Sordid, and assuredly time to giveback / share, and am guessing he best not try to hide anything, to the fen and the penny, as alt-meaning of 'stakeholder' might be righteously applied

no need for convoluted trials and such, as prima facie plenty enough and more than adequate to mete out justice

no imperative to socialise losses borne of scam-like act, whether scam or not, the mathematics rule

bloomberg.com

Evergrande’s Hui Amassed Billions in Dividends Before Crisis

Venus Feng

updated an hour ago

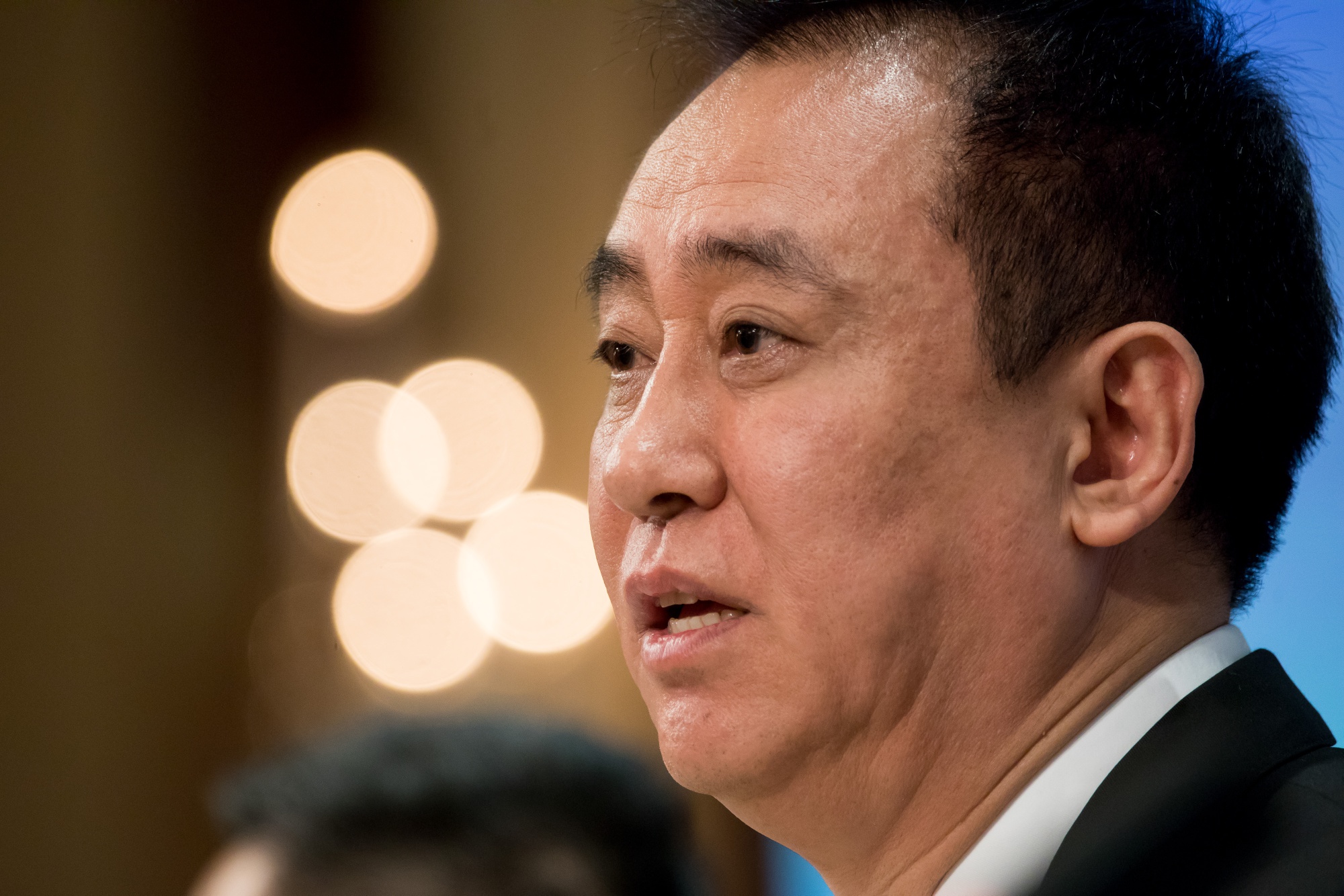

Hui Ka Yan Photographer: Paul Yeung/BloombergWhen Hui Ka Yan was cruising the world in a private jet, splurging on mansions and jewelry at the peak of China’s Gilded Age, his extravagant lifestyle barely stood out among the country’s burgeoning billionaire set.

Now the China Evergrande Group founder’s property empire is teetering on the edge of default -- and his personal fortune has landed squarely in the Chinese government’s crosshairs.

Wealth for You

Enjoying Bloomberg Wealth?

