Re <<"only few will make it to the top of K2">>

... only fewer-still will make it to the top of K2.7

Spoiler: To answer that question, we look at the latest note out of Goldman which analyzes Chinese gold demand to conclude that a $2,700 year-end price forecast for gold is appropriate.

from behind ZeroHedge paywall

zerohedge.com

Goldman Expects Gold To Surge On Relentless Chinese Demand

BY TYLER DURDEN

TUESDAY, JUL 23, 2024 - 07:45 PM

Back in December 2022, with gold trading below $1800/oz, we first discussed the beginning of a precious metal buying-binge from China which as we noted then had emerged as the "Mystery" massive gold buyer after its first official purchase in three years, and noted that the price for physical gold had never been more expensive at the time (while western gold prices were still below their prior record highs). Additionally we noted a curious divergence between the apparent lack of demand for so-called 'paper gold' via ETFs as holdings underlying these vehicles was declining, coupled with a gold price that seemed to have disconnected from ETF holdings and was driven instead by physical demand, or as we noted "the rising interest in gold bars and coins was primarily driven by investors’ safe-haven demand, supported by global geopolitical instability and weak performance of investment products denominated in Chinese yuan.”

[url=] [/url] [/url]

In retrospect, not only did we bottom tick the price of gold, which hit a five year low right around the time of our December 2022 article predicting China's relentless buying, but in the 18 months since, the yellow metal has risen by 40%, a staggering appreciation for an asset which is best known for its boring stability.

We bring this up for three reasons:

- First, the gold price set a new all-time high of $2,483/toz on Wednesday (July 17) as expected Fed cuts are poised to bring Western capital back into the gold market: see that little kink in the black line in the chart above? That means the constant gold ETF selling since 2020 is finally over.

- Second, besides rising interest from Western investors, demand from central banks is now structurally higher

- And third, as Goldman writes in a research note published on Monday and picking up where we started almost two years ago, third major component of global gold demand - Chinese households - is likely to keep demand for physical gold elevated for the foreseeable future.

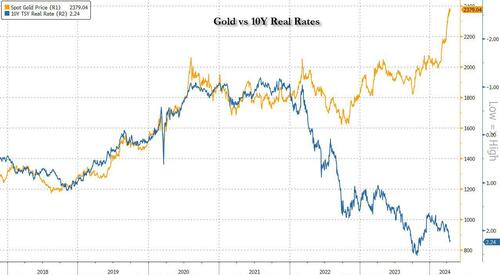

There is another reason why the ongoing surge in gold is remarkable: as we have noted on multiple occasions, gold prices have rallied since mid-2022 despite sharp increases in US real interest rates, which traditionally predict falling gold prices...

[url=] [/url] [/url]

... and again, we have relentless demand out of China to thank for this.

So what is it is about gold that China is suddenly so enamored by it, its demand surpassing that of long-time gold champion India?

To answer that question, we look at the latest note out of Goldman which analyzes Chinese gold demand to conclude that a $2,700 year-end price forecast for gold is appropriate.

Below we excerpt from the Goldman note, starting with a primer of China’s gold market, which accounts for about one-third of total global physical demand. We then model Chinese gold demand based on measures of fear and income/wealth, as well as Chinese interest rates and gold prices. Finally, we show that although cyclical gold demand is soft due to price sensitivity, structural changes leave China gold demand roughly intact on net because the demand boost from fear and lower rates roughly offsets the hit from reduced income growth.

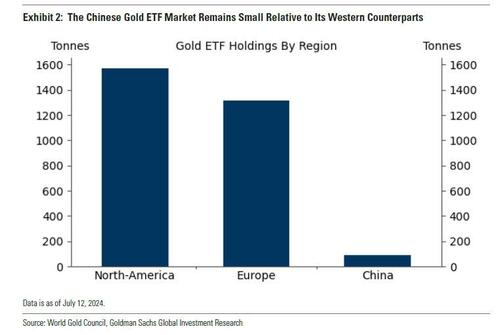

China’s Gold Market OverviewChina’s strong tradition of physical gold ownership and easy access to physical gold keep it as the dominant form of demand. Although gold-backed ETFs are gaining traction in China, their market size remains tiny compared to Western counterparts

[url=] [/url] [/url]

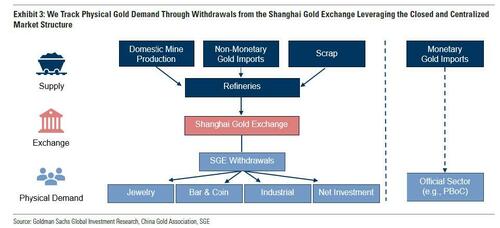

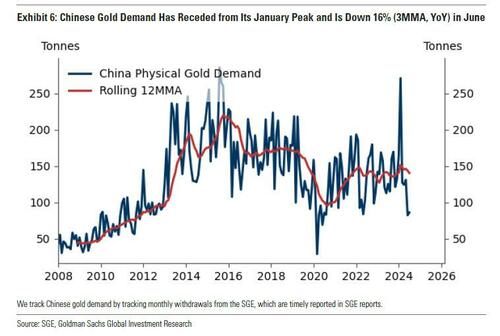

Physical Gold demandWe can track (private) physical gold demand by tracking withdrawals from the Shanghai Gold Exchange (SGE) because it is a centralized closed market. Nearly all physical gold transactions are routed through the SGE due to its high liquidity, regulation, and tax incentives.

[url=] [/url] [/url]

An exception is the official sector, including the PBoC, that operates outside of the SGE and purchases gold directly on the international markets which provide the necessary liquidity for large transactions and allow payment in foreign currencies — unlike the SGE’s Renmimbi-only contracts.

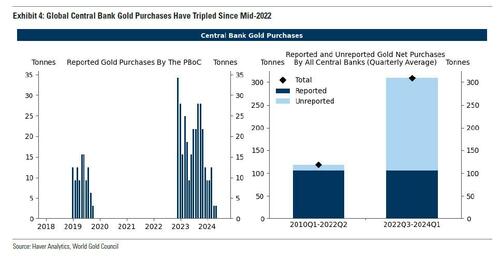

China’s central bank has reported 18 consecutive months of gold purchases starting in November 2022, accumulating 317 tonnes. We have also shown that EM central banks have tripled their central bank buying since mid-2022 due to fears of US financial sanctions and concerns about US sovereign debt, with most buying now unreported. Despite a break in China’s reported purchases for May and June, the reality is that EM central banks, including China, will continue to frequently buy gold, disclosed or not.

[url=] [/url] [/url]

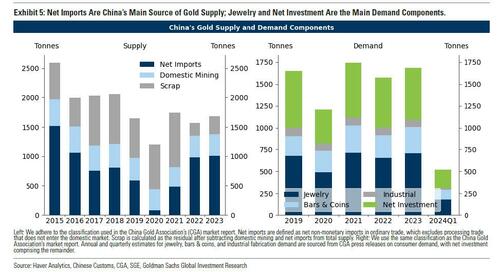

SupplyChina gold supply originates from three sources: (1) non-monetary imports in ordinary trade (1007 tonnes in 2023), its primary source of supply, (2) scrap, and (3) domestic mine production from the world’s largest producer at roughly 400 tonnes annually. Gold destined for China’s domestic private market is routed through the SGE and must meet stringent quality standards, being melted and cast in SGE-approved refineries before being supplied.

[url=] [/url] [/url]

DemandAccording to figures released by the China Gold Association, Chinese physical demand comprises about 40% in jewelry, 20% in bars and coins, and 5% in industrial fabrication, which together make up wholesale demand, with the remainder allocated to net investment . The next chart shows that Chinese gold demand — as tracked by monthly SGE withdrawals — has receded from its January peak and is down 16% (3MMA, YoY) in June.

[url=] [/url] [/url]

Supply and Demand Clear (Mostly) LocallyDue to the relatively insular nature of the Chinese gold market, local and international prices can diverge, with the difference known as the Shanghai-London premium or discount. Given China’s strict export restrictions, any excess supply that induces a discount is ultimately absorbed by increased domestic demand. Conversely, supply shortages induce a premium such that either it destructs demand or it encourages an influx of scrap supply. The supply shortages can also be resolved by increased imports, which in turn can impact international prices. However, import adjustments are not a guaranteed solution, as Chinese authorities closely monitor gold inflows through quarterly import quotas, though adjustable based on market conditions. In 2023H2, gold import restrictions tightened, and the local premium reached more than $120/toz on September 14, 2023.

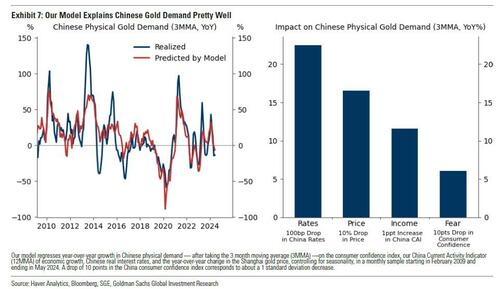

Fear, Income, Yields and Prices Drive Chinese Gold DemandGoldman models Chinese gold demand based on measures of fear, income, Chinese interest rates, and gold prices. The model regresses year-over-year growth in Chinese physical demand — after taking the 3 month moving average (3MMA) —on the consumer confidence index, the China Current Activity Indicator (12MMA) of economic growth, the level of Chinese real interest rates, and year-over-year growth in the Shanghai gold price. The bank finds that fear (measured as low consumer confidence), income/wealth (i.e. our China Current Activity Indicator), low China interest rates, and low gold prices all boost China gold demand significantly. As Exhibit 7 (Left) shows, the model explains the swings in Chinese gold demand pretty well.

Notably, Goldman finds that the Chinese market is particularly price sensitive; the bank estimates that a 10% drop in the Shanghai gold price would boost physical China gold demand by 16%

[url=] [/url] [/url]

Cyclically Soft, Structurally Intact

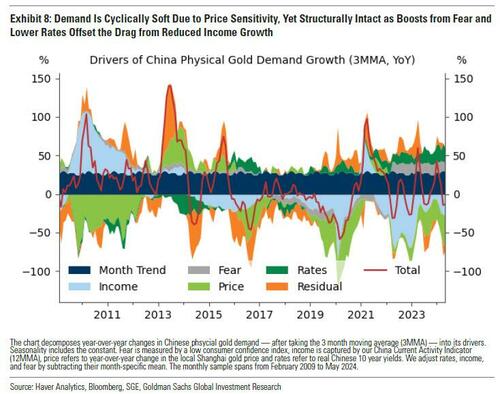

This model also explains the swings in Chinese gold demand over the past 15 years. Goldman finds that rapid economic growth drove the surge in gold demand in 2010. During the pandemic, high international gold prices and weak economic activity led to a 27% year-over-year drop in demand, as price-sensitive Chinese consumers curtailed discretionary spending on gold jewelry (down 27% YoY).

While Chinese gold demand is now cyclically soft due to price sensitivity and recent price surges, structural changes leave China gold demand roughly intact on net because the demand hit from lower trend GDP growth (income/wealth) is roughly offset by the boost from lower interest rates and lower confidence (fear) due to property woes and economic uncertainties.

[url=] [/url] [/url]

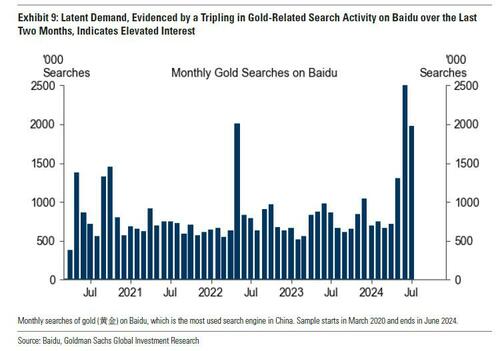

Goldman also finds further evidence of this price sensitivity in the recent demand shift across gold categories: Gold jewelry purchases declined 3% YoY in 2024 Q1 as consumers cut back on discretionary spending, while demand for the more cost-effective bars and coins surged 27% YoY. Additionally, a tripling in gold-related search activity on Baidu hints at robust latent demand, and hypothetical large price declines would likely reinvigorate Chinese buying.

[url=] [/url] [/url]

Putting it all together, Goldman's analysts say that they "still see very significant value in long gold positions" and maintain their bullish $2,700 forecast (+12% vs. spot) for 2025 for three reasons:

- First, they believe that the tripling in central bank purchases since mid-2022 on fears about US financial sanctions and US sovereign debt is structural.

- Second, Fed rate cuts are poised to bring Western capital back into the gold market.

- Third, gold offers significant hedging value to portfolios against geopolitical shocks including tariffs, Fed subordination risk, and debt fears.

That said, the finding that the particularly price sensitive Chinese market is digesting the price rally and already elevated CFTC gold positioning point to some risk that gold reaches Goldman's $2,700 target later than the bank's 2024 year-end baseline. However, this same price sensitivity also insures against hypothetical large price declines, which would likely reinvigorate Chinese buying.

More in the full Goldman note available to pro subscribers in the usual place. |