Re <<China has been the top gold producing nation>>

(1) Certainly true. However a note of context, that given China has never been a well-known ‘gold-producing’ domain on par w/ S Africa, Canada, Australia, Russia and USA, and that the ore grade in China is at level of garbage tailings in other lands, that makes me suspect (i) China mining and metallurgy of merit, (ii) elsewhere gold potential not yet fully exploited as the locals are spoilt and/or lazy and/or comparatively incompetent and/or too costly (red-taped) relative to gold pricing

(2) I succinctly note my context and strategy and tactics

(2-i) Context: we are going to blowup but timing unknown, for ‘they’ can keep the game going because they intend to and are going all-in, to sacrifice every single one of us

(2-ii) Strategy: do not fight the Fed, because we can only win once by doing so, and only nearer or at the end-game’s end, timing unknown, and may be broke by then fighting the mostly losing fight

(2-iii) Tactics: As we cannot know when the end comes, we best be long and short, but sustainably

- Using the likes of TSLA as funding currency but safely

- Get more gold, in all forms, physical, paper, DRD, SPA, ... but safely, at a pace by which we can fund, and continue to fund

- Above, succinctly, is the path am on. The posting and dialogue is for purpose of sanity-check, way-point ping, and course-correct calibration

- Recommendation: Spell out a schema that covers Focus, Structure, Phasing, Economics, and Risk / Risk Mitigation

So ...

Focus: GetMoreGold

Structure: by physical, paper, tailings, and mining, seniors and juniors, whilst shorting something that must go down but timing unknown, using ‘safer’ derivatives (OTM calls, to take advantage of animal-spirit volatility, and leverage time-decay)

Phasing: expiration by expiration, every week, but no more than 3 months out, rolling

Economics: Try not to spend cash, only to margin cash

Risks / Risk Mitigation: Phased / paced, calibrate by volume (as opposed to whether in / out), stay within safe-margin capacity

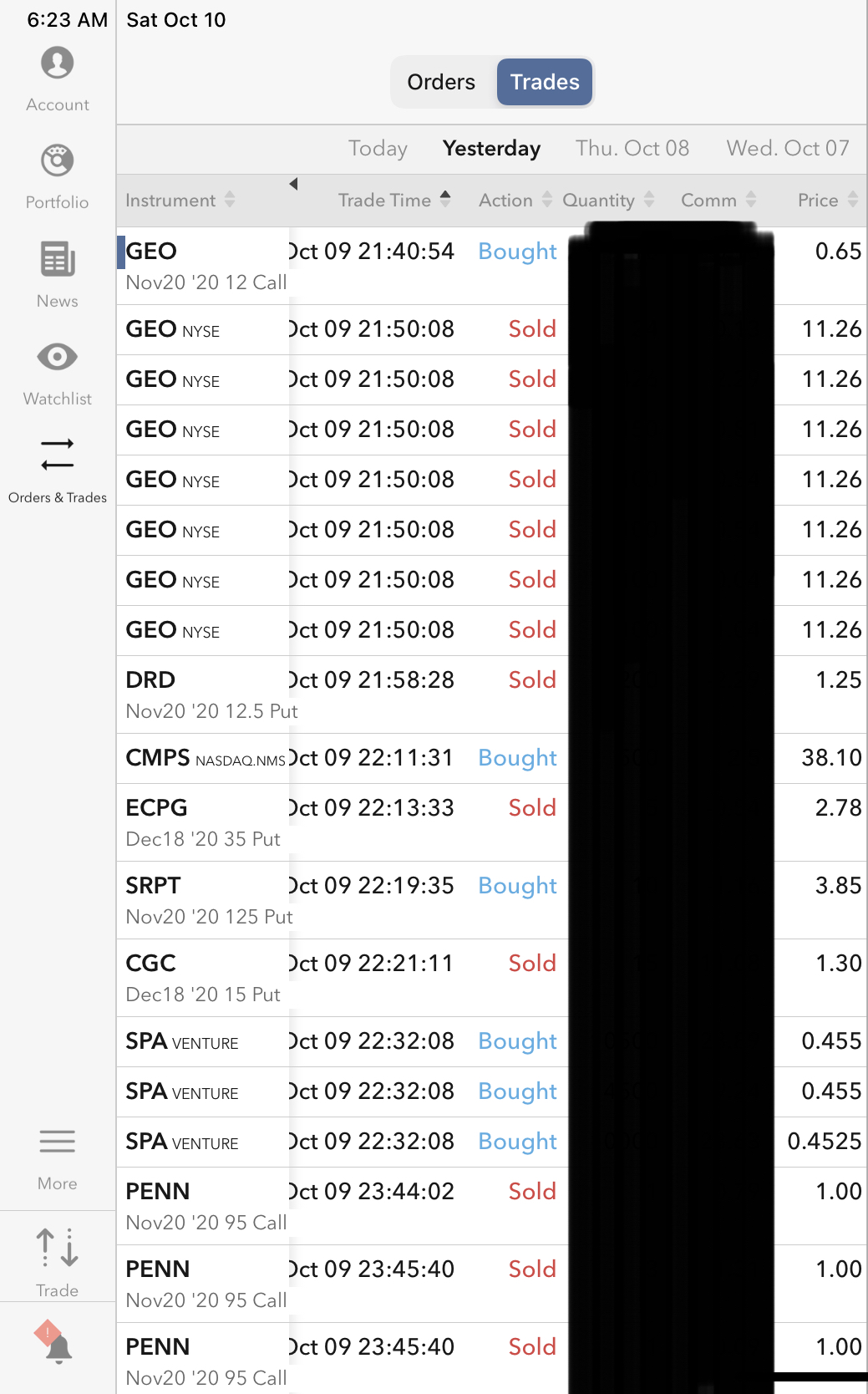

(3) Last nights operations, before and after mid-night HK time

(3-i) Got rid of GEO and its paired short-call option, as Biden might win, and in any case California looking lost bloomberg.com <<California’s law to eliminate the use of privately operated prisons in the state mostly survived an initial challenge by the federal government and Geo Group Inc.>>

(3-ii) Hot-pursuit DRD by shorting of still ATM puts (actually at the time of short-put execution, well in-the-money, and now at closing, OTM :0)

(3-iii) Picked up stake in assorted previously socially undesirable but may soon be popular by electoral mandate assets from the habit-forming illegal / alegal / might soon to be very extremely legal drug sector

(3-iv) Added to SPA (SPA Venture), a junior hotsie-totsie gold exploration company

(3-v) Initiated ‘safe-short’ protocol against PENN finance.yahoo.com , teeing up the energy of Davy Portnoy for the greater good. It is not as safe to short as TSLA, but must explore its possibilities, to diversify from Key-Man risk of Elon Musk.

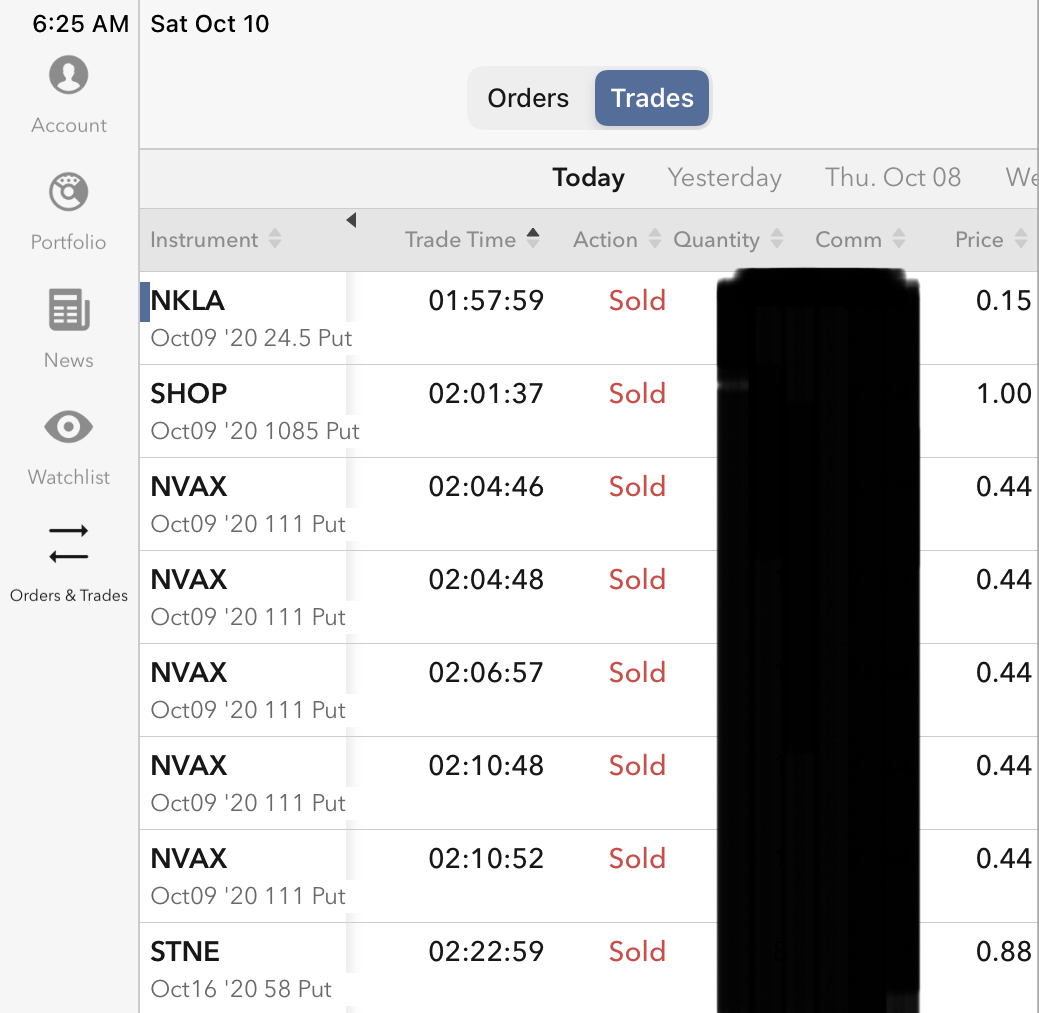

(3-vi) After midnight, 120 minutes before the market closed in USA domain, shorted the Puts on a bouquet of stocks I did not mind temporarily owning if put, all except one with expiration today market-close, then 120-minutes in the short future, all at / near the money, to make the waking up worthwhile, and

now, fully out of bed, I see none shall be put against me, I get to keep the premium money, and maybe again do next Friday at 2:00am :0)

(4) I note that NAK finance.yahoo.com continues to indicate a Trump win, even as MSM seems to have concluded Biden shall not lose.

The state of one candidate wins / another candidate not-lose may persist into January, and if so, drama, of the sort that if correctly approached can make 2021 as good as 2020.

(5) Should the Trump lose, USA politics be less interesting unless of course the Trump keeps tweeting, and ‘they’ go after him as they are Bannon, and doubtless soon Rudy, etc etc

|