Data Reveals Companies Have Used Tax Cuts to Increase Capital Spending

Why, yes. Companies have used the tax relief to invest more into the business.

Posted by Mary Chastain

Thursday, May 3, 2018 at 1:00pm

legalinsurrection.com

Remember when the left said that President Donald Trump’s tax reform would not work because the companies would give those breaks to shareholders instead of reinvesting in the company?

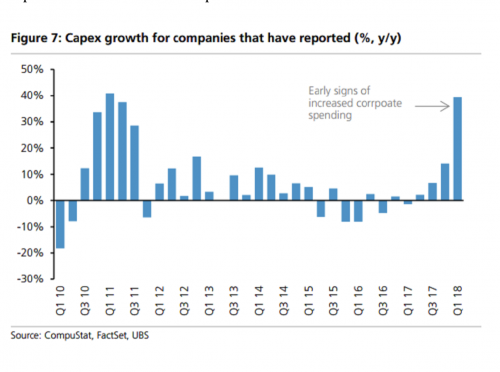

Well, Bloomberg released data that shows capex (capital expenditure) has won out. It shows that the 130 companies in the S&P 500 have increased capital spending by 39%, which is the fastest rate in seven years. Returns to shareholders has only grown by 16%.

Bloomberg continued:

The data is a fresh rebuttal to those who warned that hundreds of billions of dollars of tax relief will head directly to the stock market and be harvested by shareholders already fattened by a nine-year bull market. While buybacks indeed got a boost from the windfall, companies increased the rate at which they unleash cash for building factories and upgrading equipment, a strategy that’s preferred by investors for the benefit of future growth.

Corporate buybacks, while increasingly a key pillar of the second-longest bull market on record, are constantly drawing criticism from politicians and money managers as being short-sighted. By their line of logic, companies take advantage of low interest rates to borrow money and buy back shares as a quick way to boost per-share earnings. In doing so, they’re forgoing investment opportunities that may benefit long-term growth.

Via Bloomberg Via Bloomberg

Technology has seen a huge upswing in capital spending. S&P Global Marketing Intelligence found that “tech companies posted 48 percent growth in first-quarter capex as of Tuesday.”

Google’s parent company Alphabet increased capital spending from $2.5 billion to $7.3 billion and purchased new offices in New York. CFO Ruth Porat said that Google “has 20 new data centers in construction across the world.”

From The Wall Street Journal:

Many companies are returning their tax savings to their investors. The amount spent on share buybacks in the first quarter rose by more than 50% over the fourth quarter of 2017, and by two-thirds over the first quarter of 2017, according to S&P Dow Jones Indices. Companies have also set plans to invest in expansion and new technology, and paid one-time bonuses to employees.

For 28 S&P 500 companies, lower taxes were enough to account for the difference between reporting earnings growth and an earnings decline. Those included chemical maker Monsanto Co. , asset manager T. Rowe Price Group Inc. and laboratory chain Quest Diagnostics Inc.

The tax cuts have helped small business owners and employees. From CNBC:

In West Virginia, the President spoke with Tony Hodge, a mail carrier, and his wife, Jessica, who said that tax savings are “a big deal for our family.” In Iowa, John Anfinson, a small business owner, was equally pleased, telling the President that revisions to the tax code would ensure his family was “going to have about an additional $6,000 that we get to keep.”

Business owners throughout the country continue to praise tax reform, stating that the savings is allowing them to invest, raise wages, and hire more employees. Small business confidence has reached record highs since passage of the bill, according to a March 2018 CNBC/Survey Monkey survey.

During the tax reform debate, I pushed for lowering taxes on companies so those in charge could keep more money. Honestly, I don’t know why people would think the owners wouldn’t want to invest more money into their business. After all, the more you invest and develop better products, the more money you can make. How do I capitalism?!

Then again, a lot of those people seem to think money grows on trees.

Ben Steverman wrote at Bloomberg that Trump’s loudest critics have also won big with the tax cuts: Hollywood. Not everyone in Hollywood, though, as the tax plan eliminated “deductions for work-related expenses such as union dues, lessons, publicity, travel to auditions and payments to agents who line up jobs.”

But the studios, despite heavily supporting failed Democrat presidential candidate Hillary Clinton, received much relief:

Still, those donations don’t mean the industry’s lobbying groups were absent in Washington as GOP lawmakers were crafting the bill, which passed in December without a single Democratic vote. The big studios such as Walt Disney Co., Viacom Inc., Warner Bros. Entertainment Inc. and NBCUniversal Inc. will benefit from the new corporate tax rate of 21 percent. Most of the studios’ owners, including Disney and Comcast Corp., previously paid effective tax rates above 30 percent.

But beyond that, one of their main lobbyists, the Motion Picture Association of America, successfully pushed for the entertainment industry to immediately write off the costs of large U.S.-made film and TV projects. An earlier iteration of the House tax bill wouldn’t have allowed entertainment projects to be included in the new expanded write-off provision.

The tax bill allows these studios to deduct total production costs “as soon as a new product is released to the public.” Benson Burro, a partner at KPMG, said that these quick write-offs might “make it easier for Hollywood to attract outside investors” especially with an increase “demand from streaming services like Netflix and Amazon.

One thing that annoys me nowadays is the need for instant gratification. The overall relief will take time. It doesn’t happen overnight. But it seems so far, so good.

And how much do you want to bet that even though Hollywood has received a huge break they will still hate on Trump and the GOP?

|