we can watch trucks, china and Cummins

seekingalpha.com

Cummins: Hitting The Highway With Hydrogen

James Hanshaw

Given the shocking state of our polluted environment, we have to make changes fast to ensure we have a future and since we also depend on energy to live, that must come from reliable and clean sources.

Global transportation is currently responsible for 16% of GHG emissions, with a significant portion from road transport. In Canada, 10.5% of these emissions come from freight transportation. In the US, this number increases to 23% stemming from medium- and heavy-duty trucks. Most of those trucks use polluting diesel engines and many of those were made by Cummins (NYSE: CMI).

Diesel causes 38,000 deaths per year and that is expected to rise to 184,000 by 2040 so there is global pressure to get that changed and Cummins is a leader in the way forward by making engines that use cleaner fuels such as LNG and CNG and soon; hydrogen - our future’s fuel.

The demand potential is enormous and I will say more about that later.

We can make investing dual purpose; a way to make money and help clean up our environment by hitting the highway with...

Cummins

Cummins is the world-leading maker of engines for buses, trains, and medium-sized to heavy-duty trucks. It makes 1.2 million engines per year. Germany’s Daimler ( OTCPK:DDAIF) is number 2.

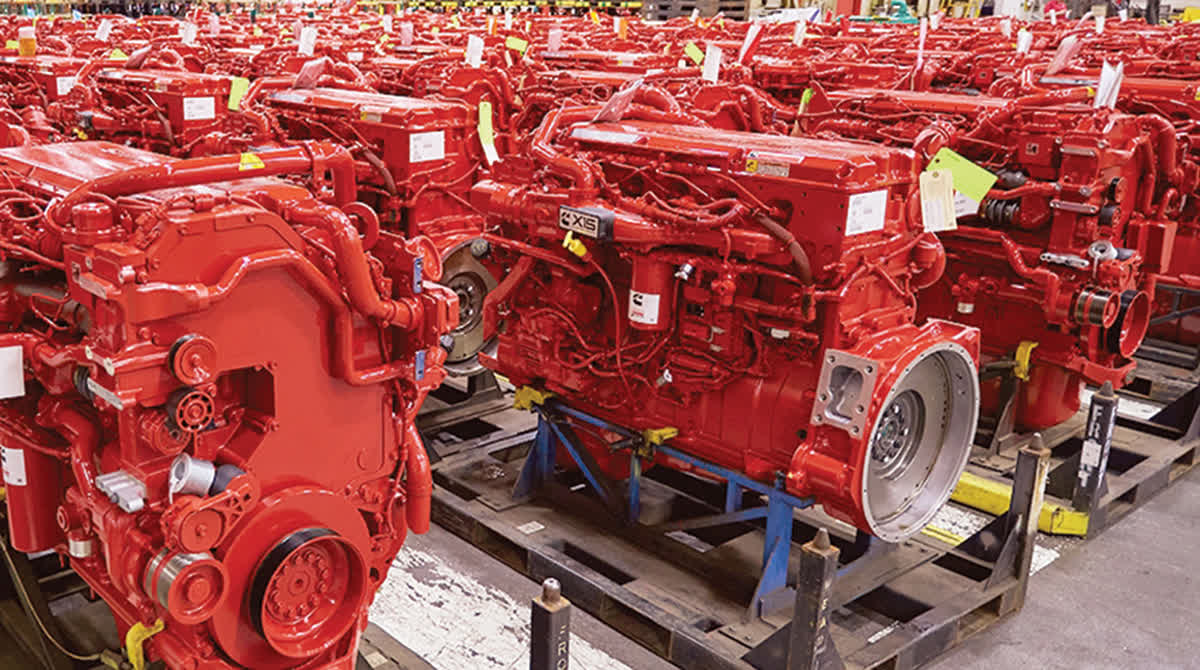

Photo: Cummins Photo: Cummins

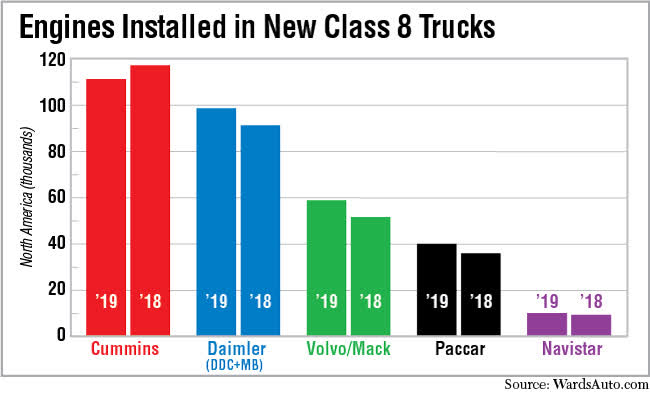

I have found it difficult to find actual shares worldwide and 2020 figures but in the US, in 2019, Cummins had a leading 34.8% of the total, or 112,756 out of 323,225, according to a Ward’s report.

The report breaks Class 8 engines into two segments, Group 1, under 10 liters, and Group 2, 10 liters and over. Cummins’ dominance with its smaller L9 engine ensured it posted the overall lead.

Cummins had an 88% share or 25,343 engines of the total 28,829 in the Group 1 category. Others with engines in the under 10-liter category included Detroit Diesel, 1,853; Paccar (NASDAQ: PCAR), 1,379; Mercedes-Benz, 210; and Hino Motors Manufacturing U.S.A. ( OTCPK:HINOY) ( OTC:HINOF) with 40.

The picture worldwide is far more fragmented with Isuzu ( OTCPK:ISUZF) of Japan being a big player outside the US. Hino, also of Japan makes engines for their own trucks as does Daimler and others. I calculate that CMI’s world share of the truck engine market - excluding China - is around 6%. That sounds small but it is still as high or higher than any other maker and is an indication of the dispersal of business thus suggesting both threat and opportunity.

Cummins and China

China is a world of its own with trucks and, unusually, has not bothered much with exports. Perhaps that is because the home market is so large; In 2018, China, the largest heavy truck market around the globe, sold approximately 1.15 million heavy trucks (a 48.1% share of global total). That is 3 times the size of the US large truck market! Cummins is strong there. It entered China over 40 years ago so has been part of China’s modern development from nowhere to becoming the world’s second-largest economy from the beginning. It has invested more than $240 million US dollars in China and has 14 joint ventures and wholly-owned manufacturing enterprises, producing engines, turbochargers, alternators, and generators there.

Elsewhere Some truck makers make their own engines but use CMI’s as options for engine versions they do not make. Roy Horton, director of product strategy for Mack Trucks said this; “In certain cases where we do not offer proprietary engine solutions, including natural gas-powered engines and engines for our medium-heavy duty models, we offer Cummins engine options to complement our offer.”

Photo: Mack

More about that later. First...

Cummins and hydrogen

Cummins started to get involved with hydrogen around 20 years ago but has put its foot down hard on the accelerator pedal in recent times. In 2019 the acquired Hydrogenics, a Canadian world-leading maker of fuel cells and hydrogen generation equipment that was and remains 25% owned by French company Air Liquide ( OTCPK:AIQUF) (AI:PAR). Air Liquide is one of 3 world-leading gas companies and is leading the way into hydrogen too. I wrote about Air Liquide in Making Money Cleaning our Polluted Planet

In addition to acquiring Hydrogenics, Cummins also announced an investment in Loop Energy, a fuel cell electric range extender provider, and signed a memo of understanding with Hyundai Motor Company ( OTCPK:HYMLF) to collaborate on hydrogen fuel cell technology across commercial markets in North America.

Photo: Hyundai

I shall say a bit more about hydrogen under Opportunities later.

First a few words on other fuels...

Cummins and natural gas

That Mack reference to natgas above is very important because CMI is on the road with those too via its arrangement with Westport (NASDAQ: WPRT). Mack is owned by Swedish company Volvo ( OTCPK:VOLAF) who made this claim; "new trucks from Volvo running on LNG offer the same performance as diesel but with 20-100% lower CO2 emissions". Volvo Trucks now has heavy-duty trucks running on LNG.

Photo: Volvo

CMI has a comprehensive website where readers can explore more. Financially it is super safe:

Total debt/total equity; 0.5165

Total debt/total capital; 0.3166

Positive cash flow; last 5 years...

Net change in cash

ROE; 22.98%

ROI; 12.99%

P/E; 22

And for those that like a safe dividend CMI pays one of 2%. I like cash as well and CMI has a $3.862 billion cash mountain available.

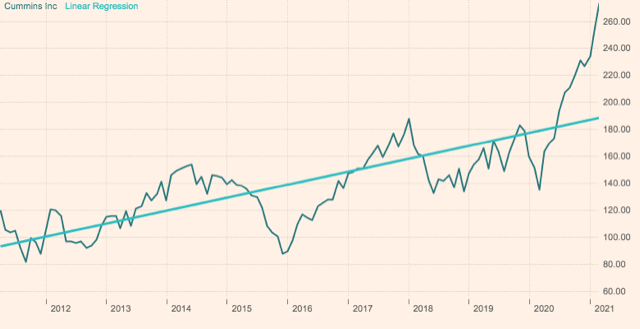

The stock price shows steady growth over 10 years:

Chart: Financial Times

The recent jump upwards could be a problem. According to the Financial Times, 16 analysts offering 12-month price targets for Cummins Inc. have a median target of $259.00, with a high estimate of 325.00 and a low estimate of 226.00. The price at the time of writing is $262.

I shall live with that believing the opportunities will take it to that high estimate but first a word on...

Threats/risks

Semiconductor Chip shortages may slow down truck production and the need for engines.

Recessions

Are not good for truck makers. Given the coronavirus-caused recession of the past 12 months and the recovery financing promised by political leaders in many countries we will most likely not see another recession for several years. That view is probably baked into the recent stock price increase but it might be ignoring the possibility of a prolonged life for existing trucks that have been off the road during that period so will not need replacing at the normal changeover time.

Competition

There is plenty of that outside the US but - unlike some old established US manufacturing companies such as GM (NYSE: GM) and Ford (NYSE: F) that are retreating from the world - CMI is innovating and moving outwards plus that competition is fragmented across those many suppliers outside the US, some of whom are now operating with CMI.

Trains

There is growing pressure worldwide to move freight off the road and onto rail to reduce pollution.

Chinese copiers

There may be some but I do not see this as a significant threat especially given Cummins' strength in China. It makes copies of its own products there! Trucks and train engines are not a priority in China’s 14th 5-year development plan; the 2025 and onwards plans.

The three major industries that have supported China's rapid economic development in the past - traditional manufacturing, construction, and real estate – are being replaced rapidly by three new pillar industries: strategic emerging industries, services, and modern manufacturing.

Already China is leading the development of entire new industries (built around digitalisation, artificial intelligence, big data, fifth-generation telecommunications networking (5G), nanotechnology, biotechnology, robotics, and quantum computing), new types of businesses (e-commerce and payment systems) and new business models (including new digital business-to-consumer and business-to-business applications and channels).

History and hydrogen deniers

For decades, hydrogen has been hailed as a potentially revolutionary alternative to fossil fuels - General Motors built its first hydrogen-powered vehicle in the 1960s. Yet its high costs and complexities have stunted previous attempts at creating whole new economies centred around hydrogen, which were often driven by oil price surges and shortages, or governments’ desire for energy independence. There are many such examples and they give fuel to today’s deniers.

Their siloed 20th century thinking could prevent progress in today’s world.

Accidents

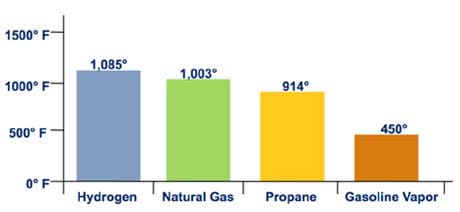

The deniers also claim it is very dangerous. Fact: it is certainly explosive and must be handled and stored properly but it is not much worse than natural gas. The auto-ignition temperatures of hydrogen and natural gas are very similar. Both have auto-ignition temperatures over 1,000°F, much higher than the auto-ignition temperature of gasoline vapour for example, as shown here by h2tools.org

Many countries are not among the deniers and the new Biden administration promises action to help clean up the environment at his level. At state level, California is leading the way in the US. North of the border, Canada is a world leader in clean fuels.

That adds to opportunities for Cummins that are not solely linked to hydrogen but other clean gas truck fuels too...

Opportunities & Demand Growth PotentialTrucks and buses

Photo: Toyota ( OTCPK:TYIDF)

Prices and those Hydrogen Deniers

Deniers like to flag up prices but ignore the cost of those 8 million plus people (WHO stats) killed each year by pollution that is never figured into the price of filthy fuels. Thus, hydrogen is portrayed by them as expensive but as with all such things costs are coming down. Solar and wind energy was once expensive and is now cheaper than coal in many places. Thierry Lepercq, author of the book Hydrogène, le nouveau petrol (Hydrogen, the new oil) said this recently; “In five years, we’re expecting a price of $1 per kilo. Some manufacturers are announcing a price of $1.50 starting in late 2020.” There are two reasons for this price drop. First, in order to produce green hydrogen, you need access to completely clean electricity from renewable and cheap sources. From 2009 to 2019, the cost of electricity produced in solar power plants decreased ninefold to reach $40 per megawatt-hour, and wind energy dropped from $135 to $41 per megawatt-hour, according to a study by Lazard Bank published in late 2019. “And prices will continue to fall in coming years, reaching $10 per megawatt-hour in 2025 with solar, which will automatically reduce the price of green hydrogen,” predicts Lepercq. The second reason is electrolysers – the machines that can transform water into hydrogen using electricity. “In recent years, the sector has gone from small pilot units – demonstrators with less than one megawatt of power – to industrial-scale projects that can reach 10, 20, and even several hundred megawatts,” says Xavier Regnard, an analyst at investment bank Bryan Garnier & Co. “This change in scale will lead to an industrialisation of the industry and a drop in prices.”

That means hydrogen powered trucks will soon hit the highway in ever growing numbers.

Cummins and hydrogenTheir New Power applications are shown here

Crucially refuelling facilities will be needed. California is leading the US with refuelling stations. Canada has one of the most advanced hydrogen strategies in the world including trucking that is seen as “low hanging fruit” on the highway to a cleaner environment. To transition China to cleaner energy, Sinopec Shanghai Petrochemical (NYSE: SHI) plans to have 1,000 refuelling stations equipped with hydrogen by 2025. As mentioned earlier, Cummins is well established in China. Hydrogen refuelling stations in Europe are expected to expand from 185 to 3,700 by 2030, and then on to 15,000 by 2040. Spain has announced a long term and strategic commitment to develop an extensive hydrogen fueling station network as part of its ambitious National Hydrogen Strategy, “Hoja de Ruta del Hidrógeno”. They plan to use "best-in-class technology to produce truly competitive green hydrogen from sunlight alone with zero emissions.” Japan and South Korea are becoming hydrogen countries

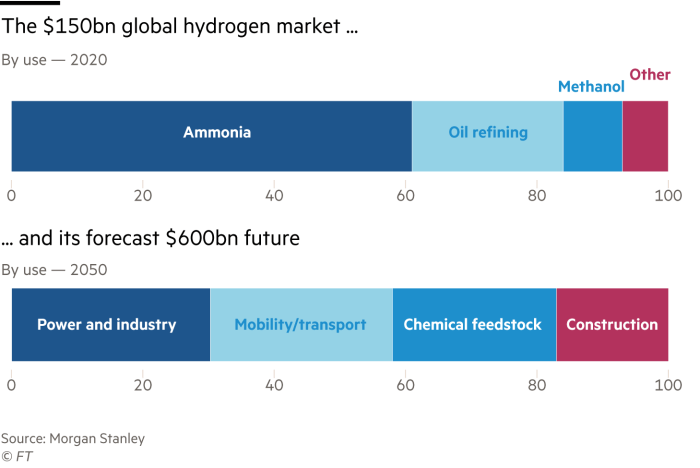

There are many more such hydrogen happenings worldwide, too many to put in an article but this Financial Times chart summarises those with forecasts for growth including transport...

Diesel phase out in Europe

In a potentially game-changing move, seven of Europe’s largest truck manufacturers – Daimler, Scania ( SCV.B), Man ( OTCPK:MAGOF), Volvo, Daf, Iveco (NYSE: CNHI), and Ford – have signed a pledge to phase out traditional combustion engines by 2040, focusing instead on hydrogen, battery technology, and clean fuels.

Cummins and clean natural gas engines More and more CNG and LNG fuelled buses and trucks are hitting the highways. Refuelling facilities are ready for those as I wrote in the article I linked earlier; Clean Energy - in name and in deed in a time of need Waste to energy - clean/renewable natural gas is being separated from landfills and farms thus aiding the environment that way. Cummins makes the engines!

Cummins and competitors

Competitors are usually a threat. for Cummins they are becoming an opportunity. One example; Cummins and Daimler of Germany are entering a partnership to make medium-sized engines for trucks and buses. That will help CMI expand its global footprint and market share. Another collaboration has been made with Isuzu of Japan. That too will make CMI more of a global player - Isuzu is strong in Japan and South East Asia.

Cummins and trains I mentioned trains above as a threat. They are but they are also an opportunity. This old form of transport from the first Industrial Age is becoming a key part of the newest Digital Age. I wrote about that in Trains are the New Age Planes. Many of CMI’s competitors are not in this sector but CMI is an important part of it, making engines for trains from high-speed passenger trains to slower-moving freight carriers.

Photo:Cummins Photo:Cummins

Cummins engines are used on some trains built by French company Alstom ( OTCPK:ALSMY) ( OTCPK:AOMFF), now the world’s second-largest maker of trains following its acquisition of Canadian company, Bombardier. China’s state-owned train maker is the largest and I assume they might use Made in China Cummins engines. Siemens ( OTCPK:SIEGY) of Germany, the world’s 3rd largest train maker, also uses Cummins engines.

Hydrogen-powered trains are hitting the tracks worldwide to replace diesel so Cummins is in the driver’s seat with those too.

Political pressures

These will also be a driver. Flight Shame is getting people off planes and onto trains in Europe and many European countries are pushing to get freight off trucks and onto trains as well.

In the US, Amtrak Joe is trying to get people and freight off roads and planes and onto trains. Amtrak’s newest trains are being made by Siemens using Cummins engines.

Photo: Redux/Eyevine. President Joe Biden, who made the three-hour round-trip to the Senate every day for 36 years, steps off an Amtrak in 1988

Cummins Boarding Time for Investors? A shift from trucks to trains is both opportunity and threat because the volume of engines needed will be much smaller but any transition will be a long time coming for freight as a vast amount of track upgrading is needed in many countries. Passengers shifting from planes to trains is happening now plus more passenger trains are changing from diesel to cleaner fuels.

Adding to opportunities could be the anticipated commodity super-cycle and the $3 trillion infrastructure investment boom that President Biden will unleash if he gets the go ahead for his spending plans. Consumers released from virus lockdown may recreate the big spending Roaring Twenties with its knees up happy dancers...

Photo: BBC History

Some of those developments will flow through to a need for more Cummins engines.

At this time, however, we also have bubble threats with some stocks being massively overvalued, in my view. Tesla (NASDAQ: TSLA) being one example with a P/E of 995. If that bubble bursts herd panic might flow and drag all down.

Cummins P/E is 22. Other “traditional" manufacturers are higher. John Deere's (NYSE: DE) is 34 and Caterpillar (NYSE: CAT) is 43. I own both of those and will stay with them, despite that apparent high valuation, also for growth reasons.

I recommend others hit the hydrogen and other clean fuels highway by boarding Cummins soon too.

I do not try to guess where CMI’s price will go but if that high estimate of $325 by analysts - that I mentioned above - proves correct, then we shall enjoy a 24% gain plus the 2% dividend and help clean up our polluted planet. I shall dance to that tune! |