re <<F*CKING F*CKS>>

... coming week might be good for metals

zerohedge.com

Jobs Shock: October Payrolls Huge Miss As Private Jobs Go Negative For First Time Since 2020

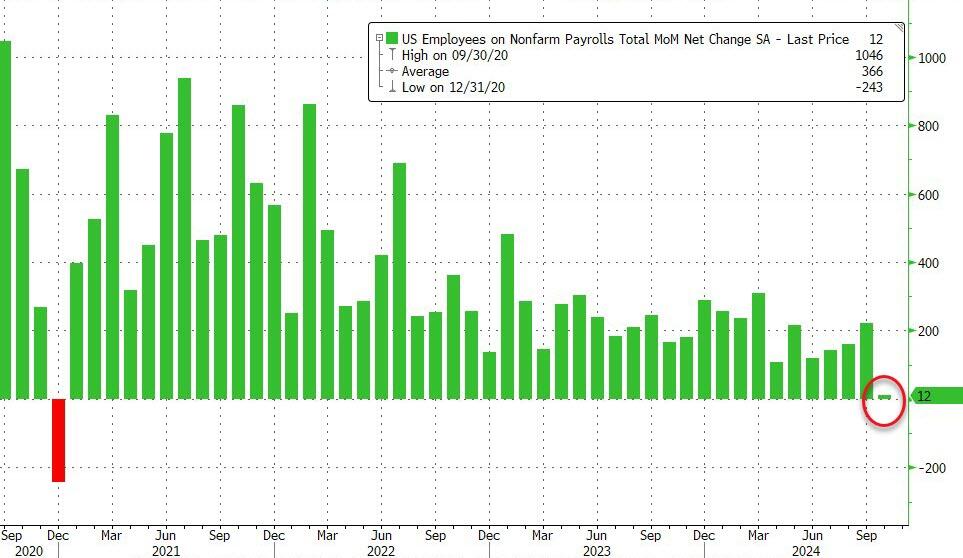

In our nonfarm payrolls preview last night, we said that the October payrolls report may show the first negative print since 2020. Well, moments ago the BLS reported the highly anticipated number and... it was close: the monthly print was only 12K, a huge drop from the pre-revision 254K in October (revised naturally lower to 223K), and just 13K away from a negative print.

[url=] [/url] [/url]

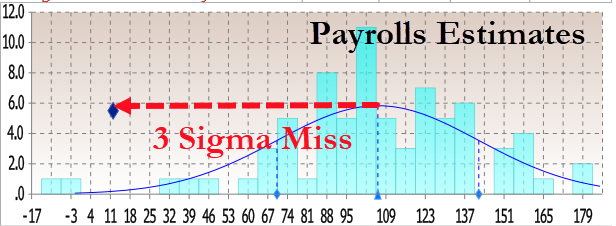

The print was so low it was only above the two lowest estimates (those of Bloomberg Econ for -10K and ABN Amr0 for a 0 print). That means it was a 3 sigma miss to estimates.

[url=] [/url] [/url]

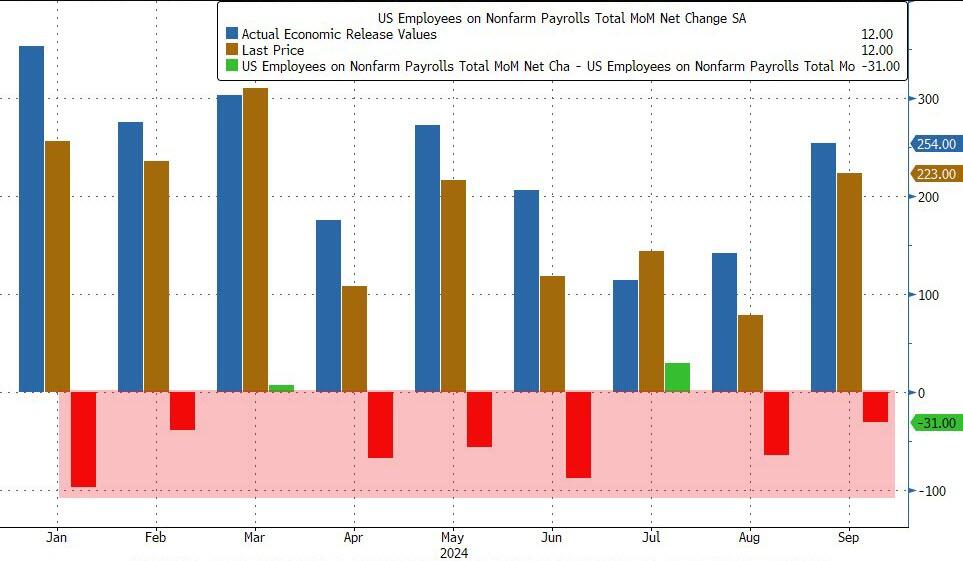

And of course, as has been the case for the entire Biden admin, previous months were revised sharply lower once again: August was revised down by 81,000, from +159,000 to +78,000, and September was revised down by 31,000, from +254,000 to +223,000. With these revisions, employment in August and September combined is 112,000 lower than previously reported. This means that even after the monster September revision when 818K jobs were removed, 7 of the past 9 months were again revised lower!

[url=] [/url] [/url]

This means that once the November jobs are released, we can be virtually certain that October will be revised to negative.

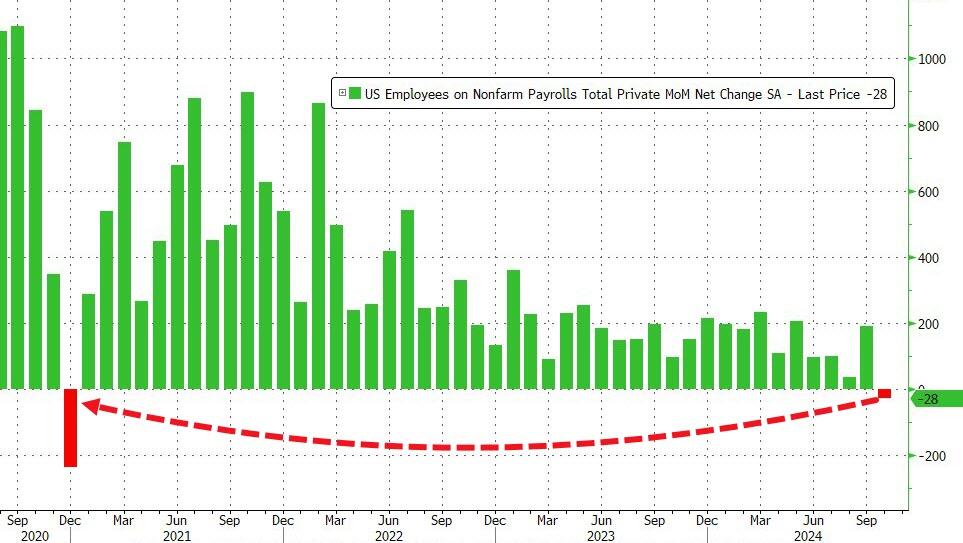

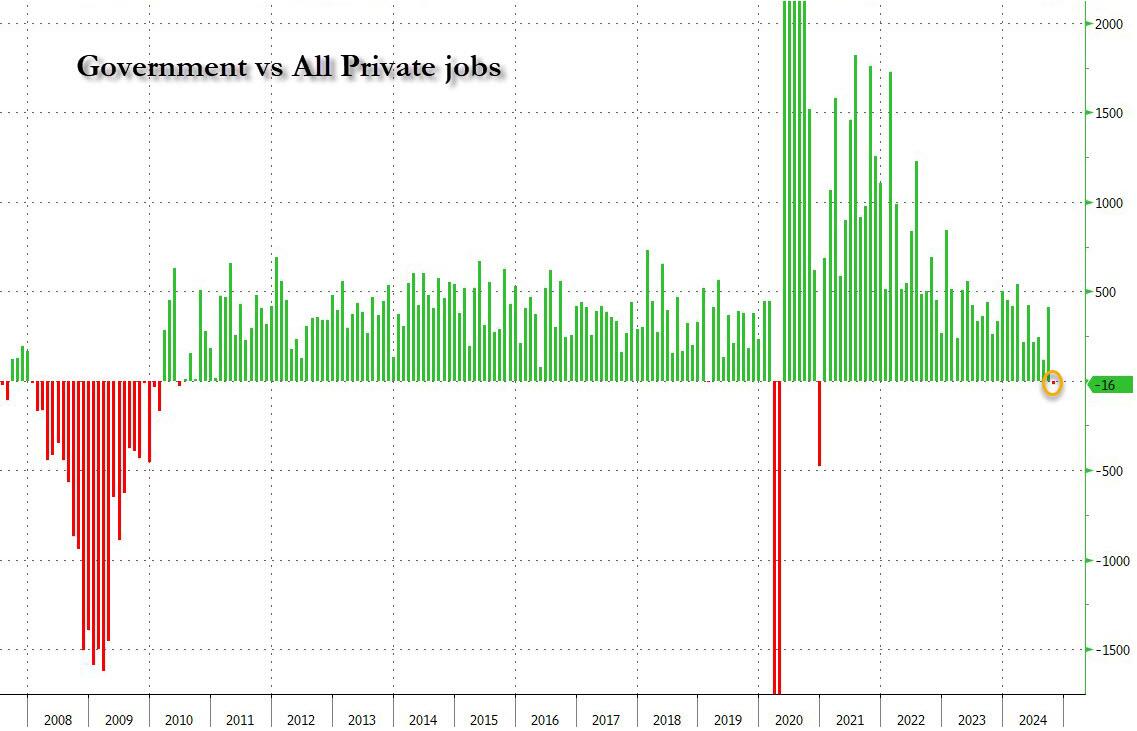

But wait, there's more because while the total payroll number was just barely positive, if one excludes the 40K government jobs, private payrolls was in fact negative to the tune of -28K, down from 223K pre-revision last month, and the first negative print since December 2020. In other words, we were right... when it comes to actual, non-parasite "government" jobs.

[url=] [/url] [/url]

To be sure, as we noted yesterday, a big part of the drop was due to the one-time event discussed, including the Boeing strike and Hurricanes Helene and Milton. This is what the BLS said on the topic: "In October, the household survey was conducted largely according to standard procedures, and response rates were within normal ranges" however, "the initial establishment survey collection rate for October was well below average. However, collection rates were similar in storm-affected areas and unaffected areas. A larger influence on the October collection rate for establishment data was the timing and length of the collection period. This period, which can range from 10 to 16 days, lasted 10 days in October and was completed several days before the end of the month."

More importantly, the BLS said that "it is likely that payroll employment estimates in some industries were affected by the hurricanes; however, it is not possible to quantify the net effect on the over-the-month change in national employment, hours, or earnings estimates because the establishment survey is not designed to isolate effects from extreme weather events. There was no discernible effect on the national unemployment rate from the household survey."

