'they' appear to be gradually guiding us to yet another script

the reasonable question is "why?"

theatlantic.com

The mRNA Vaccines Are Extraordinary, but Novavax Is Even Better

Persistent hype around mRNA vaccine technology is now distracting us from other ways to end the pandemic.

By Hilda Bastian

June 24, 2021

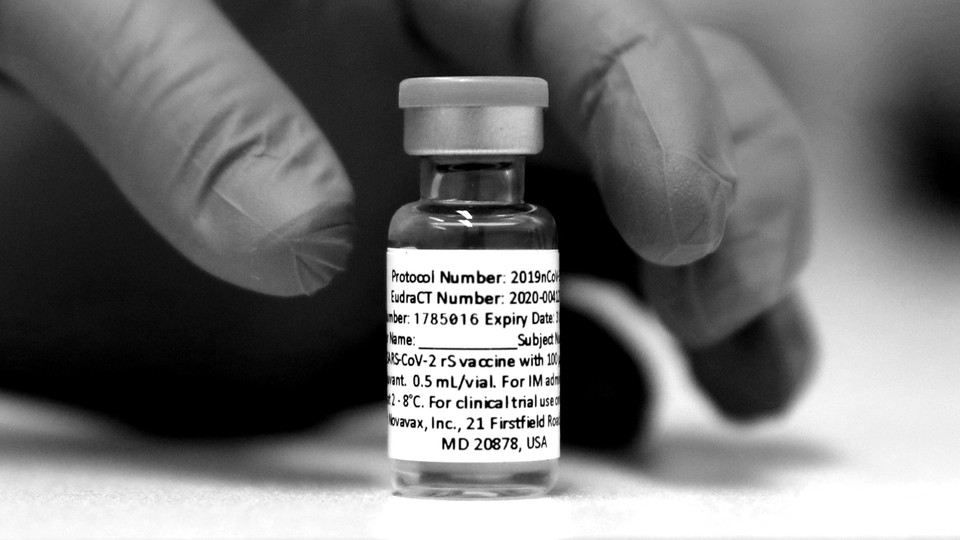

Alastair Grant / AP

At the end of January, reports that yet another COVID-19 vaccine had succeeded in its clinical trials—this one offering about 70 percent protection—were front-page news in the United States, and occasioned push alerts on millions of phones. But when the Maryland-based biotech firm Novavax announced its latest stunning trial results last week, and an efficacy rate of more than 90 percent even against coronavirus variants, the response from the same media outlets was muted in comparison. The difference, of course, was the timing: With three vaccines already authorized for emergency use by the U.S. Food and Drug Administration, the nation is “ awash in other shots” already, as the The New York Times put it.

Practically speaking, this is true. If the FDA sees no urgency, the Novavax vaccine might not be available in the U.S. for months, and in the meantime the national supply of other doses exceeds demand. But the asymmetry in coverage also hints at how the hype around the early-bird vaccines from Pfizer and Moderna has distorted perception. Their rapid arrival has been described in this magazine as “ the triumph of mRNA”—a brand-new vaccine technology whose “potential stretches far beyond this pandemic.” Other outlets gushed about “ a turning point in the long history of vaccines,” one that “ changed biotech forever.” It was easy to assume, based on all this reporting, that mRNA vaccines had already proved to be the most effective ones you could get—that they were better, sleeker, even cooler than any other vaccines could ever be.

But the fascination with the newest, shiniest options obscured some basic facts. These two particular mRNA vaccines may have been the first to get results from Phase 3 clinical trials, but that’s because of superior trial management, not secret vaccine sauce. For now, they are harder and more expensive to manufacture and distribute than traditional types of vaccines, and their side effects are more common and more severe. The latest Novavax data confirm that it’s possible to achieve the same efficacy against COVID-19 with a more familiar technology that more people may be inclined to trust. (The mRNA vaccines delivered efficacy rates of 95 and 94 percent against the original coronavirus strain in Phase 3 trials, as compared with 96 percent for Novavax in its first trial, and now 90 percent against a mixture of variants.

Read: The differences between the vaccines matter

Pandemic-vaccine success, as I wrote last year, was never just about the technology. You needed a good vaccine, sure—but to get it out the door quickly, you also had to have a massive clinical-trial operation going, and it had to be situated in places where the virus would be spreading widely at just the right time. Even if your candidate worked amazingly well, if you weren’t testing it in the middle of a huge outbreak, you’d have to wait a very long time for the evidence to build.

The precise timing of these studies mattered a great deal in practice. The Phase 3 clinical trials for Pfizer and Moderna, for example, were up and running in the U.S. by late summer 2020, and so they caught the nation’s giant wave of infections in the fall. By the time Novavax had finished recruiting in the U.S. and Mexico, in February, case rates had been dropping precipitously. This fact alone, independent of any aspect of vaccine technology, did a lot to shape the outcome.

Corporate strategy was another crucial factor. To “win” the vaccine race, a company would need to be able to produce high-quality vaccine doses reliably and quickly, and in vast numbers. It would also need to field the challenges of working with multiple regulatory agencies around the world. And it would need to do all of this at the same time.

