a watch & brief topic re interest rate, money dilution, qe, mmt, etc etc and china china china usa usa usa

bloomberg.com

Haunted by 2008, China and U.S. Diverge on Stimulus Plans

Chris Anstey

The U.S. and China are pursuing divergent economic policies in the aftermath of the coronavirus recession in a role reversal from last time the world economy was recovering from a shock.

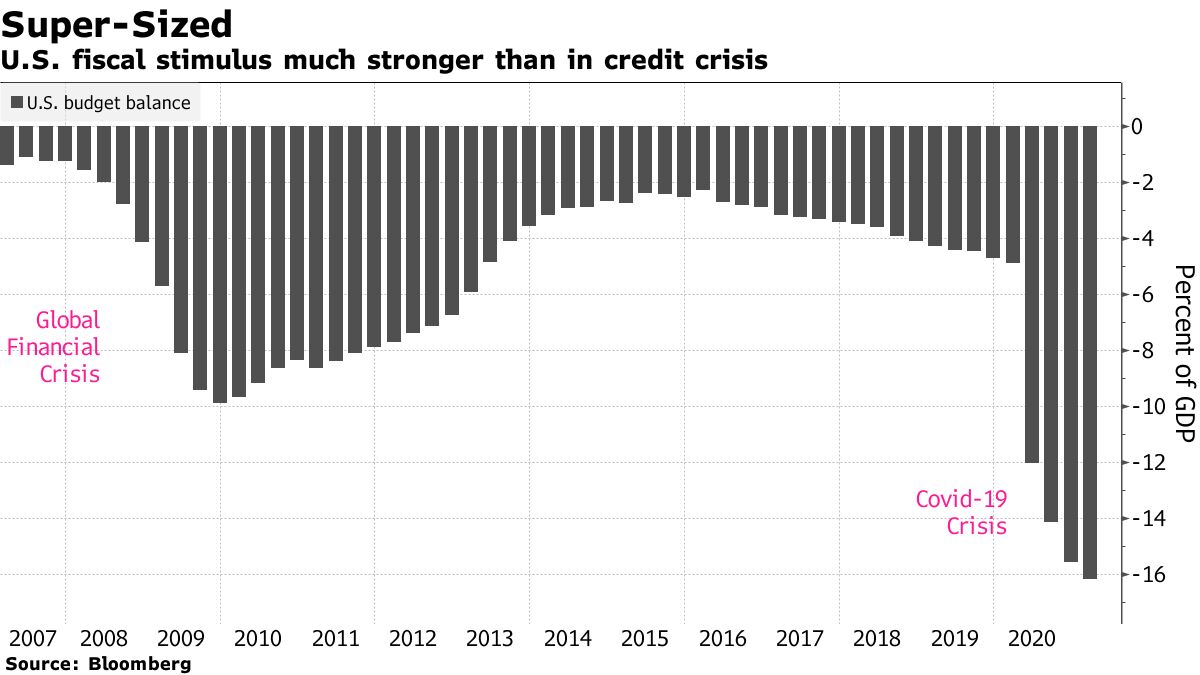

One of the takeaways from the annual National People’s Congress under way in Beijing is a conservative growth goal, with a tighter fiscal-deficit target and restrained monetary settings. That’s a big contrast with Washington, where President Joe Biden is preparing a second major fiscal package after he gets final approval for his $1.9 trillion stimulus.

The widening policy divergence is putting strains on exchange rates and could potentially reshape global capital flows. It stems, in part, from different policy lessons from the 2007-09 crisis.

A stunted and choppy U.S. recovery left key Democrats concluding it’s vital to “go big” on stimulus and keep it flowing. For monetary policy the moral was: “Don’t hold back” and “don’t stop until the job is done,” Federal Reserve Chair Jerome Powell said last week.

China’s leaders have a different take. A massive unleashing of credit growth back then led to unused infrastructure, ghost towns, excess industrial capacity and an overhang of debt. While rapid containment of the pandemic meant the economy didn’t need as much help in 2020, President Xi Jinping and his team are now winding things back to re-focus on longer-term initiatives to strengthen the technology sector and tamp down debt risks.

“Each learned a lesson from the previous episode, and so it is kind of a swap of positions,” said Nathan Sheets, head of global economic research at PGIM Fixed Income and a former U.S. Treasury undersecretary for international affairs. The policy mix now makes “a compelling case for renminbi appreciation,” Sheets said.

That’s a view that’s widely shared: the median forecast is for a strengthening to 6.38 against the dollar by the end of the year, from 6.5238 in Hong Kong on Monday afternoon.

One of China’s financial regulators, Guo Shuqing, highlighted in a briefing just days before the opening of the annual legislative gathering that high leverage within the financial system must continue to be addressed. Guo pointed to worries about inflated property prices and the risk of overseas money pouring in to take advantage of the premiums China’s assets offer. He also indicated the nation’s lending rates will likely go up this year.

While U.S. Treasury yields have surged recently, 10-year rates remain less than half those in China, where the central bank has forsworn Western-style zero interest rates or quantitative easing.

“Unlike many of its peers, including the Fed, China’s central bank has continued to calibrate its policy partially with a view to prevent an excessive rise in asset prices,” said Frederic Neumann, co-head of Asian economics research at HSBC Holdings Plc in Hong Kong. Confronted with currency-appreciation risks, China will be hoping for a “well-timed exit from the Fed’s ultra-ease stance.”

That’s unlikely to come soon. Powell in three appearances the past fortnight has made clear the Fed is going to keep policy rates near zero until well into the economic recovery, when most jobless Americans are brought back into employment. He also gave no indication asset purchases will be tapered as Biden’s fiscal stimulus kicks in in coming months.

As China contends with capital inflows, the U.S. is likely to be pumping out a greater supply of dollars into the global economy -- via a widening current-account deficit -- as its growth revs up, supercharged by Biden’s stimulus and the Fed’s easy stance.

“There’s been a regime break,” in the U.S. with the outsize Biden relief bill and a planned longer-term follow-up, said Robin Brooks, chief economist at the Institute of International Finance. As growth soars past 6% this year, a wider current-account deficit will be “the pressure valve” given domestic production constraints, he said.

Brooks projects that deficit will hit 4% of gross domestic product this year. That would be the highest since large shortfalls during the 2002-08 period, when a broad measure of the dollar tumbled as much as 27%.

“As our fiscal support goes into uncharted territory, it puts enormous pressure on our budget deficits -- and by inference our domestic saving rate and the current account and trade deficit, with the consequences primarily falling on the currency,” said Stephen Roach, a Yale University senior fellow and former chairman of Morgan Stanley Asia.

China’s reluctance toward the kind of “go big” message of Treasury Secretary Janet Yellen dates back many years. After unleashing a fiscal package of 4 trillion yuan ($586 billion, at the time) and an unprecedented surge in broader credit after the 2008 crisis, Beijing was already by 2012 saying it wouldn’t do that again.

Reticence toward across-the-board stimulus later turned into a concerted push to rein in leverage. A May 2016 front-page treatise in the People’s Daily -- the Communist Party’s mouthpiece -- blasted excessive debt as the “original sin” sowing risks across financial and real-estate markets. The anonymous article -- widely said to have been written by Vice Premier Liu He, Xi’s top economic adviser -- called stimulating the economy through easy monetary policy a “ fantasy.”

So with the country’s success in applying draconian restrictions to contain the coronavirus, it should come as little surprise that Beijing is returning toward its pre-pandemic focus on building domestic tech capabilities and managing down debt risks.

What Bloomberg’s Economists Say...“China is increasingly shifting its attention from pandemic recovery to managing the economy in more normal conditions.”

--Chang Shu, chief Asia economist

For the full report, click here

After ditching an annual growth target for 2020 given the turmoil caused by Covid-19, China’s leadership set a goal of a GDP increase of more than 6% this year -- conservative since it’s well below economists’ projections for this year’s expansion.

In the meantime, surging American GDP gains are set to lift China’s prospects as well. Exports to the U.S. soared more than 87% in the first two months of this year compared with the pandemic-hit period a year before, faster than China’s overall rise of just under 61%.

“The U.S. locomotive is back on track,” said Catherine Mann, global chief economist at Citigroup Inc.

— With assistance by Zoe Schneeweiss

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |