New Data Reveal the Hidden Mechanisms of the Collapse of the Roman Empire

By Ugo Bardi, originally published by Cassandra’s legacy

May 29, 2018

The reasons for the fall of the Western Roman Empire have remained a mystery for modern historians, just as for the Romans themselves. Yet, recent data from the Greenland ice core provide us with new data on collapse of the Empire, showing how fast and brutal it was – a true “ Seneca Collapse.” Could our civilization go the same way?

The Ancient Romans never understood what hit them. Nor did later historians: there exist literally hundreds of theories on what caused the fall of the Roman Empire. In 1984 Demandt listed 210 of them, ranging from moral decline to the diffusion of Christianity. Today, some historians still say that the fall is a “mystery” and some attribute it to the improbable piling up of several independent factors which, somehow, happened to gang up together.

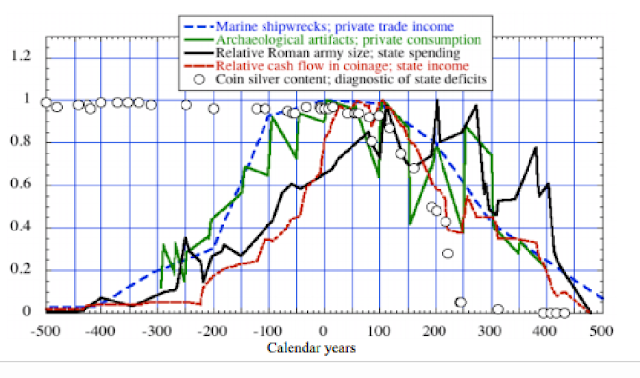

Why is it so difficult to understand something that was so massive as the fall of the Western Empire? There is more than one reason, but one is the lack of data. We have scant written material about the last centuries of the Empire and very little has arrived to us in terms of quantitative data. Things are changing, though. Modern archaeology is generating astonishing results telling us a lot about the mechanisms of the collapse of the ancient Empire. For instance, look at this graph: (from Sverdrup et al., 2013):

Recent data by McConnell et al on lead pollution provide a more detailed picture (See also Peter Turchin’s blog).

The beauty of having data is that we are not discussing any more of vague concepts such as the “lack of moral fiber,” a factor that was proposed as the cause of the fall. No, the data are there, stark clear. They show that, when the Roman Empire officially disappeared during the 5th century, it was already an empty shell. The actual collapse took place during the 3rd century, when the Roman economy ceased to function, as shown by the data on lead production – a proxy for the industrial activity of the Empire. Look at how abruptly the collapse was. It is a typical case of a “ Seneca Collapse,” when growth is slow but decline is rapid. A general phenomenon shown in the image below.

Now, the big question: the data tell us how the collapse took place, but why did it occur? Here, we face a problem typical of complex systems. These systems are dominated by the phenomenon called “feedback” which may strongly amplify the effects of a small, nearly undetectable perturbation. It is the story of the straw that broke the camel’s back: if you were to see the camel falling down, you wouldn’t notice the role of the straw. This is another reason for the proliferation of theories on the fall of the Roman Empire: people saw consequences and thought they were causes. For instance, it is tempting to say (and many people did) that the Roman Empire collapsed because it was overwhelmed by invading Barbarians. But that’s not the case: the Barbarians invaded an already weakened Roman Empire as the data clearly show us.

So, what was the straw that generated the economic collapse of the Empire? The most likely culprit is the debasing of the Roman denarius. As you can note in the figure by McConnell, above (look at the red dots), the content of silver in the denarius coin collapsed along the same trajectory followed by lead.

The Romans could surely survive without lead, but could they survive without the currency that made the whole system work? No money means that nobody can buy things. And if nobody buys, nobody sells. And if nobody sells, nobody produces. The collapse of the production of precious metals may very well the element we are looking for: the perturbation that broke the Empire’s back.

Of course, the debasing of the denarius was not a choice: it must have been a necessity. And the obvious factor may have been mineral depletion, provided that it is correctly understood. We have scant direct data on the production of the Roman mines, but we know that progressive depletion forced the Romans to go deeper and deeper into the veins of precious metals they were exploiting in Spain.

That required more and more expensive procedures and equipment. The mining system gradually became a terrible burden for the Roman economy and, eventually, something had to give. We don’t know exactly what broke the back of the Roman mining system – maybe a political crisis or the Antonine Plague (*) – but, in any case, by the end of the 2nd century AD, the mines were abandoned. The pumps ceased to function, the shafts were flooded with water, and the production of precious metals stopped. Without a constant supply precious metals, the Roman gold disappeared, used to buy luxury items from China. Without gold, the Roman economic system couldn’t work – at least not in the same way as before.

Note that depletion is not the same thing as “running out” of something. The Roman mines still contained some precious ore when they collapsed, it was just too expensive for the Romans to extract it. Only much later, during the 19th and early 20th century, the availability of modern technologies made it possible to restart exploiting these old mines. Note also how different is the case of lead: by the late Middle Ages, more lead was produced in the world than during the high times of the Roman Empire. Depletion was not an important factor in the decline of lead production.

So, you see how the Roman system went down in a cascade of effects that was originated by the depletion of their precious metal mines. It was slow and it wasn’t recognized by the Roman themselves, nor by modern historians. But it was unavoidable: no mine can last forever. It is what’s happening to us, today, with our “black gold,” petroleum. Depletion may well cause crude oil production to go through a “Seneca Collapse” not because we are running out of oil, but because extracting it is becoming progressively more expensive. A new perturbation, such as a regional war, could be the straw that breaks the oil industry’s back. And that could have devastating consequences on the modern empire we call “globalization”.

(*) Note that McConnell and the others cite the “ Antonine Plague” as the direct cause of the decline in lead production revealed in their data. This is most likely an oversimplification of a much more complex chain of events. In any case, the highest lead production was attained with a total population of some 45 million people. At the foot of the collapse curve, around 250 AD, the Empire had about 65 million inhabitants. The plague may have caused a temporary perturbation, but no long-lasting reduction of the Empire’s population (BTW, this is a behavior, reproduced by the models of “ The Limits to Growth” study for our society: the population starts declining much later than the industrial system.)

Teaser photo credit: (the sack of Rome by the Visigoths of King Alaric in 410 AD). |