>> … meant to earlier ask your opinion, will the Kamala or the Donald win make our gold go up higher faster?

Zerohedge opines from behind paywall, and gold pricing 2029 seems too tame

zerohedge.com

Where Will Gold Trade In 2029 Under A Trump vs Harris Administration

In a must read special report from DB's Michael Hsueh ( available here for pro subscribers), the commodities strategist takes a look at how the best performing asset of 2024 will fare in the next five years, assuming the status quo, but more importantly modeling a Trump vs Harris administration. The results are startling... and encouraging for gold bulls.

As Huseh notes, Gold's perceived safe haven quality means it can be an all-inclusive expression of anxiety about departures from the status quo. As such, gold's election reaction will be dominated by the disruptive breaks in trade, immigration and foreign policy indicated by former President Trump. From this, DB analyst says, it would follow the intuition that this tips the balance in favor of gold higher on a Trump victory (+2%%), and gold lower on a Harris victory (-2%). Then again, as Goldman also noted, Hsueh would expect a gold sell-off to be short-lived as Asian import and central bank demand would balance against speculative futures outflow.

Separately, Gold's positive response to higher federal debt growth is unambiguous, and it is hardly a secret that debt is going much, much higher. Some, such as DB, expect a higher trajectory of debt growth resulting from Trump budget plans, although budget scoring for a potential Harris administration also shows upside deviation from baseline. In other words, no matter who is in the White House, the US debt in 5 years will be much higher. That said, a Trump administration without import tariffs is the high outlier trajectory for the federal debt, implying a gold price of USD 4,150/oz at end-2029 compared with a baseline of USD 3,730/oz at end-2029.

On the other hand, in the context of trade policy, the potential for a USD higher response makes the gold impact ambiguous, along with the host of unknowns: the outcome of bilateral trade negotiation, and behavioral responses of importers, exporters, and consumers. An examination of the 2018-19 episode demonstrates the possibility of a gold decline, although this was partly influenced by the Fed hiking cycle.

For immigration policy, Trump would again represent a departure from the status quo, but here we get the significance of the Congressional makeup; without a Red sweep there would be greater scope for Congress to constrain deportation efforts.

Of course, there is always the possibility of a disputed result in a Harris victory but only as a footnote given the difficulty of handicapping outcomes in this scenario. Gallup polling on election accuracy and the possibility of voter fraud has shown an increasingly partisan split since 2016.

Let's take a closer look at these points starting with...

The federal debt load

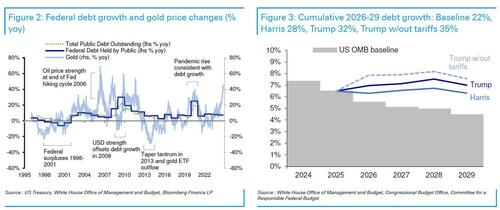

We start with government spending and the national debt, which under both candidates are expected to rise faster than baseline projections by the Congressional Budget Office (CBO) and the White House Office of Management and Budget (OMB). According to the revised construction of the financial fair value model as of April of this year ( Federal debt and gold fair value, 10 Apr 2024), this would have a direct and quantifiable impact on the long-term value of gold.

Instead of assuming a large fixed rate of nominal growth in the gold price, this model revision ties the bulk of gold's nominal growth rate to the growth in the federal debt. In fact, the model sensitivity to growth in the federal debt is almost exactly 1. As the model is constructed in growth terms, this means it holds a 1-to-1 relationship between nominal gold price change and federal debt growth. As a result, the model assigns a relatively small fixed rate of nominal growth in the gold price of 1.4% yoy, all else equal (in-sample period of 1998-2022).

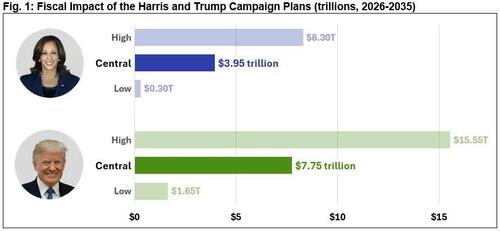

Trump v. Harris fiscal scoring

Working from the assessment performed by the Committee for a Responsible Federal Budget (CRFB), the federal budget under a potential Trump administration would incur its largest costs through the extension of some parts of the Tax Cuts & Jobs Act (TCJA) of 2017 (mainly individual and estate tax provisions), exempting overtime income from taxes, and ending taxation of Social Security benefits. The prospective budget would gain its greatest savings through baseline tariffs on foreign-made goods.

[url=] [/url] [/url]

For a potential Harris administration, the largest costs come from a TCJA extension, but those costs are smaller because the extension is limited to households making less than $400,000 per year. The second-largest cost comes from the expansion of the Child Tax Credit and Earned Income Tax Credit. The greatest savings come from an increase in the corporate tax rate from 21% to 28%, and increased taxes on capital gains and dividends.

The cumulative impact of these measures over the four budget years 2026 through 2029 as compared with the Office of Management and Budget (OMB) baseline is 7% for a potential Harris administration, 10% for a potential Trump administration,

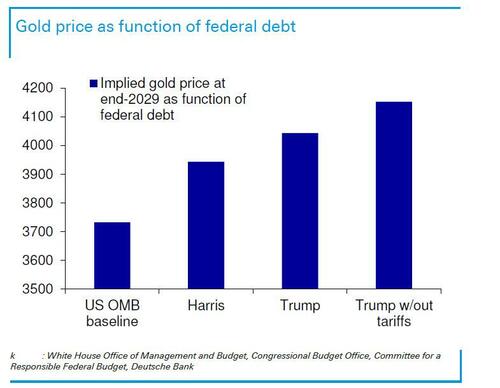

and 14% for a potential Trump administration without tariff revenue, Figure 3. Given the 1-for-1 gold model sensitivity to federal debt, this would imply the equivalent impacts for gold valuation at the end of 2029.

[url=] [/url] [/url]

Including the 1.4% annual fixed model increase in gold price, and benchmarking to a presumed end-2024 gold price of USD 2,700/oz, this would imply the following end-2029 gold prices (rounding to nearest USD 10/oz):

- Baseline: USD 3,730/oz (6.7% nominal CAGR)

- Harris: USD 3,940/oz (7.9% nominal CAGR)

- Trump: USD 4,040/oz (8.4% nominal CAGR)

- Trump w/out tariffs: USD 4,150/oz (9.0% nominal CAGR)

[url=] [/url] [/url]

Trade policy

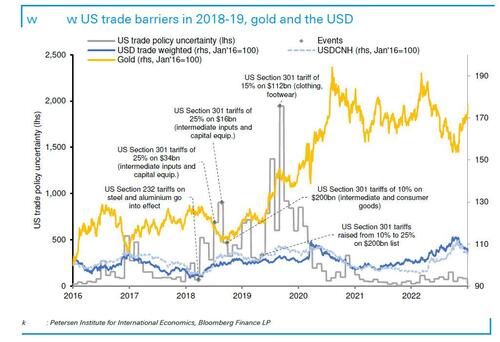

Trade policy arguably ranks first on the list in terms of importance but is ambiguous in its influence on gold, given a countervailing effect from the appreciation of the US dollar. Consider the following factors to be important:

- a) Inflation. New tariffs may be applied across the board to all countries under a Trump administration, with a higher rate tariff potentially placed on goods from China. Recent experience indicates that higher costs were largely passed on to US firms and consumers as average tariff rates on imports rose from 1.6% to 5.4%.

- b) USD gain. Academic research finds that currency changes partially offset the increase in tariffs. This comes as domestic producers are able to raise goods prices, and the central bank choosing a tighter monetary policy setting than would otherwise have been the case.

- c) Safe assets. A rise in the value of perceived safe assets, including the US dollar and gold, would be driven by the increase in trade policy uncertainty. This point recognises that although tariffs were the most visible policy outcome in 2018-19, the period of negotiations and disputes meant that "it became increasingly difficult to infer the possible future path of policy actions."

While (c) is clearly positive for gold, the combination of (a) and (b) is ambiguous because the balance between the two depends on the degree to which (a) influences monetary policy and rates. A tenuous link from (a) to (b) involving the policymakers' tendency to look through one-time shocks is the environment in which gold excels, while a pre-emptive and forceful policy response could even lean negative for gold.

Looking back at the episode of 2018-2019 underscores the potential for ambiguity in gold prices. We see that gold was not insensitive to the USD, initially falling through the first stages of the tariff war in 2018 as the trade-weighted USD rose by 5%. This was coincident with USD rates rising from #3 to #1 in G10 3m rate ranking, and the Fed partway through a hiking cycle. However, as USD gains slowed in late 2018, gold began to recover, then rising beyond its 2018 starting level in early 2019.

[url=] [/url] [/url]

Immigration policy

On immigration policy, former President Trump's platform would represent another gold-positive disruption to the status quo. DB thinks that this may even outweigh inflation concerns, since deportations would reduce both demand and supply. It is worth noting that immigration policy and deportations rank #1 and #2 on the Trump policy platform. Tariffs, on the other hand, do not actually appear. To facilitate deportations, former President Trump has cited the Alien Enemies Act of 1798. This law provides for the removal of 'alien enemies', but has only previously been used during times of war. The letter of the law requires the precondition of a declared war, invasion, or predatory incursion by a foreign nation or government.

There are two points to make. First, critics of deportation may argue for executive overreach. This means that there is a distinction from the tariff issue in that the legislative branch may have a balancing role to play. Under a Red sweep, Congress would presumably yield to a potential President Trump's immigration agenda. But with a divided Congress, there would be greater likelihood of Congress stepping in to temper executive power, possibly through a repeal of the Act, according to the Brennan Center for Justice.

Second, if deportations did occur under the act, it would likely be a slow process since the law provides for a "full examination and hearing" in US courts prior to removal. The law also allows for reasonable to settle affairs and depart.

Foreign policy

DB sees another clear divide that favors gold on foreign policy under a Trump victory. Former President Trump's public statements indicate a different approach on foreign policy as compared with the status quo which characterises Vice President Harris's approach. Key differences include former President Trump's proposed halt to US aid to Ukraine, a skeptical approach to NATO including doubts cast on the US commitment to the collective defense clause, and a reduction of US involvement in NATO.

- On China, while Harris shares many of the same concerns on forced technology transfer and US technology exports, she has suggested that the US should 'de-risk', not decouple from China and that the two countries should "maintain open lines of communication to responsibly manage the competition between our countries" according to the Council on Foreign Relations. Also relevant to China is that the Trump administration in 2020 had rejected China territorial claims in the South China Sea.

- On Iran, Trump has historically held a more antagonistic stance, withdrawing from the JCPOA nuclear deal in 2018 and reimposing sanctions on Iran crude oil, lowering production and exports by nearly 2 mmb/d between 2018 and 2020. With Iran crude oil exports having risen again since 2022, former President Trump may favour a tightening of sanctions enforcement. Harris would likely favor a different approach; in 2018, she criticised the US withdrawal from the JCPOA in 2018 as 'reckless', and spoke in 2019 of rejoining the JCPOA, "an agreement that was verifiably preventing Iran from obtaining a nuclear weapon."

- On Ukraine, former President Trump has criticized the scale of US security assistance, implying that he would seek an end to US aid if he were elected, and has asserted that he would quickly arrange a negotiated end to the war. By contrast, Vice President Harris would likely to continue to provide aid to Ukraine and has promised to "stand strong with Ukraine and our NATO allies."

Post-election dispute

In Gallup polling, the partisan split on confidence in the accuracy of the presidential election has widened to the largest since at least 200410 . Republicans' confidence has steadily fallen from 55% in 2016 to 28% in 2024, while Democrats' confidence has remained steady near 84%. A similar partisan split is seen in the expectations of election-related problems. On illegal or fraudulent voting, more Republicans expect problems, while on refusal to concede, vastly more Democrats expect problems. Therefore, for gold there must be a tail risk accorded in the event of a Vice President Harris victory, a disputed result, and potential post-election period of extended vote counting to settle the dispute.

Gold rally enhanced by Trump, interrupted by Harris

In short, DB thinks gold's first reaction to the election result will be positive on a Trump victory primarily as a function of greater uncertainties attached to policy departures from the status quo, aided by more elevated federal debt growth and likely ignoring the complexities of the tariff impact on gold. On the other hand, a Harris victory would imply a shrinkage of risk premium, but expect any selloff in gold to be short-lived as Asian import and central bank demand would balance against speculative futures outflow. |