Just had spare long moment to read below, did not figure on having to read it 3 times, and shall have to again, and ... well ... you read and reckon

I am in shock even as I figured on 2026 / 2032 and realise there is a lead-up and lead-into spanning a few years, but perhaps as we post, we are entering the front-edge of 'a few years', and I am unsure of how quickly to GetStillMoreGold

Do you see what I see? Do you see inflation in the West written all over this like I do? This crisis is not like anything we have seen since President Nixon took the U.S. dollar off gold in 1971 � the end of the era of commodity-based money. When this crisis (and war) is over, the U.S. dollar should be much weaker and, on the flipside, the renminbi much stronger, backed by a basket of commodities. From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with un-hedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities).

zerohedge.com

Wall Street Stunned By Zoltan Pozsar's Latest Prediction Of What Comes Next

More than a week ago, when looking at the latest price dynamics in the commodity sector in general and oil in particular, where Russian-produced oil was suddenly toxic and could not find a willing buyer anywhere in the Western world despite record discounts while non-Russian oil hit the highest price since 2008, we summarized this dynamic as "Russian oil bidless, non-Russian oil offerless"

One day later, one of Wall Street's most respected voices, Credit Suisse repo guru (formerly the NY Fed's most erudite expert on market plumbing) Zoltan Pozsar took this analogy and extended it into a lengthy explanation why the disconnect in the commodity world between "Russian" commodities (and as a reminder Russia is one of the world's biggest exporters of raw commodities) and "non-Russian" commodities has set the stage for a "classic liquidity crisis" as the world suddenly finds itself locked out of trillions in commodities that serve as collateral in subsequent monetary transformations which are critical in keeping the existing financial system well-oiled (so to speak) and whose absence could lead to unprecedented shocks across virtually all asset classes (that is a rough summary, for a much more detailed explanation see here) .

But while that particular note was absorbed by Wall Street relatively painlessly - after all Pozsar is best known for peering behind the dark corners of Wall Street's complexities and serving as one of the most accurate predictors of both known and unknown unknowns - his latest note has sparked a shockwave not only across the financial realm but also the political.

Why? Because in it he writes that what we are witnessing in the geopolitical, the commodity and the financial arenas is nothing short of a new financial and monetary system: a Bretton Woods III.

However, while many have been predicting the birth of a new monetary system in the past decade, it is the nuances of Zoltan's vision of the monetary future that is especially troubling: as he puts it "we are witnessing the birth of Bretton Woods III � a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West."

For those who have missed our recent posts revealing Pozsar's recent post-Ukraine war views ( here and here), a brief summary from the man himself:

A crisis is unfolding. A crisis of commodities. Commodities are collateral, and collateral is money, and this crisis is about the rising allure of outside money over inside money. Bretton Woods II was built on inside money, and its foundations crumbled a week ago when the G7 seized Russia�s FX reserves& The beautiful paradox of linear rates (the stuff you trade and I write about) is that you need to think linear to find relative value most of the time, but you have to think non-linear to recognize and survive regime shifts.

In other words, we are now seeing "a regime shift unfold in funding markets currently (which, as always, will pass), and a sea change in inflation dynamics and FX reserve management practices."

For those pressed for time, what Zoltan is effectively saying is that the legacy, Western monetary system based on fiat currencies (and a US dollar reserve) is about to end in an inflationary supernova, and will be replaced with a metallic monetary system, one using commodity-based currencies as a payment method (however, not quite a gold standard), and one where China and the yuan will become the world's most important sovereign and currency, respectively.

Incidentally, this is something we predicted back in April 2009, so you can see why so many were shocked to hear one of the most respected people on Wall Street echoing this shocking prediction.

* * *

At this point, we urge those pressed for time or those familiar with Pozsar's "commodity as collateral" view to jump to the conclusion where the punchline is, as what follows next is a trek through Zoltan's (at times confusing) stream of consciousness. For everyone else, please read on.

Pozsar starts off by advising readers of his two highest "convictions" at this moment: one deals with a topic he is very well versed in, and one in which as he admits, he is an amateur. Both are fascinating:

We have two convictions today. First, June FRA-OIS spreads can widen more, to at least 50 bps, both due to funding premiums driven by commodity prices and the market taking out Fed hikes Second, it�s a good time to get long shipping freight rates. Yes, freight rates, which, at the current juncture are linked to �geo-monetary� dynamics.

Ok, FRA-OIS we get: as the liquidity crisis gets worse, FRA-OIS will spike as it always does when there is a shortage of liquidity or collateral (we have the latter, we will soon have the former). But why freight rates? Well, according to the former NY Fed staffer, freight rates "are the price of balance sheet for �commodity RV traders� (the commodity trading houses) and for sovereigns that can take the risk of moving and storing subprime, sanctioned commodities."

More on that in a second, but first, let's discuss his views on funding.

As Pozsar writes, since the start of the conflict in Ukraine, spot U.S. dollar Libor, FRA-OIS, and FX swaps have been showing signs of stress. Not much, but as Zoltan says, he is hearing two things from funding desks: "cash is bid, and term cash is hard to come by." Normally, where o/n points trade in the FX swap market determines how the rest of the curve trades (low premia in o/n space mean low premia in term space). But these aren�t normal times. We have a crisis of sorts unfolding, and in a crisis, like in 2008, everyone lends at short maturities and the collapse in o/n premia is at the expense of term premia � in a crisis, term funding premia increase on the back of compressed o/n premia, as opposed to decline as they normally would."

Assuming there is indeed a "bid for cash", who is driving said bid? In other words, whose bid is driving term funding premia in this environment where lenders are less willing to lend cash for longer tenors? Accorsing to Pozsar, the answer goes back to the bidless/offerless commodity divergence noted at the top: it's the commodities world that is suddenly starved for liquidity, for three reasons.

First, non-Russian commodities are more expensive due to the sanctions-driven supply shock that basically took Russian commodities �offline�. If you are a (leveraged) commodities trader, you need to borrow more from banks to buy commodities to move and sell them.

Second, if you are long non-Russian commodities and short the related futures, you are likely having margin calls that need to be funded (just ask Tsingshan Holding Group and its biggest nickel short counterparty, JPMorgan). According to Pozsar, right now everyone in the commodities world is experiencing a perfect storm as correlations suddenly shot to 1, which is never a good thing. But that�s precisely what happens when the West sanctions the single-largest commodity producer of the world, which sells virtually everything. As a result, the Hungarian warns that "what we are seeing at the 50-year anniversary of the 1973 OPEC supply shock is something similar but substantially worse � the 2022 Russia supply shock, which isn�t driven by the supplier but the consumer." In other words, it is the eagerness of western commodity merchants to self-sanction so they do not offend the delicate sensitivities of an entire generation of snowflakes by doing trade with Russia, that will lead to the biggest financial crisis in modern history, far worse than Lehman ever was.

Third, if you are short Russian commodities and long the related futures, then you are likely having margin calls too that also need to be funded like above.

Shifting to the immediate implications from these three points, Pozsar notes that tes, the aggressor in the geopolitical arena - Russia - is being punished by sanctions, as Putin's economy is about to suffer a historic collapse, but as Zoltan warns sanctions-driven commodity price moves threaten financial stability in the West, to wit "Is there enough collateral for margin? Is there enough credit for margin? What happens to commodities futures exchanges if players fail? Are CCPs bulletproof?"

These questions are absolutely critical, and yet as the repo guru admits, he hasn't seen anyone address these topics: "Is the OTC commodity derivatives market the gorilla in the room" Zoltan asks, adding that "the commodities market is much more financialized and leveraged today than it was during the 1973 OPEC supply crisis, and today�s Russian supply crisis is much bigger, much more broad-based, and much more correlated. It�s scarier." To this we sould just add that America's problem with hyperfinancialization of both commodities and the broader economy is something we have warned about since 2014 (see " The Oil-Drenched Black Swan: The Financialization of Oil") so we are delighted that one of the smartest people on Wall Street finally admits what the true elephant in the room, or black swan as the case may be, truly is.

Another way of putting this: the value of US financial assets is more than 6x greater than the value of US GDP.

Think this is sustainable in a world where financial linkages and repo chains are suddenly broken? Think again.

Going back to Pozsar's take, he warns that the higher non-Russian commodity prices get (or as we put it, the more "offerless" they become) and the lower Russian commodity prices fall (or the more "bidless" they turn), the wider FRA-OIS will get, and if you want to express all this in the credit space, look at what CDS spreads on some bigger commodity traders have done in the past few weeks.

With that in mind, let�s move on to the heart of Zoltan's argument focusing on freight rates... and Bretton Woods III.

As Zoltan says next, regular readers of his publication are aware of Perry Mehrling, who happens to be his "Keynes" and father of the money view. As Perry Mehrling taught Pozsar, money has four prices:

Par � which is the price of different types of money and which means that cash, deposits, and money fund shares should always trade 1:1.

Interest � which is the price of future money and which refers to OIS and spreads around OIS across all possible money market segments.

Exchange rate � the price of foreign money, i.e. U.S. dollars vs. the rest.

Price level � which is the price of commodities (all of the Russian, non-Russian stuff) and, via commodities, the price of everything else.

Pozsar next asks readers to recall his previous note, when he looked at the parallels between the currently unfolding crisis and the crises of 1997, 1998, 2008, and 2020, and the conclusions that he drew from the review of these crises: these were that every crisis occurs at the intersection of funding and collateral markets and that, in the presently unfolding crisis, commodities are collateral, and more precisely, that Russian commodities are like subprime collateral and all other stuff is prime (or, as we put it even before Pozsar, bidless and offerless).

So going back to the four prices of money and how they link up with these themes:

Par � this is what broke in 2008 when money funds broke the buck and funding markets froze from fearing subprime mortgage collateral.

Interest � this is what broke in 2020 when bond RV trades crashed as the drawdown of credit lines pulled funding away from good collateral.

Exchange rate � this is what broke in 1997 when collateral (FX reserves) went missing and U.S. dollar funding staged a sudden stop in Asia.

Price level � this is what�s in play as we speak&Here Pozsar notes ominously that "if you see the pattern I see, you should be concerned."

Why? Because until now, commodities used to trade at tight spreads without dislocations based on provenance. There was one global market across all commodities that the large commodities traders arbitraged, much like a bond RV hedge funds arbitrage the cash-futures basis. Mortgages were like that too before 2008 � public or private, prime or subprime, they all traded at par... until they didn�t.

Well, just like money markets and mortgages after Lehman collapsed, commodities no longer trade at par.

Going back to the point we first made on March 3, there are Russian commodities that are collapsing in price and there are non-Russian commodities that are rallying, a rally which is due to the 2022 Russia supply shock which, once again, is driven by present and future sanctions-related stigma.

In other words, it�s a buyers� strike, not a seller�s strike: Russian commodities today are like subprime CDOs were in 2008. Conversely, non-Russian commodities are like U.S. Treasury securities were back in 2008. One collapsing in price, and the other one surging in price, with margin calls on both regardless of which side you are on, and as a result, the �commodities basis� is soaring, while commodity correlations are also at 1, which, Zoltan stresses, "is never a good thing."

Going back to his previous observations from the 1997, 2008, and 2020 crises, we also learned that every crisis is about the core vs. the periphery (large New York banks refusing to roll U.S. dollar funding in Southeast Asia in 1997; secured funding against subprime collateral to SIVs, Bear Stearns, and Lehman Brothers in 2008; and secured funding against good collateral to RV hedge funds during 2020). And from these crises we also learned that someone, somehow must always provide a backstop � or as Perry Mehrling would say, an �outside spread� (the IMF in Southeast Asia in 1997 in exchange for Washington consensus-type structural reforms; the Fed backstopping the shadow banking system with a range of facilities in 2008 in exchange for Basel III; and the again Fed backstopping RV funds with QE and the SRF in March 2020, in exchange for �we don�t yet know what,� but history says there will be a price).

Which brings us back to today � the present � and shipping freight rates.

If Pozsar are right, and if this is a �crisis of commodities� � a 2008 of sorts thematically, if not in terms of size or severity � who will provide the backstop? Well, this is where Pozsar really crosses over into tinfoil hat territory (i.e., agrees with this website), because he sees just only one entity that can backstop the world against the escalating crisis: the PBoC!

Conclusion

Having laid out the unique nature of the "commodity-as-collateral" crisis that is sweeping the globe, has sent the price of oil soaring, the price of stocks tumbling, and halted the price of nickel until the LME finds a way to bail out a Chinese tycoon without angering Beijing, and why unlike typical "financial" crises the Fed is powerless to assist in what is a "hard-commodity" crisis, Pozsar next moves to the punchline of his argument - that we are shifting from a western-dominated, or financialized monetary world, to an eastern-dominated, or commoditized monetary world.

According to Zoltan, at the heart of the problem is that Western central banks cannot close the gaping �commodities basis� because their respective sovereigns are the ones driving the sanctions. They will have to deal with the inflationary impacts of the �commodities basis� and try to cool them with rate hikes (which will send economies spiraling into recession, and stock markets simply spiraling), "but they will not be able to provide the outside spreads and won�t be able to provide balance sheet to close �Russia-non-Russia� spreads."

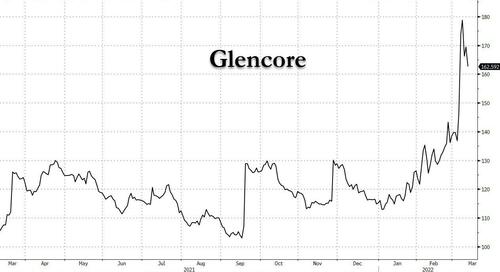

And commodity traders won�t be able to either. Consider Glencore, whose CDS we show above has spiked sharply higher, and which rose from the ashes of Marc Rich + Co, and with Switzerland along with the sanctions, otherwise neutral Swiss-based commodity traders will think twice about arbitraging the spreads.

But one entity can step in: the Chinese central bank.

The PBoC can as it banks for a sovereign who can dance to its own tune, according to Zoltan who notes that to make things more complicated, China is probably thinking deep and hard about the value of the "inside money" claims (or those claims which are dependent on counterparties recognizing them, as opposed to gold which is standalone, "outside money") in its FX reserves, now that the G7 seized Russia�s.

As such, the PBoC has two �geo-strategic� = �geo-financial� options:

Sell Treasuries to fund the leasing and filling of vessels to clean up subprime Russian commodities. That would hurt long-term Treasury yields and stabilize the commodities basis and would give the PBoC control over inflation in China, while the West would suffer commodity shortages, a recession, and higher yields. Needless to say, "that can�t be good for long-term Treasury yields" as Pozsar notes (at least until the Fed launches mega QE).

The PBoC�s second option is to do its own version of QE � printing renminbi to buy Russian commodities. If so, that�s the death of the Petrodollar and birth of what Pozsar calls the Eurorenminbi market, and China�s first real step to break the hegemony of the Eurodollar market. That is also inflationary for the West and means less demand for long-term Treasuries. That also isn't good for long-term Treasury yields either.So going back to the beginning, Pozsar's idea of going long shipping freight rates is simple: the price the PBoC will be paying to lease ships to fill them up with Russian commodities can in theory rise as much as the collapse in the price of Russian commodities: a lot. Renting boats is like renting balance sheet at a dealer to fund inventory, according to the Credit Suisse strategist, and if China does not have enough storage capacity on the mainland, "it will store Russian commodities on vessels floating on the seas, encumbering not balance sheet (the PBoC is funding all this by printing money) but shipping capacity, which, for the rest of the world, will also be inflationary." Even more inflation.

At this point Zoltan takes a slight detour to mock all those politicians and pundits who believe that the West can easily crush Russia's economy and society without any material consequences, writing that "if you believe that the West can craft sanctions that maximize pain for Russia while minimizing financial stability risks and price stability risks in the West, you could also believe in unicorns." Or, as he also puts it, "what G-SIBs are for financial stability Glencore is for price stability."

In this instance, unlike 2008, price instability of commodities (via surging and collapsing prices) feeds financial instability: Pozsar notes that "margin calls may trigger the failure of some smaller commodity traders and maybe even some CCPs � the commodity exchanges" which is remarkable because he wrote all of this before we learned that the LME itself may be at risk unless it figures out a way to bail out Tsingshan Holding (and make JPMorgan whole).

And while the Fed and other central banks will be able to provide liquidity backstops, which will send stocks and cryptos soaring briefly higher, those will be Band-Aid solutions because in this case, the real problem is not liquidity per se.

The real problem, according to one of the smartest people on Wall Street who was never consulted before politicians decided to exclude Russia and its commodity exports from the rest of the Western world, is that in this case "liquidity is just a manifestation of a larger problem, which is the Russian-non-Russian commodities basis, which only China will be able to close."

We will let you read Zoltan's concluding tour de force without interjecting because it is pure financial poetry in action:

Do you see what I see? Do you see inflation in the West written all over this like I do? This crisis is not like anything we have seen since President Nixon took the U.S. dollar off gold in 1971 � the end of the era of commodity-based money. When this crisis (and war) is over, the U.S. dollar should be much weaker and, on the flipside, the renminbi much stronger, backed by a basket of commodities. From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with un-hedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities).

Yes, the "tinfoil hat" theory we first presented over a decade ago... just through the writing of the man who helped the Fed survive the 2008 financial crisis with his unprecedented insights into how the financial plumbing of the financial system was clogged up. As for how to trade it:

After this war is over, �money� will never be the same again&and Bitcoin (if it still exists then) will probably benefit from all this.

All we would add here is that besides a "call option" on future money via bitcoin - which may or may not exist - one should also hedge with the one asset that will certainly benefit from all this - the same asset that has always benefited from human crises over the past three thousands years: gold.

* * *

Earlier we said that Zoltan's forecast sparked shock and revulsion across Wall Street, or at least those handful of people who actually read his full note (available to pro subscribers in the usual place). While most who opined were too confused to even grasp what Pozsar was talking about, one of the more credible criticisms came from Rabobank's Michael Every (who to our surprise refuses to view recent events in the world through the lens of Realpolitik when assessing the proximal causes and consequences of the war in Ukraine), and in one of his latest Global Daily notes writes the following:

At this point, one must surely notice that a new �Berlin Wall� is going up. (I wish I had not lost the piece I chiselled out of the old one.) The issue is that this time the economies on the other side of it have vast amounts of both physical commodities that we need, and the manufacturing supply chains we also need. The shock and pain of this decoupling, which both sides are driving, is therefore only just beginning to be felt. As regular readers will know, this is hardly new territory for us. Indeed, we have done a lot of past work looking at who wins and loses in these kinds of scenarios.

Without naming the Credit Suisse strategist directly, Every then proceeds to deconstruct Pozsar's theory presented above:

One much newer view doing the rounds this week has been that �China is a big winner because it will sell its holdings of US Treasuries, forcing US yields higher, and then buy Russia commodities, setting itself up as an alternative to the US dollar globally�. Really? No. There are the usual, sound arguments of a closed capital account, no rule of law, and no trusted, deep pool of financial assets. But that overlooks more fundamental problems for China. Let�s imagine Beijing sells all its Treasuries. That makes sense now Russia shows that if China misbehaves geopolitically then its FX reserves can be �turned off�. But China will sell its Treasuries to whom, and at what price, and what cost to itself? Maybe the PBOC takes the hit and monetizes the loss. But in these hyper-political times, the Fed would notice this happening and step in to buy the US debt with QE, keeping US yields low. China would then get (more) printed money for all the goods it has sold the US rather than (low) interest-yielding US debt. So, China would still have US dollars. It would have to use those dollars to buy the Russian commodities that will apparently back CNY. Except Russia doesn�t want dollars because it can�t use them. So China would have to sell them to someone else for RUB � which is not possible either because of the scale involved and the risk of sanctions.

What Every fails to comprehend here is precisely the point that Pozsar made about how central banks are now unable to intermediate in this crisis - sure, the Fed can do QE in response, and we noted as much above, but that does nothing to mitigate the fact that between China and Russia, not to mention assorted ideological hangers on like Brazil, India and Saudi Arabia, the western world will suddenly find itself with all the "reserve" currencies in the world... and zero commodities. How long can Western dominance persist in such a world when the population runs out of food, gas, heat and electricity in a few months. And another question Every didn't ask: what if it is precisely the intention of Russia (and China, and India, and others) to explicitly challenge both the reserve status of the dollar and US supremacy in the world, sensing just how weak the superpower is under the Biden regime. But we digress - Every continues:

Let�s assume China buys Russian commodities somehow: how does this �back CNY�? China is massively SHORT all commodities due to its geography and demography. Its backing for CNY, which *is* strong, comes from manufactured goods, not commodities. Is it going to put $1 trillion of grain, which rots, or oil or nickel or palladium, which it needs to use daily, into a vault as an anchor for the currency, like a gold standard? If so, consider gold standards need tight monetary and fiscal policy while China has expanded its debt and broad money supply to war-economy dimensions already: the IMF says it ran an augmented fiscal deficit of -19.9% of GDP in 2020. How is this dynamic stable? Only with the capital controls to stop that debt/money flooding out that mean CNY cannot be a true global reserve currency like the US dollar. If China takes a big stake in Russian commodity exporters, the latter will want to be paid in RUB unless Russia is prepared to become a de facto empire of resources for it to extract. (Trust me, Russians know this � and the move risks Western secondary sanctions, as we have flagged.) If Russia accepts CNY, China still faces the problem of what it does with the exports it builds with them � because it sells those goods to the rest of the world for US dollars or Euros! The only way not to do that is to sell less to the US and Europe � which may now happen more quickly than some expect, if not imminently, if the West sees China as supporting Russia. In other words, Russia switches from Western to Chinese technology supply chains � and the West decouples from China as a result. That would undermine the Chinese trade surplus which also keeps its currency stable. That is, unless China can find a new set of major importers willing to buy in CNY and run vast trade deficits with it: that used to be called an empire. Or China could consume more locally so it doesn�t need to export so much to others. Yet that involves changing its entire political economy towards more private sector and private consumption, and less state sector and mercantilism. Regrettably, it seems far easier for China to try to change the global economy than to do that, because it also undermines the Chinese trade surplus and political control of the key levers of the economy.

While these are valid observations, one thing Every does is take his thought experiment to its very end (by that "logic" the US, which even the CBO predicts will have 200%+ debt/GDP in a few decades, is on its way to oblivion). What if China didn't think that far, but merely thought in increments: both Putin and Xi have visions of empire, and both are near the ends of their lives. They sense that the US is weak now and the time to strike is also now. Yes, shifting a global reserve status to the yuan would lead to transformational changes in the global economy but they would not be terminal. While the US would no longer be able to monetize its debt infinitely if the USD was no longer the reserve currency (without sparking hyperinflation that is), it would still be a viable client for Chinese exports. As for who China would co-exist with in this brave new world, again there is India, Latin America, the Gulf nations, oh and Africa, which China quietly colonized with debt over the past decade. With all due respect to Michael, it would appears that it is the western world that is far more dependent on what everyone else makes, than vice versa... unless the pinnacle of Chinese ambition is to also have a hyperfinancialized system where the artificially inflated value of all assets is 6x greater than GDP.

Finally, one place where Every is wrong is his assumption that China is "massively short" all commodities. Here we will counter with what Marko Kolanovic said on February 22 in his "J.P.Morgan View" weekly. While lately we have disagreed with much of what Marko has to say, we agree wholeheartedly with the below:

The world is short Commodities. China is not. Global tradeable commodity inventories have contracted sharply over the past six months, declining in aggregate by 25% from 64 days of consumption at the peak in April 2020 to 48 today, a five year low. This drove the BCOM up 85% during the same period, to a multi-year high. While tradeable commodity stocks are critically low, it is important to acknowledge the abundance of available inventories in leading commodity consumer and importer China, to draw upon as required, which can influence import demand. China currently holds an estimated 84% of global copper, 70% of corn, 51% of wheat, 40% of soybeans, 26% of crude oil and 22% of aluminum inventories, according to our sources.

There is just one way that China can maintain its commodity addiction and that is to transform its financial system to one where continued purchases from Russia are even more streamlined. And it will, it's just a matter of time.

Or maybe we are just overthinking it, because someone far more pragmatic would look at the inventory stockpiling above and simply ask: is China preparing for war?

Zoltan's latest note is available to pro subscribers. |