Read the entire article and the link included and get back to me.

youtube.com

+++

Disney's liquidity crisis: Must buy Hulu in early 2024, but may not have enough cash

by Rebel Capitalist

Wednesday, Jun 07, 2023 - 5:15

I’ve been planning to write a follow up to my last Disney article. But yikes, so much more has happened since. And every time I start writing, more dismal Disney news drops.

There is just too much to cover, and the title of the article is what I really, so I’ll sum up so I can move on.

Sum Up- Activist investor Nelson Peltz entered a proxy fight with Disney.

- Rumors are that Bob Chapek was ousted by Bob Iger because Chapek was going to give Peltz the board seat Peltz wanted, and Iger’s circle was adamentally opposed to this.

- Because Peltz was denied the board seat behind the scenes, he took it directly to the shareholders via a proxy fight, outlining the problems of Disney and his proposals in a 35 page slide presentation entitled “Restore the Magic”.

- Peltz has since withdrawn his proxy fight, but it is believed he got concessions behind the scenes, such as the public announcement that Disney will reinstate the dividend by the end of calendar year 2023.

- Reedy Creek Improvement District dissolution was passed by the Florida legislature and signed by Governor Ron DeSantis:

- In 1967, the state of Florida granted special, unprecidented, wide ranging powers ( such as build their own nuclear power plants) known as the Reedy Creek Improvement Act, with expectation that Mr. Walt Disney was going to build a real city. That city was never created, but the powers were never revoked, which gave the Disney company unequal advantages that none of their competitors have (such as Universal).

- Disney injected themselves into Florida politics over Florida’s HB 1557 Parental Rights in Education Act. This energized the legislature into questioning why unprecidented special district powers were ever granted to Disney or any company in the first place.

- While Chapek was in charge, there were some rumors Chapek was trying to smooth things out behind the scenes and lay low to let the whole thing blow over. But when Chapek was ousted by Iger, instead of laying low, Iger seemed to actively provoke the Florida legislature and DeSantis, and ultimately the legistlature acted to repeal.

- By law, Reedy Creek needed to be a public and separate entity than the private commercial Disney, but Iger has repeatedly shoved his foot in his mouth by claiming DeSantis is attacking Disney (admitting that Reedy Creek is not a separate entity from Disney). The Florida government has already acted and Iger has already lost Reedy Creek, but he is now risking potential securities fraud allegations by admiting these entities were not separate. This is fraught with danger, and there is no benefit but for Iger’s ego.

- Among many perks, Reedy Creek effectively gave Disney the ability to issue muni bonds, which allowed Disney to borrow money at much lower interest rates than corporate bond rates. It is estimated that this loss will likely cost Disney trillions of dollars in higher expenses over the following decades.

- The best coverage of this is by Legal Mindset, who is a lawyer with a YouTube channel, that coincidentally happens to have actual extensive experience in this highly niche part of law involving Florida special districts. Main stream media coverage is exceptionally awful because they know nobody will call them out because nobody understands the legal system, let alone the minutia of Florida state law involving special taxing districts.

- Disney keeps putting out expensive films that are bombing (definition: failing to make a profit accounting for all expenses). Many have argued this is ‘get woke, go broke’. But whatever the reason, the films are terribly reviewed and they are not earning enough money to overcome their enormous expenses in production and marketing.

Let’s examine Disney’s major theatrical releases for 2023. It is possible that Disney does not release a single profitable film this entire year.

- Ant-Man and the Wasp: Quantumania (with lowest ratings, biggest second week box office drop off in MCU history, high budgets, and inflation, this puts it in contention for biggest MCU loss ever)

- Guardians of the Galaxy 3: (still clinging to a chance to squeak out a break even).

