Re <<shorting ... US treasuries>> ... likely shall work out, but given the bleakness you described well, and given the bubble-dimension of the financial market, a pop is perhaps too easy a prediction i am sympathetic to, and if so, when the pop causes kaboom, there ought to, as always, be a rush towards US treasuries. Am currently short the puts of TLT to either not get put, or to get put, am indifferent.

Feels as if there are fewer and fewer hedges in the market, because we have an almost-everything-crackup-bubble that when it pops would take all down as leverage shrivels and size of books reduced.

I read the below article, and note the wise counsel of the money-managers re GME, and ponder why what they noted would not apply to the entire market that GME is a part of.

BTW, I am at this time still agnostic on exactly what happened w/r the GME which allowed me a gift. The sums of money seemed large for the RobinHooders, what I do not know that RH could not have done what they are all edged to have done. I am hoping that there is more to the story for such a better story can make a good Pulitzer Prize book.

bloomberg.com

Dead Right About GameStop, Four Pros Recount a Week of Reckoning

Vildana Hajric

Rarely do predictions come true so fast.

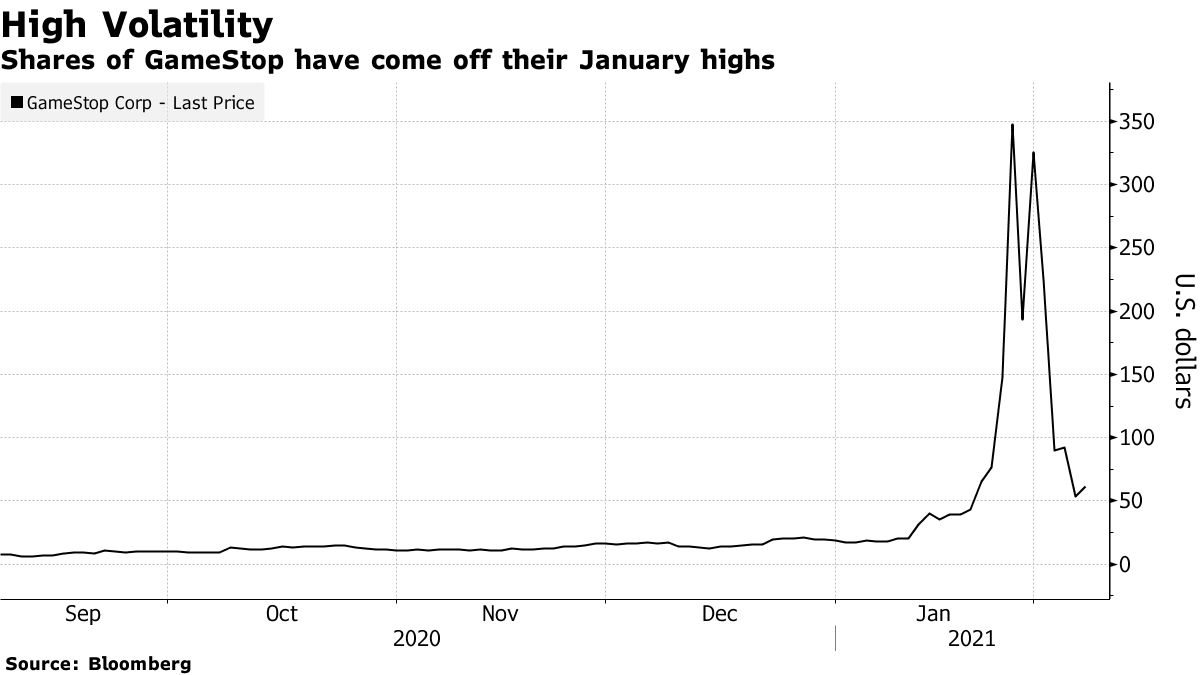

Seven days ago, with GameStop Corp. still north of $300, Bloomberg News sounded out institutional investors for their prognosis on the stock. No one foresaw a bright future. On Wall Street, unanimity is unusual. So was the outcome. A week later, $18 billion has been erased.

Of the many divisions the GameStop saga laid bare, none was wider than that between retail day traders and the securities industry’s professional class. While none of the pros said they were happy to be right when reached Friday, each said the prediction was an easy one to make.

Here’s what Kim Forrest, who is chief investment officer of Bokeh Capital Partners in Pittsburgh, said last week: “Some day people are going to put down the phone and get back to work. Then there’s going to be too many sellers and not enough buyers of that stock.”

Here’s what she says now: “I’m not saying it can’t go up again for a little while, but there’s still always going to be a limit to how high it can go because interest is just going to wane at a certain point,” said Forrest. She described showing her husband a GameStop chart, likening it to a stake driven into the ground.

That plunges in GameStop and other retail favorites coincided with buying restrictions imposed by the Robinhood investment app will do little to heal the rift between day traders and Wall Street. Shares of the video-game retailer have declined about 85% since hitting an intraday all-time high of $483 on Jan. 28. Despite a 15% rally Friday, it’s on pace for its worst week on record, though still up 230% for the year.

Last week, Barry James, portfolio manager at James Investment Research, said he’d never seen a rally like GameStop’s end well. While early bulls “made quite a killing,” others won’t be as fortunate. “That’s just the way these things work out. They end up returning to a fair valuation.”

Bearish bets in GameStop are fewer now, a sign that many investors have covered positions. Short interest has fallen below 50% of its free-floating shares, down from a high of roughly 140% reached earlier this year, data compiled by S3 Partners show. The number of shares borrowed to short the stock has dropped by 32.4 million over the last week to reach 25.4 million.

“All of those things play into it starting to return to normal,” James said.

As shares of GameStop fell this week, so did activity in its options. The average volume of contracts betting on gains in GameStop fell to half of that last week, while the volume in bearish ones subsided by a third. Just like last week, puts continue to be more active than calls -- the ratio of the two hovered around 2.3 times on Thursday, though still far from a 3.4 level seen last Wednesday, Bloomberg data show.

Steve Chiavarone, portfolio manager and equity strategist at Federated Hermes, says he watched for correlations between GameStop’s up and down moves and the overall market. Last week, while GameStop rallied, many hedge funds were forced to sell other positions to cover losses, leading to speculation it could morph into a wider market selloff. The opposite happened this week, with the S&P 500 gaining near 5% since last Friday, while GameStop tumbled.

“The risk to overall de-leveraging and downward pressure on the market has subsided and, therefore, this looked like more of a contained issue than something that could have bled into a greater level of market disruption,” he said by phone. It gave his firm confidence to add to equities within their asset-allocation recommendations. “From our perch, it looks like things have settled meaningfully,” he said.

Norm Conley, chief executive officer of JAG Capital Management, last week said the whole GameStop ride had been the wildest thing he’d seen in markets in nearly three decades.

Now he says: “You never know how long these sorts of things will last but you can be pretty sure it’s not sustainable for the long term,” Also: “Trading propositions or trading action in securities or commodities could be often crazy to some degree in the short term, but investing propositions usually do not look that crazy.”

— With assistance by Elena Popina, and Katherine Greifeld

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |