Another part of the scenery ...

bloomberg.com

Nobody Benefits From a U.S.-China Trade War With No End in Sight

An economic trade rift could have dire consequences for global safety and security.

More stories by Peter Coy

September 13, 2019, 12:01 PM GMT+8

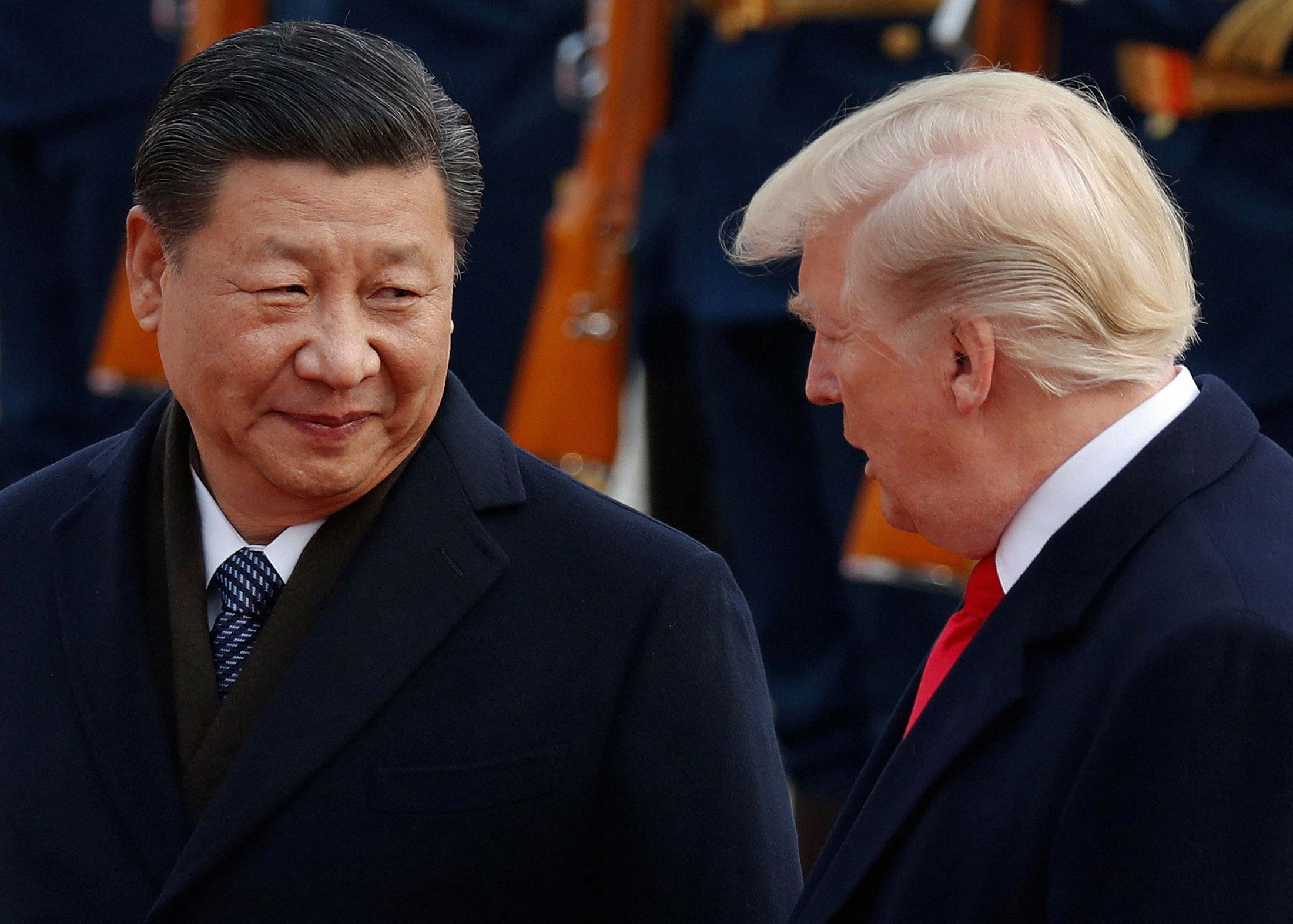

U.S. President Donald Trump and Chinese President Xi Jinping in 2017.

Photographer: Damir Sagolj/ReutersIt’s tempting to laugh off the U.S.-China trade dispute as a soap opera featuring men with big hair and bigger egos. Presidents Donald Trump of the U.S. and Xi Jinping of China once professed close friendship; now both feel jilted. The two countries are said to be “ consciously uncoupling,” like Gwyneth Paltrow and Chris Martin. Xi’s just not that into Donald, you know?

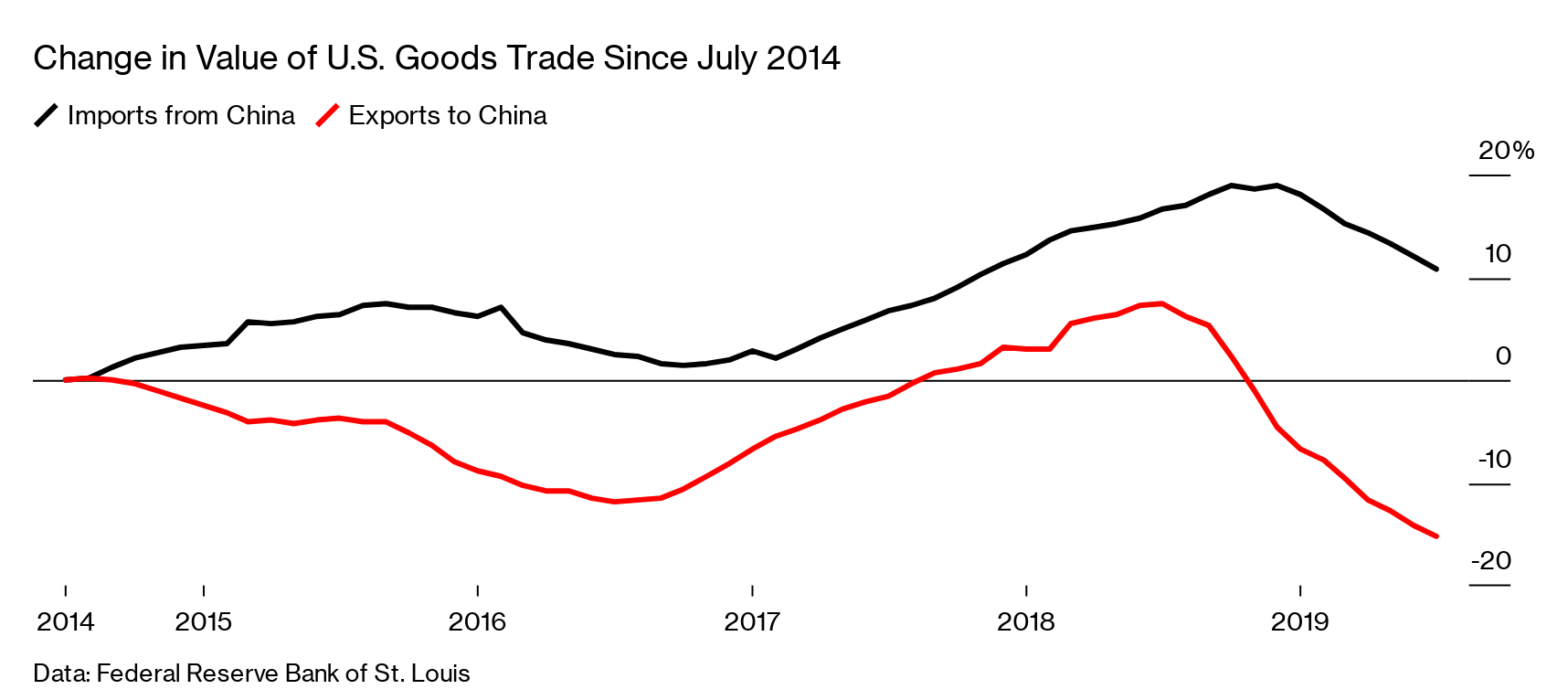

Except the consequences of this uncoupling—or decoupling or disengagement or whatever it’s called—are deadly serious. The world’s two largest economies, still heavily interdependent, are systematically chopping away at the ties that bind them. There is less trade, less investment, fewer students crossing borders to study, and fewer contacts between militaries.

Value of Foreign Direct InvestmentData: Rhodium Group

The only question now is how much more contentious the relationship is likely to get. In a worst-case scenario, the U.S. and China split the world economy in two, each tugging a group of trading partners into its own orbit. That would be reminiscent of the 1494 Treaty of Tordesillas, in which Spain and Portugal agreed to split the New World, or like the Iron Curtain that divided Europe between the West and the Soviet bloc after World War II.

A deepening division between the U.S. and China would further disrupt trade, investment, and movement of people, which together are a source of innovation and prosperity. “The result of forcing Europe and the rest of the world to choose between the United States and China cannot yet be discerned, but it will be costly for all involved,” Jacob Kirkegaard, a senior fellow at the Peterson Institute for International Economics, wrote in a policy brief this month.

The consequences for global safety and security are potentially even greater. True, there’s no guarantee that countries with a dense web of contacts will be friends. But countries that wall themselves off from each other are invariably rivalrous, if not outright hostile, says Jeffrey Bader, a Brookings Institution senior fellow who was director for Asian affairs on President Barack Obama’s National Security Council.

The main reason for thinking things might get worse is that trust, once broken, is hard to repair. (Ask any divorce lawyer.) There will be no “just kidding” moment in which Trump and Xi laugh off the whole episode as a silly misunderstanding. For instance, now that the U.S. has slapped restrictions on the sale of American-made chips to Chinese telecommunications giants Huawei Technologies Co. and ZTE Corp., it’s impossible to imagine that Xi will ever again regard the U.S. as a reliable source of critical components. The companies are redoubling in-house research and development. Huawei’s HiSilicon chip subsidiary is on track to become one of the world’s largest makers of core processing chips, according to Sanford C. Bernstein (Hong Kong) Ltd. analyst Mark Li.

Another reason to expect worse to come is that a trade war tends to feed on itself. Each act of retaliation by one side is taken as a fresh affront by the other. Trump’s tariffs began small in January 2018, with levies on washing machines and solar panels imported from all countries, not just China. By this December, according to each side’s stated plans, there will be punitive tariffs on almost all products sold by each country to the other.

Finally, some of Trump’s advisers view China not just as a rival but as an implacable and fundamentally alien foe. The National Security Strategy, published in 2017, said China and Russia seek to “shape a world antithetical to U.S. values and interests.” Secretary of State Mike Pompeo said in June, “China wants to be the dominant economic and military power of the world, spreading its authoritarian vision for society and its corrupt practices worldwide.” Peter Navarro, the White House’s director of trade and manufacturing policy, wrote a book called Death by China.

Last year at Bloomberg’s New Economy Forum in Singapore, Henry Paulson, who was President George W. Bush’s secretary of the Treasury, warned of an “ Economic Iron Curtain” dividing the world if the U.S. and China fail to resolve strategic differences. Paulson blamed China for a good deal of the impasse but said the U.S. needs to tone down the rhetoric. “If we treat China like an enemy, they might become one,” he is fond of saying.

The dissolution of what used to be called Chimerica has already begun. Michael Scicluna, chief financial officer of Shyft Global in Provo, Utah, says his small outsourcing company used to arrange for all of its clients’ manufacturing to be done in China, but over the last year it’s switched 15% of production to lines in Taiwan, Thailand, and Vietnam, with more likely to come. “We understood the Chinese culture quite well. We built a relationship with factories. It’s just a good system for us,” he says. But, he adds, the tariffs are making China far more costly.

The tariffs are also inadvertently making the U.S. a more costly place to do business. Troy Roberts, chief executive officer of Qualtek Manufacturing Inc. in Colorado Springs, Colo., says steel tariffs have made the U.S. into an island of high steel prices, harming companies like his that buy American steel as an input. He says he recently lost a customer for tire-chain parts to a competitor sourcing its steel from Austria. Roberts, who is chair of a trade group called the Precision Metalforming Association, says, “I applaud their efforts to try to deal with China. It’s just their method is not working.”

Trump is right, of course, that China has committed theft of intellectual property, forcible tech transfers, and (in the past) currency manipulation, among other sins. But the most effective way to deal with such violations is concerted international pressure exerted through multilateral bodies such as the World Trade Organization. The goal with China should be fairer trade, not less trade.

Trying to force apart the interconnected U.S. and Chinese economies with the blunt instrument of tariffs is fraught with problems. “For each intended consequence of the tariffs, you probably get 10 unintended consequences,” says Stephen Myrow, managing partner of Beacon Policy Advisors LLC in Washington, who worked in Bush’s Treasury Department.

