I believe this below is important to note ...

zerohedge.com

A Third Of All European IG Bonds Have Negative YieldsWith much fanfare, and an astronomical (literally) dose of clickbait, Bloomberg leads off today with an article about " The Black Hole Engulfing the World's Bond Markets"...

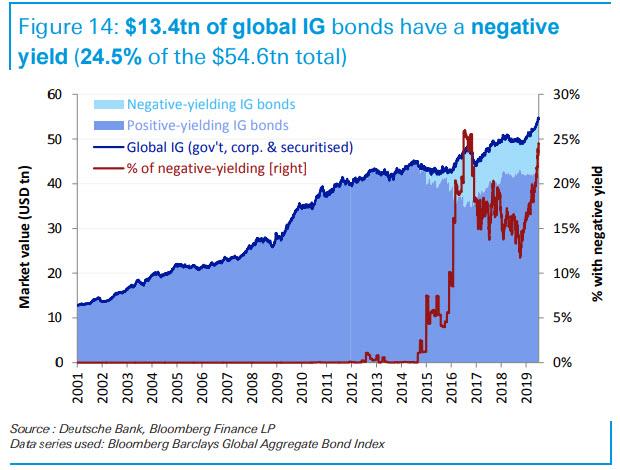

... which beyond the tantalizing headline says little that has not been already covered for years before, as well as recently, namely the $13+ trillion in negative yielding government bonds thanks to catastrophic central bank policies.

Worse, what the article should have been focusing on instead, is the truly noteworthy fact that as a result this glut of negative yielding sovereign paper, there are now hundreds of billions in investment grade corporate bonds that have a subzero yield, and - far more shockingly -there are now at least 14 "high" yield issuers (i.e. junk bonds), that also have a yield below 0%, to wit:

Ardagh Packaging Finance plc /Ardagh Holdings USA Inc.Altice Luxembourg SAAltice France SAAxalta Coating Systems LLCConstellium NVArena Luxembourg Finance SarlEC Finance PlcNexi Capital SpANokia Corp.LSF10 Wolverine Investments SCASmurfit Kappa Acquisitions ULCOI European Group BVBecton Dickinson Euro Finance SarlWMG Acquisition Corp.In other words, instead of focusing on the "black hole" of sovereign yields, which has been widely discussed for years ever since the ECB took rates below zero in what will one day been seen as the beginning of the end of central banking , what Bloomberg should have been looking at is the impact falling rates have had on investment grade corporate bond yields (mostly in Europe,for now), dragging these towards all-time lows, some well below zero.

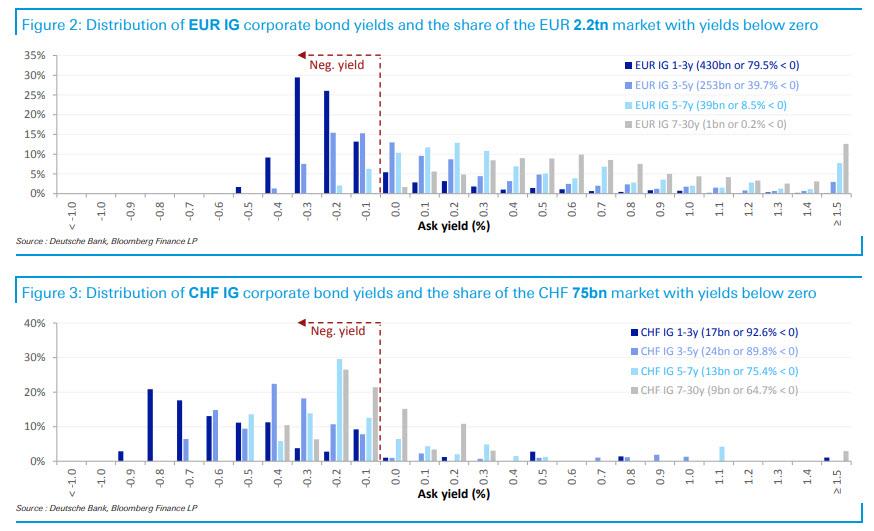

And, as Deutsche Bank notes, duration extension has been one way to reach for non-negative yield, leading to flattening of corporate yield (and spread) curves. Still, as the German bank notes, "one can run but one cannot hide", and as a result, a third of all European investment grade bonds and a third of 1-2y European BB-rated (i.e. junk) bonds now yield less than zero.

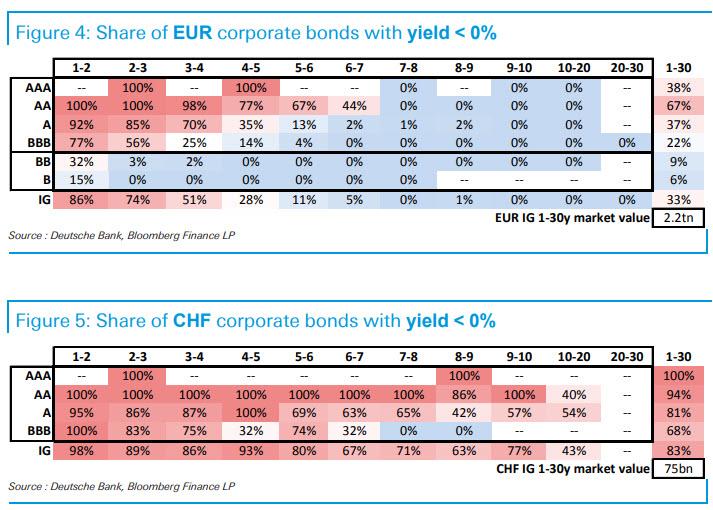

What stands out in the chart above, is that 2/3rds of AA-rated EUR bonds, over 1/3 of single As, over 1/5 of BBBs and nearly a tenth of BBs yield less than zero at the moment. Here is the shocking punchline: the higher-rated front end is essentially all under water and 33% of the €2.2tn market, or some €700bn of EUR IG corporate bonds, have a negative yield.

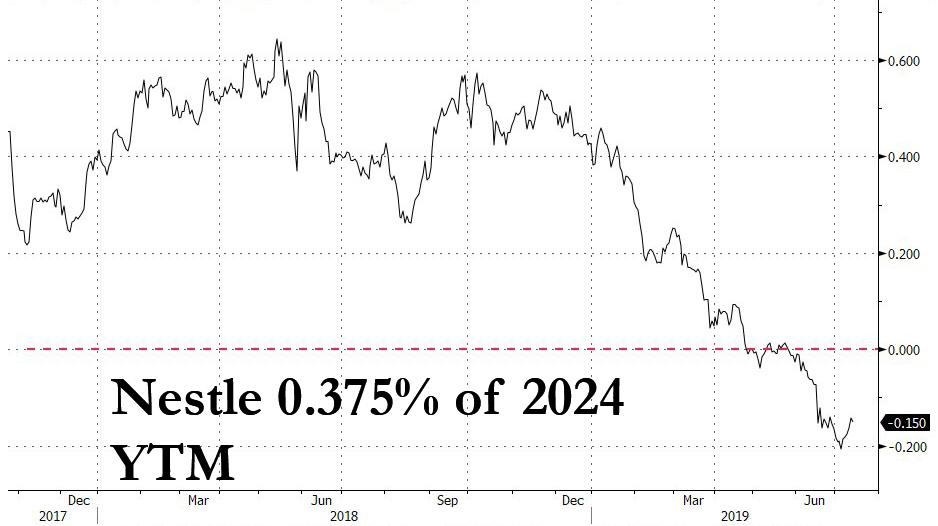

Shocking as that may be, it pales in comparison with the 75BN CHF IG market, of which 83% yields less than zero. You read that right: more than 8 out of 10 corporate bonds in Switzerland have a negative yield, such as the €500 million in bonds due 2024 issued by Nestlé which pay a 0.375% coupon, and which most recently traded at around 102.50, resulting in a negative yield of 0.15%. That means investors are paying a company - not a country, not a sovereign - for the "privilege" of issuing debt.

The red color on the heatmap below only underscores the contrast between EUR and CHF denominated issuance, indicating that there is even more room for EUR IG yields to fall if need be.

So going back to Bloomberg's "Black Hole" here is the bigger picture: there are now $13.4tn of negatively-yielding IG bonds globally, which is 24.5% of the universe that consists of $54.6tn of government, corporate and securitised IG bonds across currencies. The evolution of this trendline is shown in the chart below.

A more granular take on the subset of EUR IG corporate bonds and Eurozone sovereign bonds, reveals that the value of negatively-yielding bonds is at an all-time high in the corporate and sovereign space alike: there are some €3.5tn of Eurozone sovereign bonds eligible for iBoxx indices that yield less than zero and, as mentioned above, some €700bn of negatively-yielding IG corporate bonds. Likewise, even though the markets have grown in size over time, the percentage shares with negative yields are at record levels too.

Putting it all together, DB's Michal Jezek writes that while many investors are still reluctant to buy corporate bonds with negative yields, "the reality should eventually sink in that it is simply preferable to bleed less."

Of course, none of this makes sense. As Bloomberg does correctly note, "negative rates are at odds with basic principles of the global finance system. "One important law of financial logic –- if you lend money for longer, you should see a higher return –- has been broken," wrote Bloomberg's Marcus Ashworth.

"The time value of money has essentially disappeared.”

And, as a result, investors are crammed into ever riskier bets in the hunt for returns, assuring that when the current asset bubble in financial markets and real estate - the biggest of all time - bursts, it won't be just investors who "bleed" but shortly thereafter central banks join them as well, only less metaphorically.

|