Folks who did not call gold bull until it was in-the-face underway now call for tops, presumably because they see everything returning to pre-new-normal, all shall be well, employment good, budgets balanced, debt collaeral-good, fiat currencies worthy

bloomberg.com

As Gold Smashes Records, Forecasters Ask Whether Peak Is Near

Elena Mazneva

Photographer: David Gray/Bloomberg

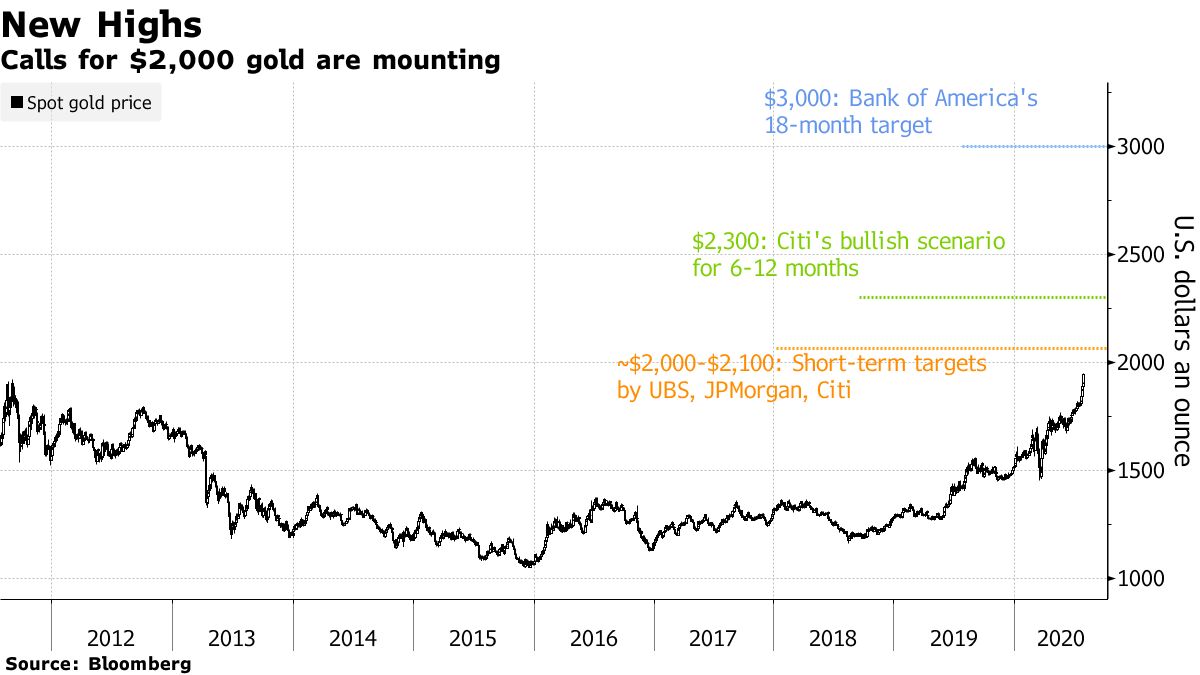

Gold has just smashed a record, and every major bank agrees that it’ll cross $2,000 an ounce. What happens next is where forecasts diverge.

JPMorgan Chase & Co. says the rally that has already seen prices rise 28% in 2020 could start to lose steam later this year. Citigroup Inc. and Bank of America Corp aren’t ready to call it quits just yet, with the former expecting higher prices for longer and the latter seeing the metal soaring to as high as $3,000 an ounce.

Gold has emerged as the safe haven of choice among investors as the pandemic upends economies worldwide. The spot metal touched $1,981.27 on Tuesday, about $60 above the previous peak set in 2011, boosted by a drop in real rates, the recent weakness in the dollar, massive government stimulus and flaring U.S.-China tensions. Gold is serving as an attractive hedge as yields on Treasuries that strip out the effects of inflation fall below zero.

Gold “will likely see one last hurrah before prices turn lower into year-end,” JPMorgan analysts said in a report Monday. The bank said it has now turned neutral on gold and added that the current price might be close to a peak.

BofA couldn’t hold a more different view, sticking to its April forecast for $3,000-an-ounce gold over the next 18 months. Citigroup said the current gold cycle is “unique” and prices can “stay in a higher range for longer.”

Signs of gold’s record-breaking ascent began to show in mid-2019, when the Federal Reserve signaled a readiness to cut U.S. interest rates as uncertainty -- primarily about the impact of the U.S.’s trade battles -- clouded its outlook. The rally gathered pace in early 2020 as geopolitical tensions increased and the coronavirus outbreak hurt growth worldwide, with gold heading for its biggest annual gain in a decade.

All the moves have generated the same fears that had taken gold to its previous record in September 2011 -- that the dollar will deteriorate and inflation will spark. But this time around, stimulus measures were quicker and more massive, UBS Group AG said, and it’s still unclear how big the impact on global unemployment and activity could be from the health crisis.

There’s still a little bit further to go for gold. Prices should breach $2,000 soon, Citigroup analysts including Aakash Doshi said in a note, raising the bank’s short-term target for the metal to $2,100.

“Prices seem biased to stay higher for longer, with 2019-2020 emerging into a unique bull regime for the yellow metal,” the bank said, adding that prices could even reach $2,300 in six to 12 months under a bullish scenario.

For UBS, gold around $2,000 may be the “new normal” with the current set of drivers, and prices could even climb to $2,300 in its “risk” scenario, said Wayne Gordon, executive director for commodities and foreign exchange at UBS’s wealth management unit.

But the rally could fade by the middle of next year, with prices coming under pressure as central banks can’t keep the same pace of easing, he said. Investors will start looking at alternatives as economies recover.

There is some support too for higher prices coming from the futures market, with some Comex contracts already topping $2,000 an ounce. Still, JPMorgan said a scenario in which U.S. real yields go much deeper into negative territory looks unlikely, while inflation will probably remain significantly below the Fed’s 2% target with the U.S. labor market remaining in significant slack well into 2021. That would help cool the gold rally.

“Things that we’ve learned from 2020 is to expect the unexpected,” said Kristina Hooper, chief global market strategist at Invesco Ltd. “All in all, I expect gold to move higher but remain in something of a range for a while, and it will take some other catalyst, like a spike in infections, rates in the U.S. or some sort of greater level of geopolitical risk to move it higher.”

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |