Re <<Get gold, buy Bitcoin>>

In this below particular case, gold & cash would not have worked, and BTC, the BetterGold stands a fairer chance ...

zerohedge.com

FBI Raids Business Renting Anonymous Safety Deposit Boxes, Forces Customers To Reveal Identity To Get Stuff Back

In a case that's already sparked one lawsuit, a Beverly Hills strip mall business which rents private, anonymous safe deposit boxes was raided by the FBI last month - at which time the agency conducted a blanket seizure of hundreds of customers' belongings.

Federal agents relied on informants and at least one undercover officer to gather information about transactions that took place at U.S. Private Vaults.

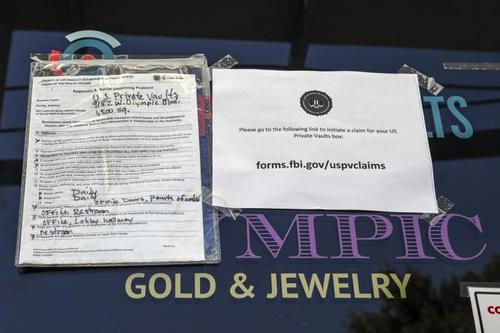

(Irfan Khan / Los Angeles Times) To retrieve their valuables, customers will need to "identify themselves and subject themselves to an investigation to verify their legal ownership," according to the Los Angeles Times, which noted that one customer has already gone to court claiming that the government overreached by confiscating the contents of every security box. To retrieve their valuables, customers will need to "identify themselves and subject themselves to an investigation to verify their legal ownership," according to the Los Angeles Times, which noted that one customer has already gone to court claiming that the government overreached by confiscating the contents of every security box.

The company, U.S. Private Vaults, has been accused of laundering money for drug dealers - who anonymously stashed guns, drugs and cash.

In an indictment against U.S. Private Vaults, Inc., the U.S. attorney for Los Angeles accused the company of marketing itself deliberately to attract criminals, saying it brazenly promoted itself as a place customers could store valuables with confidence that tax authorities would be hard-pressed to learn their identities or what was stored in their locked boxes. To access the facility, customers needed no identification; it took just an eye and hand scan to unlock the door.

“We don’t even want to know your name,” it advertised, according to prosecutors. - Los Angeles Times

The feds used "multiple informants and at least one undercover police officer who posed as customers" to surveil the store and gather information about its customers.

One of the company's owners and several employees are accused of being involved in drug sales that took place at the business, as well as helping customers to convert cash into gold in a way that would avoid suspicion. Of note, U.S. Private Vaults shared a storefront with Gold Business - named as a co-conspirator in the indictment - which is accused of helping customers convert cash into gold to avoid having to report currency transactions which exceed $10,000.

A sign taped to the front door of U.S. Private Vaults instructs customers on how to recover their possessions.

(Irfan Khan / Los Angeles Times) In the March 9 indictment that was unsealed Friday, a federal grand jury charged U.S. Private Vaults with three counts of conspiracy — to launder money, distribute narcotics and structure cash transactions to dodge detection. None of the people who are allegedly behind the operation were named in the court records. It is was not immediately clear whether any individuals will face criminal charges as well. - Los Angeles Times In the March 9 indictment that was unsealed Friday, a federal grand jury charged U.S. Private Vaults with three counts of conspiracy — to launder money, distribute narcotics and structure cash transactions to dodge detection. None of the people who are allegedly behind the operation were named in the court records. It is was not immediately clear whether any individuals will face criminal charges as well. - Los Angeles Times

The FBI and Drug Enforcement Agency took five days to go through and process all the boxes after the raid began on March 22, according to court documents. US prosecutors argued on Friday that while the original warrant remains under seal, the magistrate judge who approved it thought that the sweeping seizures were appropriate.

"The government seized the nests of safety deposit boxes because there was overwhelming evidence that USPV was a criminal business that conspired with its criminal clients to distribute drugs, launder money, and structure transactions to avoid currency reporting requirements, among other offenses," prosecutors claimed in papers filed in Los Angeles federal court.

According to prosecutors, the raid produced an unspecified number of weapons, fentanyl, OxyContin, and "huge stacks of $100 bills" which were flagged by drug-sniffing dogs. One box reportedly had $1 million in cash.

The indictment was unsealed on Friday - just one hour before a court-issued deadline to respond to a lawsuit brought by a US Private Vaults customers who alleged that the blanket seizure was unconstitutional.

The unnamed customer, listed in court papers as John Doe, said the search warrant should not have authorized seizure of the jewelry, currency and bullion that he kept in his three boxes at U.S. Private Vaults, because there was no probable cause to suspect the person committed a crime.

“Just as the tenant of each apartment controls that space and therefore has a reasonable expectation of privacy in it, each of the hundreds of renters of safety deposit boxes ... has a separate reasonable expectation of privacy in his or her separately controlled box or boxes,” the person’s attorney, Benjamin N. Gluck, wrote in the complaint. - Los Angeles Times

The customer seeks to stop the FBI from requiring anonymous customers to reveal themselves and undergo an investigation to verify legal ownership of their valuables - with attorney Benjamin Gluck arguing that the government is holding his client's goods "hostage" until he identifies himself. Gluck pointed to a statement by assistant US Attorney Andrew Brown describing the procedure for retrieving valuables.

"Though Mr. Brown perhaps deserves credit for his candor, his announced plan is grossly improper and manifestly unconstitutional," wrote Gluck, noting that Brown had previously conceded in court papers that some US Private Vaults customers were "honest citizens to whom the government wishes to return their property."

"But the majority of the box holders are criminals who used USPV’s anonymity to hide their ill-gotten wealth," he wrote. "To distinguish between honest and criminal customers, the government must examine the specific facts of each box and each claim, precisely what the anonymous plaintiff wants to prevent by refusing to disclose not only his identity, but even the specific boxes he claims are his."

Federal agents have seized evidence from U.S. Private Vaults, a Beverly Hills business that has been charged with three counts of conspiracy.

(Irfan Khan / Los Angeles Times) Beverly Hills attorney Nina Marino, who represents several US Private Vaults clients, said that even if there were some criminal customers, "that does not authorize the government’s conduct in this sweeping action of not only seizing innocent box owners’ property, but viewing that property." Beverly Hills attorney Nina Marino, who represents several US Private Vaults clients, said that even if there were some criminal customers, "that does not authorize the government’s conduct in this sweeping action of not only seizing innocent box owners’ property, but viewing that property."

"Every single person that paid money on a monthly basis did that with the expectation of maintaining their anonymity, and it’s just outrageous that the government has such low regard for the 4th Amendment and for an individual’s expectation of privacy," she added.

UCLA law professor Beth Colgan called the issue "fascinating," adding that the big question is whether the search warrant was based on sufficient probable cause to believe that evidence of criminal wrongdoing would be found in virtually all of the safe deposit boxes.

"I would just be very surprised if a judge had approved a warrant that would allow the FBI to go through every single box absent evidence that the entire system was corrupt," said Colgan. "Maybe they have the evidence, and that’s the thing we don’t know." |