>> THE F*CKING F*CKS

UNREALISED LOSSES BY U.S. BANKS 7x HIGHER THAN 2008 FINANCIAL CRISIS ... some kind of wonderful, for 'they' need to as in have imperative to, as in urgently, make our gold worth more, and probably quite a bit to possibly a whole lot more, else it shall be "Game Over, Player 1"

especially if the Luke is correct

I have rarely (twice before, a real estate deal) had a huge position go up so much in such a short moment

nuts

and the gold did not even hold a board meeting, engage in manufacturing, marketing, sales, r&d, after sales service or anything else

just out, from behind paywall, and to harvest, we merely need to sit back and do a beer

charts look promising

zerohedge.com

First Jobs, Now The Economy: US GDP Set For Huge Downward Revision In Thursday's Report

BY TYLER DURDEN

THURSDAY, SEP 26, 2024 - 10:30 AM

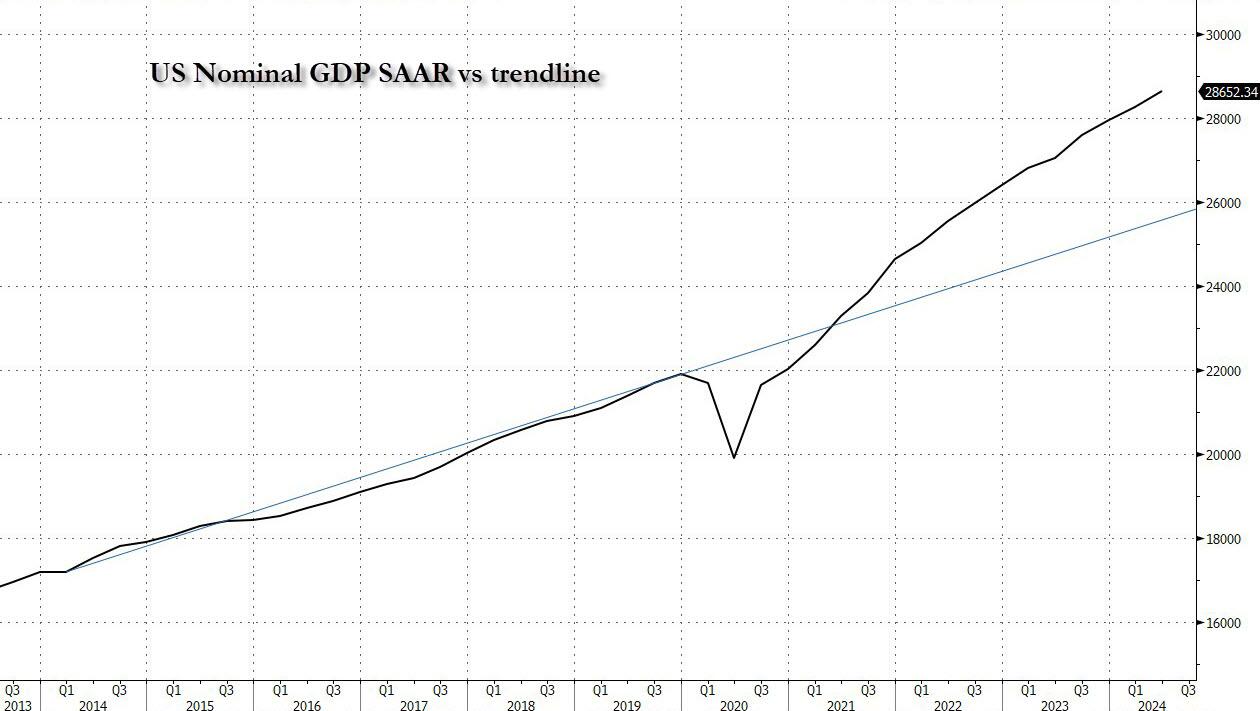

One of the saving graces of the Biden presidency is that while inflation and federal debt were soaring, the labor market and economic growth were both solid; in fact as shown in the chart below, nominal GDP was tracking about $2.5 trillion above the pre-covid trendline, an impressive achievement even if inflation accounted for the bulk of the divergence.

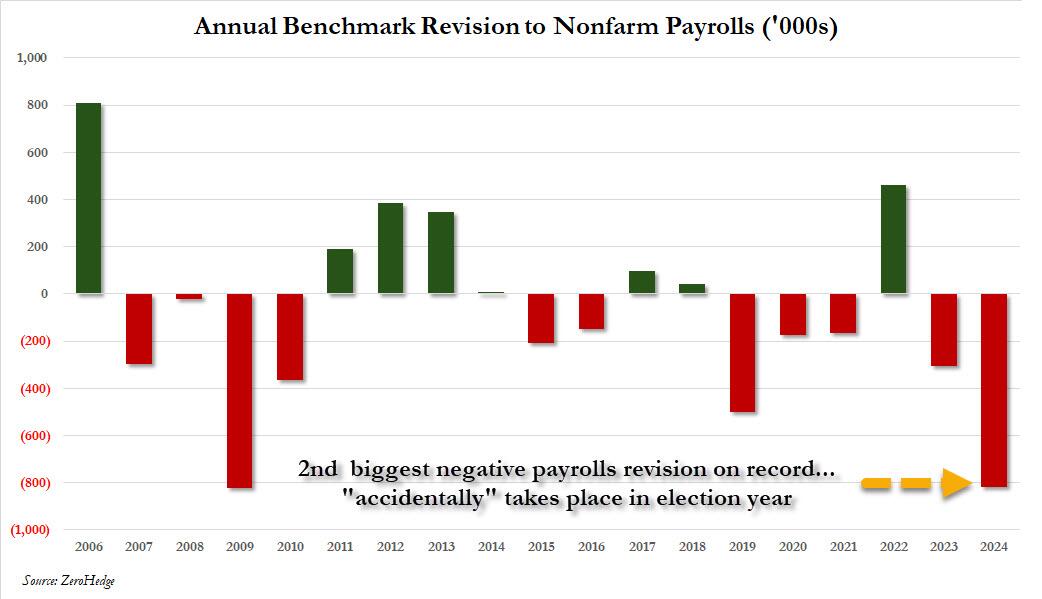

Alas, just as last month's dramatic downward revision in the number of jobs - the second biggest on record, confirming that most of the labor market strength in 2024 had been a pre-election mirage - erased much of the Biden admin's recent "stellar" jobs record...

... so tomorrow's GDP revision is about to wipe out much of the so-called economic growth of the current administration.

Oh, and for those asking, "why negative?' Well, because you can't manipulate numbers higher for purely political reasons month after month, without eventually admitting the truth and "revising" everything sharply lower.

Here are the details:

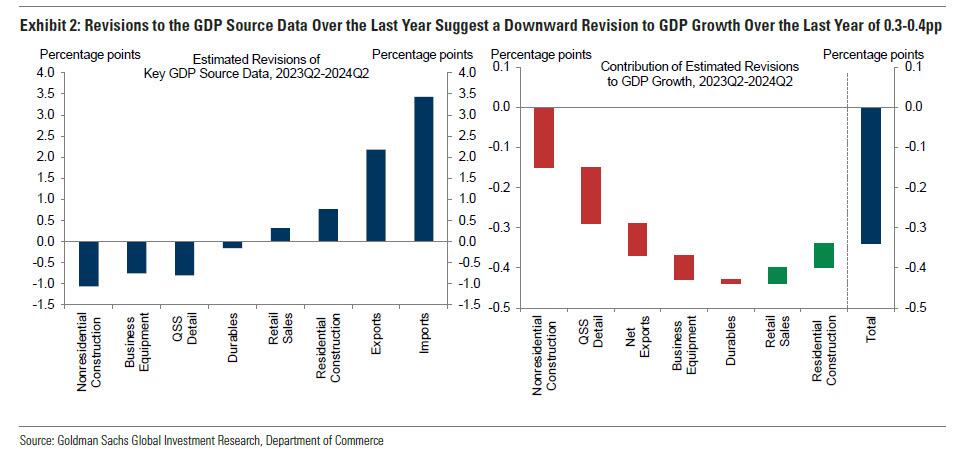

As Goldman economist Manuel Abecasis explains, tomorrow, the Bureau of Economic Analysis (BEA) will release the annual update of the national accounts, including revisions to GDP and gross domestic income (GDI), which - in keeping with the dramatic reduction in historical payrolls - will also be slashed.

Based on revisions to key GDP source data, Goldman expects a downward revision of 0.3-0.4% to GDP growth over the last year, driven by downward revisions to nonresidential construction, services consumption, and equipment investment. Together, these revisions would lower year-over-year GDP growth through 2024 Q2 from 3.1% to 2.7%.

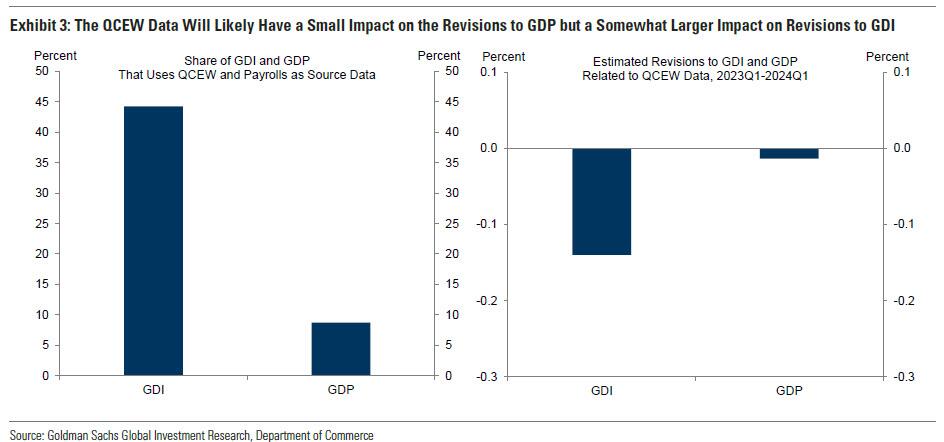

Separately, while last month's collapse in jobs was due to the revised Quarterly Census of Employment and Wages, Goldman does not expect the incorporation of QCEW data for the first quarter of 2024 to result in major revisions to GDP, both because the QCEW is used to estimate only a small share of GDP and because the 2023 QCEW data has mostly been incorporated into the current vintages of GDP (more details in the linked GS report available to pro subs). According to the bank, the inclusion of the QCEW could result in a further modest 0.1-0.2% downward revision to GDI, although the exact magnitude depends on how the BEA seasonally adjusts the data.

Once again, it's "shocking" how the data is always revised downward, never upward. But we digress.

Goldman also writes that the revisions to GDI will also include new source data for net interest payments for 2022 based on comprehensive tax records from the IRS (while net interest payments are likely understated in the national accounts, less than 5% of the decline in net interest payments between 2022 and 2024 happened in 2022, so do not expect the new source data to lead to major revisions to GDI this week). As a result, Goldman estimates that the statistical discrepancy - the difference between GDP and GDI - will narrow only modestly, by around 0.2-0.3% over the last year. That being said, revisions through 2023 Q2 and the inclusion of source data beyond those that can be accounted for could narrow the discrepancy further.

Bottom line: first jobs, then the overall economy are revised ever lower as the lies of the Biden regime slowly collapse under their own weight. And when enough air has been pulled out of the tires, the same thing will happen with non-GAAP "earnings" which will "suddenly and unexpectedly" crater, just in time for the entire market to do the same... a few months after Trump wins in November. |