Re <<TSLA>>

I am at the end of my TSLA run, end March-19 and only one position outstanding now, and I doubt TSLA can make 770 in 13 days unless BTC goes to 100K. The danger is slight. My original strikes were at 1,000 and over.

Re <<bitcoin, or gold. Or productive assets>>

I have BTCC.U and it is just sitting there, waiting for the day of insurrection, patiently this time. Should the authorities fail to crush and then pulverize BTC, the possibility of 100K - 500K and 4M per coin opens up. No more silly than its rise from 0.1 to 10, or from 10 to 1000, or from 1,000 to 60,000.

Part of my engagement w/ the gold space has been productive ...

DRD, His bank, has been working day and night, producing gold from tailings powder milled down with ancient-price electricity, aged nicely in the tailing ponds, giving up gold holding memories of economic work done through the interim history, to help us better weather what macro rushes towards us, QE, ZIRP, NIRP, MMT, and UBI. The rest of my gold engagement sleeps in boxes, waiting for call of duty.

BTCC.U, Au, DRD all share one common denominator, for all are of the insurrection on very lonely path(s).

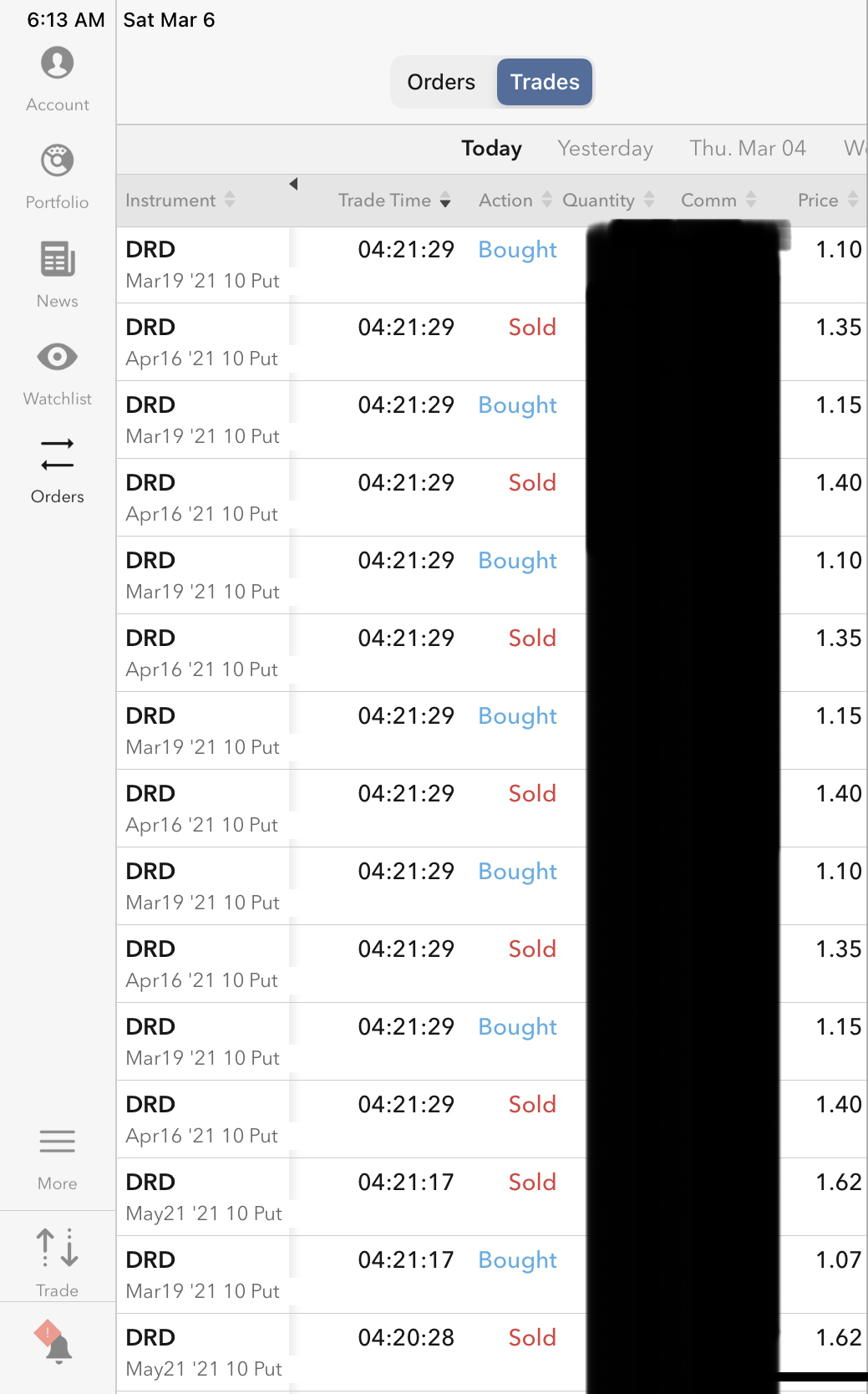

The net effect of below DRD roll is that I netted another $0.50 per share for risks taken, and pushed out the day of reckoning to yet other times, other than March 19, and

The same net reduced the cost basis of of what DRD I actually and have long held by another $0.60 per share. I own slightly less shares than I risk to play the options side of the equation, thus the variance between 0.5 and 0.6.

I also expect to receive a quarterly dividend of $0.21 by Monday Message 33205390 , reducing cost basis further. The cost basis shall mathematically go negative soon. The company, unleveraged to debt but very pivoted on gold, yields 9% at current quarterly run-rate.

This DRD is a joke on the rest of the financial market, indicating that the true cost of money, true money, gold money, accounting for three-months of rolls per quarter, is north of (0.60 x 3 + 0.21) / 9.12, or 22% per quarter, and 88% per annum.

Is S Africa risk that outrageous? Relative to Mongolia, Indonesia, Australia, Canada, and USA?

Hilarious.

A new development here in HK, that the Republicans and the Democrats and the proto-socialists all decided that HK, instead of being the most economically-free in this galaxy, is now ranked the same as China, the mainland, at 109.

Folks here do not seem to care about the re-labeling for typically the Neo-people / MSM repeating unfounded claims does not make it true. Our laws favor our private assets, and our taxes forgive us for our gains, under the sovereign protection of the ‘Communist’. The DRD takings are tax-free in HK per freedom to be tax-free and freedom from dilution. The world upside down.

In any case, whilst applying of the most basic investment / trading principle, buy low sell high, ideally at the same moment, the song comes to mind, roll roll roll your boat, gently down the stream ... :0)

|