The World Braces For Europe's July 22 "Doomsday"

"There simply is no substitute available for Russian gas."

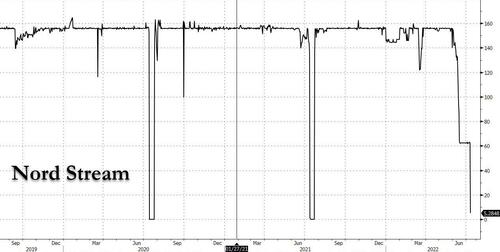

Two weeks ago, when previewing the scheduled 10-day shutdown of the Nord Stream 1 pipeline - which supplies the bulk of European nat gas usage courtesy of Russia - for maintenance, we quoted from DB FX strategist George Saravelos that if the gas shutoff is not resolved in coming weeks this would lead to a broadening out of energy disruption with material upfront effects on economic growth, and of course much higher inflation, or as he puts it, "beyond the market's worries about slower global growth in recent months, what is unfolding in Europe in recent days is a fresh big negative supply shock."

As such, DB's Jim Reid said that July 22, the day gas is supposed to come back online, could be the most important day of the year: "while we all spend most of our market time thinking about the Fed and a recession, I suspect what happens to Russian gas in H2 is potentially an even bigger story. Of course by July 22nd parts may have be found and the supply might start to normalize. Anyone who tells you they know what is going to happen here is guessing but as minimum it should be a huge focal point for everyone in markets."

Fast forward to today when, one day after the start of the scheduled 10-day shutdown period which has already sent flows through to NS 1 pipeline to basically zero...

[url=] [/url] [/url]

... and the market is now focusing on the worst case scenario: what happens if Russia cuts off all gas on July 22, the day even Bloomberg has now dubbed Europe's "doomsday scenario."

Here is a sample of what Wall Street expects to happen then: European stocks plunging 20%. Junk credit spreads widening past 2020 crisis levels. The euro sinking to just 90 cents, before a full-blown recession slams the world's 2nd biggest economy.

And all this power in the palm of Putin's hand, almost as if he knew precisely how much leverage he had back in February while Europe was - as always - completely clueless.

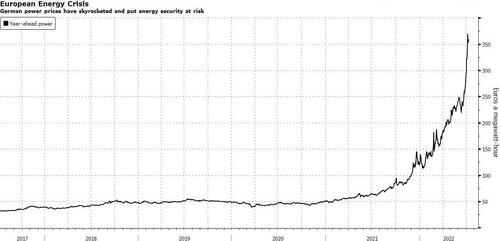

So to help Europe's braindead bureaucrats, where energy policies have been dictated by a petulant Scandianvian teenager and a bunch of German "greens", strategists across Wall Street have tried to put numbers on a scenario that would be unthinkable in normal times. The caveat of course is that there are so many variables, such as the length of any shutdown, the extent of supply cuts, and how far countries would go to ration energy, that anyone’s prediction is a guess at best. Even so, the scenarios are catastrophic.

[url=] [/url] [/url]

“The big unknown is how the shock that starts in Germany, Poland and other central European countries will reverberate throughout the rest of Europe and the world,” said Joachim Klement, head of strategy at Liberum Capital. “There simply is no substitute available for Russian gas.”

In an analysis this week (available to pro subscribers), UBS economists laid out a detailed vision of what they see happening if Russia halts gas deliveries to Europe: It would reduce corporate earnings by more than 15%. The market selloff would exceed 20% in the Stoxx 600 and the euro would drop to 90 cents. The rush for safe assets would drive benchmark German bund yields to 0%, they wrote.

“We stress that these projections should be seen as rough approximations and by no means as a worse-case scenario,” wrote Arend Kapteyn, chief economist at UBS. “We could easily conceive economic disruptions that lead to more negative growth outcomes.”

To be sure, markets are already pricing in some of the damage starting with the euro which today traded at a fresh two-decade low and briefly touched parity with the dollar, something it hasn't done since 2002.

[url=] [/url] [/url]

Meanwhile, German stocks have lost 11% since June. German gas giant Uniper SE is the biggest corporate casualty, with the stock plunging 80% this year as it seeks a government bailout.

To be sure, even though French and German leaders are warning populations to "prepare for total cut-off of Russian gas", many investors still believe there’s reason to believe Russia will turn gas supply back on when maintenance on the Nord Stream 1 pipeline ends on July 21. But, as UBS points out, if European countries start voluntary gas rationing to fill up on storage, the hit to economic growth will be severe.

“Europe is currently being caught in a vicious circle,” said Charles-Henry Monchau, chief investment officer at Banque Syz. Higher energy prices are hurting Europe’s economy, driving the euro lower. In turn, the weaker euro makes energy imports even more expensive, he said.

The other worry is that the ECB will be unable to do much to help the economy - which is about to slide into a recession - with inflation already running at decade-highs, said Prashant Agarwal, a portfolio manager at Pictet Asset Management.

“I am not sure central bank tools work in this scenario,” he said. “In the past, they had leeway to address the situation because inflation was low.”

Courtesy of Bloomberg, here’s a round-up of other strategist views:

BNP Paribas SA

A full-blown gas disruption would drive the Euro Stoxx 50 to 2,800, about a 20% plunge from current levels, wrote strategists including Sam Lynton-Brown and Camille de Courcel.

They recommend hedges, such as high-quality companies and buying options skew on the European stock index. Auto, industrial and chemical industries will be under pressure, they wrote.

Nomura International Plc

Currency strategist Jordan Rochester has been urging clients to short the common currency since April. If Nord Stream 1 doesn’t resume operations, the euro may drop to 90 cents over the winter, he wrote.

“We believe Europe may fail to build up sufficient gas storage for the winter and this may lead to energy rationing,” he said. “If that’s not an economic crisis, what is?”

JPMorgan Chase & Co.

The moves in European corporate bond spreads would be bigger than the first wave of the Covid pandemic in 2020 if Russia shuts off gas supplies, according to strategists led by Matthew Bailey.

Spreads on high-grade debt may surge to 325 basis points, they wrote. For junk-rated bonds, the spread could widen to as much as 1,000 basis points.

Goldman Sachs Group Inc.

The euro is already reflecting a lot of the negativity, but the currency could fall another 5% if markets price in a full shutdown of Nord Stream 1, said strategists including Christian Mueller-Glissmann. They recommend a defensive allocation, with overweights on cash and commodities.

Bank of America Corp.

Former copper bull Bank of America also slashed its forecasts last week, warning that in a worst-case scenario where Europe experiences widespread gas shortages, prices could plunge to as low as $4,500 a ton. Copper sank 2% to $7,429 on Tuesday.

More available to pro subscribers in the usual place. |