- The Little Mermaid: (Was a very expensive film to make with floundering international opening weekend numbers, and estimates, that inflation adjusted, it won’t even beat the original film, accountants are singing “Those Poor Unfortunate Souls”)

- Elemental (box office projections are it will be in the bottom Pixar films of all time with The Good Dinosaur, Onward, Lightyear & * Turning Red)

- Indiana Jones and the Dial of Destiny: (this has been a train wreck in motion since 2016, with one of the most expensive budgets in movie history, coming to a head with the Kathleen Kennedy drama below)

- The Marvels: (original box office predictions were Quantumania was going to be the bigger money maker of the two…ouch)

- There have been more executive level firings beyond Chapek’s trusted circles, and also some counter lawsuits. That, plus the board seat drama makes it seem like a real world Game of Thrones in the executive suite.

- Looks like Iger has launched a war against Kathleen Kennedy (head of Lucasfilm division), invoking allusions to Senator Palpatine (finally) turning on Count Dooku. As mentioned in the prior article, Disney Star Wars has been a financial failure and is deeply underwater now over 10 years since Iger’s acquisition.

- As she entered the theater for the exclusive viewing for Indiana Jones and the Dial of Destiny at France Cannes, news leaked that the failing Star Wars Galactic Starcruiser Hotel was shutting down and the Disney+ series Willow was going to become a tax write down. This was maliciously timed so she would be forced to deal with the press questions about it, when she came out of the theater (instead of talking about Indy 5).

- Also the Indy 5 movie review embargo seems to have been lifted atypically early, and the reviews are terrible. (This is more evidence that Iger has given the go-ahead with his allies to smear Kennedy.)

- Disney+ is $13 billion in the hole and continues to lose over $1-$1.5 billion per quarter (Valliant Renegade gives the analogy that this is the equivalent of sinking one Disney cruise liner every quarter). Disney+ has been a boondoggle since its inception.

- Disney+ lost 4 million subscribers in the last earnings period.

- Disney Parks & Experiences are the only thing keeping the company afloat, because they are a cash cow.

- The writers strike is going to create more uncertainty for their studios and Disney+. This will stall the production pipeline and the effects will be felt down the road. But ironically, since Disney is cash strapped now, this might help them right now.

- Meanwhile, Comcast/Universal is eating Disney’s lunch with the massive successes of the record breaking Super Mario Bros Movie and Super Nintendo World at Universal parks. There are a lot of rumors/speculation about a “Nintendo Cinematic Universe” (NCU), a Zelda movie, and Zelda land park expansion at Universal. Comcast is starting to emerge as the biggest potential competative threat Disney has seen in over a generation.

- And without the special Reedy Creek privileges, Disney now must compete following the same laws as every other company in Florida. So Universal in Florida which already has momentum behind it, also finally gets a level playing field.

With that summed up, moving on…

Disney’s big problem with Comcast’s Hulu “Put”The main topic I wanted to focus on is Disney’s upcoming cash problem. If circumstances pan out poorly for Disney, this event could inflict serious and lasting financial damage to the company.

Stepping back for everybody, Hulu is a streaming service created in 2007, that was joint venture between Disney, FOX, and NBC Universal (and a few other smaller companies I will omit for brevity).

Since then, Disney bought FOX, and Disney became a 2/3 owner. And Comcast bought NBC Universal which made them a 1/3 owner.

There is an agreement between Disney and Comcast, that beginning in 2024, Comcast has the right to force Disney to buy their share of Hulu from them at fair market value. Disney guaranteed a minimum price of $9 billion. In investment terms, Comcast has a “put” option on Hulu.

Comcast has said they will likely sell their Hulu stake.

And in Disney’s most recent earnings call, they announced they are combining Disney+ and Hulu into a single app. During Q&A, when pressed to confirm this meant Disney was buying Hulu, Iger re-acknowledged Comcast’s put in early 2024, and said “we’ve had some conversations with them already.”

Iger also said, “How that ultimately unfolds is, to some extent, in the hands of Comcast and in the hands of a – basically, a conversation or a negotiation that we have with them.” This statement might be interpreted as a confirmation that Comcast has negotiating leverage in the deal, and Comcast believes they can get more than $9 billion.

