Re <<Gold>> the consolation prize ... let us watch S Korea and Japan, and points further east, and watch New Delhi and points west

On 22 Feb 2020, at 8:04 AM, J wrote:

I think the clear & present danger, too enormous, cannot be taken in by the market, and so is not.priced-in

We watch the numbers, and should the sick start to pile into hospitals in NYC and Silicon Valley, London and New Delhi, and and and, then nothing is out of the question

It reminds me a bit of the night I was reading SI on-line before going to sleep, and someone interjected Message 16330144 , rudely, something about “World Trade Center collpased Pentagon ablaze and you are worrying about the 1930s?”

The thing was that I just stepped into my hotel room Message 16330798 , but muted, thinking the CNN anchor was talking about some movie.

At the moment of the interruption it dawned on me, “no, not a movie. The World Trade Center just got crashed by a plane”

The mind does not take in big events, when too enormous, in an instant

In any case I just got a new iPad, and with it comes Apple TV+ for one year. My kids got notified on their iPads set to family sharing, and in an instant, “dada, click to accept”

I think tonight’s program shall be Resident Evil Apocalypse

On 22 Feb 2020, at 6:47 AM, b wrote:

https://www.theguardian.com/world/2020/feb/21/irish-drug-dealer-clifton-collins-l46m-bitcoin-codes-hid-fishing-rod-case

On 22 Feb 2020, at 5:00 AM, H wrote:

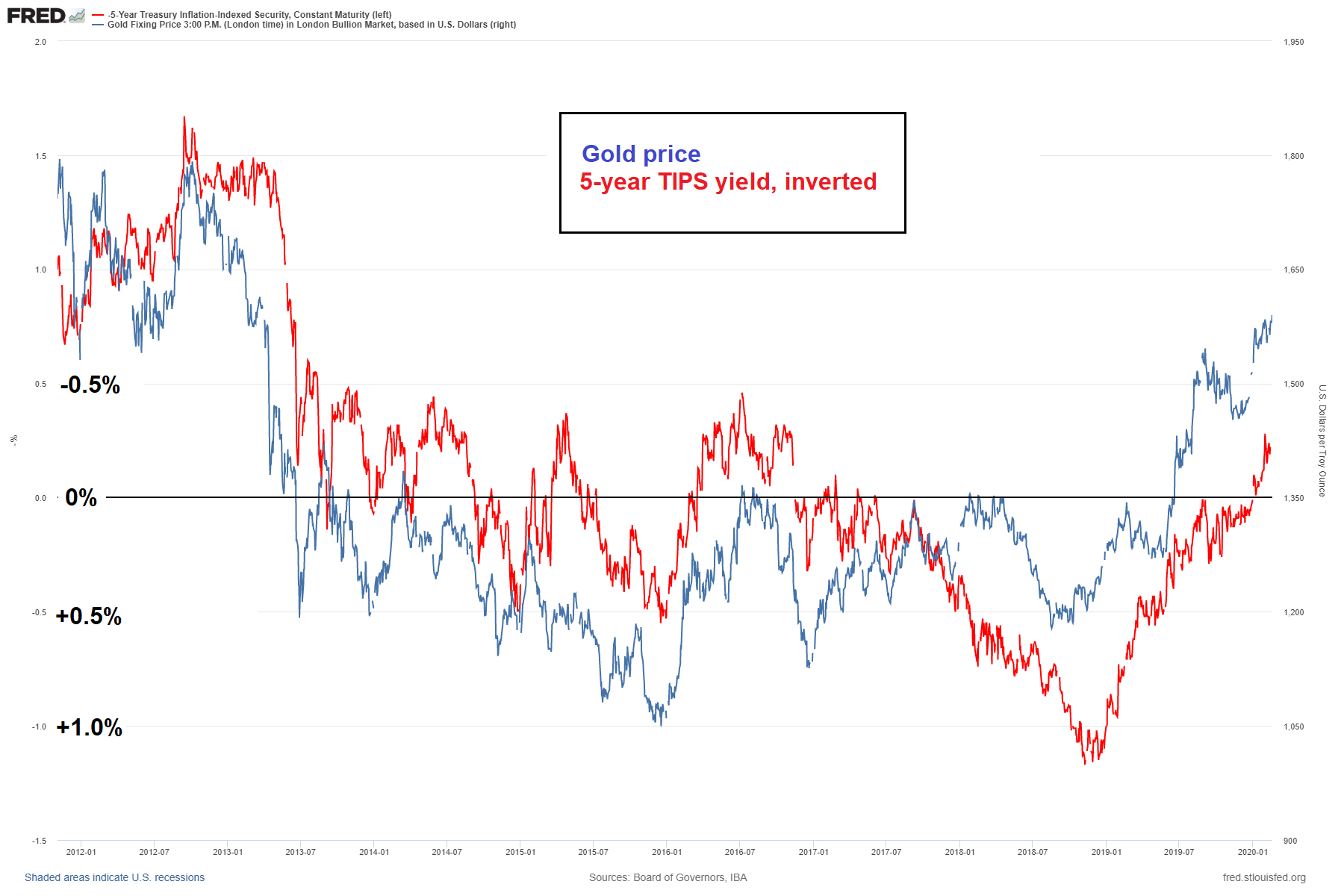

This is what is driving gold (chart).

As to the virus: imo this has now become unstoppable - a global pandemic seems a near-apodictic certainty. I conclude this from the surge in new cases in S. Korea and Japan.

On Fri, Feb 21, 2020 at 9:09 PM b wrote:

i am supposing just that.

the leaders such as they are are all acting just as they did in 2007.

no common purpose, no common rhetoric, no focused effective battle plan.

its a world wide joke.

and the peepole are not being fooled, the real failure. fool them and they will buy stocks LOL.

On Friday, February 21, 2020, 2:00:04 PM CST, J wrote:

Suppose for a second the virus spreads, and it is certainly doing that, but wide, far and deep,

And suppose for another moment that fate of empires at burning stakes, unless they can hold off the panic

Then what must happen?

On Feb 22, 2020, at 3:57 AM, b wrote:

gutsy given the 10 year chart and............ the straight up nature of the move.

so, tell me it is not so, there's a crash taking place.

and we're only six weeks into the pandemic.

at this rate the metal goes to 2500 in the next six weeks?

On Friday, February 21, 2020, 1:39:25 PM CST, J wrote:

Bought GLD at the ask

On Feb 21, 2020, at 10:02 PM, b wrote:

cnn.com

On Thursday, February 20, 2020, 11:11:15 PM CST, J wrote:

NFW

Continue as before, accumulation by puts then call

On 21 Feb 2020, at 12:45 PM, b wrote:

selling ur gold then?

|