let's see if Africa can be helped along towards its potential

zerohedge.com

What Is Africa's Role In The New Silk Road? Authored by Richard Mills via SafeHaven.com,

A lot of resource investors stop listening to corporate presentations when they learn the company’s project is in Africa.

More often than not the country risk of exploring for minerals is just too big a gamble for retail investors’ hard-earned capital.

Development projects are hi-jacked by rebels, or over-run by artisanal miners. Operating mines get expropriated by governments that can’t resist the temptation to raid a foreign company’s coffers. And African miners frequently see their profits reduced by corrupt officials intent on re-negotiating royalty contracts.

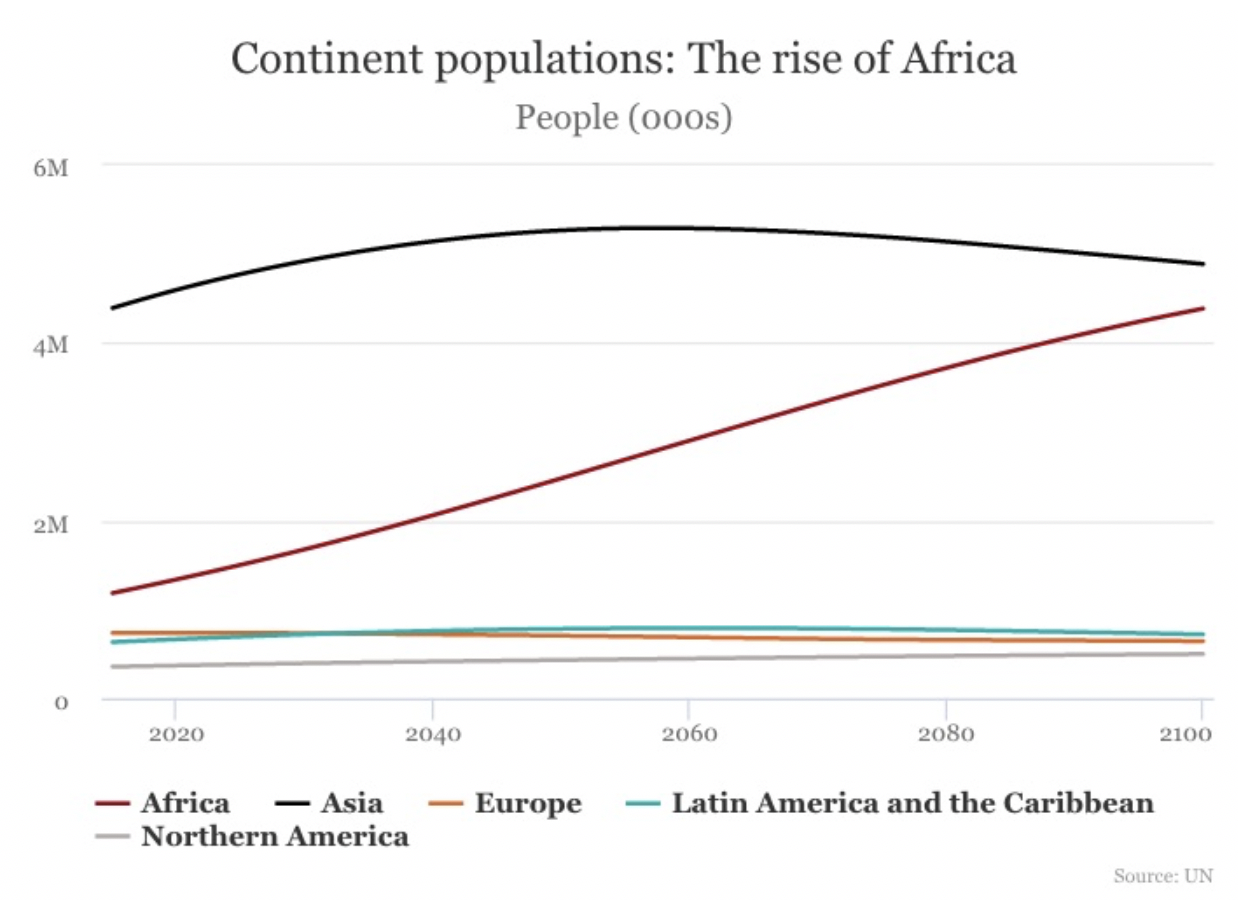

All of these things are true, yet in the long run, Africa cannot be ignored. The hammer-shaped continent is expected to drive global growth over the next several decades, as populations there climb, but dwindle elsewhere.

“About half of the world’s fastest-growing economies will be located on the continent, with 20 economies expanding at an average rate of 5% or higher over the next five years, faster than the 3.6% rate for the global economy,” Brahima Coulibaly, director of Brookings’ Africa Growth Initiative, wrote in its 2019 Foresight Africa report.

The growth as always will be driven by population expansion.

(Click to enlarge)

According to the Center for International Policy, in 2035 the number of working-age people in Africa will exceed the rest of the world combined, and by 2050 one in four humans will be African. At 2100, 40% of the world’s population will hold a passport from an African country.

In this article we’re tackling Africa - its importance to future trade flows, for commodities its middle class will be demanding, and most importantly, the role of China in helping to develop, and purchase influence, in fast-growing African economies.

The goodThe Center for International Policy points out that Africa’s impending “demographic dividend” will no doubt increase its economic clout:

Since 2000, at least half of the countries in the world with the highest annual growth rate have been in Africa. By 2030, 43 percent of all Africans are projected to join the ranks of the global middle and upper classes. By that same year, household consumption in Africa is expected to reach $2.5 trillion, more than double the $1.1 trillion of 2015, and combined consumer and business spending will total $6.7 trillion.

Sub-Saharan Africa has done exceptionally well, buoyed by higher commodity prices, an improved global economy and better access to capital markets, reports Quartz.

The region is expected to grow by 3.8% this year, edging out the global growth forecast of 3.7%. Among the top 10 economies are Ethiopia, Rwanda, Ghana, Côte d’Ivoire, Senegal, Benin, Kenya, Uganda and Burkina Faso. Between 2003 and 2013, Nigeria, population 170 million, averaged about 7% annual growth.

The IMF expects Ghana, which 30 years ago was a dead loss, to be 2019’s fastest-growing economy, at 8.8%. The country well known for its coffee exports is seeing its GDP given a major kick from oil sales, as crude prices rise and production expands.

Africa is also something of an economic incubator. For example Kenya has pioneered a system of “mobile money” the Financial Times reports, which allows users to send and receive cash via their mobile phones.

(Click to enlarge)

The bad But it’s not all puppies and rainbows. Africa’s dark side frequently pops up in the headlines, giving most North Americans an image of the continent as dangerous, disease-ridden, lawless, and dirt poor.

A quick check of the headlines Monday yielded a video, circulating on social media, of two women and two young children who were blindfolded and shot last summer by Cameroon soldiers; kids in Nigeria used as suicide bombers in an attack on UNICEF; and white South African farmers who say they are living in fear of being attacked by blacks and losing their farms. The farmers patrol their farms at night wearing bullet-proof vests.

As noted at the top, mines are frequently targeted for treasure, and sometimes blood. In January of this year, Kirk Woodman, a geologist at Progress Minerals, was kidnapped and killed while working at a gold mine in Burkina Faso.

Africa’s economic success has been uneven, and comes with a price - debt. Despite being the fastest growing continent, Africa is home to three-quarters of the world’s poorest nations. One in three living in sub-Saharan Africa are under-nourished. 589 million live without electricity and rely on biomass for cooking. The World Bank says more Africans are poor today than in 1990, proving that economic growth is not finding its way down to the lowest rungs of society.

We can appreciate their desperation in the thousands of north African migrants who pay snake heads their family fortune to get them across the Mediterranean Sea to Europe.

A fifth of African countries are basket cases, dragged down by political instability and conflicts, which as we know, can get downright ugly. Among the countries that have seen brutal, and sometimes painfully prolonged civil wars, are Rwanda, Liberia, Mozambique, Nigeria, Uganda and South Sudan.

Growth for these countries is difficult when they don’t have a lot of money. As their populations continue to soar, the demand for infrastructure and social services rises as well. African governments need to figure out a way to address poverty, education and diseases, and to manage social divisions.

Take this stat for example: By 2050 over half of Africa’s 2.2 billion people will be living in cities - the same as the anticipated population of China. Imagine the need for new roads & bridges, electricity, schools, health clinics, etc. According to the UN, three-quarters of 71 African cities over 750,000 lack the infrastructure to support large populations. Usually the answer is to borrow.

Countries that piled on debt in the last half of the past decade are now seeing interest rates rise, putting their ability to manage debt payments into question - especially if commodity prices drop.

According to Brookings, a Washington, DC-based think tank, at least 14 African countries are at high risk of being unable to pay their debts, compared to five years ago. These heavily-leveraged nations have a total debt burden of $160 billion, $90 billion of which is owed to foreign countries.

Africa is the prize In the 1990s, Africa was languishing in debt, disease, droughts and civil wars. Who can forget the failure of the United Nations to stop the massacre in Rwanda?

One country that didn’t turn its back, that saw opportunity in Africa, was China. The Huffington Post argues it was the help of China that led several African countries, where the Chinese invested, down a better economic road:

It also helps that Africa has a patient new friend with deep pockets and a long view. When the rest of the world was dismissing Africa as a troubled backwater, China was busily embracing it, maybe recalling its own rise from famine and chaos. As Moyo puts it, China has been striking deals with struggling developing countries — the “axis of the unloved,” in her words — in return for investment, employment and infrastructure.

Why did China choose Africa? The answer is simple. China needed to secure raw materials for the country’s economic boom that started around 2000, and Africa had those materials.

The sheer size of the African continent - the world’s second largest - implies a bounty of natural resources. South Africa and Botswana are rich in diamonds, the DRC supplies 60% of the world’s cobalt, a mineral that is critical for the manufacture of electric vehicle batteries. Africa ranks highly as a source of aluminum, chromite, copper, gold, iron ore, manganese, zinc, graphite, coal, oil, uranium, platinum group elements, and phosphate rock.

Armed with hundreds of billions of US dollars from the country’s foreign reserves, in the early 00’s China’s state-owned enterprises (SOE) and sovereign wealth funds (SWF) were sent out to scour the globe for resources - to fuel China’s exploding economy.

China wanted to diversify out of the massive US-dollar component of its foreign exchange reserves, so the SOE/SWFs had no problem dealing in straight cash and operating in what some might consider high-risk areas. Chinese investors shifted their focus from Australia and Canada to higher-risk destinations which included Brazil, Ecuador and Africa.

According to a Pricewaterhouse Cooper (PwC) report on M&A activity in the mining sector for the decade ending in 2010, PwC counted a total of 400 Chinese deals worth US$48 billion. At the start of that decade, China was a negligible player in M&A.

The Chinese are making massive loans, building huge infrastructure projects such as high speed rail, dams, bridges, roads, schools and hospitals. While SOEs and SWFs are making deals for the country’s resources, other Chinese companies are building the necessary infrastructure that every country needs to build a future for its citizens. This is the key to China’s overseas investments - adding infrastructure capacity makes their massive, most often early-stage resource investments viable and creates a long-lasting economic legacy for the host country.

Thanks to the trillions of foreign exchange reserves it holds, China offers loans at highly competitive interest rates. For example, the Export-Import Bank of China (Exim Bank) gave the Angolan government three loans at interest rates ranging from LIBOR (London Interbank Offered Rate - the rate banks charge each other on loans) +1.25 %, up to LIBOR +1.75%.

The Chinese have a longer-term horizon for repayment, because they are mostly after off-take mineral supply agreements from early-stage development projects.

Reconstruction in war-battered Angola was helped by three oil-backed loans, then Chinese companies came in and built roads, railways, hospitals, schools, and water systems. Nigeria took two loans from China to finance electricity-generating projects. The Chinese built a hydropower project in the Republic of the Congo that was repaid in oil and built another hydropower project in Ghana that was repaid in cocoa beans.

“While the West supports microfinance for the poor in Africa, China is setting up a $5 billion equity fund to foster investment there. The West advocates trade liberalization to open African markets; China constructs special economic zones to draw Chinese firms to the continent. Westerners support government and democracy; the Chinese build roads and dams.” Isaac Twumasi Quantus

The overall Chinese package is very attractive and there are a lot of resource-rich countries taking the Chinese up on their offers.

MINING.com reported in under 10 years, the number of China-headquartered mining companies with assets in Africa went from just a handful in 2006, to 120 in 2015. Two high-profile examples are the acquisition, by China General Nuclear Power Corporation, of the Husab uranium project in Namibia, and Zijin Mining’s involvement (39.6%) in the massive Kamoa-Kakula copper deposit in the DRC.

While iron ore and copper have been the hot targets of overseas acquisitions by Chinese firms, the Chinese have also gone after gold, nickel, tin and coking coal.

More recently the most desired metals are those that feed into the tectonic global shift from fossil fuels to the electrification of vehicles.

China Molybdenum bought the Tenke copper and cobalt mine in the Democratic Republic of Congo for $2.65 billion in an effort to secure a supply of cobalt for EV batteries.

Africa and the New Silk Road The “New Silk Road” is the term for an ambitious trade corridor first proposed by China’s current president, Xi Jinping, in 2013. The grand design also known, confusingly, as the Belt and Road Initiative (BRI), is a “belt” of overland corridors and a “road” of shipping lanes.

It consists of a vast network of railways, pipelines, highways and ports that would extend west through the mountainous former Soviet republics and south to Pakistan, India and southeast Asia.

So far over 60 countries, containing two-thirds of the world’s population, have either signed onto BRI or say they intend to do so. According to the Center for Foreign Relations, the Chinese government has already spent about $200 billion on the growing list of mega-projects projects including the $68 billion China-Pakistan Economic Corridor. Morgan Stanley predicts China’s expenditures on BRI could climb as high as $1.3 trillion by 2027.

The Belt and Road Initiative is seen by proponents as an economic driver of proportions never seen before in human history. It would not only allow Asia to relieve its “infrastructure bottleneck” ie. an $800 billion annual shortfall on infrastructure spending, but bring less-developed neighboring nations into the modern world by providing a growing market of 1.38 billion Chinese consumers.

Opponents argue that is naive and the real intent of BRI is to carve new Chinese spheres of influence in Asia that will replace the United States, in-debt poor nations to China for decades, and restore China to its former imperial glory.

Whatever the motivations for it, the power of the New Silk Road was shown earlier this year during a summit in Beijing. China reportedly used the conference - which included the participation of Kenya, Ethiopia, Tunisia and Egypt, among 50 countries - to increase the Silk Fund for BRI projects, from $40 billion to $100 billion. The presidents of Russia, Argentina, Chile, Indonesia, Switzerland, Turkey, Vietnam and Uzbekistan were there, along with representatives from the UN, IMF and the World Bank.

As for who stands to benefit most from Belt and Road, Africans or Chinese, it’s probably too early to say, but the Africa Center for Strategic Studies reels off a number of benefits. They include:

Addressing Africa’s inadequate infrastructure, which is a bottleneck to Africa’s development. The World Bank estimates that Africa will need up to $170 billion in investment a year for 10 years to meet its infrastructure requirements.

East Africa’s projects, where most of the funds are being directed, could increase by up to $192 billion, if the projects are used profitably. Examples are the railway connecting Mombasa to Nairobi, and the electric railway from Addis Ababa to Djibouti, China’s first overseas naval base.

