- Home

- Markets

- U.S. & Canada

- Market Extra

Defensive stocks are making a comeback as Fed readies rate cuts. What’s next for Wall Street’s hottest trade.

Published: Sept. 12, 2024 at 7:30 a.m. ET

By

Isabel Wang

A previously unloved corner of the stock market has quietly stood out as a surprise winner on Wall Street so far in 2024

A previously unloved corner of the U.S. stock market has quietly emerged as one of the top performers of the S&P 500, reshaping Wall Street over the past few months.

Surging over 21% year to date, the S&P 500’s utilities sector XX:SP500.55 has been the second-best performer among the large-cap benchmark index’s 11 sectors so far in 2024. The group of companies that provide electricity, water and gas utilities has outperformed the S&P 500’s SPX 16.4% year-to-date gain and lagged the information-technology sector XX:SP500.45 by less than three percentage points in the same period, according to FactSet data.

Other defensive stocks also have come back in vogue. The S&P 500’s consumer-staples sector XX:SP500.30 has advanced over 16% so far this year, while the healthcare sector XX:SP500.35 has gained 13.6% and the real-estate stocks XX:SP500.60 were up over 11% in the same period, according to FactSet data.

See: Utility ETFs saw big inflows last week, and BofA upgrades the sector to overweight

“In the very recent days, more leadership from the pure defensive sectors just signifies some of the uncertainty [in the stock market] ahead of the Fed meeting next week and ahead of the U.S. presidential election,” said James Ragan, director of wealth management research at D.A. Davidson.

Stocks in utilities, healthcare, consumer staples and real-estate sectors are often considered defensive stocks since these companies provide goods and services that consumers would purchase and use regardless of the state of the economy.

That’s why defensive stocks have been a rare bright spot in the recent market selloff, as recession concerns and expectations that the Federal Reserve will begin cutting interest rates soon have made these sectors more appealing.

Now, the question for investors is whether the strength in defensive stocks could foreshadow market weakness in the future, said analysts at Bespoke Investment Group.

“Utilities have a reputation for being the most defensive sector in the market, so it’s uncommon enough for it to be the top performer, but in a strong year [for the stock market], it’s unheard of,” the Bespoke analysts said in a Tuesday client note. They also noted the only other year that the utilities sector had a better year-to-date performance through Sept. 9 was in 2000 when it had rallied 42% in that period.

