Time for a NVDA review..... fundamentally and technically

CEO Huang Sells Nvidia, Insiders Sell, And You Should Too

Apr. 18, 2018 1:20 PM ET|81 comments | About: NVIDIA Corporation (NVDA)

Moreover, it is not only CEO Huang who brought down their Nvidia holding in 2017; the rest of the insiders cumulatively (excluding Huang) have brought down their ownership also. In more detail, at the end of January 2017 insiders held 1.15% of Nvidia, however, in January 2018, insiders as group (excludingHuang) have brought down their collective ownership of Nvidia by 40%. Now, this starts to materialize into a certain picture.

I truly understand Huang wanting to diversify his holding of Nvidia - it has done wonders for his wealth. But the rest of the insiders? Do all of the insiders really have better opportunities to increase wealth outside of Nvidia? Well, collectively, they certainly appear to think so. Which makes me question further why, if those who understand Nvidia best from the inside (excludingHuang) brought their undoubtedly biggest holding down by 40%, wouldn't readers of this post do the same?

Investment ThesisI wanted to put the record straight on Nvidia ( NVDA). Nvidia is one of the best companies of our time (with fierce competition for the top space). My argument has been and continues to be that its share price leaves no room for savvy investors to profit from and that Nvidia’s realistic medium-term potential, of say, the next 5 years is more than accounted for already.

Every decade, new investors come to the market and become enchanted with the 'new era' of tech, and inevitably end up overpaying for the sexiest companies. Going into Nvidia's Q1 2019 earnings in the coming weeks at close to $150 billion mcap, the stock is more likely than not to disappoint its shareholders.

Valuation

Right off the bat, for those very few readers left who I have not fully antagonized previously when discussing Nvidia’s current valuation and emphasizing that most blasphemous topic of Nvidia’s stock 'price', I will not add further insult by arguing that AMD ( AMD) is any sort of realistic competitor to Nvidia.

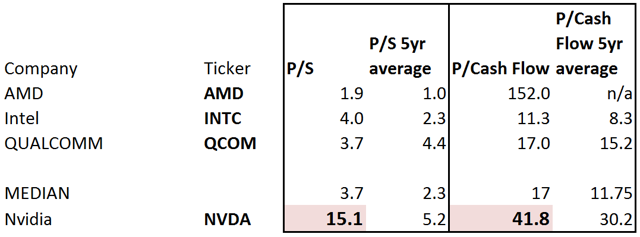

Incidentally, the case remains that numerous studies, such as those performed by James O'Shaughnessy, have shown time and time again that mean reversion works. And most importantly, that the P/S ratio is a very good indicator of a group of stocks’ likelihood to disappoint investors; with the higher the P/S ratio, the greater investors’ expectation, and the smaller their actual return – with very tight correlation in the findings. The inverse is also true: stocks with the smallest P/S ratios have the least investor expectation and the greater the shareholder return.

Back on Nvidia, how can investors seriously think that when a stock is priced nearly 3 times more expensively than its own 5-year average, there is any opportunity left to profit downright confounds me. Even without any elaborate further thinking, just by looking at the price that investors have paid for Nvidia over the past 3 years, should inform readers that 'the secret' is out. Nvidia is a great company, with not only a highly promising future, but that its GPUs are leading the technology revolution into the new era. But everyone knows this already. Nvidia's stock price has already leapt by no less 10 times in the past 3 years.

Furthermore, let's take Nvidia's outlook for Q1 2019. Nvidia expects its revenue to be roughly up 50% YoY, with greatly expanded non-GAAP gross margin at 63% and benefitting strongly from the recently enacted U.S. tax law, allowing its tax rate to be only 12%; which should make last year's non-GAAP EPS of $0.85 look paltry by comparison. However, even if Nvidia where to deliver a stunning $2 dollars of non-GAAP EPS in Q1 2019, and a ground breaking $8 of non-GAAP for FY 2019, it doesn’t take a lot to see that at close to $240 per share, shareholders are getting close to 3% forward earnings yield - which is not a lot considering the risks of investing in a public company.

Insider OwnershipWhenever I argue about Nvidia's valuation, investors always comment back to me that CEO Jensen Huang is a genius and is a phenomenal leader and that they want to profit alongside him. However, so too does everyone else. In fact, we can see from the new proxy released a few days ago, that CEO Huang has already sold a small portion of his holdings (roughly 4% of his holding, down to 3.87%). And why wouldn’t he want to diversify his position? He clearly understands his company's opportunity versus its current valuation.

Moreover, it is not only CEO Huang who brought down their Nvidia holding in 2017; the rest of the insiders cumulatively (excluding Huang) have brought down their ownership also. In more detail, at the end of January 2017 insiders held 1.15% of Nvidia, however, in January 2018, insiders as group (excludingHuang) have brought down their collective ownership of Nvidia by 40%. Now, this starts to materialize into a certain picture.

I truly understand Huang wanting to diversify his holding of Nvidia - it has done wonders for his wealth. But the rest of the insiders? Do all of the insiders really have better opportunities to increase wealth outside of Nvidia? Well, collectively, they certainly appear to think so. Which makes me question further why, if those who understand Nvidia best from the inside (excludingHuang) brought their undoubtedly biggest holding down by 40%, wouldn't readers of this post do the same?

TakeawayNo matter how passionate readers are about their Nvidia holdings, a lot of that passion comes from their stock having performed wonders for them in the past 18 months. It is only human nature to become enchanted with a company that has offered us a rewarding investment - to expect these feelings to continue for the foreseeable future.

The problem with the stock market is that when everyone 'expects' miracles, anything less than a miracle means that the stock has a tendency to disappoint in the near-term. Again, just to repeat what I said at the beginning. Nvidia is a phenomenal company, doing wonders for our society. Yet its stock price remains elevated and offers investors more risk than reward at its current valuation.

Disclaimer: Please do your own due diligence to reach your own conclusions.

seekingalpha.com

-----------------------------

seekingalpha.com

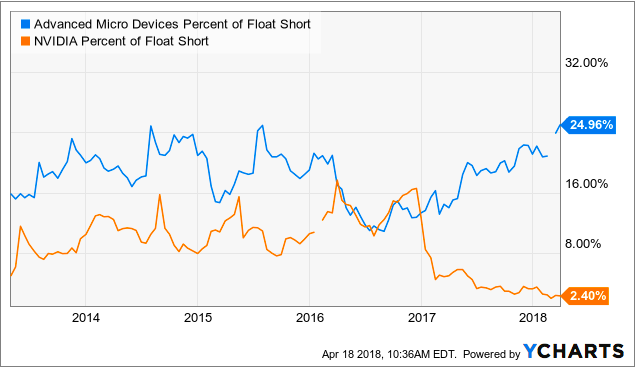

Where’s the bet against Nvidia?Now, there’s another metric available to us in the public domain which provides us with insights on how the market is broadly reacting to a particular stock -- the short interest data. It’s basically the aggregate amount of short positions that are open and are yet to be covered. A sharp rise in the metric generally indicates that market participants are betting on the concerned company’s stock to plunge going forward. Conversely, a sharp decline in the metric suggests that market participants rapidly closed their short positions as they don’t forecast the particular stock to fall any further by a meaningful amount.

Now, one might argue that Nvidia shares have rallied quite a bit over the past year and that its shares are due for correction in a major way. But unfortunately, at least for the bears, there’s little to no backing evidence which suggest that this hypothesized scenario will play out anytime soon. This is evident from the fact that short interest in Nvidia has only plunged while its shares continued to rally over the past year.

(Source: Ycharts) (Source: Ycharts)

Only 2.4% of Nvidia’s entire floating stock stood shorted at the end of the most recent reporting cycle, as opposed to AMD’s 25%. This is a miniscule amount and we can hardly call it a market-wide bet against the GPU giant. For what it’s worth, its current short interest figure could be due to a myriad of reasons like hedging activities, risk mitigation, option spreads, gambling etc. It’s hard to accurately pin point which of the aforementioned factors is predominant here, let alone term the entire short figure as a bearish bet.

This at least goes to show that the broad swath of speculative traders doesn’t feel confident in shorting Nvidia at current valuations either, maybe because they too feel its shares are poised to appreciate further.

(editorial note by JJP: the speculative traders, after an 8 year bull market are not shorting

NVDA at all....... everyone is leaning to one side of the boat on NVDA......

When NVDA was going up dramatically the past few years the short interest was 10-16%.

In 2017, when NVDA has become as overloved as QCOM in 1999-2000...... no one wants to

be short the stock and short interest has collapsed... this for a stock that has a Price to Sales

of 15..... 3 times it's 5 year average... That is way to high a price to revenue level for $150 billion mkt cap company.

Granted it's not quite as egregious as B2B darlings ARIBA and Commerce one in 2000 that

had a price to sales ratio. However those companies suffered a 90% drawdown for ARBA,

and CMRC common stock holders got nothing..... )

----------------------------------------------------------------

TSM..... makes most of NVDA's hardware....... they had an earnings miss and guiding forward guidance down.....

Chips are down pre market due to Taiwan Semi missing on earnings and guiding down for the year ro low end of guidance. Taiwan Semi blamed slowing smartphone sales. Looks like NVDA INTC MU will all be down today in reaction.

19 Apr 2018, 09:16 AM

--------------------------------------------------

The broader cryptocurrency bubble has arguably blown up and demand for The GPU's that NVDA makes, the chips that AMD make the semiconductor chips are going to see some reduction in demand.

------------------------------------------

------------THE NVDA TECHNICAL REVIEW----------

NVDA --Technical outlook.

1 year daily....

NVDA 60 minute chart with Fibonacci Fractals......... bear mode.....

NVDA daily sold off at the 1.618 of the dynamic fractal advance which occurred in Sept 2017.

there is a clustering of support at the 189-191.level.......

If a flash crash materialized, or a Black Swan Market event were to transpire.....

$120-122 would be where you would put "when your wish upon a star" Good till Cancelled Buy orders......

The 5 year weekly NVDA chart reiterates...... the huge run the NVDA has been since early 2016.

The 50 week MA reiterates the support at 191-192... with lower Bollinger Band @ 188 further

reinforcing a prime buying zone..... should we actually have that much weakness develop.

Just as a note the 200 week MA is @ 80.......

JP |