Re <<SBSW being taken to the woodshed for unknown reasons>>

... can be a gift.

(1) SBSW working to substitute platinum for palladium, and palladium for rhodium miningweekly.com

(2) My takeaways from this management presentation thevault.exchange are

- anti-fragile / global

- multiple geewhizbang metals where SBSW is either the largest or one of the largest players

- much long-life mines w/ reserves

- robust against stagflation, inflation, given gold-backing

- future-proof against deflation given ramping green angles

(3) Iridium is a footnote on SBSW books, but turns out SBSW is the world's largest iridium miner with much of the reserve in the best places as reserve, that which we know as staying-power

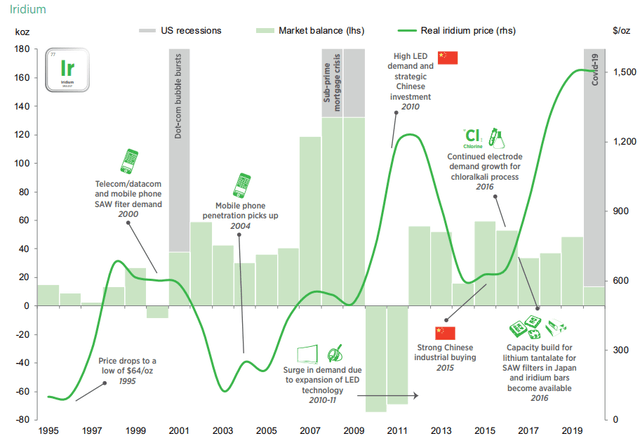

and iridium has been moving spglobal.com

Iridium hits all-time high of $6,000/oz on supply issues, strong demand

Iridium base price up 9% week on week

South Africa accounts for 81% of global iridium mine supply

Demand to be boosted by developments in 5G smartphone market

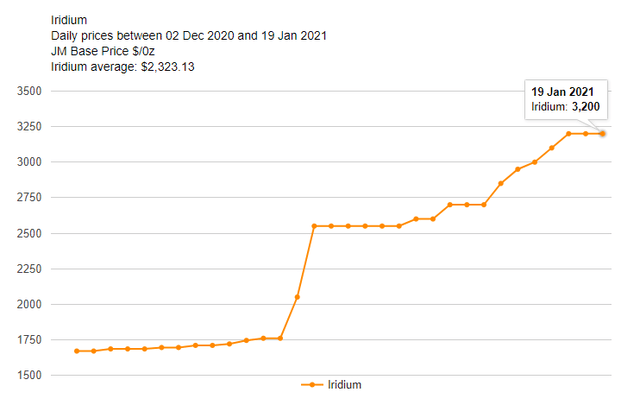

London — Iridium base prices continued to maintain their upward momentum March 19 to hit a new all-time of $6,000/oz on supply tightness from South Africa and strong demand in the electrical and electrochemical sector.

The platinum group metal (PGM) has been on a tear over the past three months, rising nearly three-and-a-half fold since Dec. 18, when it stood at $1,760/oz.

The Platts New York Dealer iridium price rose to $5,750-$6,150/oz for the March 12-18 period, from $5,000-$5,750/oz the week prior.

Johnson Matthey (JM) – the largest secondary PGM refiner in the world – said in its iridium base prices stood at $6,000/oz, up 9% on March 12, while refiner Engelhard Materials Services (BASF) of Germany also stood at $6,000/oz, up 9% week on week.

Iridium is a critical element in several niche products, including temperature resistant crucibles used to grow synthetic crystals for electronics and telecommunications systems, such as 5G, high-performance spark plugs, medical devices and iridium-coated electrodes for navel ballast systems.

On the supply side, COVID-19 severely disrupted South African supply in 2020. South Africa accounts for 81% of global iridium mine supply. In 2020, 31% of total iridium demand came from the electrical sector, 26% from the electrochemical and 13% from automotive.

Strong demand

Heraeus Precious Metals, one of the world's largest platinum group metals refiners, said in a research note that iridium demand is expected to be boosted further by the development of the 5G smartphone market, with premium products propping up demand for organic light-emitting diode (OLED) displays.