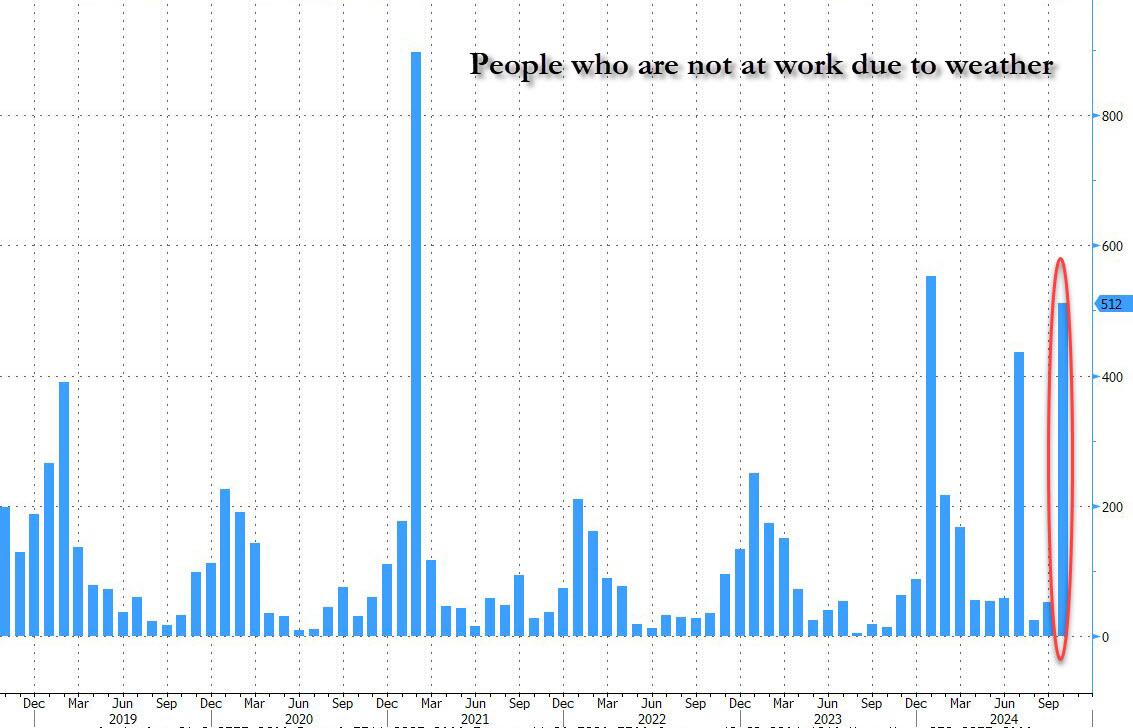

Ironically, while the BLS was unable to "quantify the net effect" from the hurricanes, it was able to calculate that the number of people not at work due to weather surged to the third highest in recent history, up 512K!

[url=] [/url] [/url]

In other words, the BLS now has an excuse to blame the plunge on, it just doesn't know how to quantify it. Translation: if Trump is president next month, expect the downtrend to continue with little to no mention of hurricane as the BLS prepares to admit the true state of the labor market; if however Kamala wins, the November jobs will magically rebound (even as downward revisions accelerate) and all shall be back to fake normal.

Oh, and of course, today's catastrophic jobs print gives the Fed a full carte blanche to again cut 25bps next week, even if the plunge was all hurricanes...

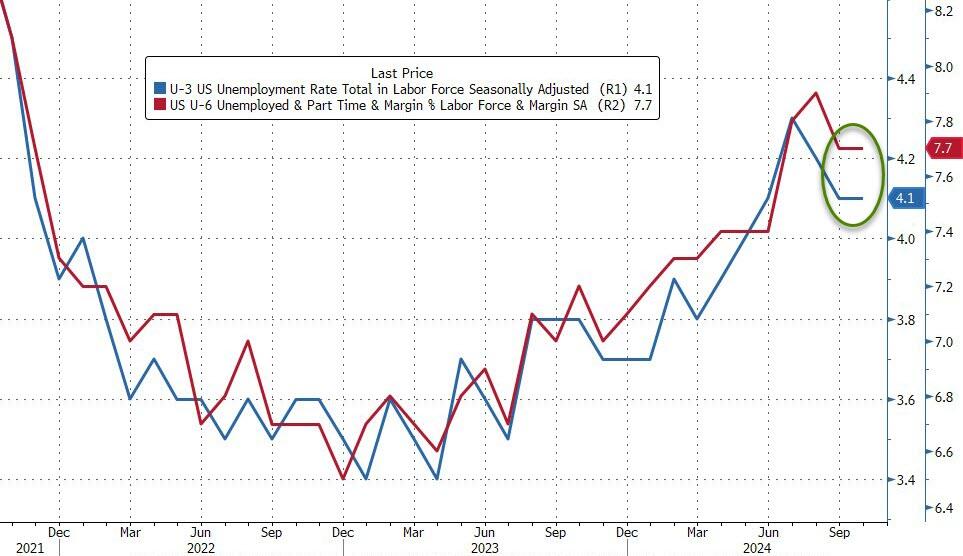

The rest of the jobs report was not that exciting: the unemployment rate printed at 4.1%, unchanged from last month and in line with expectations. The number of unemployed people was little changed at 7.0 million.

[url=] [/url] [/url]

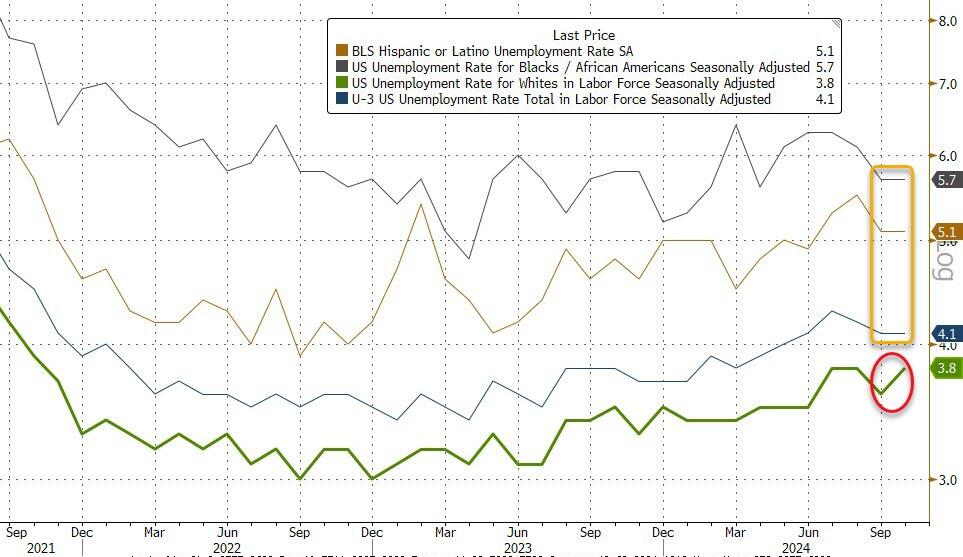

Among the major worker groups, the unemployment rates for adult men (3.9 percent), adult women (3.6 percent), teenagers (13.8 percent), Whites (3.8 percent), Blacks (5.7 percent), Asians (3.9 percent), and Hispanics (5.1 percent) showed little or no change over the month.

[url=] [/url] [/url]

It's worth noting that the unemployment rate actually rose almost 0.1% despite being reported as flat because in September it was 4.05% and in October it was 4.145%, and rose due to a surge in layoffs (+166K) as well as re-entrants (+108K). Additionally, as Southbay research notes, the average duration of unemployment rose from 22.6 weeks to 22.9 weeks

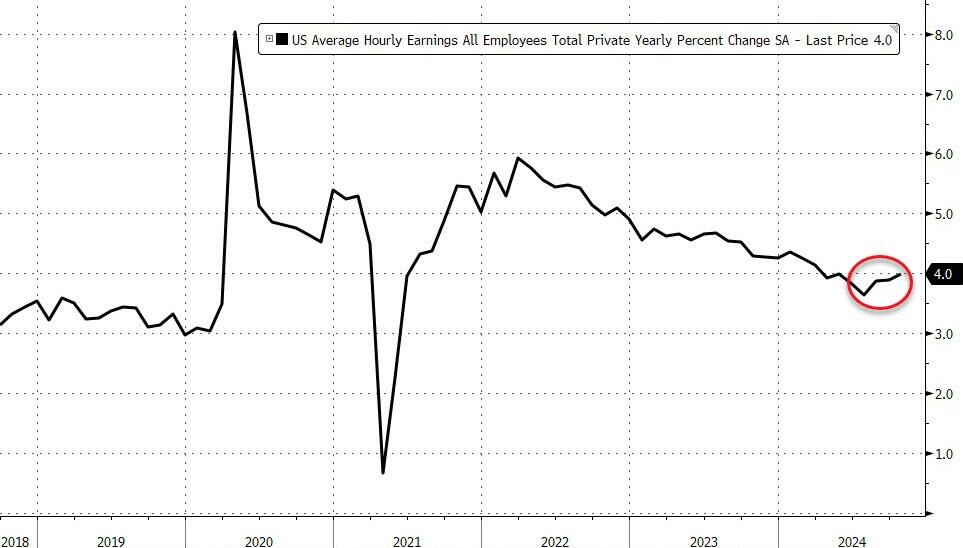

Wage growth came in slightly higher than expected, with average hourly earnings rising 0.4% in October, higher than the 0.3% expected, and up from the downward revised 0.3% in September (was 0.4%). On an annual basis, earnings rose 4.0%, in line with expectations, and above the downward revised 3.9% (was 4.0%).

[url=] [/url] [/url]

Some more stats from the latest monthly report:

- Among the unemployed, the number of permanent job losers edged up to 1.8 million in October. The number of people on temporary layoff changed little at 846,000.

- The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.6 million in October. This measure is up from 1.3 million a year earlier. In October, the long-term unemployed accounted for 22.9 percent of all unemployed people.

- Both the labor force participation rate, at 62.6 percent, and the employment-population ratio, at 60.0 percent, changed little in October.

- The number of people employed part time for economic reasons was little changed at 4.6 million in October.

- The number of people not in the labor force who currently want a job, at 5.7 million, was essentially unchanged in October. These individuals were not counted as unemployed because they were not actively looking for work during the 4 weeks preceding the survey or were unavailable to take a job.

- Among those not in the labor force who wanted a job, the number of people marginally attached to the labor force, at 1.6 million, was little changed in October. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, changed little at 379,000 in October.

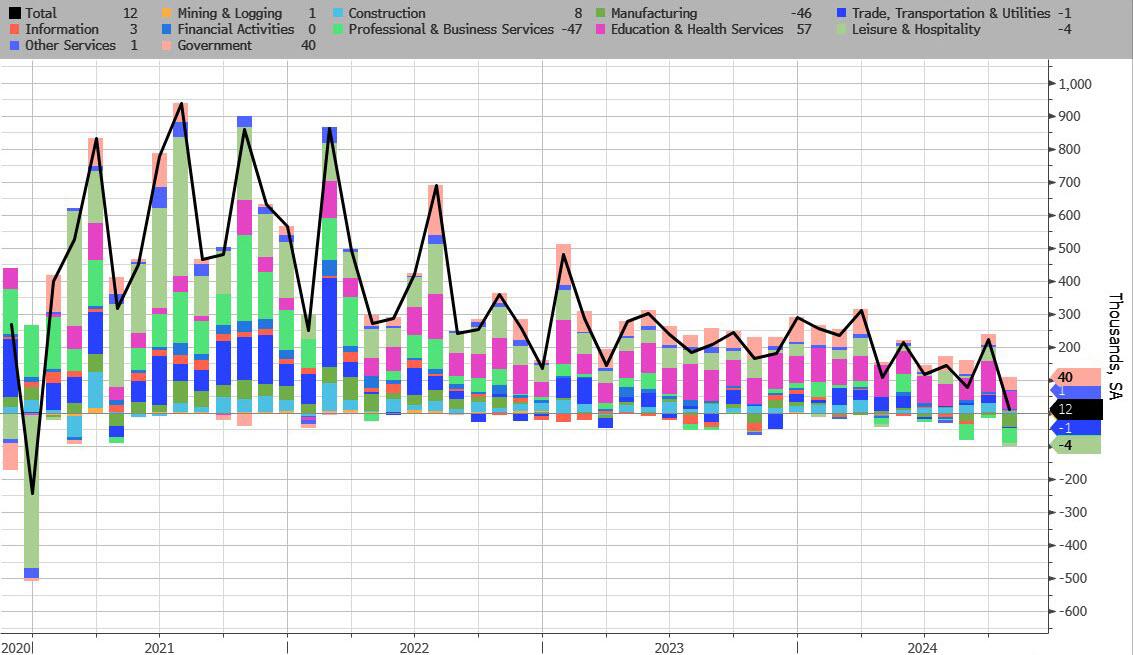

Turning to the establishment survey, we find the following breakdown in jobs:

- Health care added 52,000 jobs in October, in line with the average monthly gain of 58,000 over the prior 12 months. Over the month, employment rose in ambulatory health care services (+36,000) and nursing and residential care facilities (+9,000).

- Employment in government continued its upward trend in October (+40,000), similar to the average monthly gain of 43,000 over the prior 12 months. Over the month, employment continued to trend up in state government (+18,000).

- Within professional and business services, employment in temporary help services declined by 49,000 in October. Temporary help services employment has decreased by 577,000 since reaching a peak in March 2022.

- Manufacturing employment decreased by 46,000 in October, reflecting a decline of 44,000 in transportation equipment manufacturing that was largely due to strike activity.

- Employment in construction changed little in October (+8,000). The industry had added an average of 20,000 jobs per month over the prior 12 months. Over the month, nonresidential specialty trade contractors added 14,000 jobs.

And visually:

[url=] [/url] [/url]

Three things stick out here:

- First, manufacturing is a disaster, with the US losing manufacturing jobs for 3 months in a row, and 4 of the last 5. Can't blame that on hurricanes.

[url=] [/url] [/url]

- Second, the number of construction jobs is becoming absolutely ridiculous, especially when contrasted with the plunge in actual housing starts, completions and last but not least, actual job openings.

[url=] [/url] [/url]

- Finally, delta between government jobs and private jobs was a whopping 12K, the biggest since covid. This means that more government jobs were added in October than all private jobs lost in the month! Just in case you needed to know how the Biden admin avoided a negative total headline print.

[url=] [/url] [/url] |