shall likely reallocate / redeploy from official-doom hospitality / reeducation grouping into officially-sanctioned habit-forming grouping, as war-on-drugs phase-change to drugs-won (no, am using drugs as shorthand, and making no claim on whether weed is good or bad; and yes, do have an exposure via a business that supplies LED lighting to the indoor / vertical containerised agricultural sector).

seekingalpha.com

Prison REITs: The End Is Near

Oct. 8, 2020 12:00 PM ET

REIT Rankings: Prison REITs

( Hoya Capital Real Estate, Co-produced with Brad Thomas)

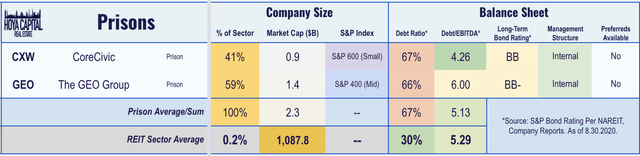

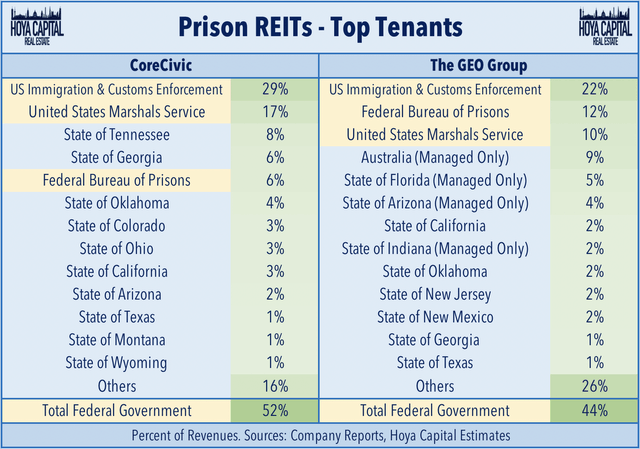

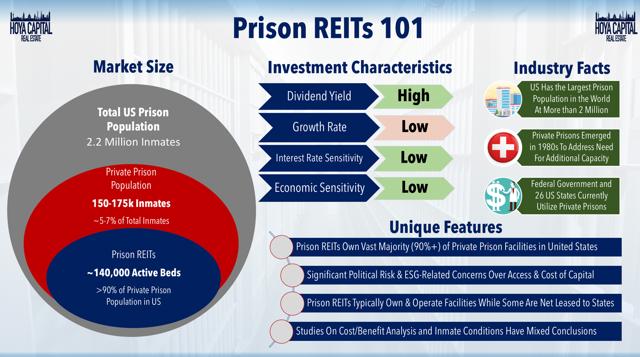

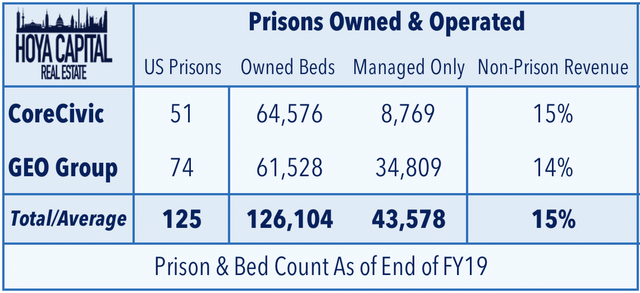

Prison REIT Sector OverviewPrison REITs - the "darkest corner" of the REIT sector - have been slammed in 2020 as pandemic-related operational struggles have clashed with ever-intensifying political headwinds. In the Hoya Capital Prison REIT Index, we track the two largest private prison owners and operators in the world: CoreCivic ( CXW) and The GEO Group ( GEO). Together, these two prison REITs own 125 correctional facilities in the United States and account for roughly $2.3 billion in aggregate market value. Excluded from many mutual funds and ETFs due to ESG-related concerns, prison REITs account for roughly 0.5% of the broad-based Vanguard Real Estate ETF ( VNQ).

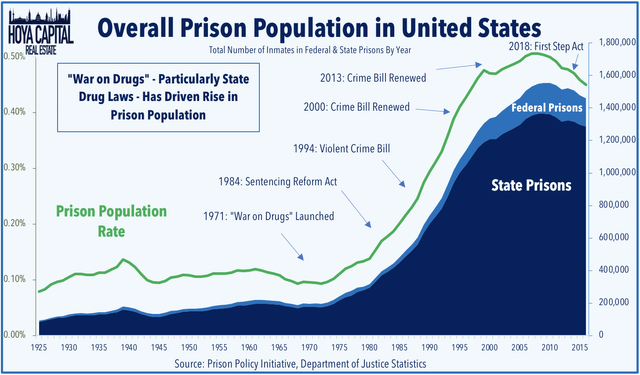

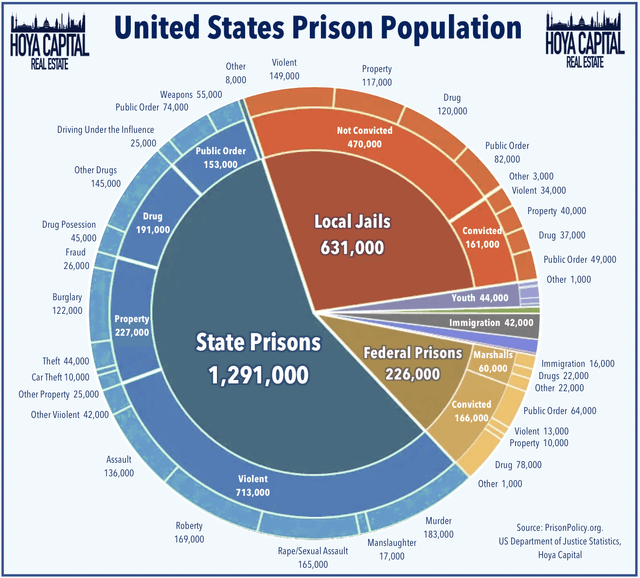

Undoubtedly, the most controversial real estate sector, Prison REITs have been under assault from the hardline " cancel culture" that views private prisons as conspirators in a powerful "prison industrial complex." With more than 2 million inmates, the United States has the largest prison population in the world, an inmate count that has quadrupled since the 1970s. The U.S. has the highest incarceration rate in the developed world and despite accounting for 5% of the world's population, it houses nearly a quarter of the world's prisoners. According to the Sentencing Project, at current imprisonment rates, one-in-nine men in the U.S. will be incarcerated at some point in their lives.

Driven primarily by the "War on Drugs" that began in the 1970s, along with mandatory sentencing requirements associated with measures like the 1994 Crime Bill, there are now more people incarcerated for drug-related offenses than the total prison population in 1975, according to data from the U.S. Bureau of Justice compiled by the Prison Policy Initiative. The National Research Council estimated that half of the increase in the state prison population between 1980 and 2010 was due to an increase of time served in prison. The vast majority of prisons are held in state and local prisons with Federal facilities accounting for less than 10% of the total prison population.

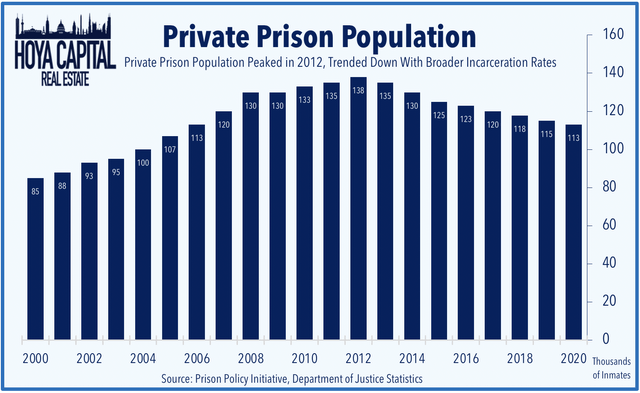

The swelling prison population, combined with limited state and federal resources earmarked for prison construction, facilitated the rise of privately-owned prison facilities in the early 1980s. After several decades of rapid growth and progressive consolidation into these two major operators, the private prison industry has fallen on tougher times over the last decade as the growth in the prison population has stalled - and even reversed - in recent years. Since peaking in 2012, the overall U.S. prison population, along with the private prison population, has declined due to bipartisan criminal justice reform measures including the First Step Act in 2018.

Already facing secular headwinds from declining prison populations, private prisons are facing a more immediate existential crisis if Democrats sweep the 2020 Elections, an outcome that polls and betting markets suggest is more-likely-than-not. The abolition of the Federal use of private prisons - which comprise roughly 50% of industry revenues - is a central policy goal of the 2020 Democratic Party Platform. While Joe Biden's political history as one of the most vocal proponents of the 1994 Crime Bill suggest he would be more "friend than foe" to the private prison industry, the Democratic nominee has indeed included the " end of the federal use of private prisons" on his official platform.

Stop corporations from profiteering off of incarceration. Biden will end the federal government's use of private prisons, building off an Obama-Biden Administration's policy rescinded by the Trump Administration. And, he will make clear that the federal government should not use private facilities for any detention, including detention of undocumented immigrants. Biden will also make eliminating private prisons and all other methods of profiteering off of incarceration - including diversion programs, commercial bail, and electronic monitoring - a requirement for his new state and local prevention grant program.

The federal government and 27 states currently utilize private prisons. Between 2000 and 2016, eight states - Arkansas, Kentucky, Maine, Michigan, Nevada, North Dakota, Utah, and Wisconsin - eliminated their use of private prisons while five states - Alabama, Connecticut, Pennsylvania, South Carolina and Vermont - began utilizing private prisons. Federal contracts account for roughly half of private prison industry revenue with the U.S. Immigration and Customs Enforcement as the heaviest users of private facilities. ICE has been the primary driver of incremental demand for incarceration beds over the past decade amid a surge in border crossing apprehensions.

Prison REITs typically own and operate these correctional facilities through their taxable REIT subsidiary. These REITs also operate facilities that are owned by third parties (typically, state and local governments) and a handful of facilities are owned by these REITs and leased under a triple-net structure to government operators. Private prisons remain an easy political punching bag, not only for politicians but also for financial institutions and asset managers. Many of the largest banks including JPMorgan ( JPM), Wells Fargo ( WFC), and Bank of America ( BAC) have committed to no longer provide new financing to private prisons after any current agreements expire.

Prison REITs hadn't always garnered the political attention that they do today. CoreCivic was founded in 1983 while GEO Group was founded in 1984 and each company transitioned to REIT status in 2013. While the hard evidence generally debunks the core claims of the harshest critics, prison REITs have faced mounting difficulty in accessing capital from an "ESG-focused" institutional investment community. Citing the need for more "more flexibility" in dividend policy and capital allocation decisions, CoreCivic announced during its Q2 earnings call that it is abandoning the REIT structure.

Many investors incorrectly categorized and CoreCivic as a non-ESG investment and despite unprecedented leadership in supportive ranging programs and public policies designed to keep people out of prison for good, the cost of our capital has increased. As a REIT we are required to distribute a substantial portion of our cash flows of dividends. Revoking our REIT election will provide us more flexibility in how we allocate our substantial free cash flow.

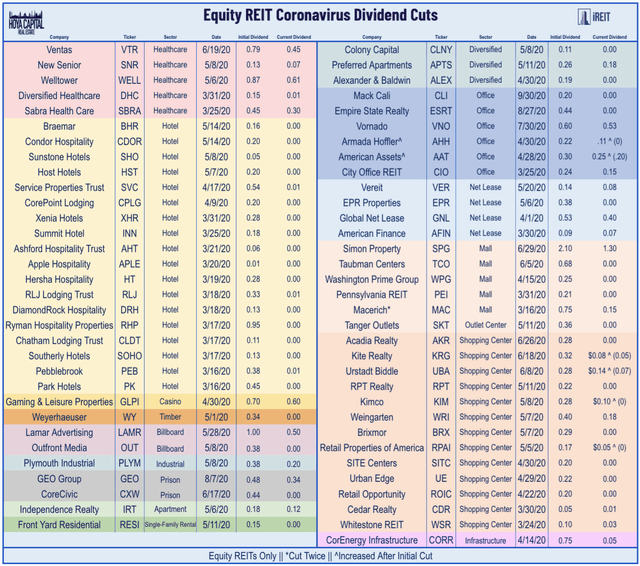

Along with the revocation of REIT status, CoreCivic also eliminated its dividend, one of 65 equity REITs to have reduced or eliminated their dividend since the beginning of the coronavirus pandemic. This week, as previously announced during their Q2 earnings report, GEO Group also reduced its quarterly dividend from $0.48 to $0.34 per share, and we believe that GEO likely isn't far behind CXW in a transition away from REIT status, underscored by an unconvincing answer on their Q2 earnings call: "I think we're committed at this time to remain in a REIT."

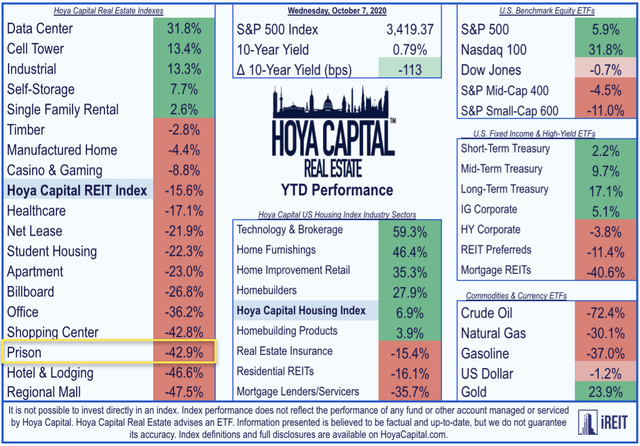

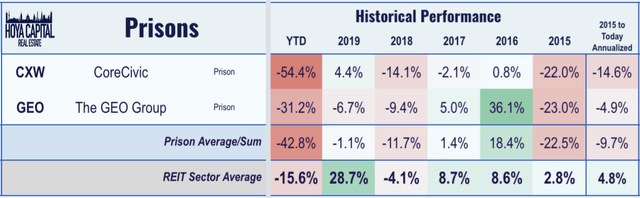

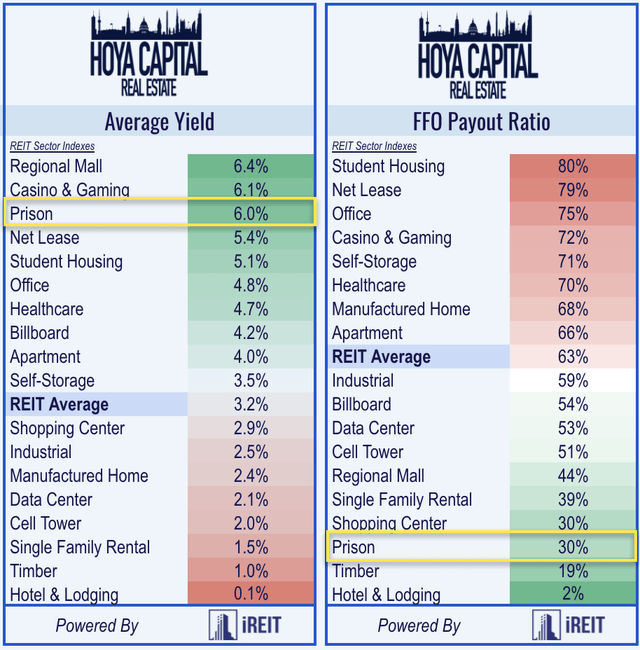

Deeper Dive: Prison REIT Performance & FundamentalsIf there is indeed a vast "prison industrial complex" as critics allege, prison REITs haven't been very effective conspirators. Private prison ownership remains a challenging, low-margin business with both volatile and poor historical investment returns over most recent measurement periods. Pandemic-related headwinds and the mounting political heat have added further pressure to the sector this year. Prison REITs are lower by roughly 43% in 2020, the third-worst performing property sector this year. By comparison, the Vanguard Real Estate ETF is lower by roughly 16%.

Prison REITs had bounced back in late 2016 and early 2017 after the Trump administration reversed the Obama administration's order to phase-out the federal usage of private prisons, but that rebound was relatively short-lived. Following the passive of the First Step Act by the Trump Administration - which has further reduced prison populations - and as the 2020 campaign season has ramped up over the last several years, so too has the scrutiny on the private prison industry. Since the start of 2015, prison REITs lost more than half their value, delivering an average annualized return of -9.7% compared to the 4.8% average annualized returns on the NAREIT All Equity REIT Index.

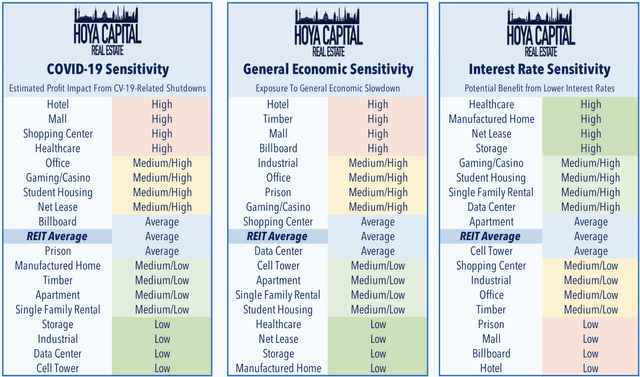

Below, we present a framework for analyzing each property sector based on its direct exposure to the anticipated COVID-19 effects, as well as its general sensitivity to a potential recession. We note that prison REITs fall into the "Average" category in direct COVID-19 sensitivity, but while these facilities may indeed be "essential" infrastructure with government contracts that are generally as "high-quality" as any tenant, the COVID-19 pandemic has nevertheless weighed significantly on operating fundamentals.

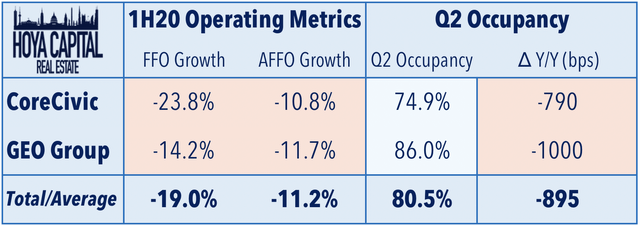

Pressured by declining occupancy rates and rising COVID-19-related operating expenses, through the first six months of 2020, Prison REITs have reported an average FFO decline of 19.0% and an average decline in AFFO of 11.2%. Occupancy rates plunged nearly 9 percentage-points in the most recent quarter compared to 2Q19. At Federal facilities, the dip has been driven by a decline in border crossings and apprehensions along the Southwest border, as well as an overall decrease in court and sentencing activity at the federal level. At the state facilities and other properties, occupancy rates were negatively impacted by occupancy limits designed to limit the spread of COVID-19.

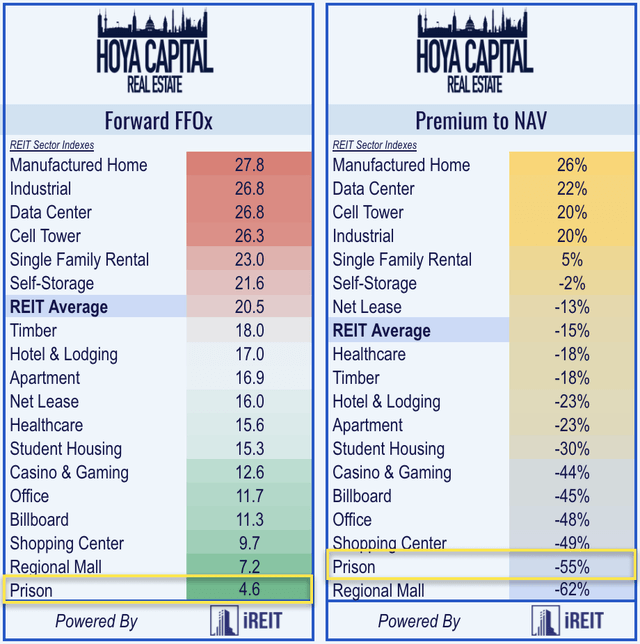

Prison REIT Trade At (Persistent) DiscountsPrison REITs continue to trade at wide discounts to the REIT sector average. Prison REITs trade at an estimated 4.6x Price-to-FFO ("Funds from Operations") multiple compared to the REIT sector average at 20.5x. Prison REITs also trade at sharp Net Asset Value discounts, which can be a double-edged sword for value-seeking investors as external growth becomes all-but-impossible with such an unfavorable cost of equity capital. Prison REITs trade at a 50-60% NAV discount based on consensus estimates, but it's unclear whether a private market exists to potentially close this valuation discount.

Once the highest-yielding REIT sector, CoreCivic's elimination of its dividend and GEO Group's reduction in its dividend have knocked the prison REIT sector off its top spot. Prison REITs pay an average dividend yield of 6.0%, still far above the REIT sector average of 3.2%. Despite the dividend reduction, GEO Group still yields 12.0% with an estimated 60% FFO payout ratio. GEO commented that the reduction "allows GEO to remain structured as a REIT and will give us sufficient flexibility to sustain our dividends should our cost of debt increase in the future." CoreCivic, meanwhile, has no plans to reinstate any dividend this year before its conversion to a C-corp on January 1, 2020.

Key Takeaways: The End Is Near, On Several LevelsWhile intrinsic value exists in the 125 prisons and nearly 200,000 prisons beds that are generally in short-supply in states, these companies will likely face continued difficulty operating as public entities. While we believe that prison REITs would see a substantial "bounce" on an unexpected Republican victory next month, as with the rebound following the 2016 Presidential election, we question whether the improved valuations would be sustained given the underlying secular headwinds of declining overall prison populations in the US. Absent a significant shift in political and cultural attitudes or in the structure of capital markets, we believe that these entities face continued difficulty operating as public entities.

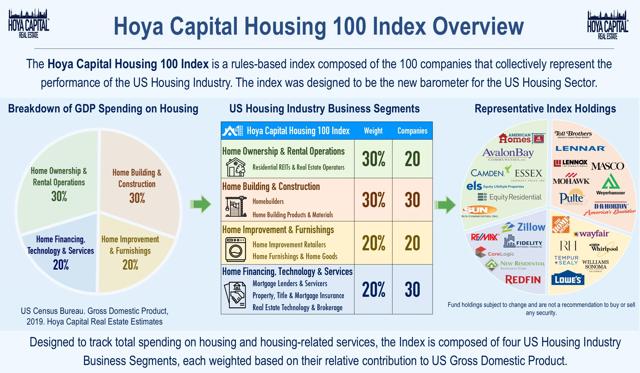

In the event of an "abolishment" of private prisons at the Federal and/or state level, we see these REITs utilizing a lease structure more akin to a ground lease, but based on the underwhelming reaction to CXW's shift in corporate structure and strategy, it's unclear whether equity shareholders would ever ultimately be rewarded. We continue to see better opportunities elsewhere in the REIT sector - particularly in the "essential" sectors, including technology, industrial, and housing REITs where valuations generally remain attractive.

If you enjoyed this report, be sure to "Follow" our page to stay up to date on the latest developments in the housing and commercial real estate sectors. For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Storage, Timber, Prisons, Real Estate Crowdfunding, High-Yield ETFs & CEFs, REIT Preferreds.

Disclosure: Hoya Capital Real Estate advises an Exchange-Traded Fund listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index. Index definitions and a complete list of holdings are available on our website.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Hoya Capital Real Estate ("Hoya Capital") is an SEC-registered investment advisory firm that provides investment management services to ETFs, individuals, and institutions, focusing on portfolio and index management of publicly traded securities in the residential and commercial real estate industries. A complete discussion of important disclosures is available on our website (www.HoyaCapital.com) and on Hoya Capital's Seeking Alpha Profile Page.

It is not possible to invest directly in an index. Index performance cited in this commentary does not reflect the performance of any fund or other account managed or serviced by Hoya Capital Real Estate. Nothing on this site nor any published commentary by Hoya Capital is intended to be investment, tax, or legal advice or an offer to buy or sell securities. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and should not be considered a complete discussion of all factors and risks. Data quoted represents past performance, which is no guarantee of future results. Investing involves risk. Loss of principal is possible. Investments in companies involved in the real estate and housing industries involve unique risks, as do investments in ETFs, mutual funds, and other securities. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing. Hoya Capital, its affiliate, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings is available and updated at www.HoyaCapital.com. |