"Costs are declining as more manufacturers release 5G handsets, which will accelerate the rate of adoption," Heraeus said.

"German technology group Merck recently announced a €20 million [$24 million] expansion of its OLED manufacturing capacity at sites in Korea and China to meet growing customer demand in Asia."

Heraeus said OLED technology, which is used in consumer electronics and is built on an iridium compound, was currently the quickest growing display technology.

"OLED screens have many advantages over LED and LCD screens in terms of picture quality and efficiency," Heraeus said.

"Electrical end-uses, including OLED display, accounted for around 70,000 oz of iridium last year, 31% of total demand."

Heraeus said that according to the International Data Corporation (IDC), global smartphone shipments are expected to increase 5.5% year on year in 2021, boosted by a post-COVID recovery in demand and 5G device interest.

"5G is anticipated to be a key driver of growth, boosted by the success of Apple's full iPhone 12 line-up and selected Samsung Galaxy handsets," Heraeus said. "IDC expects 5G smartphone shipments to account for more than 40% of global volume in 2021, growing to 69% in 2025."

Heraeus Precious Metals iridium industrial price stood at $6,600/oz, up 8.2% on March 12.

seekingalpha.com

Sibanye Should Benefit From Hydrogen Wars Thanks To Its Iridium Exposure

Gold Panda

Investment thesis

Back in December, I wrote an article covering how Impala Platinum ( OTCQX:IMPUY, OTCPK:IMPUF) is set to benefit from European Union's (EU) push to boost renewable hydrogen capacity from 1GW today to 6GW by 2024 and 40GW by 2030.

European companies are betting on polymer electrolyte membrane (PEM) electrolysers, which use iridium. Annual production of the latter is just around 300,000 ounces and the green hydrogen revolution is pushing the market into a structural deficit. Iridium is currently almost as twice as valuable as gold and I think it has the potential to become a $6.5 billion market if its rise is anything like the one of rhodium, which is another member of the platinum group metals (PGMs) family.

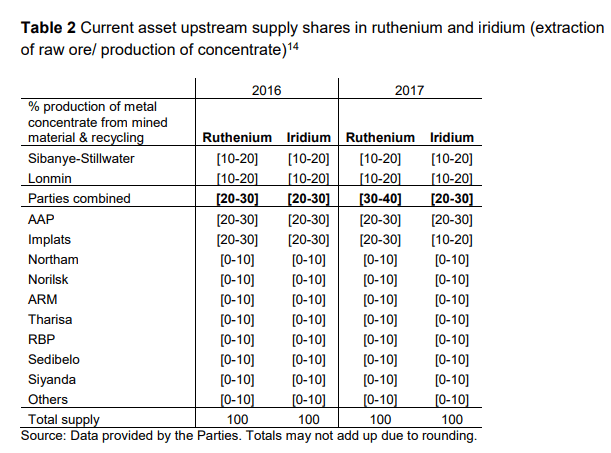

Like rhodium, iridium comes mainly from South Africa and there are only three major producers in the world today. The most significant among them is Sibanye Stillwater (NYSE: SBSW).

If iridium manages to match rhodium's price, Sibanye will be generating over $1.2 billion from this metal alone. The company can also boost production by reopening old shafts that it closed following the acquisition of Lonmin.

PEM and the hydrogen wars

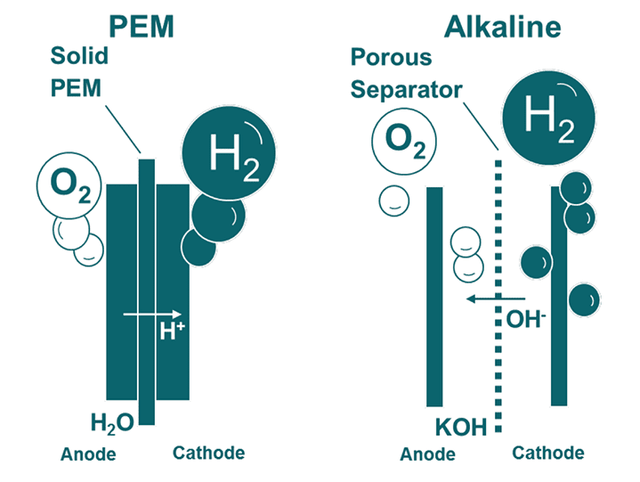

Renewable or clean hydrogen is manufactured through water electrolysis, in which an electric current is applied to split water molecules into hydrogen and oxygen. There are two main water electrolysis technologies, which are characterized by their electrolyte type - PEM and alkaline.

(Source: POWER magazine)

Large-scale projects mainly use alkaline electrolysers and they are much cheaper. The market is dominated by Chinese producers, which have managed to significantly push down prices as a result of economies of scale and automation.

According to estimates by BloombergNEF, Chinese company can sell alkaline electrolysers for just $200/kW, which is around 80% lower compared to European rivals.

PEM electrolysis cells are considered more suitable for small hydrogen plants due to their small size as well as their ability to handle variable power supply from renewable sources more efficiently. This is perfect for the storage of energy when wind and solar energy generation is the cheapest.

The reason the EU is focusing its efforts on PEM is that it's a leader in it and innovations and price decreases will be easier since it's a less-established technology compared to alkaline. According to Johnson Matthey ( OTCPK:JMPLF, OTCPK:JMPLY, OTCPK:JMPLD), PEM can reach a global market share of between 30% and 60%.

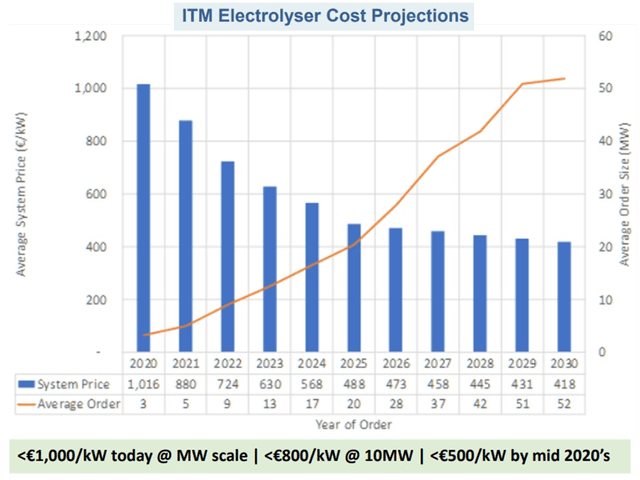

Britain's ITM Power ( OTCPK:ITMPF) has built the world's first hydrogen gigafactory and is set to reach 1GW of PEM eletrolysers by 2024. The company aims to cut prices per kW by more than half by 2030.

(Source: Utility Dive, with data from ITM)

Also, German technology group Heraeus recently announced that it has developed a new electrocatalyst, which has 50-90% less iridium than conventional products and up to three times higher catalyst performance. When I talk about the hydrogen wars, I mean EU's race against China in the green hydrogen market, which could become a $700 billion business by 2050, according to Bloomberg NEF.

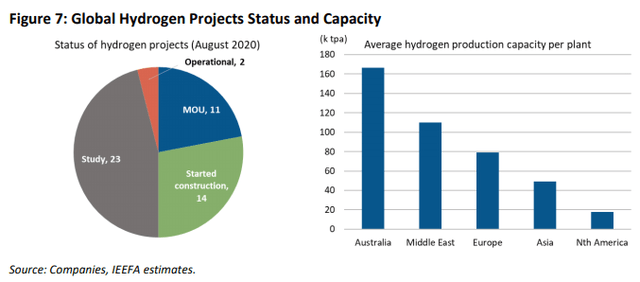

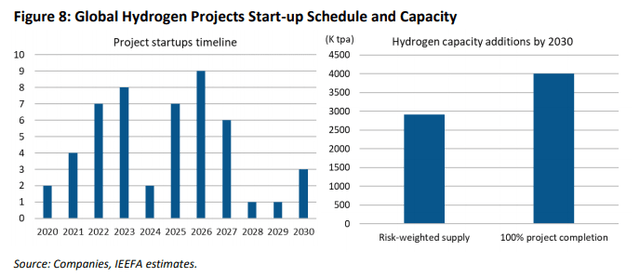

The EU plans to invest as much as $550 billion in hydrogen infrastructure over the next years and the Institute for Energy Economics and Financial Analysis (IEEFA) estimates that some 50 viable renewable large-scale hydrogen projects have been announced over the past year across the globe. The capex to develop these projects stands at $75 billion and the planned electrolyser capacity is 11GW.

