From Oct 2017:

investingnews.com

Silver Price Update: Q3 2017 in Review Our silver price update covers the metal's Q3 performance and what could be next.

The silver price has underperformed gold so far in 2017, and was up less than 10 percent year-to-date at the end of Q3.

The white metal has put on a mixed performance since last year. In 2016, silver fell from over $20 per ounce in September to an eight-month low of $15.63 in December. It recovered to over $18 at the start of 2017, but hit a 15-month low of $15.19 in July before rallying back to about $18 in early September. As of 11:00 a.m. PST on Wednesday (October 4), silver was at $16.63.

“Silver is trending so far this quarter at $16.88, and looks like it’s going to come in just under $17 for all of Q3. For Q4, we still have a fairly lackluster level average of around $17.25, so little improved from where we are now,” Bart Melek, head of commodity strategy at TD Securities, said via phone.

Melek said every time there is a bullish gold environment, silver tends to outperform; however, that hasn’t happened yet this year. He explained, “the mining side of the equation isn’t particularly robust. I think the big problem here is that the market continues to be concerned about long-term demand, and there hasn’t really been that much investor appetite in the metal.”

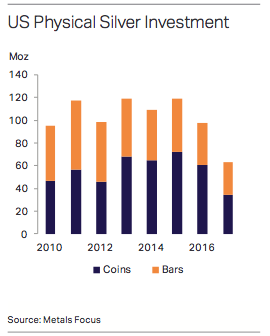

Silver price update: DemandSilver demand has been hurt by a drop in coin and bar purchases this year. According to a recent report from Metals Focus, that’s partially due to Indian bullion imports. In Q4 2016 they were down 60 percent year-on-year, and were down 16 percent year-on-year in January and February of this year.

“There’s been a crackdown by the government on unaccounted money, and it’s no great secret that a lot of these consumers used to put their unaccounted money, or a chunk of it, into silver. It’s now more difficult [to do that],” Metals Focus Director Philip Newman told the Investing News Network. “There’s been a crackdown by the government on unaccounted money, and it’s no great secret that a lot of these consumers used to put their unaccounted money, or a chunk of it, into silver. It’s now more difficult [to do that],” Metals Focus Director Philip Newman told the Investing News Network.

Silver bar and coin demand is expected to recover next year but, “against a low base, with the global total still the lowest this decade,” reflecting ongoing weakness in India and the US.

Most recently, India’s silver imports have increased ahead of the Diwali festival. The Gujarat State Export Corporation reported that silver imports at Sardar Vallabhbhai Patel International Airport increased from 0.25 tonnes in September 2016 to 25.56 tonnes in September 2017.

Only modest gains in jewelry and silverware demand are expected next year because projected price rises will cause damage in countries such as India.

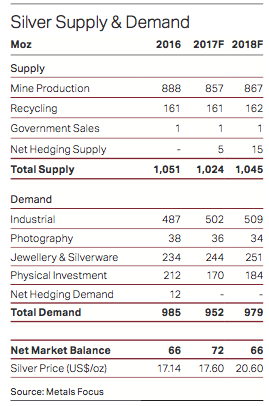

Meanwhile, industrial demand for silver is expected to grow by 2 percent next year, an all-time high, due to demand from the solar and automotive sectors. The silver market is expected to remain in a surplus for the third consecutive year in 2018, with oversupply reaching about 70 million ounces.

Silver price update: SupplyMetals Focus is calling for a year-on-year fall in mine output this year, and notes that resource nationalism, for example in Guatemala, has been in the news. Guatemala’s Supreme Court suspended the operating license for Tahoe Resources’ (TSX: THO,NYSE:TAHO) Escobal mine earlier this year, halting operations between July and September.

Total silver supply for the full 2017 year is expected to be 1,024 million ounces, which includes mine production and recycling, according to the firm. Total silver supply for the full 2017 year is expected to be 1,024 million ounces, which includes mine production and recycling, according to the firm.

Tahoe Resources’ Escobal mine is the fourth-largest silver mine in the world. Other precious metals companies that Metals Focus says gain over 30 percent of their revenue from silver include:

Fresnillo (LSE: FRES)Polymetal International (LSE: POLY)Buenaventura (NYSE: BVN)Pan American Silver (TSX: PAAS,NASDAQ:PAAS)Hecla Mining (NYSE: HL)Hochschild Mining (LSE: HOC)Coeur Mining (NYSE: CDE)It’s worth noting that these producers accounted for less than 10 percent of silver mine production in 2016. According to Metals Focus, “compared with the gold sector, options are a lot more limited when looking for mining equities to gain exposure to silver.”

Gold-silver and silver miners underperformed over the first eight months of 2017 in comparison to gold miners. Their underperformance has been attributed to weaker gains in the silver price compared to the gold price, along with a recovery in the Mexican peso, which pushed production costs higher. Mexico accounted for 40 percent of primary silver production and 30 percent of silver produced as a by-product of gold mining in 2016.

Mine output is expected to rise marginally in 2018, and a recovery in recycling will see total supply record its first annual increase in four years. Metals Focus estimates that total silver supply for all of 2018 will be 1,045 million ounces.

Silver price update: Factors to watchFed interest rate hikes:Newman noted that the US Federal Reserve is “heavily in favor” of a December rate rise, with “at least two” more increases expected in 2018.

“At that point maybe you’re not going to have negative real rates. We’ll have to see, but ultimately in our view rates will remain low by historical standards. We still think it’ll be a supportive environment for investors to come into the market for gold predominantly, but also for silver as well,” he added.

Melek said markets have been “quite cautious in going long silver, and we see that in the US Commodity Futures Trading Commission speculative investor numbers.” He explained, “I think that’s because there’s this prospect of higher interest rates if the Fed starts removing some of the liquidity from the banking system, and unwinding allowing some of the balance sheets to erode.”

He added, “the Fed currently holds about $4.5 trillion worth of assets, and they’ve said that over the next three months they’re going to wind it down by some $30 billion; roughly $10 billion a month. They are [also] putting the prospect of higher interest rates into the mix. That has recently helped the US dollar and made it more expensive to carry silver.”

“The fear is that it could very much turn into a negative precious metals environment in a situation where interest rates are on the rise. That might be a good explanation why investors haven’t been so enthusiastic,” Melek continued. He also noted that gold and silver prices are expected to increase over the next 12 months because “we don’t think the Fed is going to be anywhere near as hawkish as its statements are indicating.”

|