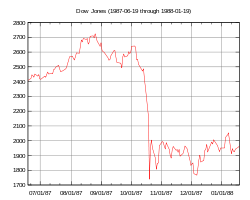

The crash of '87 happened much more quickly than '01.

Down 22% in one day, with a lead up of a number of down days in succession following an enormous bull market.

Black Monday (1987)

From Wikipedia, the free encyclopedia

In finance, Black Monday refers to Monday, October 19, 1987, when stock markets around the world crashed, shedding a huge value in a very short time. The crash began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin. The Dow Jones Industrial Average (DJIA) fell exactly 508 points to 1,738.74 (22.61%). [1] In Australia and New Zealand, the 1987 crash is also referred to as "Black Tuesday" because of the time zone difference.

The terms Black Monday and Black Tuesday are also respectively applied to October 28 and October 29, 1929, which occurred after Black Thursday on October 24, which started the Stock Market Crash of 1929.

Contents

1 Timeline

2 Market effects

3 Causes

4 Regulation

5 See also

6 References

7 Further reading

8 External links

Timeline

Timeline compiled by the Federal Reserve.

In late 1985 and early 1986, the United States economy shifted from a rapid recovery from the early 1980s recession to a slower expansion, resulting in a brief " soft landing" period as the economy slowed and inflation dropped. The stock market advanced significantly, with the Dow peaking in August 1987 at 2,722 points, or 44% over the previous year's closing of 1,895 points. Further financial uncertainty may have resulted from the collapse of OPEC in early 1986, which led to a crude oil price decrease of more than 50% by mid-1986. [2]

On October 14, the DJIA dropped 95.46 points (3.8%) ( a then record) to 2,412.70, and fell another 58 points (2.4%) the next day, down over 12% from the August 25 all-time high.

On Thursday, October 15, 1987, Iran hit the American-owned (and Liberian-flagged) supertanker, the Sungari, with a Silkworm missile off Kuwait's main Mina Al Ahmadi oil port. The next morning, Iran hit another ship, the U.S.-flagged MV Sea Isle City, with another Silkworm missile.

On Friday, October 16, when all the markets in London were unexpectedly closed due to the Great Storm of 1987, the DJIA fell 108.35 points (4.6%) to close at 2,246.74 on record volume. Then- Treasury Secretary James Baker stated concerns about the falling prices.

The crash began in Far Eastern markets the morning of October 19, but accelerated in London time—largely because London had closed early on October 16 due to the storm—by 9.30am the London FTSE100 had fallen over 136 points. Later that morning, two U.S. warships shelled an Iranian oil platform in the Persian Gulf in response to Iran's Silkworm missile attack on the Sea Isle City. [3] [4]

Market effectsBy the end of October, stock markets had fallen in Hong Kong (45.5%), Australia (41.8%), Spain (31%), the United Kingdom (26.45%), the United States (22.68%) and Canada (22.5%). New Zealand's market was hit especially hard, falling about 60% from its 1987 peak, and taking several years to recover. [5] [6] The damage to the New Zealand economy was compounded by high exchange rates and the Reserve Bank of New Zealand's refusal to loosen monetary policy in response to the crisis, in contrast to countries such as West Germany, Japan and the United States, whose banks increased short-term liquidity to forestall recession and experienced economic growth in the following 2–3 years. [7]

The Black Monday decline was—and currently remains—the largest one-day percentage decline in the DJIA. (Saturday, December 12, 1914, is sometimes erroneously cited as the largest one-day percentage decline of the DJIA. In reality, the ostensible decline of 24.39% was created retroactively by a redefinition of the DJIA in 1916. [8] [9])

Following the stock market crash, a group of 33 eminent economists from various nations met in Washington, D.C. in December 1987, and collectively predicted that "the next few years could be the most troubled since the 1930s". [10] However, the economy was barely affected and growth actually increased throughout 1987 and 1988, with the DJIA regaining its pre-crash closing high of 2,722 points in early 1989.

continues at en.wikipedia.org

[Important to emphasize the last paragraph.] |