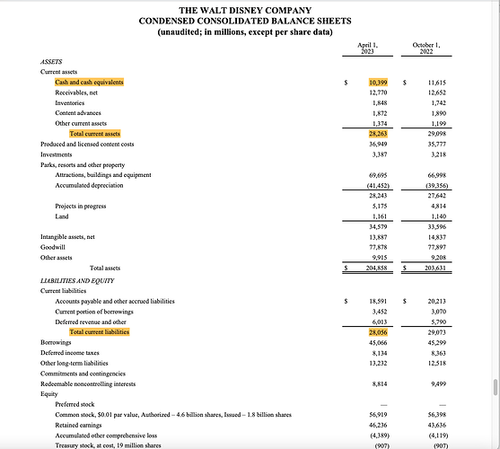

Disney’s Balance Sheet ProblemsBut looking at Disney’s balance sheet, they may not have enough liquidity to buy it.

YouTubers, Jonas J. Campbell and “Mike” Mexican Ironman deserve accolades for spotting this in Disney’s financials and breaking it down. Here is a link where they walk through the financial statement and show the problem.

Disney’s Cash ReservesIn summary, Disney has a coming liquidity problem because of Hulu. Disney may not have enough cash to pay for Hulu depending on the sale price. Even at the base price of $9 billion, it will drain the rest of Disney’s coffers. We can look at Disney’s official balance sheet to prove this.

- Disney has $28.263 billion in total current assets and $28.056 billion in total current liabilities.

- Subtract those two values and this means they only have $207 million in cash flow per quarter, which is tiny for the size of the company.

- Furthermore, based on $10 billion of cash but $28 billion in liabilities per quarter (10 weeks), this equals only about 4 weeks worth of emergency savings if things turn bad, well short of the 3-6 month emergency fund people are advised to have. If another crisis such as in 2020 hit Disney again, they do not have much cash to weather a storm for long.

- Disney is leveraged up almost 10 to 1, i.e. for every $1 in cash they have on hand, they owe $10.

- Two earnings calls ago, Disney announced they were planning to re-instate paying a dividend suspended in 2020 following the lockdowns along with furloughing and laying off tens of thousands of employees. (Don’t worry, the executives already reinstated their own pay and bonuses back in 2020.) It is speculated that the dividend reinstatement was one of the terms Peltz won in exchange for dropping his proxy fight. But if Disney does start paying a dividend again, this will further squeeze their available cash flow.

How much does Hulu cost?We know that Comcast is guaranteed a price of at least $9 billion.

But the Wall Street Journal just reported (probably at the behest of Comcast execs) that in 2021, “NBCUniversal executives pegged Hulu’s valuation at north of $70 billion” and “Disney’s valuation has been tens of billions of dollars lower”.

- 1/3 of $70 billion is $23.1 billion.

- And 2021 is before all the price inflation we’ve seen. Adjusted for inflation, that would be around $26 billion.

- Since all the companies keep spinning how great things are in the streaming business in their earnings reports, Comcast can pick from a wide variety of vanity metrics to show Hulu has increased in value since 2021. As an example, they can just point to a revenue chart.

So if Disney can buy Hulu for $9 billion, Disney might be able to just scrape by with the amount of cash they have on hand. But Disney doesn’t have much margin to spend more here. So if Comcast demands even a more paltry $20 billion compared to the $23-26 billion valuation they think they are entited to, that number breaks Disney’s bank. Even $15 billion appears to be beyond what Disney can manage.

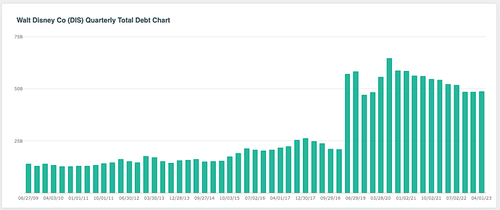

Can Disney borrow more money?This is a terrible time for Disney to try to borrow more money.

- Interest rates have been rising, the cost of borrowing money is much more expensive.

- Banks have been tightening their lending standards because of worries about the economy and the recent regional bank failures.

- Disney’s credit rating is already down because of the enormous debt they have incurred, most notably because of the FOX acquisition, but also because of the lockdowns.

- Using easy numbers, assume Disney issues more corporate debt, paying 10% interest on $10 billion. That is $1 billion in interest per year.

- Disney only has $207 million in cash flow, which is the limit of their ability to service more debt.

- In terms of return on investment, Disney needs to earn more money from the acquistion, than what they pay in interest. We know Disney is losing over $1 billion per quarter already on their streaming service. So paying $1 billion in interest per year, just to additionally lose another $4 billion per year in the streaming service doesn’t make any financial sense.

Can Disney pay with a stock deal?A part stock deal would be the most likely outcome. But there a bunch of problems with this if Comcast commands a higher sale price and Disney’s stock price keeps sinking. Other things break if too much stock is needed.

- For calculations, I will use the the May 26, 2023 close price of $88.29.

- Assuming $10 billion price of Hulu, at $88.29/share, they need to give Comcast 113,263,110 shares.

- Total Disney shares outstanding is 1,825,000,000

- This is about 6% of the company.

- But if we double the price to $20 billion, then we are at 12% of the company.

- SEC and anti-trust scrutiny kick in at 10%, so this becomes extra problematic to pull off.

- This could also result in Comcast becoming Disney’s largest shareholder. Having one of your biggest competitors as a majority owner brings up a headache of problems.

- The large ownership by Comcast would also entitle them to a number of board seats, which would give them both strategic information and influence. Iger and crew can’t be happy about this, considering how hard they worked to keep Nelson Peltz off the board, whose interests are benign compared to Comcast.

- A stock deal this large also might need shareholder approval. With a little imagination, you might be able to see shareholder anger and a shareholder revolt. This leads to more uncertainty, and the stock price continues to sink lower, putting Disney into a dangerous financial death spiral because they are still legally required to buy Hulu some how.

- On top of all this, Disney’s stock has been falling since it peaked at $201.91 in March 2021. ($201.91 to $88.29 is a 56% decrease.) If the stock continues the downtrend by the time of the Hulu settlement, Disney will have to use more stock to make up for the lower stock price, so the situtation could be even worse when early 2024 rolls in.

- The problem that Comcast is a competitor to Disney is made worse by the fact that Comcast CEO Brian Roberts and Bob Iger seem to hate each other.

Sell off parts of Disney?Disney has the option to sell off parts of the company. But this will be a sore point for Iger, who built his entire CEO tenure around big acquisitions (Marvel, Pixar, Lucasfilm, FOX). Selling in desperation, particularly as a consequence of the enormous debt he incurred under his tenure, would permanently tarnish his legacy.

- Also, any sale right now, with Disney’s back to the wall, the countdown clock ticking, and in an economic tightening cycle, will make it difficult for Disney to get top dollar on anything.

- There is also the question of what could Disney sell, and who has both the desire and the money to buy such a thing?

- The Disney US parks and ESPN are cash cows, so Disney won’t be selling those lest a shareholder revolt.

- But this does pose the question about the Disney parks in Hong Kong and Shanghai. But any deal of this magnitude with the Chinese government would be really complicated and drawn out. Disney Shangahi is also deeply intertwined with Iger’s legacy.

Sell Lucasfilm?It has been over 10 years since the Disney purchase of Lucasfilm, and as a whole, it is still a big financial loss for them and become another albatross around their neck. So maybe cutting the loss would be wise.

- But Disney admittedly overpayed for Star Wars, and Disney has since tarnished the Star Wars brand. They will probably take a big loss selling it.

- There is also an issue of who has both the money and the desire to buy such an enormous property. Few companies have the resources to execute something as grand as Star Wars. And few people have the creative vision to lead and execute a property like Star Wars.

- Maybe George Lucas could be convinced to buy it back at fire sale prices?

