Re <<104,761>>

A friend who had gone through personal- / work- / income statement / balance sheet hell in the past 24 months losing everything (wife and daughter moved out, partnership dissolved, everything else blew up) and all lost except for a personal vehicular injury legal case and the deployment of that stake into BTC.

He is back from hell, and he says he shorted QQQ, even as he remained long BTC. He was a very good but what I considered insane trader (less than 10 positions, long / short, in size). Let’s see if he still is.

He figures his combined position has 10% downside, and put in stop-loss, with much upside.

I do not know the specifics other than he is in the main long BTC and short QQQ.

In the meantime I plugged 5M into the spreadsheet and see that it reacted well to the theorized / theorizable 5M price ... I think it crazy but should the trillion dollar platinum coin be minted in even a single coin, opening the door to many more, Zimbabwe beckons unless empire strikes-back no more.

zerohedge.com

"Gold Is Dead, Move On" Billionaires Bet On Bitcoin, Draper Sees $5MM Price

While Gary Gensler, nominated to chair the SEC, was evasive on specifics at yesterday's Senate Banking Committee hearing, he was far more supportive broadly-speaking than many expected ( especially after Yellen's lies):

“Bitcoin and other cryptocurrencies have brought new thinking to financial planning and investor inclusion,” said Gensler.

“I’d work with fellow commissions both to promote the new innovationbut also, at the core, ensure investor protection. If something were a security, for instance, it comes under security regulation, under the SEC.”

That provided some relief for crypto investors, but the last 24 hours have seen a great deal of news.

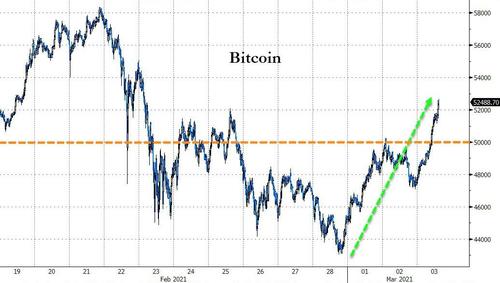

Bitcoin has rallied above $52k...

Source: Bloomberg

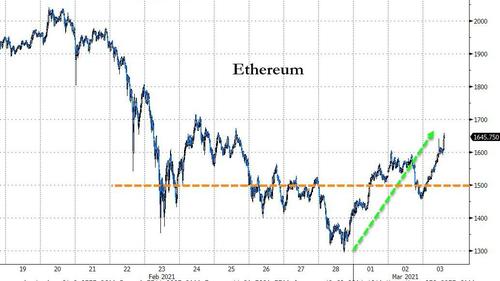

And Ethereum is back above $1600...

Source: Bloomberg

Billionaire VC Tim Draper also raised Bitcoin's profile further yesterday in his podcast

CoinTelegraph reports that the famous investor picks Netflix among major companies as the most likely to put Bitcoin on its balance sheet.

"I think Reed Hastings is a very innovative guy and has a lot of creative thinking and I think he still controls the reins at Netflix and so I think that might be the next big one to fall."

Ever the optimist, Draper also considered that Amazon would add a direct Bitcoin payment option in future.

"Amazon will probably start accepting Bitcoin pretty soon," he said, noting that consumers have been able to buy products indirectly using cryptocurrency for many years.

Draper sees the (fiat) price of crypto soaring...

“I think bitcoin in 2022 or the beginning of 2023 will hit $250,000,”he said at the time, when bitcoin was worth less than $4,000. “I think the reason is that bitcoin will be the currency of choice.”

“The current currency holdings in fiat is about $100 trillion and bitcoin‘s market cap is just reaching $1 trillion now, so there’s no reason it can’t go up 100-fold,” he said.

Which would imply a $5,000,000 price for bitcoin.

“It’s not like it’s going to completely replace the dollar, although I think people are going to laugh when you’re trying to buy things for dollars in the future.”

In addition, billionaire Mark Cuban had a Twitter-tirade warning Peter Schiff that gold "will die" as a store of value

"Let me help Peter. Gold is hyped as much as Crypto. Do we really need gold jewelry? Gold can make you a ring," one tweet reads.

"BTC/Eth are technologies that can make you a banker, allow friction free exchange of value and are extensible into an unlimited range of biz and personal applications."

Continuing, he gave a stark verdict on the future of gold.

"What we are seeing built w/crypto today is just proof of concept. As tech continues to get better/cheaper/faster there will be new applications and maybe even something that supersedes what we know as crypto today," a further post says.

"But Gold won't ever change. Which is why it will die as a SOV."

"Don't forget, Gold was a SOV built on technology. From picks and shovels to mining operations that keep trying to improve. Whoever could use the tech of the day to find and mine the most efficiently was the most rewarded. Much like Crypto is today," a final message to Schiff concludes.

"Gold is dead Peter. Move on."

Cuban's 'Shark Tank' colleague Kevin O'Leary has 'come to the dark side' as he said yesterday that he would be allocating 3% of his portfolio to Bitcoin (BTC) and looking into investing in sustainable crypto mining

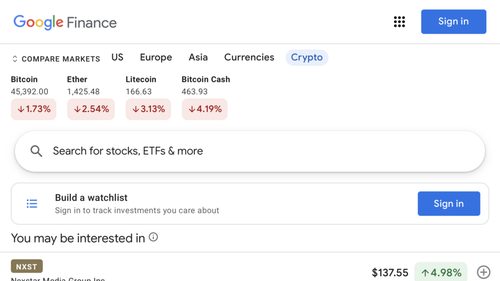

With regard mainstream adoption, Coinivore reports that browser-based Google Finance slyly listed a “crypto” tab among its offerings this week.

The facing page appears as usual, allowing user customization, including market comparisons by country, a basket of currencies tab, and now a “crypto” tab.

It’s quite a subtle form of capitulation for Google.

The online behemoth has had a love/hate relationship with cryptocurrencies for years. It was only two or so years ago, for example, Scott Spencer, Vice President of Product Management, Ads Privacy and Safety at Google rocked markets by acknowledging an effective ban on advertising related to cryptocurrencies, lumping the ecosystem in with scams and dangers to online surfers.

Months later it would purge crypto content from its YouTube platform.It would insist the scrubbing came as a result of an error, but such “errors” continue into the present day.

Subsequent messaging from the company about a ban of crypto was muddled, contradictory, and often confusing.

In the background, however, Google appeared to have other intentions in mind.

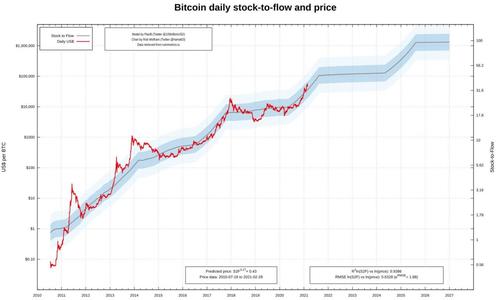

Finally, we note that Bitcoin continues to broadly track its stock-to-flow model expectations, signaling $100,000 by year-end, and $1,000,000 by the end of 2025...

Source

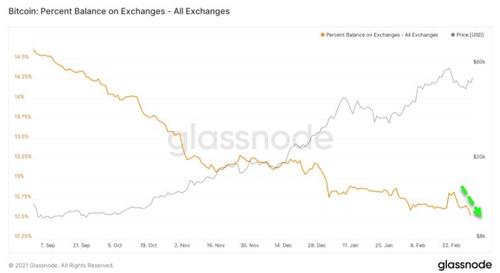

And that appears to be sparking another resurgence in HODLing as Decrypt reports that the total amount of Bitcoin on exchanges is falling further, indicating Bitcoiners are accumulating yet again.

Knowing how much Bitcoin is held on exchanges can tell us a lot about the current state of the Bitcoin market, as well as give us insights into what Bitcoin investors are thinking. If Bitcoin is coming off exchanges en masse, it tends to imply that investors are saving their holdings for the long term instead of looking to trade for short-term gains.

Bitcoin balance on exchanges since September 2020. Image: Glassnode

“The data clearly shows an asset that is in high demand and one that appears to have the confidence of traders, further implying that resale of the newly acquired Bitcoin is not on the table in the short term,” Jason Deane, Bitcoin analyst at market analysis company Quantum Economics, told Decrypt.

Sent from my iPad |