Following up Message 34068704

(1) Firstly, anniversary coming up jamestown.org

China’s 2027 Goal Marks the PLA’s Centennial, Not an Expedited Military Modernization Jamestown might be very wrong, for I have China China China and alt-China China China (a/k/a Republic of China) flipping cards down for 2028 Message 33729181 and Message 33814110

(2) Secondly, China, to be truly ready, just unload 3T (2T non-USD and 1T US$) of central bank reserves within 62 months. I am guessing readiness, once ready is a global common-good, ensuring conflicts do not breakout over minor and makeup and farcical fake news and non-issues, leaving only the real points, if any, to be haggled over

Given that the gold market is something like 13T US$, can certainly squeeze in a 3T injection of liquidity, but perhaps not avoiding weaponisation amongst the central bankers. Let us continue to follow the story. 300 tons of discrepancy within one quarter seems a lot.

<<Some unidentified purchases are to be expected, but an unspecified slice of "this magnitude is unheard of," said Koichiro Kamei, a financial and precious-metals analyst. Speculation is swirling over the unidentified buyers.>> ... ... <<China is not given they have started stockpiling commodities since 2019 and currently hold 80% of global copper inventories, 70% of corn, 51% of wheat, 46% of soybeans, 70% of crude oil, and over 20% of global aluminum inventories.">> ... ... <<Almost as if China is actively preparing for war>>

zerohedge.com

China Said To Be Mystery Buyer Stockpiling Gold To "Cut Dollar Dependence"

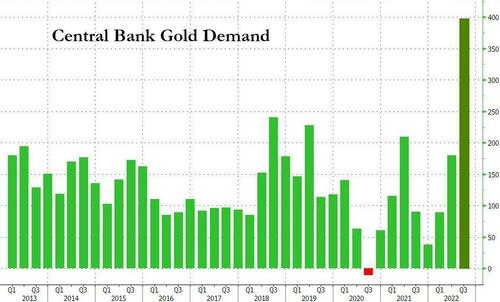

Two weeks ago we sparked a frenzy across precious metals circles when we reported that a mystery buyer had bought some 300 tons of gold, roughly three quarters of what would be a record 399 tons of central bank gold purchases in the third quarter.

[url=] [/url] [/url]

And while we clearly had one name as the most likely suspect behind the buying, it wasn't until a report today by Japan's Nikkei that said name emerged front and center.

According to the Nikkei, which paraphrases almost verbatim what we said, with central banks snapping up gold this year amid uncertainty which ones are behind most of that shopping spree, speculation has emerged that China is a big player. And citing analysts, the Nikkei then goes on to suggest that seeing how Russia has been hit by monetary sanctions by the West, "China and some other countries must be hurrying to reduce dependence on the dollar."

While regular readers already know the details ( which we laid out here), here again is the bigger picture: Central banks bought a net 399.3 tonnes of gold in the July-September period, more than quadrupling on the year, according to the November report by industry group the World Gold Council. The latest amount marks a steep jump from 186 tonnes in the preceding quarter and 87.7 tonnes in the first quarter, while the year-to-date total alone surpasses any full year since 1967.

Buyers such as the central banks of Turkey, Uzbekistan and India reported purchases of 31.2 tonnes, 26.1 tonnes and 17.5 tonnes, respectively. The problem, as we calculated at the start of the month, is that those amounts only add up to roughly 90 tonnes - "meaning it is unclear who bought the remaining roughly 300 tonnes net."

Only, it's not all that "unclear."

Some unidentified purchases are to be expected, but an unspecified slice of "this magnitude is unheard of," said Koichiro Kamei, a financial and precious-metals analyst. Speculation is swirling over the unidentified buyers. "Seeing how Russia's overseas assets were frozen after its invasion of Ukraine, anti-Western countries are eager to accumulate gold holdings on hand," said Emin Yurumazu, a Japan-based economist from Turkey."China likely bought a substantial amount of gold from Russia," said market analyst Itsuo Toshima.

Those familiar with China's gold buying patterns are all too aware that Beijing has made similar moves in the past. After keeping radio silent since 2009, Beijing shocked the market in 2015 when it disclosed it had boosted gold holdings by about 600 tonnes. It has not reported any activity since September 2019.

According to Toshima, the People's Bank of China likely bought a portion of the Central Bank of the Russian Federation's gold holdings of over 2,000 tonnes.

China's latest gold-buying frenzy comes at a time of rapid dedollarization by most non-western nations.

Central banks and government institutions have been accumulating gold reserves over the past 10 years or so, after the 2008 financial crisis eroded confidence in U.S. Treasury bonds and other dollar-denominated assets, sending them scrambling to diversify their portfolios. Emerging countries with low creditworthiness are also seeking to strengthen their reserves of gold, which has high liquidity and no sovereign risks.

Here, China has stood out by unloading substantial amounts of US bonds. It sold $121 billion in US debt , the equivalent of roughly 2,200 tonnes of gold, between the end of February -- immediately after Russia's first attack on Ukraine -- and the end of September, according to the latest TIC data.

Meanwhile, Chinese imports of gold from Russia surged in July, soaring more than eightfold on the month and roughly 50 times the year-earlier level, according to customs data.

"We think overall central banks will remain net buyers" of gold, "given its performance in recent years" and its nature of not being "another nation's liability," said Nikos Kavalis, managing director at precious- metals consultancy Metals Focus. Actually it's not just "another nation's" liability: being remote of the global fiat system, gold not only does not have any counterparty risk, it is an asset without also being a liability at the same time (as long as the physical gold is in your possession of course).

One final paradox: central banks generally do not unload their gold holdings in the market, meaning the more they buy the precious metal, the stronger support this will give its price. And yet, gold has been down markedly in 2022 which suggests that the disconnect between accumulation of physical and manipulation and shorting of paper gold is about to reach a breaking point after which a parabolic move higher in the yellow metal can not be discounted.

One final note: back in March we pointed out that according to JPMorgan, "while the world is short on commodities, China is not given they have started stockpiling commodities since 2019 and currently hold 80% of global copper inventories, 70% of corn, 51% of wheat, 46% of soybeans, 70% of crude oil, and over 20% of global aluminum inventories." And now, China is aggressively stockpiling every ounce of physical gold it can get its hands on.

Almost as if China is actively preparing for war. |