All ‘things’ considered, perhaps commodities are not money but better than money, and should such be so, and there is room for doubt, than it might follow that gold commodity money is the best money

Let’s watch some more and study

bloomberg.com

Mocked as ‘Rubble’ by Biden, Russia’s Ruble Comes Roaring Back

Currency recovers to pre-war levels even as sanctions pile up Foreign oil and gas buyers offer Putin’s government a lifeline

Sydney Maki

April 7, 2022, 3:36 AM GMT+8

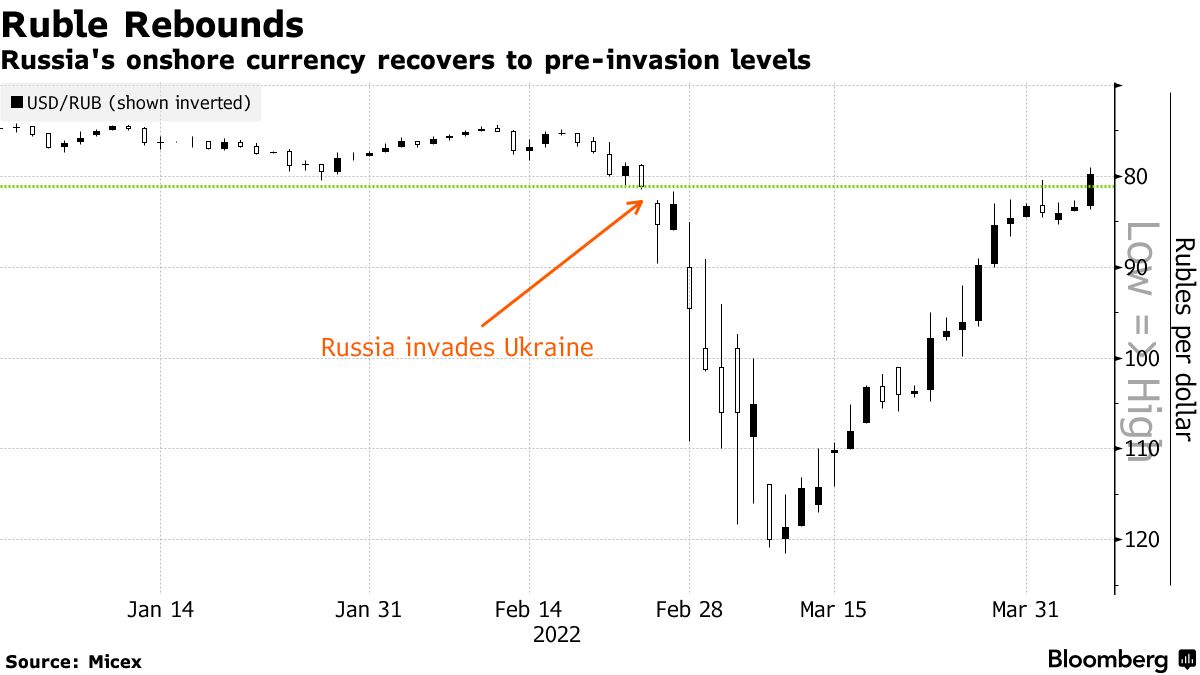

In the days after the Ukraine war began, the ruble’s collapse was a potent symbol of Russia’s newfound financial isolation.

International sanctions on Vladimir Putin’s regime sank it to a record low of 121.5 rubles per dollar, triggering memories of the battering it took during the 1998 Russian financial crisis.

Things looked dire enough that U.S. President Joe Biden said the ruble had been reduced to “ rubble.”

Now, though, it sure hasn’t. The ruble has surged all the way back to where it was before Putin invaded Ukraine, closing at 79.7 in Moscow on Wednesday.

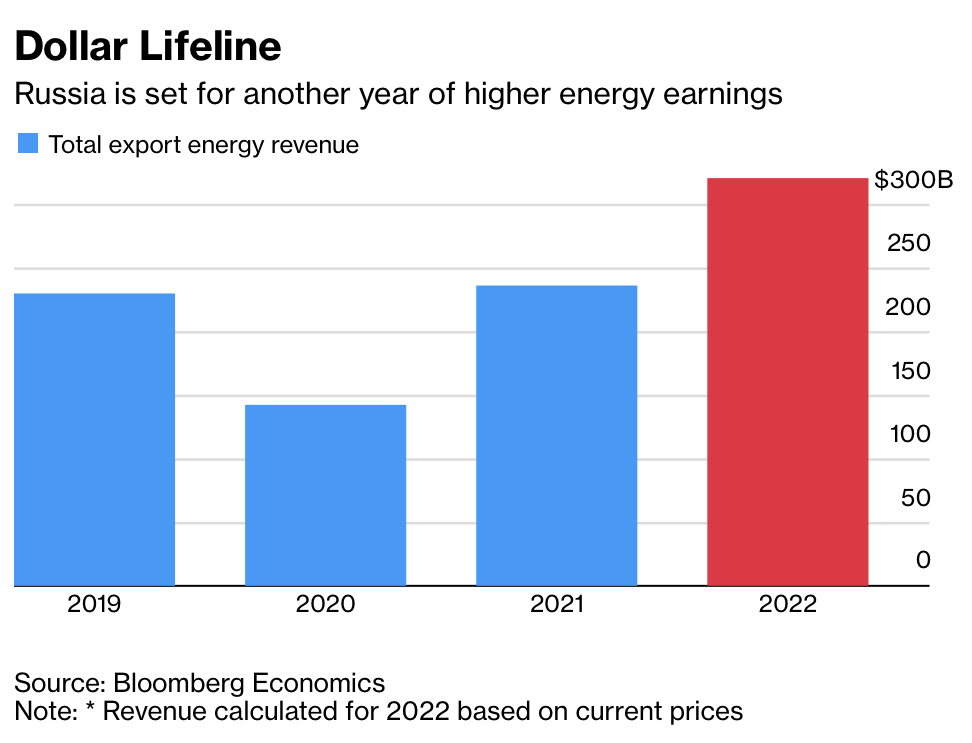

What’s become clear is that despite an incredibly wide-ranging package of sanctions on the Russian government and its oligarchs, and an exodus of foreign businesses, the actions are largely toothless if foreigners keep guzzling Russian oil and natural gas -- supporting the ruble by stocking Putin’s coffers.

Even as Russia remains mostly cut off otherwise from the global economy, Bloomberg Economics expects the country will earn nearly $321 billionfrom energy exports this year, up more than a third from 2021.

The rapid ruble recovery gives Putin a major victory back in Russia, where many people fixate on the currency’s ups and downs, even as his military gets bogged down in Ukraine and outrage mounts across the globe over atrocities it’s committed.

“For the politicians, it is a good PR tool by saying that sanctions don’t have any impact. And it will help to limit the inflation impact,” said Guillaume Tresca, a senior emerging-market strategist at Generali Insurance Asset Management.

In Russia’s post-Soviet history, the ruble-dollar exchange rate has arguably been the economic indicator Russians care most about. The rate was broadcast by the exchange kiosks that sprung up in every town and city, flagging the currency’s collapse as hyperinflation erupted in the early 1990s. The ruble dived again after Russia defaulted in 1998.

Once that chaos subsided, the government lopped off three zeros. Then during the 2008 crisis, the authorities burned through billions of dollars to slow the currency’s slide, in part to avoid spooking the population and sparking a run on the nation’s banks. Governor Elvira Nabiullina decided to risk that in 2014 when sanctions over the Crimea annexation and slumping oil prompted her to switch the currency to a free float.

In response to this year’s sanctions, Russia has enacted capital controls that also appear to be supporting the ruble. That includes freezing the assets held by nonresident investors, and telling Russian companies to convert 80% of the foreign currencies they hold into rubles.

This has some observers doubting the significance of the ruble’s recovery to pre-invasion levels -- which is also happening amid the lightest trading volume in a decade. “It is not a free-floating currency given all the measures imposed by the authorities,” Tresca said. U.S. Treasury Secretary Janet Yellen said basically the same thing Wednesday when testifying before Congress, warning against drawing deeper messages about sanctions from the ruble’s rebound.

Still, it’s hard to ignore the lifeline other nations are tossing Putin by purchasing his country’s oil and gas. Doing so gives Russia a current-account surplus -- economics jargon for exporting more than you import, which tends to lift a the country’s currency -- and undermines the attempt to pummel Russia with sanctions.

“A current-account surplus should actually be another source of stability for the ruble,” said Brendan McKenna, a strategist at Wells Fargo Securities LLC. “If energy prices remain high and major importers of Russian energy and commodities continue to purchase, the current account should stay in surplus.” He says the ruble could hit 78 per dollar, partly because of Putin’s counter-sanctions.

Dollar LifelineRussia is set for another year of higher energy earnings

Source: Bloomberg Economics

Note: * Revenue calculated for 2022 based on current prices

Read: Tracking the Sanctions Imposed on Russia Over Ukraine Invasion

Russia has been able to stabilize local markets and even stave off a messy foreign default -- at least for now. This means that if the coalition of governments who oppose Putin want to hurt the ruble again, they’ll likely have to change tack. Just this week, the U.S. Treasury barred dollar debt payments from Russian accounts at U.S. banks, an attempt to make Russia drain its domestic dollar reserves or default.

“As Russia’s economy and financial sector adapt to a new equilibrium of capital controls, managed prices, and economic autarky, it is not surprising that some of the domestic markets stabilize,” said Elina Ribakova and Benjamin Hilgenstock, economists at the Institute of International Finance. “Sanctions have become a moving target and will require adjustments over time to remain effective.”

They pointed to the likelihood of more tightening of financial sanctions, perhaps even disconnecting additional Russian institutions from SWIFT, the communications system banks use to move money around the world.

Putin has been forced to change his war strategy in Ukraine, shifting troops away from Kyiv after failing to conquer the capital. Research firm Tellimer Ltd. is warning against trusting market rallies amid negotiations to potentially end the war in Ukraine.

“Don’t buy the peace rallies,” said Paul Domjan, a senior contributing analyst at Tellimer. “Investors should be very cautious about market rallies following news about peace talks. There will be plenty of false dawns as the world valiantly seeks to end this war.”

— With assistance by Srinivasan Sivabalan

Sent from my iPad |