here below at the time must have been 'soooo cool'

like I noted, 'at the time'

sooo so cool, I correct myself :0)

buddies hanging out together, doing business, making money, having a good time, making a lot of money, feats and feasts, all casual, dorm conditions, forever young, beach and pool, pizzas and beers, and toys toys toys, all simply from the computers, day after night after day, at the taps, keystrokes, and in case I forgot to mention, hanging out

revenge of the nerds, out cooling the cool kids, a laugh a minute, and lots of money an hour

interesting business model, albeit, and incidentally a-legal, just like GTA (grand theft auto), arguably illegal

now onward to the arguments, and possibly albeit, again, arguably, jail time, or lots and lots of jail time, but possibly just a slap and walkaway, ala extend middle-single, MF Global-esque

agnostic, let's watch & wait, note and see

comment: I am a bit surprised about the presence of umbrella near at hand behind SBF's airplane seating - given all of the billions at call, surely someone can be at beck n call w/ umbrella always at the ready? and wtf, surely the gods would stop the rain at the slightest hand gesture indicating 'stop'?

bloomberg.com

A Look Inside Sam Bankman-Fried’s Empire Before It Collapsed

Photos of the crypto exchange FTX in its final year capture SBF in his penthouse and a private jet.

4 August 2023 at 07:00 GMT+8

Sam Bankman-Fried spoke frequently about the beanbag he slept on in the office. He talked less about his naps on the private plane.

In the months since Bankman-Fried was charged with running a massive crypto fraud, US prosecutors and legions of reporters have begun parsing his every word (and deed) to expose gaps between his public persona and what really went on behind the scenes. He really did sleep in the beanbag chair, but he also had access to the jets his company chartered and a $30 million penthouse it owned at an exclusive resort in the Bahamas.

Bankman-Fried is scheduled to face a criminal trial on Oct. 2 over charges he misused billions of dollars in customer deposits. Federal prosecutors have accused him of indulging in luxuries purchased with stolen money. He has said he didn’t commit fraud and that the missing money was a mistake.

Bloomberg obtained a cache of photos and video taken in the final year before Bankman-Fried’s companies, FTX and Alameda Research, went into bankruptcy. They offer an intimate look at the lives of Bankman-Fried, who declined to comment on them, and his inner circle at their peak — hosting parties and schmoozing with political figures and billionaires. It also captures the peculiar indulgences of a math geek turned crypto kingpin.

THE CHRISTMAS PARTY: The company held its 2021 holiday party at an event space near headquarters in Nassau, Bahamas. FTX had intended to make it an annual tradition and had already begun planning the 2022 celebration prior to the collapse in November.

THE OFFICE: Bankman-Fried’s father, Joe Bankman, is a renowned expert in tax law and a professor at Stanford University. Bankman also worked part-time at FTX, offering tax advice to employees and helping with recruitment, according to court filings. After work, his son would regularly sleep on what looks like a giant dog bed, sometimes accompanied by the company pet, Gopher.

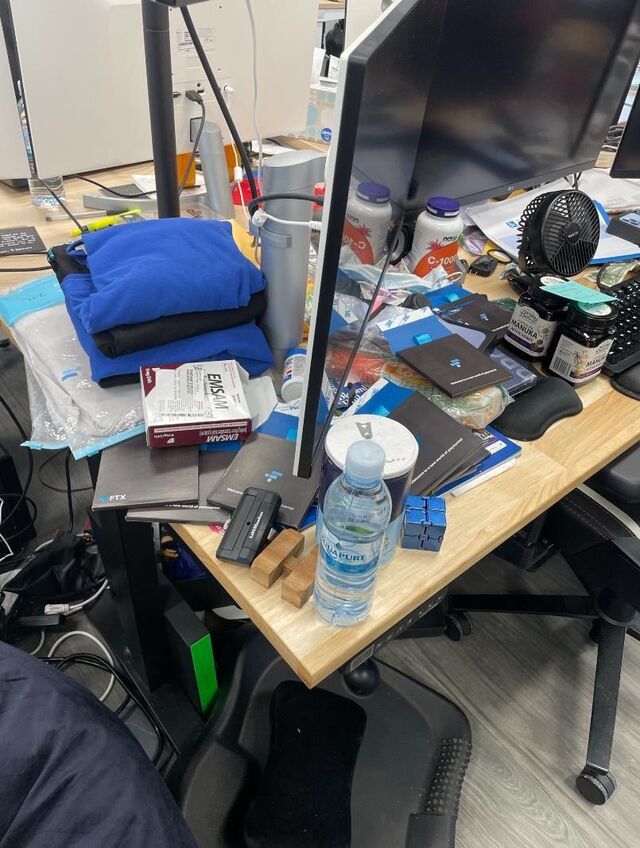

THE CEO’S DESK: Bankman-Fried spent a lot of time at the office, and his workspace was not the tidiest. Among the detritus on his desktop was a box of Emsam, a prescription patch used to treat depression and Parkinson’s. Bankman-Fried previously described his use of the depression medication in an interview with Bloomberg Businessweek. He also kept a personal saltshaker; he liked to oversalt his food.

THE PRIVATE JET: In 2022, Bankman-Fried frequently traveled by private jet between the Bahamas, New York and Washington. Among his apparent snacks of choice is a bag of Lesser Evil brand popcorn. There were also custom hoodies with his silhouette on the back.

THE CELEBRITIES: A big part of how Bankman-Fried so quickly cultivated credibility was his access to prominent political and business figures. He dined with New York Mayor Eric Adams, a once vocal cryptocurrency supporter who took his first mayoral check in Bitcoin and Ethereum, and gabbed with Stripe Inc.’s John Collison, the president and co-founder of America’s second-most-valuable tech startup.

THE PENTHOUSE: The Orchid is a palatial building in the elite Albany community in Nassau. Bankman-Fried lived in the penthouse with his colleagues and close friends. Residents amused themselves with a variety of playthings.

THE VILLA: Another location in the Albany served as a second party spot for the team and home to Constance Wang, the former operating chief at FTX. The company also owned this villa, spanning two stories and referred to as the Conch Shack, according to bankruptcy filings.

THE PARTIES: The revelry for FTX employees wasn’t the typical Bahamas vacation debauchery. Bankman-Fried played speed chess with his staff and a game called padel, a racket sport that’s a mix between tennis and squash. He celebrated his birthday in 2022 with Bahamian locals who handled office logistics like cleaning and catering.

THE INNER CIRCLE: A group of core employees, composed of Bahamas transplants, spent a lot of time dining and playing together. Some of the people would turn against Bankman-Fried as cooperating witnesses who pleaded guilty to crimes. |