The rationale for Trump’s trade war isn’t always clear. At times, he justifies tariffs as a temporary measure to force China to the negotiating table; at other times he sees them as a force for bringing jobs and production back to the U.S. The latter ambition is a mirage. Self-sufficiency sounds like a good thing, but in practice it’s a recipe for slow growth or worse. No economy, even one as big as the U.S.’s, can do everything well. Free trade allows each country to specialize in what it’s best at and to buy the rest from others.

There’s always been a security angle to free trade. In 1860, France and Britain signed the first modern trade pact, known as the Cobden-Chevalier Treaty. That was less than half a century after the end of the Napoleonic Wars and arose from the brilliant observation that trading is better than fighting. Many nations that weren’t a party to Cobden-Chevalier adhered to its spirit. That lasted until the Great Depression, when nations raised tariffs in a fit of beggar-thy-neighbor rivalry. After the Depression came the even deeper breakdown of World War II.

Those twin catastrophes renewed interest in promoting free trade in the name of prosperity and security. In October 1947, two years after the war’s end, 23 nations signed the General Agreement on Tariffs and Trade. But the Soviet Union opted out, forming a rival trading bloc with its Eastern European satellites called the Council for Mutual Economic Assistance. That self-isolation, combined with the pernicious effects of communism, sowed the seeds of the Soviet bloc’s demise by retarding technological progress and economic growth.

A high point for free trade came in 2012, when Russia joined the GATT’s successor, the WTO. But now, a couple of decades after the Soviet Union’s dissolution, the world may be sliding back into a bipolar trading regime.

Some of Trump’s advisers, including Navarro, appear to regard the rivalry with China as a replay of the long twilight struggle with the Soviet bloc. China is successful only because “they steal stuff,” Navarro said in a discussion last year at the Center for Strategic and International Studies. The Chinese “take the technology of the world and avoid the 10, 20, or 30% R&D expenditures that other companies have to spend every year,” he said. Deprived of free access to Western technology, he said, China “would be left with an economy that would effectively lose its edge.”

But hawks like Navarro may be underestimating China. It is a more productive, more competent player in technology than the Soviet Union ever was. It’s also more integrated into global supply chains, meaning that the rest of the world needs China almost as much as China needs the rest of the world.

Trump is trying to get China to abandon its Made in China 2025 program, a 10-year government plan to make the country a world player in 10 key sectors from aerospace to artificial intelligence. Trump argues accurately that China has broken free-trade rules to advance the project. But getting Xi to stop working on the 2025 project altogether is unrealistic.

While it’s easy to imagine the trade war worsening, there are grounds for hope that it will return to something nearer the status quo ante bellum. David Jacks, an economist at Simon Fraser University in Vancouver, says influential U.S. businesses may push back harder against Trump’s agenda. He expects “pretty significant lobbying on the part of very large U.S. corporations that have made very significant investments in terms of fixed capital in global value chains over the past 30, 35 years.”

One reason for corporate pushback would be that the U.S., in trying to isolate China, could isolate itself instead. That would happen if other nations choose to keep doing business with China on favorable tariff terms, leaving only the U.S. to pay high prices for Chinese goods without any concomitant benefits. “I don’t see how one can set up global supply chains excluding China if companies from other countries include them,” Brookings’s Bader wrote in an email. “We are not going to persuade the Europeans and Japanese to exclude them. That puts a ceiling on how far decoupling can go.”

Another cause for hope is that Trump or more likely whoever succeeds him in the White House will take notice that China has on many fronts performed as a responsible world citizen. Yes, its record on human rights is inexcusable, and its militarization of the South China Sea is destabilizing. On the other hand, it stopped manipulating its currency. It’s become a world leader in renewable energy and, unlike the U.S., has joined the Paris climate accord. The Chinese, far from being inscrutable, have the same hopes and aspirations as Americans. “Chinese society is more similar to American society than Soviet society ever was,” Yale historian Odd Arne Westad writes in the latest issue of Foreign Affairs magazine. America’s relationship with China can be positive, not purely a zero-sum game in which one side’s gain is the other’s loss.

Writing under the pseudonym “X” 72 years ago, American diplomat George Kennan laid out a plan for the U.S. to compete with the Soviet Union. As Westad writes, Kennan stressed that the U.S. needed to “create among the peoples of the world generally the impression of a country which knows what it wants.” Self-knowledge is equally key today. The alternative is blundering into a bitter divorce that’s in no one’s best interest. |