- Licensing is another problem. Because Disney built Galaxy’s Edge into the parks, this could force Disney into a clumsy and expensive licensing agreement because it will be too costly remove Galaxy’s Edge (and risk damaging Parks & Experiences revenues, which is the main thing keeping Disney afloat right now). Also, any buyer of Star Wars would recognize licensing to other competing theme parks as an instant revenue stream, so they would have negotiating leverage over Disney.

Sell Marvel?Despite the tarnish MCU Phase 4 & Phase 5 have done to the brand, and the chaos that appears to be taking place inside Disney/Marvel management, Marvel is still a valuable brand and its sale would most likely solve all of Disney’s liquidity problems.

And unlike Star Wars, where most studios wouldn’t have the nuianced expertise on how to fix it, the movie industry does have a lot of experience with superhero franchises. Warner Bros has tons of experience through the DC Universe, Sony with Spider-Man, and FOX (prior to Disney) had X-Men. So presumably, there would be a lot of interest in buying Marvel, and by companies that have the experience of making profits with the properties.

But selling Marvel would be a big blow to Iger’s legacy to let him actually do that.

Sell FOX?The FOX acquistion has been an expensive boondoogle for Disney. Disney has has failed to capitalize on any of the properties in any meaningful way. The Simpsons? Alien?

Iger himself said that Sky Group was the “Crown Jewel” of FOX. But the acquisition was so botched, they didn’t even get Sky.

Also, it was the FOX acquisition that really brought Disney’s debt levels to concerning levels.

discoverci.com

Disney would likely take a loss selling FOX at this point, but by removing the albatross of debt, it could save the long term viability of Disney.

It is unlikely Iger is willing to sell FOX. But even if he was, it would probably be difficult to find a buyer in this current climate of economic worry and rising interest rates.

Sell Pixar to Apple?This is my personal favorite speculation, although it is only speculation. What if Disney sold Pixar to Apple?

It is hard to price how much Disney could sell Pixar for. One one hand, Pixar is still a valuable brand, with many easily marketable properties such as Toy Story and The Incredibles. But on the other hand, other studios have caught up in technology, skill, and box office receipts, so Pixar no longer has competative advantage it had back in 2006 when Disney bought it.

And Disney may have further reduced the value of the Pixar brand by releasing poorly received films as of late resulting in significant layoffs, as well as creating some brand confusion as a result of their separate 3D animated film division, Walt Disney Animation Studios. Casual audiences do not necessarily distinguish Pixar films from WDAS films (e.g. Encanto).

But from Disney’s perspective, this studio redudnancy provides a good excuse to sell Pixar, even if it is part of Iger’s legacy. Iger can simply take credit for advancing WDAS to the level of Pixar.

Apple, as a potential purchaser, is still trying to bolster their Apple TV+ streaming service. Apple has a mountain of cash and could easily afford it. While Apple is cautious about acquisitions, and typically only buys smaller companies, Apple thinks a lot about company integration, and thus places a large value on company culture because it hopes to answer questions about how the company will operate and be managed in a way that is not counterproductive with the parent company. Apple has a very flat organizational structure compared to all other large companies, and thus relies heavily on its corporate culture to stay coherent on tasks & goals. Because Steve Jobs defined the company cultures for both Apple and Pixar, these companies could combine well and alliviate Apple’s normal concerns about integration and operations (assuming Disney didn’t destroy Pixar’s culture).

- Bob Iger has a good prior working relationship with Apple (from partnering with iTunes for ABC TV shows back in 2005), and Iger’s specialty is being a deal maker in big acquisitions like these.

- As discussed with selling Star Wars, there are potential cross-licensing headaches that could arise. But because of Iger’s prior good working relationships with Apple, I am more optimistic Iger could work out a deal here that doesn’t force Disney’s back to the wall. I don’t think Apple is interested in focusing energy on the theme park business.

- Apple is already working with John Lasseter, who was ousted from Disney/Pixar during #MeToo. Reuniting Lasseter with Pixar would also make for a fairy tale like ending.

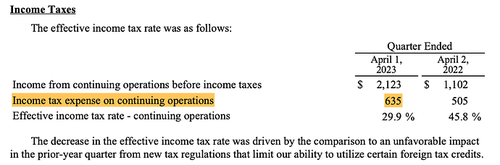

Scrounging for moneyTax Write DownsDisney started taking some large tax write downs right after the most recent earnings call.

Presumably, Disney is trying to scrounge up extra cash by redirecting money that would be normally paid out as taxes. When the Hulu put comes due and the price is right on the margins of the lower end, this strategy could give them the safety buffer they need. But this probably won’t be enough to move the needle if Comcast can demand the higher price range.

Cost Cutting- Chapek announced cost cutting and layoffs, shortly before he was ousted. Iger ran with it and announced they will lay off 7,000 workers and $5.5 billion worth of cuts. Since this ball got rolling under Chapek, this may have been before the company realized how much trouble they are in with the Hulu put. Keep an eye out for more lay offs and cuts to come. It also remains to be seen how, when, and where they cut because their working capital is so tight, that they cannot cut things that would disproportionally decrease revenues.

- For example, Parks & Experiences is their big cash cow, but it also requires a large number of employees and expenses to operate, so there are limits on what can be cut before disportionately damaging revenues.

- There are reports that Walt Disney World in Florida has lighter than usual attendence. Additionally, Disney is still constraining capacity to pandemic levels. Some have speculated that Disney is intentionally keeping attendence levels low using higher ticket prices because they cannot afford to hire more employees to handle the larger crowds, particularly following union negotiated pay raises which passed in March earlier this year.

- Headlines just appeared that Disney is cancelling their Lake Nona campus. The main stream media is framing it as fallout from the political fight with DeSantis. But you’ve now seen the balance sheet and you’ve seen the timing. Lake Nona was 2/3 funded by tax payer subsidies. Do you believe Disney is walking away from $570 million dollars of free money towards their very own development because this is some how sticking it DeSantis? Or is it more likely that Disney is in a liquidity crisis and desperately trying to free up cash?

To conclude this section, it’s also worth mentioning here that this whole mess is preventing Disney from reinvesting into their production pipeline. The lack of investment will likely show up as competitive weaknesses 3-5 years from now when Disney seems to be lacking products and shows compared to their competition. All of Disney’s problems are coming together now and are setting the stage for long term prolonged damage that will take years to work through the pipeline.

Stalling & Prayer as a strategyStalling and praying for another stock market boom or high profitability might be Disney’s most likely play. If by some miracle, when the Hulu put is due, and Disney’s stock is much higher, they might be able to skate by unscathed. Disney can buy themselves more time by letting lawsuits get filed and dragging this out in court. While ultimately, they will likely pay more due to legal fees and interest, they can try to put off the payment until a time where they have more liquidity available to them.

Unfortunately, the macroeconomic landscape is predicting a recession. Jerome Powell, Chair of the Federal Reserve, also keeps saying they do not plan to lower interest rates any time soon, which means Disney won’t be able to borrow money cheaper. But if the Fed does lower interest rates earlier, this will be likely in response to some kind of financial crisis. So if interest rates do drop, Disney’s business and revenues might be collapsing and they will be in even bigger trouble.

But will stalling for time allow them to save up enough cash for later? Assuming the status quo, and everything goes on as is, let’s go back to that $207 million in working capital from the balance sheet. As a back of the envelope math exercise, let’s assume Disney continues to save up $200 million per quarter. To make the numbers easy, let’s assume Disney must buy Hulu for $20 billion at the end of all of this. So how long does it take to save $20 billion if you save $200 million per quarter? That is 100 quarters, or 25 years. That isn’t really tenable.

But nonetheless, there might be a chance that the economy rebounds quickly and avoids a deep recession. Maybe Disney’s stock will go sky high again. Maybe Indy 5, Elemental, and The Marvels become record smashing box office successes. Maybe Parks & Experiences have blow out earnings far and above the huge earnings they are already enjoying. Maybe Comcast will only ask for the minumum $9 billion for Hulu. Maybe Disney can win a very favorable court judgement. Maybe Disney will figure out how to use AI to eliminate a bunch of employees and reduce their account payables by multiple billions.

