Re <<Boom...boom...boom...29,280....>>

one word comes easily to mind, 'phantasmagoric', for 'fantastical' fails miserably.

The battle front news flow continues to be positive. There seems to be a sort of surge going on, where the counterparties best troops and troop concentrations are mauled down and smelted away.

Oh, the poetry of conflict, longs against shorts, and the epic nature of the insurrection

Just wonderful.

Wonder if the troops will be able to breach 30,000 by lunch time and hold until dinner time, HK, and be reinforced by more troops from EU and America. 24/7, where every start of day for everyone everywhere is a gap-up day, and every night around the planet is another wonderful close, night after day after night.

There was another time I enjoyed the day / night routine of up, up again, up twice more Message 12217707 (1999) and just wonderful. Felt like the entire planet is one big happy perpetual round the clock block party.

Message 12853201

One day what happens to bitgold shall happen to gold, for exactly the same rationale. Investing is easy :0)

The Chinese and Norwegian and Russian mines shall just have to work harder to supply what the planet desires.

deribit.com

zerohedge.com

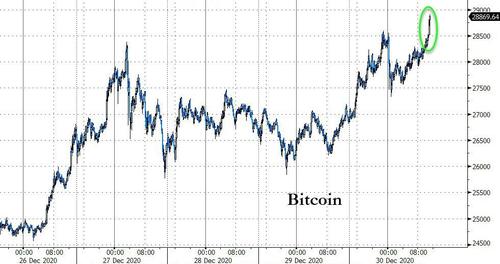

Bitcoin Surges To New Record High Near $29k Amid "Liquidity Crisis"

Cryptos rallied overnight, faded modestly, and are now pushing higher once again with Bitcoin surging to new record highs near $29,000...

[url=] [/url] [/url]

Source: Bloomberg

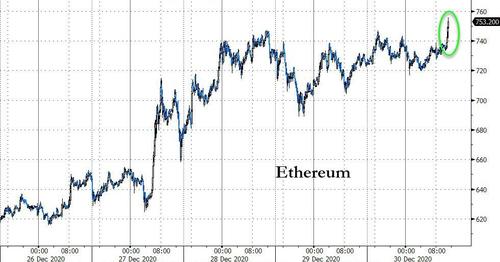

And Ethereum topped $750...

[url=] [/url] [/url]

Source: Bloomberg

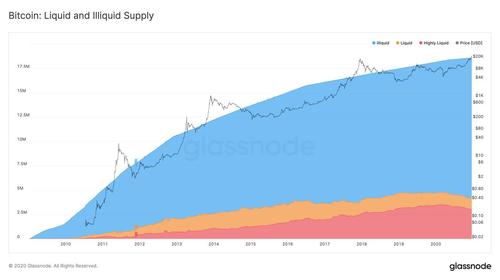

While catalysts are manifold and much-discussed, CoinTelegraph's Joseph Young notes that Bitcoin liquidity is declining, data from Glassnode shows, which could propel BTC price even higher.

[url=] [/url] [/url]

image courtesy of CoinTelegraph

Bitcoin is becoming more difficult to buy, according to analysts at Glassnode. The amount of BTC received and spent among entities is decreasing, which means the liquidity is declining.

If Bitcoin liquidity is low, it means there is less BTC available to buy and sell. In the medium term, this could make BTC even more scarce.

[url=] [/url] [/url]

Bitcoin liquid and illiquid supply. Source: Glassnode

Bitcoin on track for an explosive 2021

Throughout 2020, institutions have been increasingly accumulating Bitcoin, which has become compelling because of its fixed supply.

In recent months, the concerns about inflation and rising central bank liquidity have intensified. This trend has led high-profile institutional investors, like Paul Tudor Jones, to consider Bitcoin as a potential hedge against inflation.

Meanwhile, a trend that was kickstarted by MicroStrategy’s $425 million Bitcoin purchase in the summer spilled over to other financial giants. Eventually, PayPal, Square and even insurance conglomerates like MassMutual stepped into the fray.

Consequently, the institutional accumulation of Bitcoin has accelerated since. As a result, Glassnode found that only 4.2 million BTC are in constant circulation for buying and selling. The firm wrote:

“Bitcoin liquidity is defined as the average ratio of received and spent BTC across entities. We show that currently 14.5M BTC are classified as illiquid, leaving only 4.2M BTC in constant circulation that are available for buying and selling.”In the past 12 months, $27.8 billion worth of Bitcoin has become illiquid. More long-term investors are holding onto their BTC, refraining from selling their assets.

If long-time holders continue to move away from selling their BTC, the dominant cryptocurrency would become more scarce and difficult to accumulate.

Such a trend would push up the value of Bitcoin in the longer run, fueling the ongoing bull cycle. The analysts explained:

“Over the course of 2020, a total of 1 million additional BTC have become illiquid — investors are increasingly hodling. This is bullish, and suggests that the current bull run has been (partly) driven by this emerging #Bitcoin liquidity crisis.”There is a variable in minersAnother factor that could cause the circulating supply of Bitcoin to decrease in the foreseeable future is miners.

Kyle Davies, the co-founder of Three Arrows Capital, said that there is a shortage of ASIC miners. Typically, miners would deploy capital to acquire hardware such as ASIC miners. But given that they are unable to buy, that could potentially drive inflows into BTC. He said:

The combination of multiple factors, such as increased HODLing activity, the likelihood of miners selling less BTC, and the drop in Bitcoin liquidity could further fuel BTC’s momentum in the first quarter of 2021. |