love it, either a rug-pull or a to-the-moon, do not know about use-case, but should not matter

it being zerohedge.com

Trump Unveils "Official" MemeCoin Late Friday; 12 Hours Later It Is Up 16,000% To $30 Billion

BY TYLER DURDEN

SUNDAY, JAN 19, 2025 - 11:30 AM

Just hours after Gary Gensler left the SEC headquarter for the last time in his life...

... Trump showed the world what an outsized role crypto, and certainly memecoins, will have in his administration.

After nearly a year of frenzied speculation which of the dozens of Trump-linked memecoins the 47th president will pick as his own, just before 10pm ET on Friday night - and just two days before his inauguration as the 47th president of the United States - Trump stunned the world when he unveiled on his Truth Social and X accounts, his “official” meme coin, TRUMP...

... which in the 12 hours since its unveiling has surged to a $30 billion market capitalization, roughly three times bigger than Trump's other momentum chasing venture, DJT (whose market cap is $8.7 billion and has roughly the same amount of revenue or cash flow as the meme coin) as part of an exponential move that has seen its market cap rise (and occasionally fall) by a billion dollars every few minutes.

“My NEW Official Trump Meme is HERE! It’s time to celebrate everything we stand for: WINNING! Join my very special Trump Community. GET YOUR $TRUMP NOW,” Trump wrote on his social media platform.

The token started trading at an opening price of $0.1824, but within 12 hours had jumped over 15,000%, trading at roughly $30 as of 10:00am ET, 12 hours after its launch. Its market cap stood at ~$30 billion at the time.

[url=] [/url] [/url]

Initially, the crypto community initially voiced concerns about the token’s legitimacy, with some warning of a possible hack or social engineering scheme. According to blockchain engineer cygaar, the project’s official website mirrors those of Trump’s previous NFT collections and suggested that “either this is the greatest cyber heist of all time, or this is legitimate.”However, as Trump’s posts remained online, and with Polymarket data suggesting only a 10% chance of account compromise, skepticism began to subside, pushing the price of the token further up.

The token’s explosive growth has also drawn concerns regarding its allocation.

“80% of the token supply is locked in a multisignature wallet, amounting to $3 billion controlled by the creator, who also added $40 million in liquidity,” Conor Grogan, head of product business operations at Coinbase, said in a post on X, adding that the project was seeded with millions of dollars of funds from Binance and Gate, two exchanges that don’t serve US customers. Other analysts noted that 80% of the token’s circulating supply is allocated to Fight Fight Fight LLC and CIC Digital LLC, entities linked to the Trump Organization, with only 20% of the supply split equally between public investors and liquidity.

While Trump controls the vast majority of the tokens, they remain locked which means the US president is unlikely to "rug" millions of his most ardent fans... at least for now.

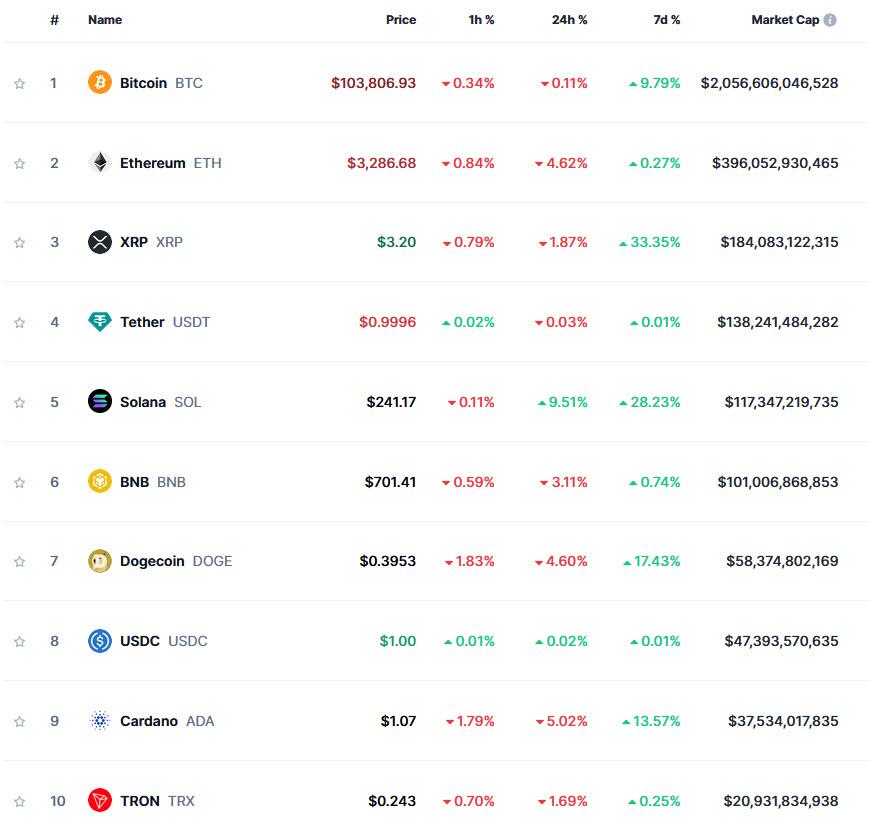

Meanwhile, amid the panicked buying frenzy, the market value of the token is now $30BN, meaning it has surpassed such veteran cryptocurrencies as TRON, Avalanche, Chainlink and Shiba Inu.

[url=] [/url] [/url]

Separately, while the Solana-linked memecoin has pushed the market cap of Solana - a cryptocurrency conceived with the purpose of create such shitcoin pump and dump schemes - to a record $118 billion, there has been an offsetting drain in the price of Ethereum, which has served as the primary source of liquidity, and whose market cap has dropped by 5% overnight, losing about $240BN in value.

[url=] [/url] [/url]

TRUMP's launch comes as the president-elect continues to align himself with cryptocurrency initiatives. Once an outspoken crypto-skeptic, he made a U-turn during his election campaign and pledged to reshape the US cryptocurrency landscape to make the country the “crypto capital of the planet.” Paul Atkins, Trump’s pick to chair the Securities and Exchange Commission (SEC), is expected to spearhead these efforts. A known crypto advocate and former SEC commissioner, Atkins will replace Gary Gensler, who has been criticized for his crackdown on the industry.

Finally, while many are delighted to jump on board of the biggest momentum trade in history which is eclipsing even such social media phenomena as Gamestop and AMC, some such as Bloomberg ETF guru are voicing skepticism that this particular foray by Trump "seems exploitative" and is an "unforced error in the making".

Whether he is right or not will depend on how long before this particular bubble bursts. |