Another piece adding to many piling up of why gold is gold

I would think the cratering might have been had the boyz wanted such cratering of gold, unless they now wish to devalue the dollar against gold and everything, and if such be so, we best run, fast, in the away direction

One thing to note, such stories as below never seem to use the same photos. I do not see such treatment for say, iron or aluminum

While the current price looks expensive, it could easily rise further. For all we might guess, gold might be too cheap, as cheap as the parachute left in the waiting room as folks meandered on to the to-be-doomed airplane.

bloomberg.com

Gold Is Expensive, and May Be Just Warming Up

History shows that once the price rises above fair value, it has a tendency to keep going.

John Authers

August 5, 2020, 9:00 PM PDT

When you see retail investors clutching piles of these, then it’s time to bail out.

Photographer: Chris Ratcliffe/Bloomberg

John Authers is a senior editor for markets. Before Bloomberg, he spent 29 years with the Financial Times, where he was head of the Lex Column and chief markets commentator. He is the author of “The Fearful Rise of Markets” and other books.

Read more opinion Follow @johnauthers on Twitter

To get John Authers' newsletter delivered directly to your inbox, sign up here.

Answering an Impossible Question

As I write, gold has surged to yet another record, topping $2,050 per ounce. Is it overpriced?

The question is impossible to answer. Gold’s value rests in the eye of the beholder, and over recorded human history people have continued to find it beautiful. It pays no income, and its intrinsic value is set by the market. Valuation techniques that work for other assets won’t work for gold.

The fact that we will never scientifically arrive at a “correct” price need not stop us from trying, however. And after going through the various valuation exercises, the rally looks rational. While the current price looks expensive, it could easily rise further.

One way to measure gold is to compare it to other commodities. Back in the 1970s, the oil-price shocks could be seen as a way for petroleum exporters to keep the value of their product constant in gold terms, once the dollar’s peg to the metal had ended. On this basis, gold looks expensive. The ratio of oil to gold, or the amount of metal it would require to buy a barrel of crude, hit its lowest since the peg’s end earlier this year as oil tanked. There has been a rebound since, and a further recovery for oil would help gold, but the shiny metal is plainly not cheap on this basis:

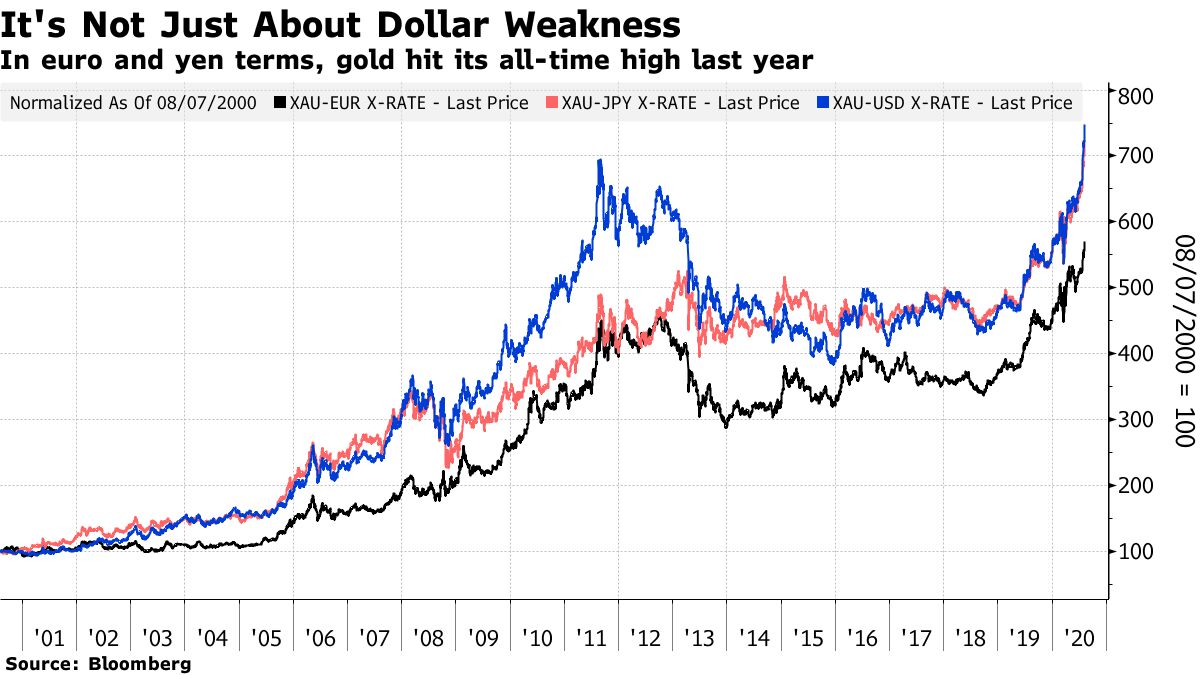

Another possibility is to look at money illusion. The gold price in dollars depends on the value of the currency as much as on the value of the metal. The dollar has weakened sharply in the last few months. But if we look at gold in euro and yen terms, there is more to this than dollar weakness. Gold hit an all-time high against both these currencies last year. It is currently at a record in all three:

Then we come to the issue of inflation. Gold is seen as a store of value. This value will naturally tend to rise when people expect inflation ahead. On this basis as well, gold might initially seem overpriced. The Federal Reserve has received a lot of deserved criticism for its handling of the U.S. economy over the last two decades. But on one important measure, it has been undeniably successful — nobody has ever thought that inflation will take off. The Fed’s target is to keep inflation between 1% and 3%. Since 1998, 10-year inflation expectations derived from the bond market have never exceeded 3%, and have dipped below 1% only very briefly.

Inflation expectations have been rising fast following the Covid shock, which helps explain the rise in gold, but remain at a level that makes an all-time high look hard to justify:

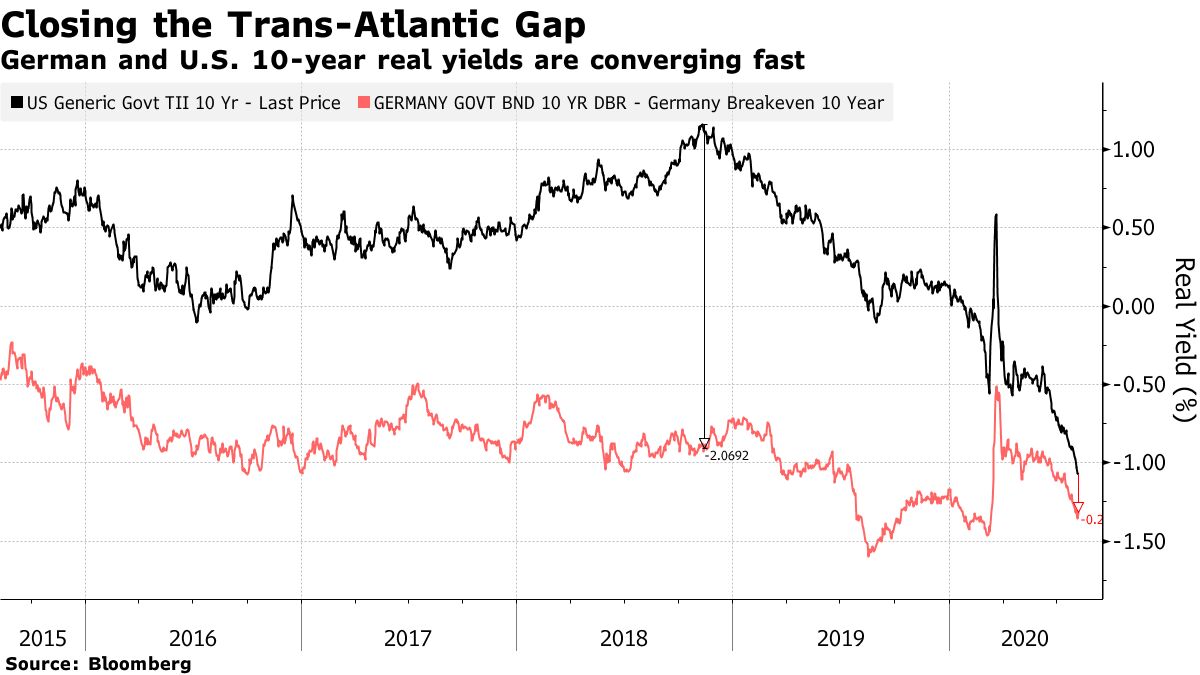

But now we come to the most important influence on gold, which is the real yield available on bonds. Gold doesn't pay an income, and this becomes less and less of a problem as bonds pay less in real terms. At present, real 10-year yields are more negative than they have been since inflation-linked bonds became widely available. One crucial development of the last year is that the U.S. has joined Germany in having very negative real yields (which presages a weaker dollar, as well as higher gold prices):

