RE <<cynical>>

ultra bullish, that chip investment goes high even as chip supply go low, everywhere, leading to a mother of all crashes once the chip code is inexorably cracked wide open inevitably, and even as the war has a natural limit, given WMDs rare earths and gallium

chips shall go begging once all the players place their chips on the wagering table

zerohedge.com

China's Huawei Blames US For Global Chip Shortage

Just around the time Joe Biden was concluding a meeting with more than a dozen CEOs on Monday addressing the global chip shortage that has snarled supply chains and brought high-tech industries to a stop (a meeting in which he offered $50 billion for semiconductor manufacturing and research), China's Huawei Technologies - which has been stockpiling chips at an unprecedented pace for the past 4 years - blamed the U.S. for the chip crunch rocking the global tech industry, saying Washington's sanctions against Chinese companies have spurred panic buying of semiconductors and other supplies.

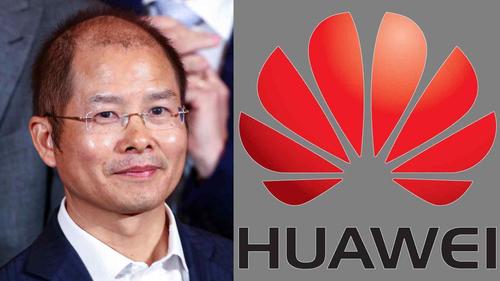

"Because of the U.S. sanctions against Huawei, we have seen panic stockpiling among global companies, especially the Chinese ones. In the past, companies were barely stockpiling, but now they are building up three or six months' worth of inventory ... and that has disrupted the whole system," Rotating Chairman Eric Xu said at the company's 18th Huawei Analyst Summit , the Nikkei reported.

Huawei Rotating Chairman Eric Xu says U.S. sanctions on Chinese companies has spurred a rush to stockpile chips and other components So... it's the US' fault that China is buying up and stockpiling every chip it can find in advance of the next trade war? Got it. So... it's the US' fault that China is buying up and stockpiling every chip it can find in advance of the next trade war? Got it.

In retrospect, Trump's decision to place Huawei and other Chinese tech companies on trade blacklists that restrict their access to American technology was prophetic as their behavior demonstrates.

"Clearly the unwarranted U.S. sanctions against Huawei and other [Chinese] companies are creating an industry-wide supply shortage, and this could even trigger a new global economic crisis," Xu added.

In other words, if Biden even thinks about thinking about imposing a fresh round of tariffs, the industry-wide chip shortage which is created by Chinese companies - but is entirely the fault of the US - will get far worse and lead to countless high-tech industries grinding to a halt.

Xu's remarks came hours before the White House plans to host a summit aimed at addressing the chip shortage, with an emphasis on its impact on the automotive industry. Dozens of executives from U.S., Asian and European tech companies and automakers - including General Motors, Ford, Google, Intel, Taiwan Semiconductor Manufacturing Co., Samsung Electronics, and NXP - attended the event.

Xu said US trade restrictions on Huawei have not only undermined the company but also damaged the relationship of trust that existed in the global semiconductor supply chain. Now, he said, more and more countries are pushing to onshore chip production and boost their own tech self-reliance, rather than relying on cross-border supply chains.

And guess what that means for prices? According to Xu, this will entail at least $1 trillion in upfront investment, which will push up semiconductor prices by 35% to 65% and ultimately lead to higher costs of electronic devices for end users, he added, citing a recent report submitted to the White House by the Semiconductor Industry Association, the top U.S. chip industry alliance.

The rotating chairman also said Huawei is planning its strategy under the assumption that the company will remain on Washington's so-called Entity List, which restricts its access to American technologies, for a long time, which means the company will continue buying up every chip it can find... all while blaming the US. While Huawei's inventories for its business-to-business segment are currently sufficient, they "will not last for a long, long time," Xu acknowledged.

Meanwhile, and as we explained back in December 2018 in " This is What The "Trade" War With China Is Really All About", where we said that "chips, or semiconductors, have become the central battlefield in the trade war between the two countries. And it is a battle in which China has a very visible Achilles heel", other Chinese companies worry they will face a similar situation to Huawei, Xu said, adding that he believes there will be companies willing to invest in chip manufacturing to satisfy the needs of Huawei and other Chinese companies while maintaining compliance with U.S. rules.

"If it can be done ... and if our inventory level can help Huawei to last until that time, then this would be how we address the problems and the challenges we face," Xu said.

Still, he acknowledged that currently no chip manufacturers globally are able to help Huawei to put its chip designs into production because of the U.S. export control rules. Nevertheless, he said, Huawei will continue to fund its team for chip research and development "as long as we are able to afford it." |