutional investors to act like venture capitalists who are willing to forgive poor financials because future growth will improve them over time. A big part of venture capital is not just liking the story of future growth into large markets, but also an agreement with and a desire to bring about a company's mission.esla's Product Vision (source: tesla.com)Tesla has not only told stories about electrifying the auto industry, automating production and driving, and bringing solar and energy storage to the market as the renewable energy solution

but also Tesla managed to instill a craving in investors for the outcomes of these stories. It's not just about this company becoming profitable from growing into these large markets, it's also about this company putting an autonomous electric car powered by renewable energy into everyone's garage.

The Self Fulfilling Prophecy and Virtuous Cycle

The father of value investing, Benjamin Graham said: "In the short run, the market is a voting machine but in the long run, it is a weighing machine." What he meant was that stocks fluctuate according to investor sentiment over a short time horizon, and they behave according to a company's financial performance in the long run.

So companies that are overvalued according to their fundamentals must eventually lose value to come in line with fundamentals. But what happens if the short run outcome influences the long run outcome?

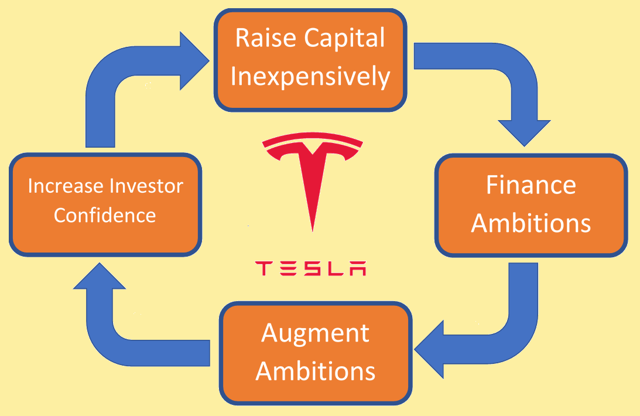

Tesla has not only mastered the art of storytelling to customers and investors, they've also mastered the art of harnessing the short-term voting machine to influence the long-term weighing machine.

The evidence of this is not hard to find: if Tesla didn't have so many secondary public offerings and convertible bond issuances to finance Elon Musk's ambitions,

they would either not be around, or have a much less inspiring product lineup and plan for the future. For instance, Tesla raised $1.5 billion in May 2016 after announcing a two-year acceleration in their 500,000 vehicles delivered target from 2020 to 2018.

Thus, Tesla took advantage of the markets short-term voting mechanism, which voted overwhelmingly in favor of Tesla because of their story (and investors' desire for its outcome), to finance the long-term targets. Tesla has even converted other voting mechanisms into cash, look no further than the ~$400 million Tesla received in customer deposits after the March 2016 reveal of the Model 3 or the likely ~$400+ million Tesla will receive in customer deposits for the Tesla Semi and new Roadster. Essentially,

Tesla has used their positive market perception to finance their ambitious projects and pursue new and even more ambitious projects, which in turn increases their positive market perception making it even easier to continue to raise capital. This is Tesla's self-fulfilling prophecy, which all started with an ambitious story that investors began to believe in May 2013, and resulted in a self-reinforcing virtuous cycle:

This idea is very similar to the idea of reflexivity, as explained wonderfully in this video and article from Sven Carlin. Reflexivity is the idea that a positive market perception is self-reinforcing because positive market perception leads to high stock prices, which leads to easier capital raises in the form of debt or equity, which leads to higher book values, which again leads to higher stock prices. Here, I have furthered this idea by showing how positive market perception is self-reinforcing not only because of increasing book values but also by financing and increasing ambitions of the company. This idea is very similar to the idea of reflexivity, as explained wonderfully in this video and article from Sven Carlin. Reflexivity is the idea that a positive market perception is self-reinforcing because positive market perception leads to high stock prices, which leads to easier capital raises in the form of debt or equity, which leads to higher book values, which again leads to higher stock prices. Here, I have furthered this idea by showing how positive market perception is self-reinforcing not only because of increasing book values but also by financing and increasing ambitions of the company.

What can stop this virtuous cycle? A shock like Tesla no longer dominating the story of electric/autonomous cars and trucks might change people's minds on Tesla.

Such a shock would lead to lower confidence about Tesla's growth, and less desire to finance Tesla's mission specifically over other companies. Also,

in broad market declines, investors start panicking and increasing focus on short-term performance metrics and fundamentals, which may also stop the virtuous cycle. In fact, investors did panic in the beginning of 2016, when the market faced a correction, and Tesla went severely bearish because there was no fundamental performance to speak of.

There are three outcomes of this virtuous cycle.

1) Either the cycle delivers Tesla to profitability and domination of automotive and/or energy markets,

2) or the cycle is broken and Tesla either manages itself without the robust support of the market or gets acquired.

3) In theory, there is the possibility that Tesla simply goes bankrupt and out of existence, but the talent gathered and the cumulative innovations that resulted from the virtuous cycle almost certainly have significant positive value, which makes an acquisition infinitely more likely than Tesla going out of existence. In fact, Google nearly bought Tesla in 2013 for $6 billion with a $5 billion commitment for future capital expenditures ( source).

Making Sense of Trends in Tesla

So what exactly happened in 2013 to kick off the virtuous cycle? Tesla crawled out of production hell for the Model S by increasing unit production by 80%, the demand for Model S exceeded capacity, Tesla's gross margins doubled to 17%, and Tesla reported a net profit for Q1 in May. This skyrocketed retail investor's confidence that Tesla could execute on their aggressive plans and their belief in Tesla's story. Retail investors wanted Tesla to succeed in order to bring about their vision, so they telegraphed their desires to Tesla by bidding up their stock and making it easy for Tesla to raise capital to achieve their ambitions. Meanwhile, institutional investors saw the terrible fundamentals of the company and correctly anticipated that the Q1 2013 profits and cash flows were a fluke that would turn severely negative over the next few years to finance Tesla's ambitions. So institutional ownership fell a lot from January-September 2013 when Tesla was skyrocketing as institutional owners were happy to sell to the bubble chasing retail investor crowd. However, when the price was resilient to "bubble-popping" behavior due to the virtuous cycle, institutions wanted in on the phenomenon, and began buying again.

Moreover, this virtuous cycle explains why Tesla often goes up when it does a secondary offering. Every single secondary offering Tesla has done ended up raising more money than originally planned due to overwhelming demand, which was a strong reassuring sign that markets still believed Tesla can execute on their aggressive plans and the will for Tesla to be successful was still strong.

This framework for explaining why Tesla is valued the way it is also explains why Tesla is such a polarizing battleground stock with vitriol between bulls and bears. Bears think in terms of fundamentals and argue the company isn't performing, bulls think in terms of potential and delivering Tesla to its potential by investing in the vision. Bulls, therefore, accuse Tesla bears of craving Tesla's failure and rejecting the electric future. Bears accuse bulls of being airheads who don't understand financials and instead understand only promises from the modern day P.T. Barnum.

Elon Musk and Tesla as a whole are aware of these dynamics and have been executing their mission faithfully using the capital provided by the unwavering bulls, and repeatedly delaying profits to instead use the virtuous cycle to their advantage (through increasing ambitious plans). Elon Musk has said that Tesla's stock price is too high based on past performance but still attractive if you believe in the future. By taking the middle ground between bulls and bears (despite his strong distaste for people short on Tesla), Elon Musk has managed bulls expectations to ensure that the stock price is relatively stable and avoids sharp corrections that can threaten the virtuous cycle.

Elon Musk has subtly expressed his desire to step down as CEO of Tesla after the Model 3 successfully ramps up.

Considering he is so good at telling Tesla's story, leveraging the short-term voting machine to influence the long-term weighing machine, and occasionally tampering investor's expectations,

why would he do this? The reasons he has provided in the past are to focus on other projects, which is likely true,

but the other reason is that his skills listed above will no longer be needed. Once Tesla is profitable, the virtuous cycle has served its purpose, and Elon Musk strongly believes that Tesla will be consistently profitable after the Model 3 ramps up. This was clear back in early 2015 when he was predicting 500,000 cars delivered in 2020 (along with full Model 3 production), he also predicted that first consistent profits will come in 2020. One year and three months later, Tesla accelerated their goals of 500,000 vehicles and full Model 3 production to 2018, which tells us that Elon Musk thinks Tesla can reach consistent profitability in 2018. If Tesla reaches profitability next year, then it will have strong footing with both fundamental investors and "we want the future this company is creating" investors, a powerful milestone that will allow Musk to move on to other projects.

Conclusion

Tesla's virtuous cycle can end one of two ways:

either shareholders lose confidence or

Tesla stops increasing their ambitions.

This will result in one of four outcomes (three if you agree that someone would buy Tesla before it is worth 0).

1)If the virtuous cycle works and ends with Tesla slowing their increasing ambitions, Tesla becomes a dominant player in automotive and/or energy industries with profits that sustain a stable level of company ambition.

2) If the virtuous cycle fails and investors lose confidence, Tesla either adapts to the cold shoulder from the market by scaling back ambitions to a sustainable level, or

3)Tesla fails to do so, and its plummeting valuation results in some other party acquiring them. and the debt holders get paid before the poor common stock

holders get anything

Tesla going completely out of business and its stock going to 0 is possible, but so highly improbable for reasons I mentioned earlier that it is an insignificant consideration.

So what should investors do with this knowledge? The only certainty is that no sane investor should short a self-reinforcing cycle unless their goal is to lose money.

They will have to wait until shareholders begin losing confidence in Tesla

(which may never happen). But in the meantime, should investors go long?

The answer to this question is more nuanced,

but essentially, an investor should evaluate the probability of each of the three outcomes of the virtuous cycle, determine the valuations that result, and finally estimate an expected valuation based on the outcomes and their probabilities. However, I think that investor sentiment on Tesla's potential has proven to be quite robust over the last 5 years, even when Tesla recently faltered their Model 3 ramp up and Tesla still held above $300/share. I believe it would take a macroeconomic event or a lot of mistakes from Tesla to begin to dent the positive investor sentiment, which means the virtuous cycle is likely to continue until Tesla begins turning a profit.

Disclosure: I am/we are long TSLA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

-----------------

That is TechTalker's take on Seeking Alpha...... I don't know them and have no affiliation

with them...... and have no interest in TSLA common stock. some of the debt might be

interesting in a real heavy panic.

JP |