BREAKING: LAWLESS MURDERING SAUDI ARABIA THREATENS COWARD TRAITOR POS TRUMP TO CUT HIS TINY PENIS & MAKE HIM EAT IT

Saudi Arabia vows to retaliate against any sanctions in Khashoggi case

By Sheena McKenzie, Peter Wilkinson and Schams Elwazer, CNN

Updated 3:43 PM ET, Sun October 14, 2018

cnn.com

(CNN)As international pressure mounted on Saudi Arabia over the case of missing journalist Jamal Khashoggi, the kingdom came out swinging Sunday, threatening to retaliate and spelling out the ways in which Riyadh would punish the US if it imposed sanctions.

Khashoggi, a columnist for The Washington Post and Saudi royal insider-turned-critic, went missing after entering the Saudi consulate in Istanbul on October 2 to obtain paperwork that would allow him to marry his Turkish fiancée.

His disappearance has drawn international condemnation and sparked warnings from US President Donald Trump on Saturday of "severe punishment" if the Saudis are found to be behind his death. Britain, France and Germany also said on Sunday they were demanding a "credible investigation."

In a statement Sunday on the official Saudi Press Agency attributed to "an official," the kingdom rejected any threats of economic sanctions or political pressure and said it would "respond with greater action."

But in a strongly worded op-ed published later on Sunday, Turki Aldakhil, general manager of the Saudi-owned Al-Arabiya news channel, warned that if the US imposed sanctions on Riyadh "it will stab its own economy to death," cause oil prices to reach as high as $200 a barrel, lead Riyadh to permit a Russian military base in the city of Tabuk and drive the Middle East into the arms of Iran.

"The information circulating within decision-making circles within the kingdom have gone beyond the rosy language used in the statement," Aldakhil wrote, referring to the earlier comment.

"There are simple procedures, that are part of over 30 others, that Riyadh will implement directly, without flinching an eye if sanctions are imposed," he said.

"If US sanctions are imposed on Saudi Arabia, we will be facing an economic disaster that would rock the entire world," he added.

He warned that any sanctions would lead to the kingdom's "failure to commit" to specific levels of oil production and "if the price of oil reaching $80 angered President Trump, no one should rule out the price jumping to $100, or $200, or even double that figure."

Aldakhil later said on his official Twitter account that the op-ed piece was his personal opinion and not the official position of Saudi Arabia's government.

"I noticed that some people are connecting this article of mine with the Saudi government's official position. This is not true, it is my personal opinion," he wrote.

Faisal bin Farhan, a senior adviser at the Saudi Embassy in Washington DC, said on his official Twitter account Sunday that the op-ed "did not reflect the thinking of the Saudi leadership."

The Saudi Embassy in Washington offered a milder statement in a tweet on Sunday.

"To help clarify recently issued Saudi statement, the Kingdom of Saudi Arabia extends its appreciation to all, including the US administration, for refraining from jumping to conclusions on the ongoing investigation," the statement said.

The Saudi warnings came after the country's stock market fell as much as 7% on Sunday amid fears of sanctions. The index recovered some ground later to close 3.5% down. The losses wiped out all the market's gains in 2018, although it is still up 8% from a year ago. None of the statements mentioned Khashoggi by name, or provided any further clues into what happened to the journalist.

Growing isolation

In a joint statement later Sunday, the foreign ministers of the UK, France and Germany said "light must be shed" on Khashoggi's disappearance.

"Germany, the United Kingdom and France share the grave concern expressed by others including HRVP [Federica] Mogherini and UNSG [Antonio] Guterres, and are treating this incident with the utmost seriousness. There needs to be a credible investigation to establish the truth about what happened, and -- if relevant -- to identify those bearing responsibility for the disappearance of Jamal Khashoggi, and ensure that they are held to account," the statement said.

"We encourage joint Saudi-Turkish efforts in that regard, and expect the Saudi Government to provide a complete and detailed response. We have conveyed this message directly to the Saudi authorities."

Separately, British foreign minister Jeremy Hunt on Sunday urged Saudi Arabia to explain what happened to Khashoggi at the consulate, saying, "if they have got nothing to hide, then they will and should cooperate."

"If, as they say, this terrible murder didn't happen, then where is Jamal Khashoggi? That's what the world wants to know," Hunt told UK Pool.

In the diplomatic fallout over Khashoggi's disappearance, international firms are pulling out of a high-profile investment summit due to take place later this month in Riyadh.

US Secretary of State Mike Pompeo on Saturday declined to confirm whether US Treasury Secretary Steven Mnuchin would still be attending the Future Investment Initiative conference being hosted by the Saudi Crown Prince -- known as "Davos in the desert" -- later this month.

"I think we need to continue to evaluate the facts and we'll make that decision -- I talked to Secretary Mnuchin about it last night, we'll be taking a look at it through the rest of the week," Pompeo, alongside President Trump, told reporters in the Oval Office on Saturday.

Doubts are also growing over whether British Trade Secretary Liam Fox will attend the Riyadh conference, the BBC reported Sunday citing diplomatic sources.

A spokesman for the UK's international trade department told CNN that Fox's diary was not yet finalized for the week of the conference.

Turkish authorities believe 15 Saudi men who arrived in Istanbul on October 2 were connected to Khashoggi's disappearance and possible killing. At least some of them appear to have high-level connections in the Saudi government.

On Friday, a source familiar with the ongoing investigation told CNN that Turkish authorities have audio and visual evidence that Khashoggi was killed inside the consulate.

Saudi Arabia firmly denies any involvement in Khashoggi's disappearance and says he left the consulate that afternoon.

Fiancée describes heartbreak over 'lonely patriot'

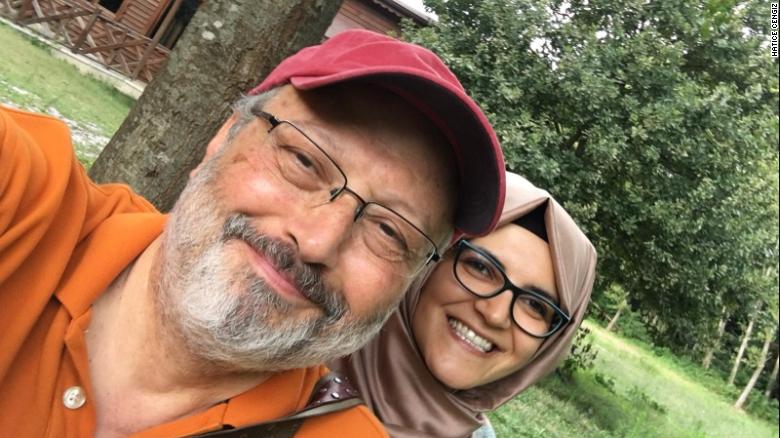

Khashoggi's fiancée Hatice Cengiz revealed how the couple spent their last hours together, writing that "tyrants eventually pay for their sins," in a New York Times article on Saturday.

Cengiz, a doctoral student at a university in Istanbul, wrote: "If the allegations are true, and Jamal has been murdered by the errand boys of Mohammed bin Salman, he is already a martyr."

Missing Saudi Journalist Jamal Khashoggi with his fiancé, Hatice Cengiz.

Cengiz said in the article that Khashoggi had been "cheerful" on the morning they traveled together to the consulate, and that the couple had made plans for the rest of their day.

"We were going to browse appliances for our new home and meet with our friends and family members over dinner," she wrote. "When we arrived at the consulate, he went right in. He told me to alert the Turkish authorities if I did not hear from him soon."

The heartfelt article, which described how the pair met at a conference in Istanbul in May and bonded over their "shared passion for democracy, human rights and freedom of expression" was published on Khashoggi's birthday, Cengiz said.

"I had planned a party, inviting his closest friends to surround him with the love and warmth that he had missed," she wrote. "We would have been married now."

Cengiz said Khashoggi fled Saudi Arabia with two suitcases for the US "amid a crackdown on intellectuals and activists who criticized Crown Prince Mohammed bin Salman."

But rather than a dissident, he saw himself as a patriot "using his pen for the good of his country," she said.

Cengiz added that she had seen reports President Trump wanted to invite her to the White House. But she said, "If he makes a genuine contribution to the efforts to reveal what happened inside the Saudi consulate in Istanbul that day, I will consider accepting his invitation."

The US President said Friday he had not yet spoken with King Salman of Saudi Arabia -- the father of bin Salman -- in the wake of Khashoggi's reported killing, but that he planned to "pretty soon." |