To read more articles based on your personal financial goals, answer these 3 questions that will tailor your reading experience.

As Evergrande struggles to meet obligations to creditors, suppliers and homeowners, authorities in Beijing are urging Hui to alleviate the crisis with his own wealth. The directive came after Evergrande missed an initial Sept. 23 deadline for an interest payment on one of its dollar bonds, according to people familiar with the matter.

That’s drawing fresh attention to a hard-to-answer question: Just how much money does Hui have? The sum -- while likely to be a tiny fraction of Evergrande’s more than $300 billion in liabilities -- may help determine the severity of a crisis that has roiled China’s credit market and undermined confidence in a real estate sector that accounts for about a quarter of the nation’s economic output.

The Bloomberg Billionaires Index estimates Hui’s fortune at $7.6 billion, down from $42 billion at its peak in 2017. While the value of his stake in Evergrande has dropped more than 80% this year, Hui has received more than $7 billion in dividends since the company started trading in 2009, the most among 82 Chinese tycoons tracked by Bloomberg.

Generous PayoutsHui has collected more than $7 billion in cash dividends since 2009

Source: Bloomberg Billionaires Index

The question of where Hui’s personal wealth has flowed may now factor into whether his company has the ability to keep paying debts in the near term. He wouldn’t be the first Chinese property tycoon to provide his firm with much-needed funding: Guangzhou R&F Properties Co.’s stock surged last month after major shareholders pledged $1 billion in financing.

While Evergrande paid a $83.5 million coupon to international bondholders last week before the expiration of a grace period, the company is having trouble raising funds via asset sales, financial institutions or wealthy friends. Earlier this month, a filing showed Hui committed 500 million Evergrande shares -- almost 5% of his stake in the developer -- to an entity that’s not a bank or a financial firm. One of his associates later pledged a Hong Kong house as collateral for a loan, with local media estimating its amount at as much as $38.6 million.

Hui accumulated many of his assets through Evergrande companies or offshore shell companies, a common tactic by the global rich to legally shield assets from creditors, tax authorities and public scrutiny. He was one of the Asian tycoons who turned up in the Panama Papers in 2016.

Read more:

Hui and his wife control 77% of Evergrande, most of it via a British Virgin Islands entity, Xin Xin (BVI) Ltd., according to a filing this month to the Hong Kong stock exchange. In 2014, he bought a $30 million mansion in Sydney using a string of cascading shell companies, one of which was named Golden Fast Foods Pty. Australia later forced him to sell the property because the deal violated foreign investment rules.

Hui didn’t immediately respond to a request for comment sent through Evergrande.

The Evergrande founder is the latest big-spending tycoon to face heightened scrutiny from Beijing as President Xi Jinping tries to shift the country toward the goal of “common prosperity.” The focus on billionaire extravagance builds the case for a greater party presence in corporate China, said Alex Payette, chief executive of Montreal-based consultant Cercius Group.

Hui, who was born in China’s central Henan province in 1958 and lost his mother as an infant, rose from poverty through education. He graduated from the Wuhan University of Science and Technology in 1982 as the nation’s economy was starting to open up and founded Evergrande in 1996 after a stint at a steel company.

He built his firm into one of China’s biggest real estate developers though debt issuance, more recently expanding into property management and electric vehicles. Hui also has operations ranging from soccer and volleyball teams to mineral water, online entertainment, wealth management and insurance.

Follow the moneyFind out how once-illegal drugs like marijuana and psychedelics are becoming big business with The Dose, a weekly newsletter.

Sign up to this newsletter

As his influence grew, Hui ensured his business priorities aligned with those of China’s Communist Party. He’s a member of the Political Consultative Committee, which helps advise the government on policy, and has touted that his company created millions of jobs and paid billions of yuan in taxes. Forbes ranked him as China’s top philanthropist, and he was named one of the nation’s 100 outstanding entrepreneurs in 2018.

Desmond Shum, author of Red Roulette, which describes China’s go-go days for wealth-seeking tycoons in the 1990s, said he once went shopping with Hui for a superyacht off France’s southern coast. Hui envisioned a “floating palace to wine and dine officials off China’s coast, away from the prying eyes of China’s anti-corruption cops and its nascent paparazzi,” Shum wrote.

Hui also bought two rings for $1 million on a whim, according to Shum, who added that splurging on big-ticket items was his way of getting the attention of those in power. In 2012, he earned the nickname “belt brother” after being photographed wearing a Hermes belt to attend a government advisory body meeting in Beijing.

While times have changed, Hui wrote in a letter to employees last month that he remains hopeful about the future.

“I believe Evergrande can walk out of the darkest hour through the endeavor of our management and employees,” he wrote. “We will hold on our spirit against all hardships, trying our best to fulfill our social responsibilities.”

— With assistance by Emma Dong

(Updates to add details of Hong Kong house pledge in seventh paragraph)

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |