>> THE F*CKING F*CKS

OMG! ... from behind paywall, super duper news re gold bull

zerohedge.com

China Secretly Buying Up Massive Amounts Of Gold, 10x More Than Officially Reported: Goldman

BY TYLER DURDEN

WEDNESDAY, DEC 18, 2024 - 09:30 AM

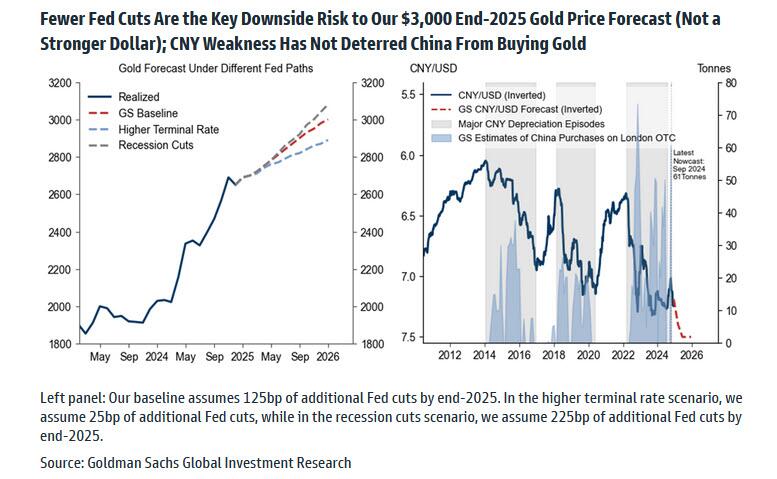

One month ago, with goal sprinting to daily record highs, Goldman's precious metal analyst Lina Thomas made the case that gold will rise by the end of 2025 to $3,000 as a result of relentless central bank purchases in general, and thanks to China's ravenous appetite for gold in particular. The bank promptly got pushback on this thesis, with skeptics countering that it is unlikely that gold will manage to keep its ascent at the same time as the dollar rises to new record highs, one of the largest consensus Trump trades.

In response, Thomas has also pushed back, and in a note ( available to pro subs) writes that she disagrees with the argument that "gold cannot rally to $3,000/toz by end-2025 in a world where the dollar stays stronger for longer", for four reasons:

- First, Goldman economists expect both Fed cuts and a strong dollar in a global monetary easing cycle, but it will be US policy rate that drives investor gold demand, with no significant additional role for the dollar. In the bank's base case, it sees a boost from 100bps of Fed cuts to end-2025 gold price of 7%, but estimate that gold would rise to just $2,890/toz if the Fed cuts only one more time (which looks increasingly likely). - Second, Thomas disagrees with the view that dollar strength will halt structurally higher central bank purchases (which boosts the end-2025 gold price by 9% in her base case) because central banks tend to buy gold internationally from their dollar reserves. In fact, the large central bank buyers tend to raise their gold demand amid local currency weakness to boost confidence in their currency. - Third, the tendency for the dollar and gold prices to rise with uncertainty supports their roles as portfolio hedges, including against tariff escalation. - Finally, the yuan depreciation and broader easing that Goldman economists expect should have a roughly neutral net effect on China's retail gold demand, as the gold demand boost from lower China rates roughly offsets the hit from higher local gold prices. Putting it all together (the full Goldman note can be found here, available for pro subs), the big downside risks to Goldman's bullish thesis are not that the dollar rises, but rather that the Fed cuts rates less than expected (as the rate cuts trigger much more inflation, which in turn will lead to even higher gold prices down the line).

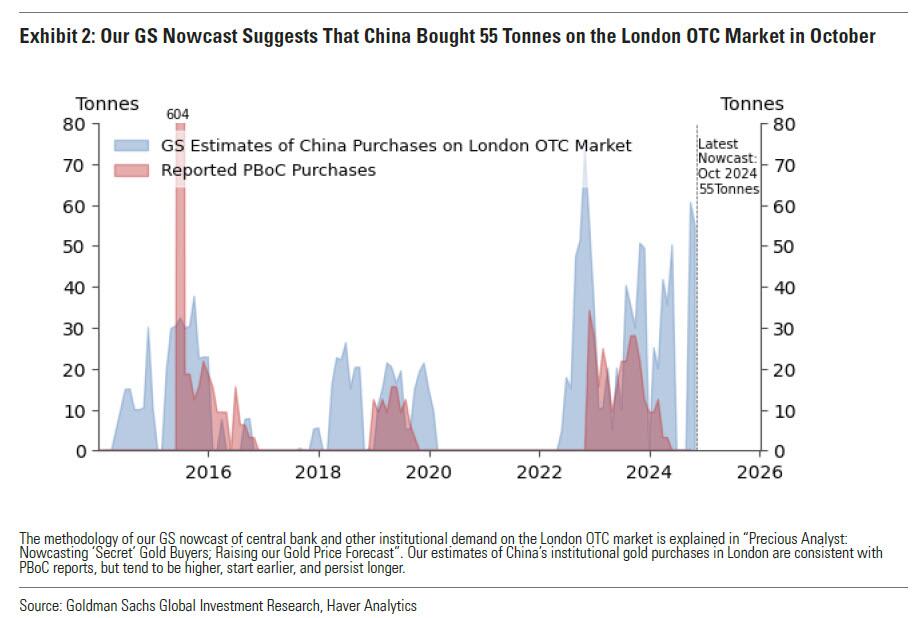

And while we wait for the thesis to play out, one aspect of the Goldman forecast is already playing out: according to the bank nowcast of central bank and other institutional gold buying on the London OTC market ( report available here to pro subs), October saw central banks buy a whopping 64 tonnes in October (vs. pre-2022 average of 17 tonnes), with China once again the largest buyer adding 55 tonnes, which is striking since the official number reported by the PBOC was one-tenth that, or just 5 tonnes. In other words, China is secretly buying up ~10x more gold than it admits (again, read the Goldman report here for pro subs).

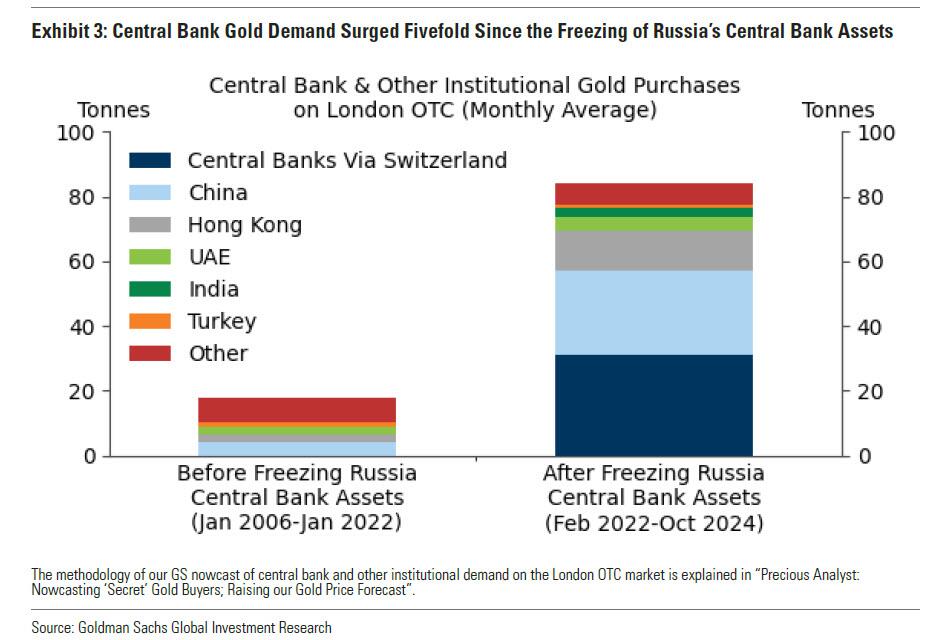

Commenting on the surge in purchases, the Goldman analyst writes that "surveys and history suggest that EM central banks buy gold as a hedge against financial and geopolitical shocks" and adds that "central bank purchases will remain elevated because fears about geopolitical shocks have structurally risen since the freezing of Russian reserves in 2022, and because relatively low gold shares in EM central banks reserves vs. DMs leaves room for growth." In fact, 81% of the central banks surveyed by the World Gold Council expect global central bank gold holdings to rise over the next 12 months, with none anticipating a decline.

Below we excerpt from the Q&A in the latest Goldman nowcast report ( available here to pro subs):

Q1: How much gold have central banks purchased in October on the London OTC market?

The Goldman nowcast of central bank and other institutional gold demand on the London OTC market -- where the majority of these purchases happen -- came in strong at 64 tonnes in October, well above the bank's 47 tonnes assumption. China was again the largest buyer, adding 55 tonnes, followed by Azerbaijan (including the State Oil Fund of the Republic of Azerbaijan) and the UAE with 3 tonnes each.

What is far more striking is the staggering (and growing) divergence between the modest amounts of gold purchases reported by the PBOC and the far greater amount China has actually purchased on the London OTC market, in a clear attempt to mask its staggering demand for the precious metal, and be extension, its diversification away from the dollar.

* * *

Q2: Why are central banks now buying so much gold?

Goldman writes that surveys and history show that emerging market central banks buy gold as a hedge against financial and geopolitical shocks, and fears about geopolitical shocks have structurally risen since the freezing of Russian reserves in 2022, just as we first noted years ago.

Based on an index of US financial sanctions and US credit default swaps (CDS) spreads, Goldman found that fears of geopolitical shocks and fears of shocks to US sovereign debt or the financial system explain central bank gold buying well. Statements from reserve managers further reinforce this view.

On the financial front, many EM central banks have sought to diversify their reserves since the global financial crisis, viewing gold as a financial hedge. To illustrate, the Chinese Prime Minister voiced concerns in 2009 about China’s US investments: "We have lent a huge amount of money to the US. Of course, we are concerned about the safety of our assets." Subsequently, the PBoC head proposed a shift from the dollar as a reserve currency, and official China gold reserves have more than tripled since 2008.

On the geopolitical front, sanctions and especially freezing of central bank assets have played a pivotal role. The first round of sanctions on Russia in 2014 led to a gold reserve buildup as the Central Bank of Russia anticipated scenarios similar to those in Libya and Iran, with a member of the board of governors noting that gold cannot be ‘arrested or frozen’. However, the 2022 freezing of Russia's Central Banks' assets marked a clear turning point, leading many EM central banks to re-think what is risk-free. After the freeze, central bank and other institutional purchases on the London OTC market surged fivefold. In China, prominent economists have stressed the need to diversify FX reserves to mitigate potential US sanctions. In 2022, Yu Yongding, a former PBoC monetary policy committee member, called for diversification to preempt possible asset seizure. Zhang Ming, Deputy Director at the Chinese Academy of Social Sciences' Institute of Finance and Banking, urged in November this year to 'address the financial risks associated with possible future sanctions from the US,' reflecting Beijing's concerns about safeguarding reserves under a new US administration, according to the South China Morning Post.

Q3: Will central banks continue to accumulate gold?

Yes! Even if Russia’s central bank assets were to be unfrozen, the 2022 freeze precedent has reshaped how central banks view tail risks (thanks to Joe Biden's incompetent handlers). Moreover, China and other EM central banks tend to hold relatively small shares of their reserves in reported gold compared to their developed market counterparts, leaving significant room for growth. Here Goldman notes that the build up is likely to be gradual: "as the then deputy governor of the PBOC acknowledged already in 2013, the gold market is too small to absorb a large-scale buildup without significant price disruptions." While developed markets like the US, France, Germany, and Italy hold about 70% of their reserves in gold, China — the world’s second-largest economy — reports just 5% (but the real number is likely far greater).

According to the 2024 WGC survey, 81% of 69 central banks surveyed between February and April 2024 expect global central bank gold holdings to rise over the next 12 months, with none anticipating a decline. For their own reserves, 29% of respondents planned to increase gold holdings, the highest proportion since the start of the survey in 2018.

* * *

Q4: What are the implications of the strong GS central bank nowcast for your $3,000/toz end-2025 gold forecast?

As noted above, Goldman sees two-sided risks to its gold forecast of $3,000/toz by end-2025 with downside risk from a higher federal funds rate relative to the base case, but some upside risk from firmer central bank purchases. In particular, if the Goldman nowcast were to consistently come in 10 tonnes stronger each month than currently forecasted, gold could see $50 (or more) upside to Goldman's end-2025 gold price forecast, rising to $3,050/toz (vs. $3,000/toz in baseline). Conversely, if the Fed’s terminal rate were 100bp higher than Goldman economists’ 3¼-3½% base case, meaning that it would only cut one more time, the end-2025 gold price would be approximately $100 lower than our current forecast. |