Re <<I suspect you will increase your interest in the trade war as time progresses>>

... my interest was nudged soon after my post, because my conditions were partially fulfilled...

... <<am considering napping until ge, gm, apple, boeing and qualcomm are offered up to the son of heaven to make examples of>> ... GE, GM, and Boeing are tee-ed up for sacrifice, along w/ copious mass of agricultural goods.

China inc surprised me by how quickly reaching for the jugular of the crux of the center so very early in the opening moves; and by reading the obvious, how the WH seems to know its posture, bluff or otherwise, has been called.

Now we watch and brief to see if n.korea does a scientific test before any trump summit.

To all players at the table, computer voice-over intones, “players, welcome to the high-stakes table; ready or not, on three, two, ...”

Am wondering when / if Peter Navarro gets the boot; whether before or after Apple is tee-ed up.

In the mean time, Advanced Micro Devices and Nvidia are tee-ed up against their China customer, but in an unexpected way ...

In any case believe the financial markets could start rally ~July/Sept into year-end, either because QE is back on, due to T-bills tee-ed up in soya / pork airplane vs plastic trinkets conflict, or trade war declared a win and back to regular scheduled programming for the masses.

Then we can move along to the 5G cellular / mobile infrastructure / phone escalations.

bloomberg.com

Chinese Crypto Mining Company Poses a Threat to AMD and Nvidia

More stories by Lily KatzApril 4, 2018, 11:17 PM GMT+8

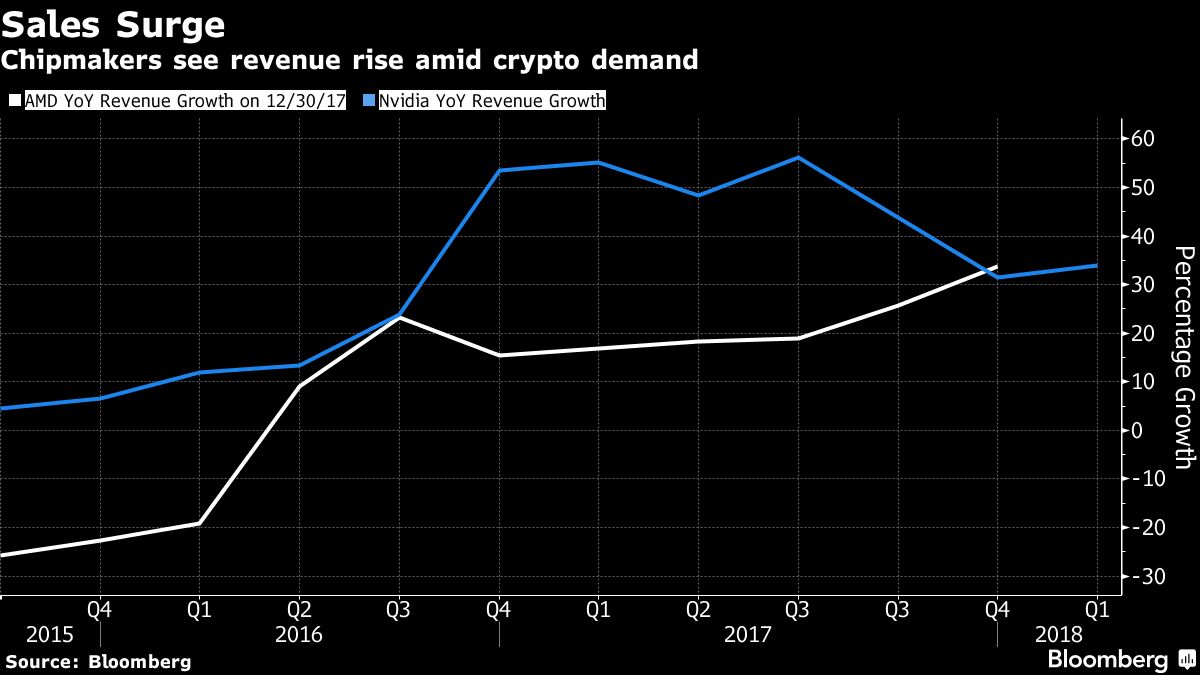

Advanced Micro Devices Inc. and Nvidia Corp. are feeling the heat from a Chinese adversary that they never imagined would become a competitor.

The chipmakers, which have seen a sales boost as cryptocurrency miners bought up their graphics processing units to solve complex calculations in an attempt to win digital tokens, now face a threat from Bitmain Technologies Ltd. The Beijing-based hardware maker just began sales of a more powerful new product for Ethereum mining.

The firm confirmed on its website Tuesday that it’s selling the Antminer E3, and analysts say the so-called application-specific integrated circuit miner, or ASIC, could dent revenue at AMD and Nvidia.

The product won’t ship until July, but can be ordered now for $800. By comparison, five GPUs would cost around $1,600 and would result in about the same level of power as the Antminer E3, RBC Capital Markets analyst Mitch Steves wrote in a note to clients Tuesday.

“The product is notably more powerful than current GPUs,” said Steves, who has a buy recommendation on Nvidia stock and doesn’t cover AMD. “We view this as a negative for the crypto currency market as it relates to GPU sales.”

The Antminer E3, along with declining Ether prices and a shift in the way cryptocurrency transactions are validated, puts a substantial portion of the chipmakers’ sales at risk, Susquehanna Financial Group’s Christopher Rolland, who has a sell rating on AMD and a hold rating on Nvidia, said in a report to clients Wednesday.

More than 25 percent of AMD’s first-quarter sales this year were tied to crypto mining, Rolland estimated. Nvidia said in February that while it’s tough to quantify cryptocurrency’s contribution to the business, it was likely higher in the fourth quarter than the prior period.

“Revenue associated with Blockchain was approximately mid-single digit percentage of revenue for AMD in 2017,” AMD spokesman Drew Prairie said in a statement. “We believe that GPUs will continue to provide value to blockchain applications for the foreseeable future. However, the largest long-term growth drivers for AMD are across our datacenter, PC, and gaming businesses and our Q1-2018 and full year 2018 guidance reflects that.”

A spokesperson for Nvidia didn’t immediately have a comment on the matter.

Bitmain’s announcement didn’t come as a big surprise to many crypto enthusiasts, who have been speculating since at least February that the company was preparing to release a new device for mining cryptocurrencies.

AMD was little changed at $9.55 while Nvidia slumped 2 percent to $220.95 as of 1:55 p.m. in New York. The tech-heavy Nasdaq 100 Stock Index was down 0.3 percent.

Evercore ISI’s C.J. Muse recommended that investors take advantage of the drop in Nvidia shares, which the analyst has a buy rating on.

“The current sell-off in NVDA thus seems overdone and offers a tremendous buying opportunity,” Muse wrote in a report Wednesday, noting that crypto likely represents about 5 percent of the firm’s overall revenue. “Quite frankly, cryptocurrency has been a giant distraction to NVDA’s longer-term story.” |