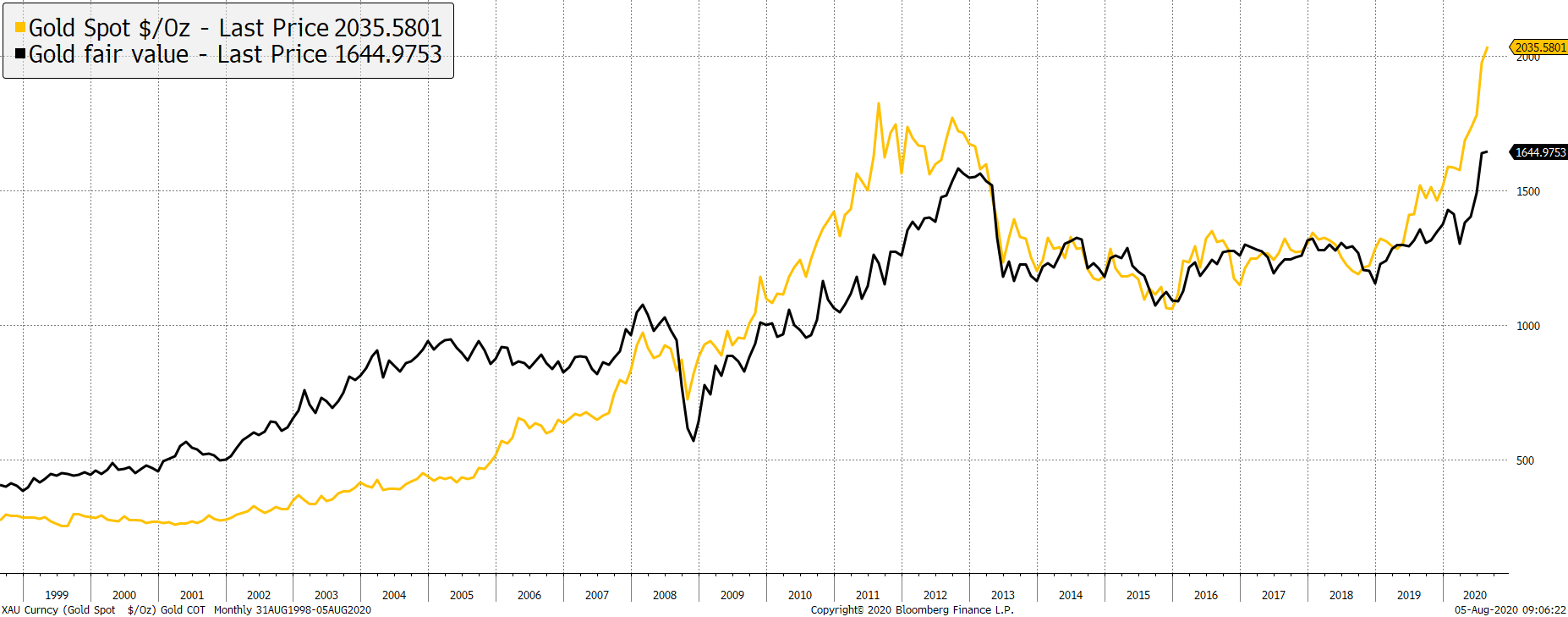

Real yields form the backbone of one of the most interesting models of “fair value” for gold, produced by City of London veteran Charles Morris, the founder of ByteTree.com. The model, described here and here, is essentially a zero-coupon 20-year Treasury inflation-protected security, or TIPS, and thus rises as long-term real yields fall. In brief summary, the factors included are:

Major factors:

Realized inflationReal interest rates (20-year expected)Speculative premium/discountMinor factors:

U.S. dollar (consequence rather than cause)Central banks, wars, bad newsJewelry demand (counter cyclical)Mine supplyHere is how the model’s “fair value” has compared to the actual gold price over time:

The key points are that fair value has risen sharply to reach its previous record in recent weeks, and that the actual price is significantly higher. The premium as of early trading Aug. 5 was 23.7%. This chart shows how the premium/discount to fair value has moved over time:

The point for a trader is that when gold is in a bull market, it has shown a propensity to move even further above fair value. So gold is expensive, but it is still significantly less expensive than at the previous peak in late 2011.

For those wanting to play the dangerous game of predicting a speculative surge, Morris offers another important data point. Equity bull markets tend to peak when retail investors are sucked in, a process that appears to be happening for stocks. The same was true for gold during its massive peak in real terms in 1980, when news bulletins were full of footage of people happily emerging from shops having converted their life savings to a small pile of gold sovereigns (transactions that would have taken decades to work out), and again in 2011 when the weight of gold-buying through exchange-traded funds reached a high. This rally has plainly been fueled by something other than ETF-buying:

The bullish scenario is that central banks keep doing what they’re doing. squashing real yields ever lower, and continuing to raise the fair value for gold. Then inflation at last begins to come untethered and rise toward or even above its upper 3% target (which is conceivable but still some years away). And then retail buyers enter in a big way. A while after this, gold would probably go splat, but the ride to get there would be lucrative.

The risks would come in a change of central-bank behavior — just as the last gold peak turned into a bear market once the Fed started to try to move away from its unlimited asset purchases. Such a change looks less likely this time. Gold does look expensive then, but there is little reason to expect it to fall much anytime soon.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

John Authers at jauthers@bloomberg.net

To contact the editor responsible for this story:

Matthew Brooker at mbrooker1@bloomberg.net

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |