Biden should just knock his king over and concede...

+++++

Saudis Double Russia Crude Imports As It Prepares For BRICS Inclusion

by Tyler Durden

Friday, Jul 15, 2022 - 07:05 AM

Saudi Arabia has a thirst for heavily discounted Russian diesel and other fuel products banned by many countries in the West.

The world's largest oil exporter more than doubled the amount of Russian fuel oil in the second quarter to supply power generation stations to meet surging cooling demand this summer and allow the kingdom's crude exports to increase.

Western sanctions forced Russia to discount fuel oils on spot markets, which has increased demand in the East, not just from the Saudis but also from China and India.

Energy trade data provided by Reuters shows Saudis imported 647,000 tons (48,000 barrels per day) of fuel oils from Russia in the second quarter -- up from 320,000 tons in the same quarter last year.

The surge in the Russia-Saudi energy trade (also detailed in "Middle East Ramps Up Imports Of Shunned Russian Fuels") comes as BRICS International Forum President Purnima Anand told Russian newspaper Izvestia that Saudis are planning to join. That would boost multilateral cooperation between BRICS, including Saudis, meaning they wouldn't cave to the US demands to restrict Russian energy imports.

[url=] [/url] [/url]

Meanwhile, the Biden administration has unleashed a barrage of financial sanctions against Russia to isolate it from the global trading system to reduce trading revenue -- all of which have backfired -- and allowed Moscow to reap record oil revenues.

President Biden will meet with Crown Prince Mohammed bin Salman (MbS) without Saudi King Salman on Friday (the same day Anand announced Saudis are preparing to apply for membership). It's expected that no public announcements on increasing oil supply will be made, according to Bloomberg sources.

Biden's meeting with MbS appears to be a waste of time and more for optics. The fundamental point behind the meeting to increase crude production won't transpire into anything meaningful. Biden needs to work on expanding the capacity of refined oil products, such as gasoline, diesel, and jet fuel, though much of that is out of his control and will take years.

The point is that Saudis need cheap Russian fuel oils and plan to join an expanding economic club that will distance themselves from Western countries and aligns them more with Russia and China. The rise of BRICS and the possible inclusion of Saudis would outline the US' waning control over the international order.

+++++

*Finland gets whacked*

German Energy Giant Warns Of Insolvency "Within Days", Starts Draining Gas From Storage

by Tyler Durden

Friday, Jul 15, 2022 - 06:30 AM

Dear Biden administration: for an example of a real emergency that justifies draining a commodity reserve - and not just midterm elections which Democrats will lose in a historic rout - read on.

German energy giant and distressed nat gas utility Uniper, which is among the companies most exposed to Russian natural gas, has started using gas it was storing for the winter after Russia cut deliveries to Europe, increasing pressure on Berlin as the German energy giant needs to be rescued “in a few days.”

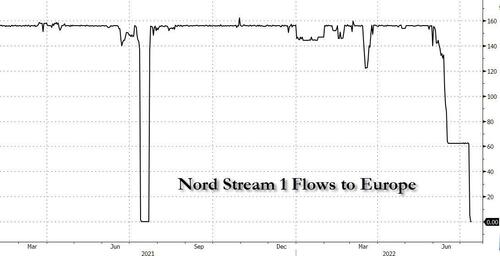

The country’s top buyer of Russian gas started withdrawing fuel from storage sites to supply its customers, the company said in a statement to Bloomberg on Friday. The drawdowns, which began on Monday, will also help the company to save some cash as it has been forced to pay up for gas in the spot market. Meanwhile, flows through the Nord Stream 1 pipeline remain shut for maintenance.

[url=] [/url] [/url]

Harald Seegatz, deputy chairman of the supervisory board, said that Uniper needs urgent help, risking insolvency within days.

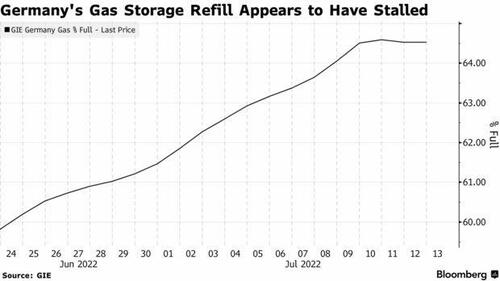

“We are currently reducing our own gas volumes in our storage facilities in order to supply our customers with gas and to secure Uniper’s liquidity,” the company said. And judging by the flatlining of German gas storage in inventory, Uniper is not alone in draining reserves.

[url=] [/url] [/url]

According to Bloomberg, citing data from Gas Infrastructure Europe, Uniper’s storage sites in Germany are now about 58% full, down from about 60% reached on Sunday. Drawdowns were also made from the company’s storage in Austria, but overall storage levels in Germany’s Alpine neighbor are still showing marginal increases.

As we reported previously, Uniper is majority owned by Finland’s Fortum Oyj, has already said it needs to be rescued by the German government, and it’s negotiating a possible stake and a cash boost. But talks have been difficult, with Berlin and Helsinki yet to agree on who to best rescue the company key for energy security.

Last month, Russia significantly cut gas flows to Europe via its biggest pipeline, a move that forced Uniper and other European energy companies to buy gas at much higher prices in the open market. Faced with a shortage of cash, Uniper has been tapping gas in inventories since the start of the week, according to Gas Infrastructure Europe.

“It is clear that Uniper cannot wait weeks, but needs help in a few days,” said Seegatz, adding that insolvency can happen “within days.”

“We cannot wait for weeks to do something,” Seegatz told Bloomberg in a phone interview. “That would have a huge impact on the company and also on the employees. The government said it wants to avoid this situation, but the fact is that we cannot lose time.”

In other words, Germany is facing a total industrial collapse; meanwhile, the media continues to repeat the increasingly more laughable propaganda that Putin is losing the war.

Uniper CEO Klaus-Dieter Maubach last Friday warned Uniper was not able to fill up storage anymore. He also said the company could be forced to raise prices for consumers and eventually reduce supply.

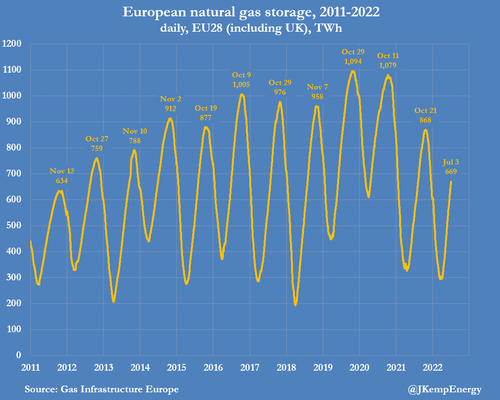

As we noted recently, European energy companies usually store gas in the summer and use the fuel during winter, when demand for heating surges. Tapping gas in storage sites in the middle of the summer increases the risk that Germany won’t have enough supplies when it needs it the most.

[url=] [/url] [/url]

It also makes it harder for the government to reach its target of filling storage sites by 90% by November. Germany has already triggered two stages of its gas emergency plan, and could enact the last step if there’s a clear deterioration in the supply picture. Such a move could force industries to ration gas, and lead to an immediate recession in both Germany and Europe, as well as pushing the euro deep below parity as the ECB would be unable to hike rates in such a dire economic situation. |