However there are a number of negatives and potential red flags that China’s Belt and Road partners need to watch out for.

The first is the Blue Economic Passage that connects Africa to new maritime corridors in Asia. The expanding commercial presence matches Xi Jinping’s goal of making China’s military stronger - which may lead to regional conflicts. In the words of the Africa Center for Strategic Studies:

This is particularly evident in the Indian Ocean, where China’s planned sea lanes are heavily concentrated and its rivalry with India is growing. Africa’s importance to China in this regard stems from its location in a maritime area in which Beijing hopes to expand its presence and power projection. Indeed, a decade ago China’s reach in Africa’s adjacent waters was nonexistent. Today, it is estimated that the PLA Navy maintains five battleships and several submarines on continuous rotation in the Indian Ocean. This is set to increase in the coming decades as India ramps up its own presence in the area.

Another is local markets getting swamped Chinese products. That happened to Kenya’s cement exports in 2017, which dropped by 40% due to a flood of Chinese cement. This can easily happen because China is using Africa as an end user of sectors that are seeing industrial overcapacity ie. producing too many goods.

Or when local workers are displaced by Chinese employees. According to the Africa Center for Strategic Studies, there are over 200,000 Chinese nationals working on Belt and Road projects across Africa. This has resulted in the need for a globally focused strategy to protect China’s overseas interests. Similarly the Communist Party of China has adopted the concept of “protecting overseas nationals” as a core Chinese interest,” states the center. Seems to me this is an open-ended dictum that could easily justify a military intervention in one of China’s BRI partner countries.

There is also the risk of widening trade deficits in African countries that are being shipped China’s excess production. In 2016 Kenya’s imports of Chinese cement, used to build the Nairobi-Mombasa railway, increased 10-fold. Chinese steel exports to Nigeria popped 15% in 2018, and Algeria imported three times as much steel. In 2019, China’s aluminum exports have risen 20%, with $46 billion worth of aluminum bought by Egypt, Ghana, Kenya, Nigeria and South Africa.

If these countries aren’t careful, they will end up with a whopping-great balance of trade deficit with China, (just like the US) that when added to large loans for infrastructure, could be economically limiting or even crippling.

ConclusionThe rise of Africa is interesting on its own, but when paired with the rise of China, the prospect for the West is actually quite scary. On the one hand we have a continent that is teeming with humanity and getting more and populated every year. Its citizens want what we as North Americans have. We have written about the scarcity of resources and the potential for conflict. Combine that with existing tribal tensions in Africa that have at times exploded into civil wars, and you have a powder keg just waiting for someone to light the match.

Then factor in China, which is playing Africa’s new economic dragons with the skill of a Chinese violinist. It’s a beautiful plan, really. Make loans to poor developing nations that want to become part of BRI, using US dollars, while the USD is still the reserve currency. The loans are paid back using offtake agreements for raw materials from these countries, which become part of the largest trading block in the world, thereby further distancing China from the West.

Remember, Russia is part of BRI. The Kremlin and Beijing have already signed billions worth of energy deals, and are talking about a new payments system that allows for trade in rubles and yuan, excluding the US dollar.

Devalue the yuan, so that China’s new south Asian trading partners can buy competitively priced Chinese goods, further enslaving them with crippling trade deficits.

China was already building the New Silk Road when Trump got elected and started poking the Chinese dragon with the stick of escalating tariffs. The trade war just hastened what China was planning on doing anyway: cut the US out of its trading loop.

It has the resources, the technology and the population to lay siege to the United States for a long time. China’s in no rush to settle the dispute.

Meanwhile, hit back at US companies as retribution against the United States which dared to stand in the way of companies like Huawei and ZTE. Build the biggest manufacturing base the world has ever seen, embargo their critical metals, effectively starving their supply chains, and watch them slowly wither and die, as the US continues down its path to self-destruction.

|