Did below whilst watch a movie, and now watching astronomy documentary w/ the Jack.

On Mar 19, 2020, at 6:52 PM, J wrote:

Tried the hijacking approach w/ DRD Mining, the high-yield gold tailings operation, and its controlling shareholder, SBSW, the platinum and palladium miner. Worked well and absconded clear away w/ loot. Very interesting market, on par w/ "Taken at the Flood" murder mystery.

DRD finance.yahoo.com trading @ 4.99 from high of 7.79, yielding rich, w/o exploration and mining risk, just a gold bank

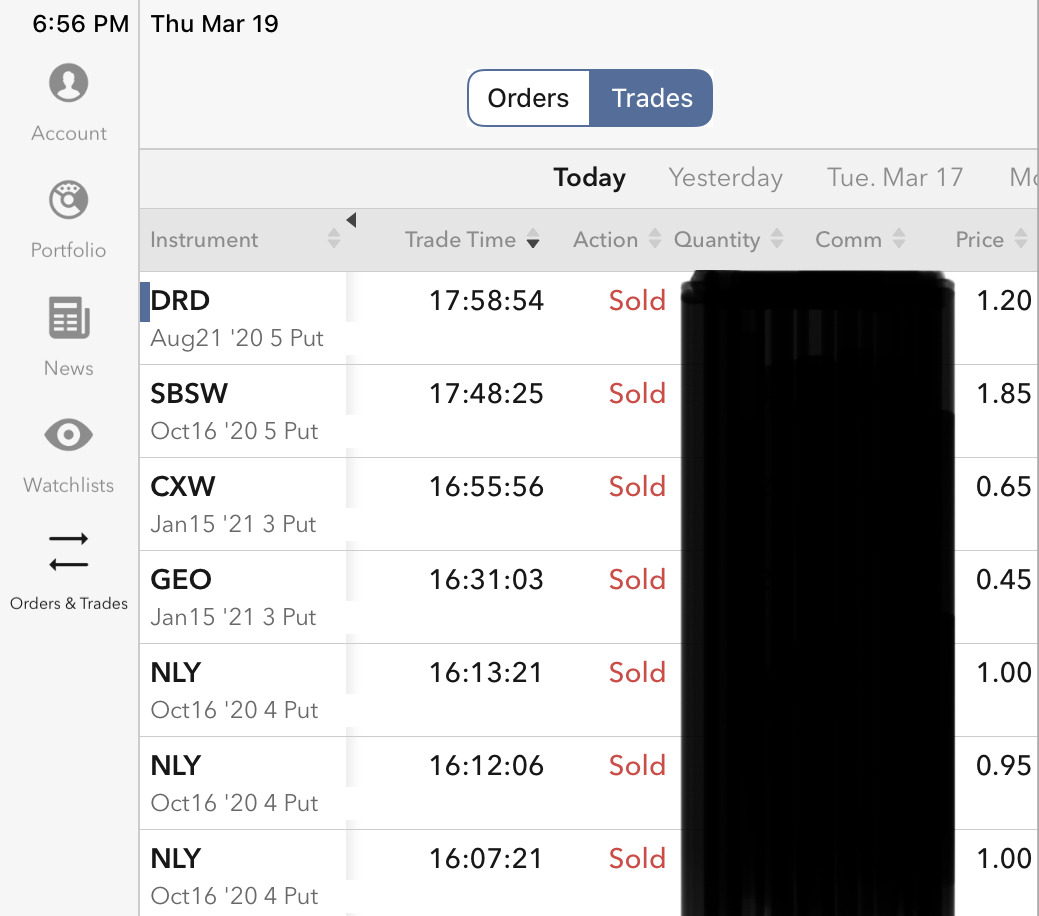

Did August 21st 2020 Put strike 5 @ 1.2

SBSW finance.yahoo.com trading @ 4.26 from high of 11.85

Did October 16th 2020 Put strike 5 @ 1.85

I doubt I would be put on any of the stuff collected from cloud-ATM this afternoon, but who can tell. Maybe the best-use-by of the world is done, and TeoTwawKi beckons

On Thursday, March 19, 2020, 05:20:46 PM GMT+2, J wrote:

I never wanted any REITs in USA, but as I watch the Agatha Christie movie, “Taken at the Flood” am multi-tasking instead of eating cold cuts, and finding the cloud-ATMs unguarded, bank vaults wide open, cops not around, and loose change all about, walking-around cash plentiful, interest rate zero

Did it again, this time to CXW, another high-yield people warehousing facility akin to GEO and NLY, trading at 8.73, down from high of 24, yielding 14+%, by shorting CVX January 15th 2021 Put strike 3 for 0.65 immediate sign-on reward.

This is stupid, either America is on sale, or am walking into a 1929 trap, but hardly matters, given the Tesla backstop already banked money-good

On Thursday, March 19, 2020, 04:49:10 PM GMT+2, J wrote:

Totally broken market, cloud-ATM wide open, no cops around, all per rule of law,

To quote Brittany, “oops, i did it again”

This time to Team American publicly-listed prison even as I know yes, the prison enterprise, a high-yield REIT (all REITs are high yield now) trading at 11 and change, ostensibly, but I shorted GEO January 15th 2021 Put strike 3.00 at 0.45 immediate freedom-supporting withholding-tax-free premium inducement

...

I am also watch an Agatha Christie movie now.

On Thursday, March 19, 2020, 04:20:40 PM GMT+2, J wrote:

As I had tanked up since beginning February on short naked calls of TSLA with different strike prices and expiration dates, I am a bit playful now.

I just shorted NLY October 16th Put strike 4.00 per share in three dollops, first to test the water, ___ shares, second to rip off p****ties, ___ shares, and third to do the dirty, ____ shares, and got a immediate withholding tax-free dividend payment of ~1.00 per share.

Should I be put these shares I had never cared for, due to the freedom-reducing withholding tax regime of the empire, the planet would have other things to worry about, and my gold would be ...

On Mar 19, 2020, at 3:51 PM, M wrote:

Annaly announced their quarterly dividend of $0.25 last week for holders as of March 30th.

They seem copacetic. Either bravely lying or the market is irrational.

Best,

M |