Moew cynically, there don’t seem to be any easy options for the Disney executives, so even with the added expense of legal fees and interest owed down the road, stalling and praying for a miracle might be as good as anything else. Also, for Iger and the current management, kicking the can down the road means this will eventually become somebody else’s problem to fix. Iger’s contract is only until Dec. 31, 2024.

Disney Hulu: Price vs. ValueWarren Buffet famously said, “Price is what you pay, value is what you get.”

An important point that gets lost in the discussion of what Disney has to pay for Hulu, is what value do they get from owning Hulu?

Since Disney already has Disney+, it does not benefit from a second streaming platform that shows the same things Disney+ has. The only value Hulu offers Disney is the unique programming that is on Hulu which Disney itself does not own. When Comcast sells their Hulu stake, it is unclear if Disney will continue to get access to Comcast owned shows. We know Comcast is incentivized to put their own content on their own streaming service, Peacock.

Assuming Comcast doesn’t keep all their content for themselves, at the very least, it is unlikely Comcast is going to give Disney exclusivity (unless there was some pre-existing contractual term). So any content Disney gets, will also be available on Peacock.

And if Comcast really wants to stick it to Disney, they could further license the same content to other content providers platforms simply to dillute the perceived value Disney+ offers its subscribers. Because Disney+ is losing so much money, and Disney’s financial situation is weak right now, Comcast/Brian Roberts can levy a war of attrition on Disney. If Comcast plays their cards right, Disney will not have the resources to combat Comcast’s expansion into theme parks (Nintendo, Harry Potter, How to Train Your Dragon), cinema (“The NCU”, Minions), and streaming.

Thus, it looks plausible that Disney is paying tens of billions of dollars for something that entirely worthless to them. Not only is the purchase of Hulu putting Disney on the financial brink, Disney isn’t getting any benefit from the acquisition.

ConclusionDisney is an interesting microcosm of the economy. Disney itself is often a symbol and reflection of the US economy. So if Disney provides us a lens to look through, what do we see?

It has embraced the DEI/ESG political agenda, it levered up on cheap money, it squandered its generations of accumlated wealth away like drunken sailors, became obsessed with vanity metrics (such as number of subscribers), and had no concern about actual profits or pleasing its paying customers. Now financial conditions are beginning to tighten and cracks are starting to appear.

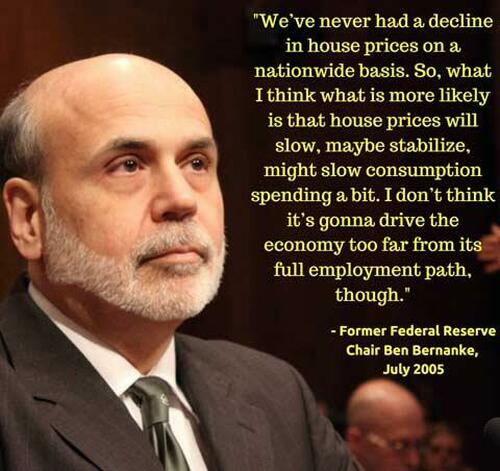

To add to more storm clouds to Disney’s worries, the Fed has declared that a ‘mild’ recession is now likely this year. (Recall that the Fed completely missed seeing the Great Financial Crisis in 2008, so who knows what’s going to happen in a ‘mild’ recession, and heaven help us if they ever forecast a ‘normal’ recession.)

If Disney truly is a reflection and representation of what’s going on in the broader economy, then it quite concerning to think how many other companies have similar balance sheet liquidity problems. Although the Hulu put is unique to Disney’s situation, companies that ignored profitbility for other objectives, combined with highly levered up balance sheets with tight cash flows, and no more access to cheap money, may (sadly) be a common theme. Disney’s ability (or inability) to navigate this may be a canary in the coal mine about how the broader economy will also fare.

and the link included and get back to me. |