Re DRD

On May 13, 2020, at 8:50 PM, J wrote:

Agree on items (1) and (2) by casual scan of local media where I am, as to (3) I thank you for the admonition and shall watch out for signs. Not immediately worried as the virus does its work.

Best, J

On May 13, 2020, at 8:37 PM, H wrote:

It should be noted: relative to the total SBSW portfolio, DRD is a relatively small part - the 50% stake is now worth slightly more than USD 400 million, and SBSW has a 7.75 billion market cap - but DRD promises to grow in importance as it expands its operations in coming years.

As to the risks, let me quickly tick them off:

1. political risk: this concerns mainly the frequent tinkering of the government with the SA mining charter. Luckily Ramaphosa seems to be good at putting the brakes on excesses - he sometimes comes off as a typical lefty ANC populist in his public pronouncements, but in reality he seems intent on preserving a market economy. The guy has been a trade union leader (in fact, he presided over the National Union of Mineworkers in the late 1980s/early 1990s), a successful businessman and now he somehow made it to top dog on the political totem pole, so we can safely assume he's no dummy. Still, the risk is not zero, but it is not as big a concern as it is sometimes made out to be.

2. electricity supply: this is a real pain in the behind for every mining operation in SA. Eskom is a textbook example of socialist failure. Governments just cannot run a business, and Eskom has been run into the ground. Reform efforts are underway, but the process is an arduous one so far. The mines are beginning to take their own countermeasures in parallel (they plan to build dedicated power plants for themselves - but they still require official approval. My bet is they are going to get it, as the Eskom monopoly has been killed earlier this year).

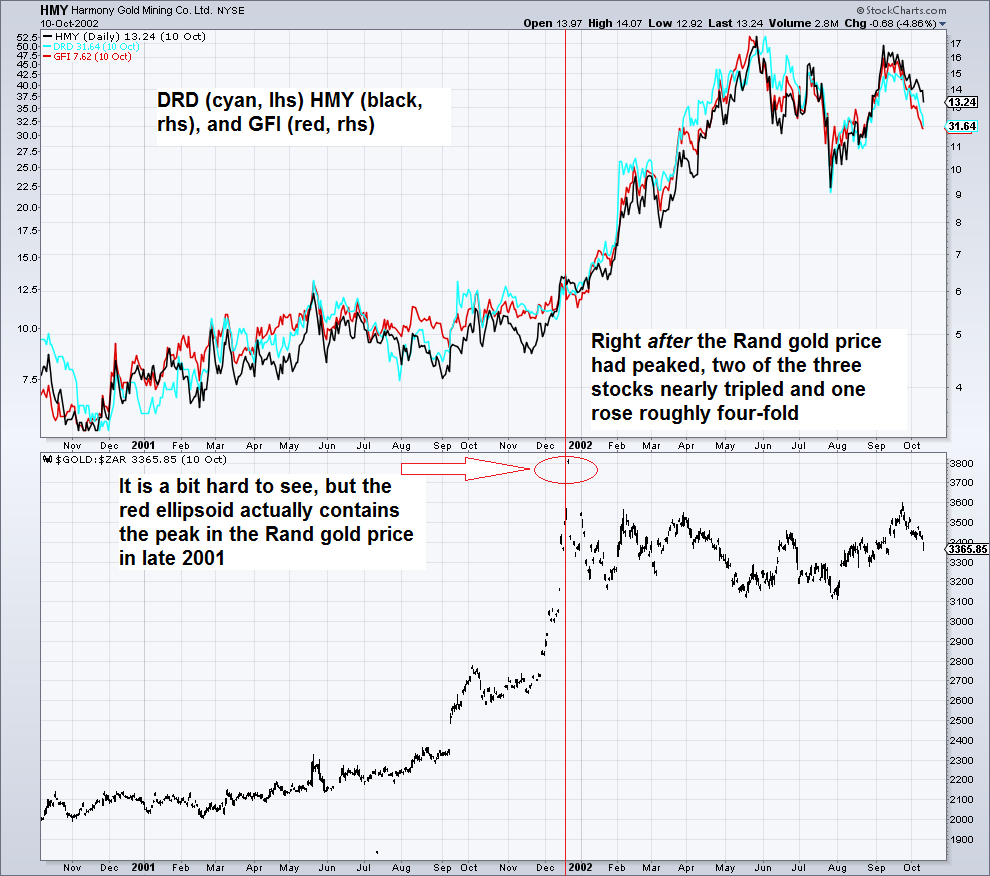

3. the Rand - the weak ZAR has been a great boon for SA gold miners over the past year. I attach a chart from an article I posted in H2 2015 - The Canary in the Gold Mine- in which I discussed the fact that SA mining shares tend to lead at major lows for the sector. The chart shows what happened in 2000 - 2002. The Rand gold price rose first - just as it did this time around. When the Rand gold price peaked, the USD gold price played catch-up. Despite the fact that gold went sideways in Rand terms, the major SA gold stocks at the time still tripled in USD terms. But that was it. From that point onward, the strong Rand became a huge drag on their share prices, and they switched from being outperformers to underperforming the sector for several years. In short: once the Rand begins to strengthen, there is a good chance they will continue to rally as long as USD gold prices continue to go up, but they will be on borrowed time and one has to move on to other stocks in the sector before the markets begin to worry about excessive Rand strength.

On Wed, May 13, 2020 at 7:43 AM J wrote:

Would be grateful.

I myself shall try best to give a look to issue of relative-value between DRD and SBSW holdings in DRD.

On 13 May 2020, at 7:13 AM, H wrote:

That is highly unlikely. Sibanye entered into the deal with DRD for the explicit reason that it wanted its surface assets to be brought to account and operated by an independent entity, which leaves SBSW management free to focus on its already complex & sprawling portfolio of underground gold and PGM mines. It has the last word as the majority owner, but actually does not interfere in management of DRD.

I will have more to say later (I'm about to go to sleep now). In particular I want to discuss what the risks are. The current incarnation of DRD is luckily the least risky and most consistently profitable it has ever been, and the risks are therefore fairly straightforward - but they clearly do exist (one only has to look at the ups and downs in the stock since 2015 - currently the market loves it, but it has hated it in the not-too-distant past despite its strong prospects).

On Wed, May 13, 2020 at 12:11 AM G wrote:

Why, all things considered, would their 50.1 percent shareholder not offer to buy them out now.

which would remove any bet based upon DRD as a stand alone.

and hence change the picture relative to the merged company at that point, and all all of the other basis points.

and why are they not doing just that?

this question seems quite worth asking on the top of the list of the other questions.

On May 12, 2020, at 10:23 PM, G wrote:

we've seen huge shit happen in markets over the last 11 years including amazing grabs at yield for the worst things offered on planet earth with the highest possible risks.

And YET: just a few months ago as the crow flies, DRD which then had a 5% yield or higher, was trading at 2 and 3 dollars per share.

WTF?

nobody wanted to buy a going concern with a great game plan, great balance sheet, no debt, money in the bank and all the rest?

HOW IS THAT?

people were scouring the planet for yield and they did not buy this company?

The starting point for DRD in the so called new gold bull should not have been, even w/o a bull, at least twice what it was trading at just months ago at the gold lows for the move, simply on the basis of the other dynamics going on for the last 11 years.

How is that?

Fuckers were scouring the planet with the yield radars, overhead sensors, and god knows what, and bought shit like junk (now being rescued, and all the rest) and they didn't buy DRD?

How is that?????????????????????????????????????????????????????????????????????????

What are we missing, OR, what are we getting right and need to get even more right before they do?

Please weigh in if there's something constructive to add...soon LOL.

everything is at a pivot point on all things. you can smell it. something is going to start happening anytime between now and soon.

the tape says so.

|