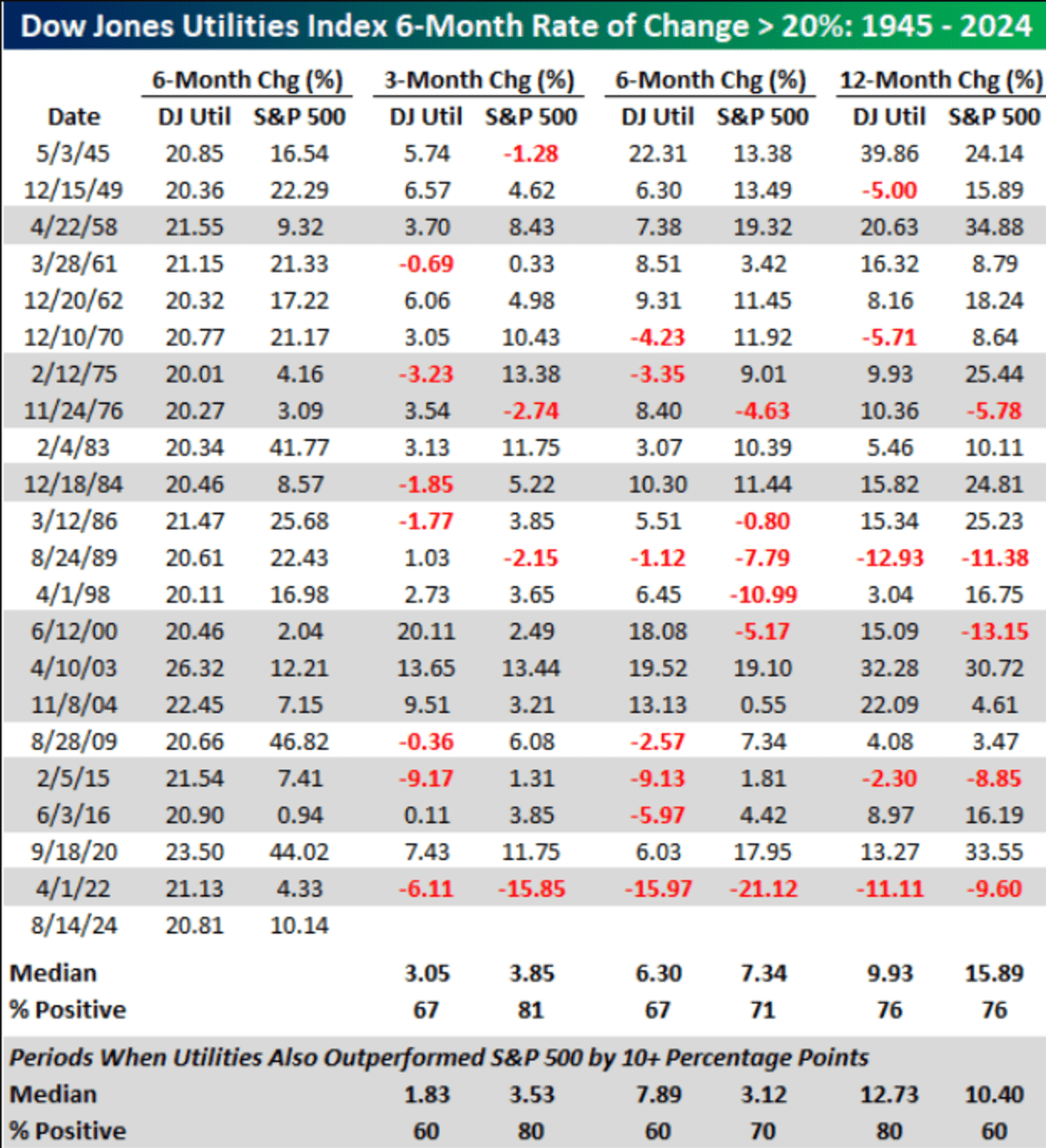

The table below shows each time the Dow Jones Utilities Index XX:DJUSUT

rallied more than 20% in six months for the first time in at least a year, and its performance three, six and 12 months later.

Forward returns for both the utilities index and the S&P 500 index have generally been positive, according to data compiled by the Bespoke team. Over the following three, six, and 12 months, the utilities index was higher at least two-thirds of the time, while the S&P 500 was even “more consistent to the upside” with gains at least 70% of the time, the Bespoke analysts said.

“Based on these historical moves, even following periods of significant outperformance by utilities, there wasn’t a clear trend of forward weakness for the overall equity market,” the Bespoke team wrote.

SOURCE: BESPOKE INVESTMENT GROUP

See: Value stocks outperform this quarter as growth equities struggle in ‘downtrend’

Historical data suggest that strong past performance of utilities might not necessarily be the canary in the coal mine that some might expect, such as signaling weakness ahead for stocks more broadly. Instead, this time it might just be investor looking to pick up cheaper stocks.

Ragan told MarketWatch that the recent outperformance of defensive stocks looks like part of the “growth vs. value” story as value stocks have beaten growth equities since earlier this summer.

The Russell 1000 Value Index RLV has advanced 4.4% over the past three months, while the Russell 1000 Growth Index RLG has risen a modest 0.2% in the same period, according to FactSet data.

Investors shoring up portfolios with defensive plays have hoped that these stocks could shield them from stock-market downturns and economic slowdowns. But this time, outside of utilities, which have benefited from AI-energy needs, there are concerns that lackluster earnings growth might keep a lid on stock prices in the sector.

See: The surprising reason why utilities stocks have suddenly transformed into the hottest sector on Wall Street

Specifically, that’s the concern of Chris O’Keefe, managing director at Logan Capital Management, who said one puzzle in the outperformance of some of the defensive sectors has been that earnings results have yet to catch up with their strong stock-market leadership.

To be sure, the utilities sector reported the highest year-over-year earnings growth rate of all 11 sectors for the second quarter of 2024, but cyclical sectors such as financials XX:SP500.40, information technology XX:SP500.45 and consumer discretionary XX:SP500.25 were still the largest contributors to the increase in earnings for the broader S&P 500 index, John Butters, senior earnings analyst at FactSet, wrote in a Friday note.

“In an environment where earnings are going to be challenged by a slowing economy, we haven’t really seen a surge in earnings from the defensive names that would drive their valuations higher,” O’Keefe told MarketWatch via phone on Tuesday.

U.S. stocks finished higher on Wednesday after the three benchmark indexes scored large intraday comebacks. The Nasdaq Composite COMP finished up 2.2%, while the Dow Jones Industrial Average DJIA rose 0.3% and the S&P 500 SPX advanced 1.1%, according to FactSet data.

See original version of this story

Read Next

The VIX is calm. But another volatility gauge is a red flag, says Société Générale.

SocGen’s JunkVIX shows prolonged market distress, according to analyst

More On MarketWatch

About the Author

Isabel Wang

Isabel Wang is a Markets Reporter for MarketWatch.

Copyright © MarketWatch, Inc. All rights reserved.

By using this site you agree to the

Subscriber Agreement & Terms of Use, Privacy Notice and Cookie Notice .

|