BioNTech, the German company that developed the Pfizer mRNA vaccine, could not have accomplished so much, so quickly by itself. Last October, the company’s CEO, Ugur Sahin, told German interviewers that BioNTech had sought out Pfizer for help because of the scale of the clinical-trial program necessary for drug approvals. That strategic partnership, and not simply the “triumph of mRNA,” was what propelled them past the post. (Moderna had the advantage of its partnership with the National Institutes of Health.) Consider this: The BioNTech-Pfizer first-in-human vaccine study appeared on the U.S. government’s registry of clinical trials on April 30, 2020—the same day as the first-in-human vaccine study for Novavax, which would be going it alone. In a parallel universe where Novavax had paired up with, say, Merck, this story could have come out very differently.

In the meantime, the early success of two mRNA vaccines pulled attention away from the slower progress of other candidates based on the same technology. Just two days after last week’s Novavax announcement came the news that an mRNA vaccine developed by the German company CureVac had delivered a weak early efficacy rate in a Phase 3 trial, landing below even the 50 percent minimum level set by the World Health Organization and the FDA. “ The results caught scientists by surprise,” The New York Times reported. CureVac is the company that President Donald Trump reportedly tried to lure to the U.S. early in the pandemic, and the one that Elon Musk said he would supply with automated “RNA microfactories” for vaccine production. In the end, none of this mattered. CureVac’s mRNA vaccine just doesn’t seem to be good enough.

The “ sobering” struggles of CureVac perfectly illustrate what epidemiologists call “survivor bias”—a tendency to look only at positive examples and draw sweeping conclusions on their basis. When the Pfizer and Moderna vaccines triumphed, The Washington Post suggested that a bet on “ speedy but risky” mRNA technology had paid off with a paradigm-shifting breakthrough. Anthony Fauci called the gamble “ a spectacular success.” Such analyses usually had less to say about the non-mRNA vaccines that had gotten into clinical trials just as quickly—and about the other mRNA vaccines that were hitting snags along the way.

Now we’ve seen what happened to CureVac, and that some mRNA formulationsclearly work much better than others. By one count, nine groups were testing mRNA COVID-19 vaccines in animal studies as of May 2020, and six were expected to be in clinical trials a few months later. By the end of the year, only BioNTech-Pfizer, Moderna, and CureVac had reached Phase 3 testing, comparedwith 13 non-mRNA vaccines. Of the nine mRNA-vaccine candidates that were already testing in animals in mid-2020, just two have proved efficacy at this point, while no fewer than nine vaccines based on more traditional technologies have reached the same mark.

These other, non-mRNA vaccines have been widely used throughout the world—and some could still make an important difference in the U.S. Although the U.S. has plenty of doses of the Pfizer and Moderna vaccines available right now, demand for them has cratered. The Washington Post reports that in 10 states, fewer than 35 percent of American adults have been vaccinated. An international study of COVID-19 vaccine misinformation, published in May, found that among the most common online rumors were those alleging particular dangers of mRNA technology—that it leads, for example, to the creation of “ genetically modified human beings.” The CDC has also made a point of debunking the circulating falsehood that COVID-19 vaccines can change your DNA. For a time, it looked as though the Johnson & Johnson vaccine would help address this worry. It’s based on a fairly new technology, but not as new as mRNA. However, concerns about tainted doses made at a Baltimore factory and the emergence of a very rare but serious side effect have pretty much dashed that hope. The Johnson & Johnson single-dose vaccine has reportedly accounted for fewer than 4 percent of doses administered in the country.

Read: Microchipped vaccines, a 15-minute investigation

In this context, the success of the Novavax vaccine should be A1 news. The recent results confirm that it has roughly the same efficacy as the two authorized mRNA vaccines, with the added benefit of being based on an older, more familiar science. The protein-subunit approach used by Novavax was first implemented for the hepatitis B vaccine, which has been used in the U.S. since 1986. The pertussis vaccine, which is required for almost all children in U.S. public schools, is also made this way. Some of those people who have been wary of getting the mRNA vaccines may find Novavax more appealing.

The Novavax vaccine also has a substantially lower rate of side effects than the authorized mRNA vaccines. Last week’s data showed that about 40 percent of people who receive Novavax report fatigue after the second dose, as compared with 65 percent for Moderna and more than 55 percent for Pfizer. Based on the results of Novavax’s first efficacy trial in the U.K., side effects (including but not limited to fatigue) aren’t just less frequent; they’re milder too. That’s a very big deal for people on hourly wages, who already bear a disproportionate risk of getting COVID-19, and who have been less likely to get vaccinated in part because of the risk of losing days of work to post-vaccine fever, pain, or malaise. Side effects are a big barrier for COVID-vaccine acceptance. The CDC reportedon Monday that, according to a survey conducted in the spring, only about half of adults under the age of 40 have gotten the vaccine or definitely intend to do so, and that, among the rest, 56 percent say they are concerned about side effects. Lower rates of adverse events are likely to be a bigger issue still for parents, when considering vaccination for their children.

Don’t get me wrong—the Pfizer and Moderna vaccines have been extraordinary lifesavers in this pandemic, and we may well be heading into a new golden age of vaccine development. (This week, BioNTech started injections in an early trial for an mRNA vaccine for melanoma.) But even the best experts at predicting which drugs are going to be important get things wrong quite a bit, overestimating some treatments and underestimating others. Pharmaceuticals are generally a gamble.

But here’s what we know today, based on information that we have right now: Among several wonderful options, the more old-school vaccine from Novavax combines ease of manufacture with high efficacy and lower side effects. For the moment, it’s the best COVID-19 vaccine we have. |