(Source: IEEFA)

Iridium and Sibanye's exposure

PEM electrolysers use around 1 g/kW to 2 g/kW of an iridium powder called iridium black. Heraeus says it has slashed this amount to as little as 0.3-0.4 g/kW.

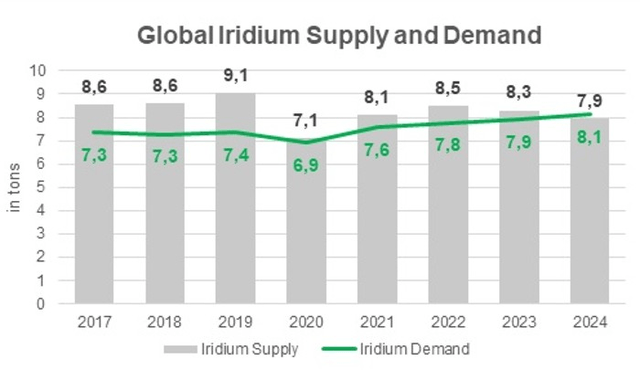

Iridium is a very small market with an annual supply of around 300,000 ounces. Since demand is steadily growing, the market is expected to be in a structural deficit around 2024.

(Source: Heraeus)

However, the metal could already be in serious deficit judging by its price performance. Iridium prices have almost doubled since my article on Impala and are at $3,200 per ounce as of time of writing.

(Source: Johnson Matthey)

I think iridium has a lot of similarities to rhodium. Both are almost exclusively mined from Upper Group 2 (UG2) orebodies in South Africa's Bushveld Complex; both are PGM metals; both are by-products of platinum and palladium mining; and both are in a structural deficit. If iridium manages to reach rhodium's price, it would become a $6.5 billion market.

In 2019, Sibanye became the largest iridium producer in the world through the purchase of South African rival Lonmin.

(Source: Competition and Markets Authority)

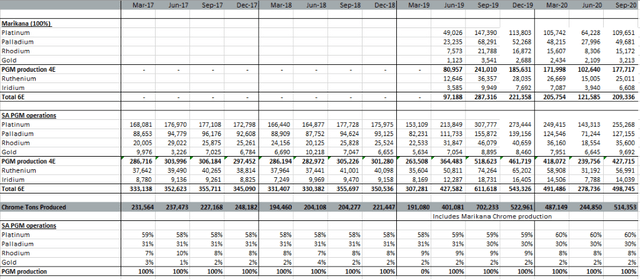

Iridium output has dropped to just above 14,000 ounces per quarter due to closures of unprofitable shafts, mainly at the Marikana operation. However, with prices of rhodium and iridium soaring, the company could decide to reopen some shafts and increase production.

(Source: Sibanye)

As I mentioned, if iridium manages to reach rhodium's current price of $21,800 per ounce, it will become a $6.5 billion market. Sibanye has an annualized iridium production of around 56,000 ounces, which translates into $1.22 billion of revenues. If the company boosts quarterly output back to 19,000 ounces, the number goes up to $1.66 billion per year.

Investor takeaway

The green hydrogen market is set to grow fast and PEM electrolysis will capture a significant share, which will boost the demand for iridium. I think the iridium market is already in a structural deficit, as the price of the metal has gone parabolic.

I think iridium prices are likely to reach levels similar to rhodium and the main beneficiaries will be a handful of South African miners. Impala has an annual output of around 67,000 ounces, but Sibanye can surpass the latter by reopening a few shafts.

In my opinion, Sibanye's share price could reach $20 in 2021 thanks to the strong price performance of iridium and some of the other PGMs. However, beware of any decreases in palladium and rhodium prices, as these two metals are the main revenue drivers for the company at the moment. |