Two possible takeaways, at least, that ...

PGM supplies may tighten going forward, and

More tailings to do by folks who know how best to do

One surmise / conjecture, but nothing akin to sure bet, that if I were SBSW w/ control of DRD, I would want DRD to sharply accelerate and up production, to extract goodness, and to do JVs w/ declining gold miners, apply DRD know-how and technologies, to do more, faster, and less capital-heavy, w/ no upfront for acquiring the tailings dams, all so that SBSW can do its PGM thing w/ help from DRD dividends.

bloomberg.com

Platinum Giant South Africa Forced by Virus to Look Into Abyss

Felix Njini

LISTEN TO ARTICLE

South Africa’s gold industry has been dying slowly for years. As the coronavirus undercuts the already fragile case for investment, its platinum mines may be next.

Beset by power and water shortages, alongside whipsawing government policies, South African producers have cut spending over the past decade on mines responsible for 75% of global platinum supply. The virus is accelerating that trend, damping demand for the catalytic converters that are the largest users of the metal, while stimulus packages push automakers to speed a shift to electric vehicles.

A series of mega open-cast projects risk being shelved -- depriving a recession-hit economy of essential investment -- but the toughest blow may land on the so-called western limb, the traditional heartland of the nation’s platinum belt.

“The western limb region has been the bedrock of South African platinum and that is in decline,” said Mandi Dungwa, an analyst at Kagiso Asset Management Ltd. “It is the end of an investment cycle in those type of mines.”

South Africa’s Shifting Platinum FortunesIndustry’s future lies in Northern Limb projects

Source: RBPlat, Platinum Group Metals

Shunning capital spending leaves one of South Africa’s biggest export industries in limbo, just as the demise of the nation’s gold mines enters its final phase. With about 170,000 people employed in platinum mining, the timing is bad for President Cyril Ramaphosa as he battles the biggest economic contraction since World War II.

Output from South Africa’s 130-year-old gold industry slumped over the past three decades as the geological challenges of operating the world’s deepest mines pushed up costs. The platinum deposits discovered by Hans Merensky in the 1920s contain about three-quarters of the world’s known resources, but were only exploited in the 1950s with a surge in demand from carmakers using the metal to cut exhaust pollution.

“The sun is definitely starting to set over some of the conventional, deep, high-grade, western limb areas,” said Johan Theron, a spokesman for Impala Platinum Holdings Ltd. “It’s exactly like gold: there is more gold, but it’s deeper and requires more capex and prospects of making a return are slim.”

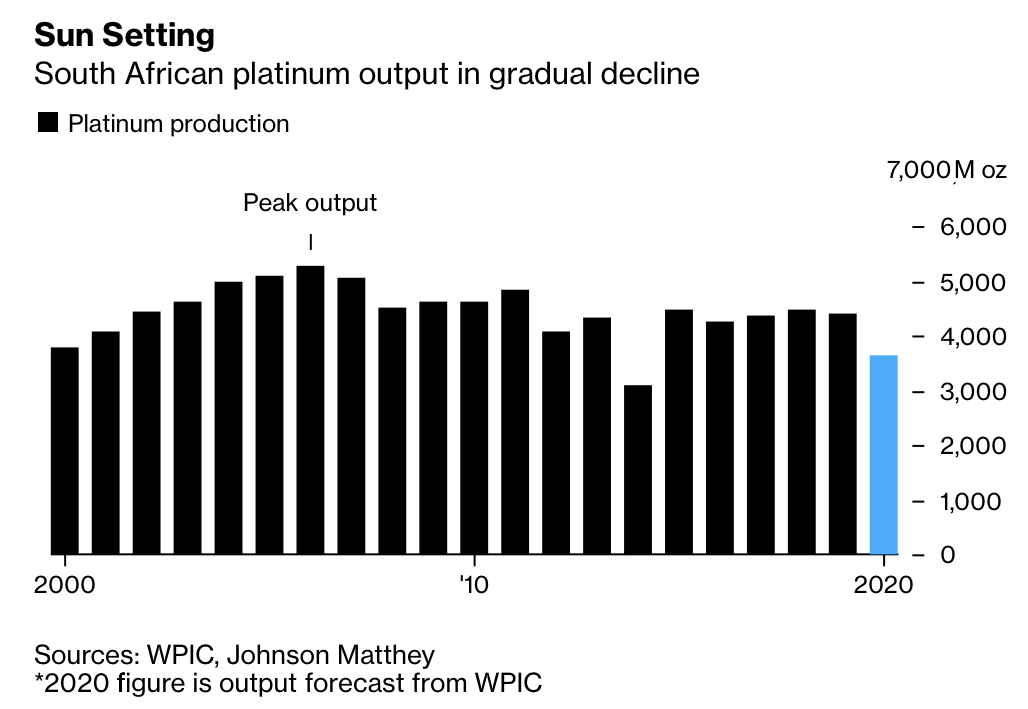

Platinum output peaked in 2006, and the lack of investment in deep-level western limb shafts will result in a further sharp contraction in production over the next 10 years.

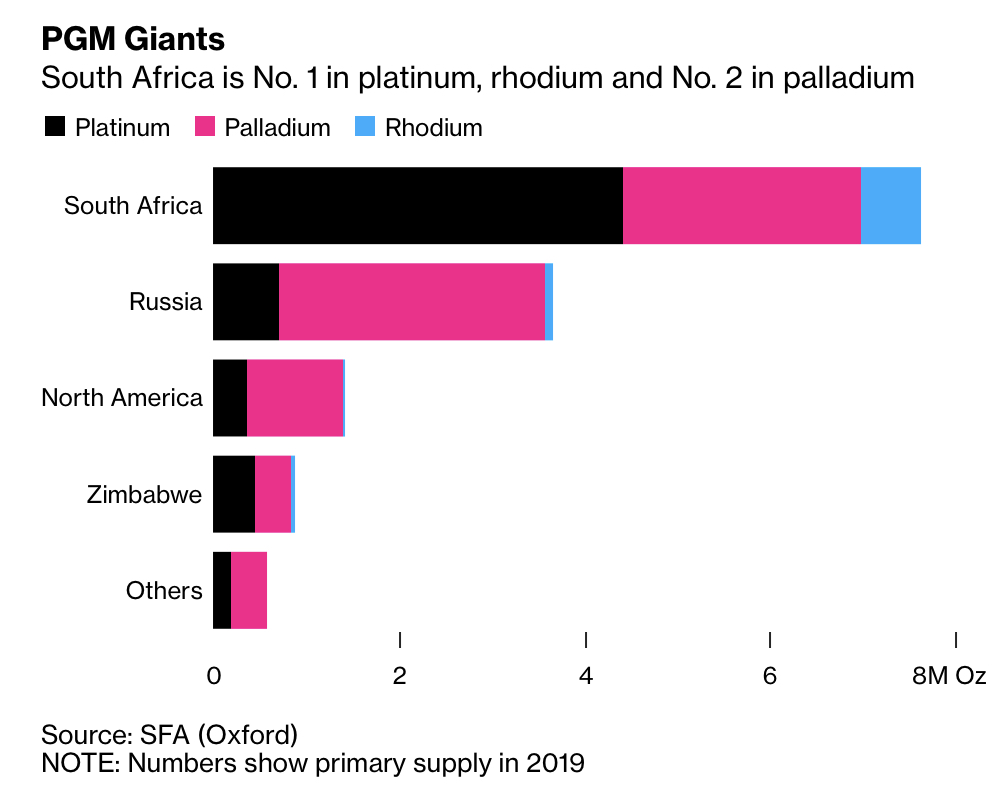

PGM GiantsSouth Africa is No. 1 in platinum, rhodium and No. 2 in palladium

Source: SFA (Oxford)

NOTE: Numbers show primary supply in 2019

The windfall from surging palladium prices -- another platinum-group metal produced at South African mines -- refilled the coffers of local producers over the past 18 months but hasn’t been enough to justify large capital expenditure projects. That’s delaying the construction of the next generation of mines on the northern limb of the platinum belt, and hastening reserve depletion.

In June, Implats balked at investing about 12 billion rand ($680 million) on building a new mine at Waterberg on the northern limb of the platinum belt. The outlook doesn’t support such spending over the next decade, said spokesman Theron.

Anglo American Platinum Ltd. has delayed a decision until the second half of next year on whether to spend as much as $1.5 billion on expanding output at its key Mogalakwena mine.

Vancouver-based Ivanhoe Mines Ltd. said it’s still evaluating finance for its new Platreef project, which could require about $1.5 billion of investment.

Still, notwithstanding the investment hiatus, the platinum sector remains in better shape than South Africa’s gold industry. Even without further spending, some deep-level mines have a 30-year lifespan, according to James Wellsted, a spokesman for Sibanye Stillwater Ltd., the world’s No. 1 platinum miner.

Sun Setting South African platinum output in gradual decline

Sources: WPIC, Johnson Matthey

*2020 figure is output forecast from WPIC

Still, investment decisions are complicated because of an uncertain regulatory and policy environment, among other challenges, Wellsted said.

With the pandemic creating doubts over future demand, the development of new, lower-cost mines has been put on hold.

“With Covid-19, all the companies went into cash preservation mode,” said Arnold Van Graan, an analyst at Nedbank Ltd. “Over the next decade, there could be a big step change down in PGM production, if the industry does not invest.”

— With assistance by Jeremy Diamond

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |