re <<we are all so fucked>>

from behind paywall ... whatever it all might and does mean should be something really good

zerohedge.com

Trump To Unveil Reciprocal Tariffs In Hours: Here's What They Will Look Like And Who Will Be The Biggest Losers

BY TYLER DURDEN

THURSDAY, FEB 13, 2025 - 12:25 PM

Two days ago, Trump's 25% steel and aluminum tariffs targeting everyone - but mostly Canada - went into effect ( our full analysis here), and according to media reports, the next iteration of Trump's trade war - reciprocal tariffs - could be announced in just a few hours.

According to Reuters, Trump could impose reciprocal tariffs as soon as Wednesday evening on every country that charges duties on U.S. imports, in a move that ratchets up fears of a widening global trade war and which, some claim, could accelerate inflation.

"I may do it later on or I may do it tomorrow morning, but we'll be signing reciprocal tariffs," Trump told reporters at the White House.

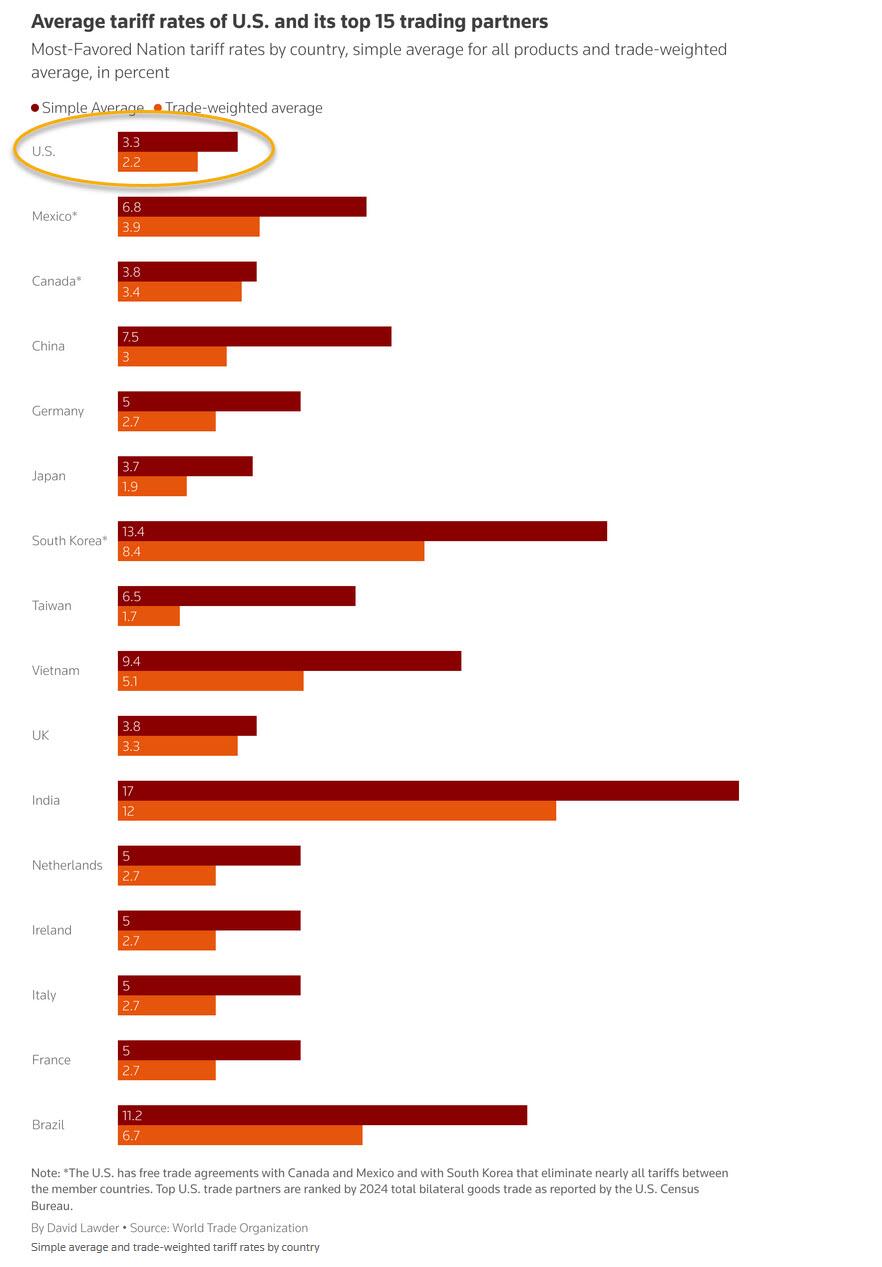

Trump's latest round of market-rattling tariffs comes as Indian Prime Minister Narendra Modi is due to visit the White House on Thursday. The Trump administration has complained that India has high tariffs that lock out U.S. imports, and judging by the following chart showing average tariff rates across most developed nations, Trump is right again.

Republican U.S. House of Representatives Speaker Mike Johnson said that he believed Trump is considering exemptions that would include the automotive and pharmaceutical industries, among others, but said he was not certain.

Meanwhile, EU officials signaled they would prioritize negotiations over retaliatory countermeasures to avoid a damaging trade war, although an EU government official said ministers considered reinstating countermeasures imposed in 2018 on products like bourbon and Harley-Davidson in response to Trump's tariffs on steel and aluminum.

Bottom line, nobody really knows what will happen, especially since Trump changes his mind several times each day. And even if he didn't, where does one start to analyze the various aspects of this thorny issue?

We split this post into two parts: the first one looks at what precisely Trump's reciprocal tariffs will look like, and the second one analyzes who the biggest losers will be.

* * *

Starting with the first, and courtesy of Goldman's top political economist, Alec Phillips, we excerpt from a primer ( full note available to pro subscribers) of what to expect in the coming hours.

President Trump has indicated that he plans to announce “reciprocal tariffs” in coming days (likely Feb. 11 or 12), which would raise the US tariff on imports to the same level that the exporting country imposes on US products (it is safe to assume US tariffs would not decline to match lower foreign tariffs). If applied at the product-specific level (e.g., the US tariff on cars from the EU would equal the same rate the EU applies on cars from the US), the US weighted average tariff rate might rise by around 2%. If applied at the country level, the effect could be smaller.

The risk scenario related to reciprocal tariffs is that the Trump administration could attempt to equalize non-tariff barriers (NTBs) to trade. These are difficult to quantify but could result in a greater increase. The main risk is that the Trump administration could consider value-added taxes (VATs) in the calculation, which would raise the average effective tariff rate by 10% further. However, while President Trump has criticized VATs in some countries, there is no indication at this point that the reciprocal tariff policy he plans to announce would include VATs in the calculation.

It seems possible that President Trump might take a hybrid approach that is primarily at the country level but includes some product-specific tariff equalization. For example, it seems likely that a reciprocal tariff would equalize auto tariffs—this would be aimed mainly at the EU, which has a 10% tariff on cars—even if it does not try to equalize every product-level tariff (our baseline tariff assumptions assume new US tariffs on EU autos).

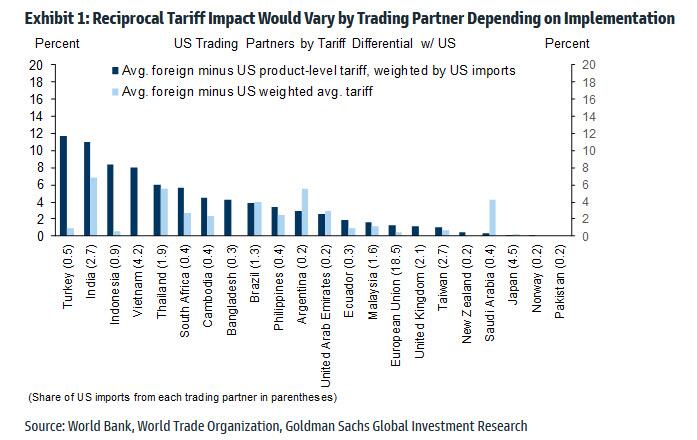

The chart below shows two measures the Trump administration might consider if it adopts a reciprocal tariff plan. The first series (dark blue) shows the difference between a country's tariff rate and the US tariff rate at the 6-digit product level, weighted by US imports in each product category. If foreign product-specific tariffs were used to set US tariffs on individual products from that country, this is the average tariff increase that would occur for each trading partner. The second series (light blue) shows the difference between a country's average tariff rate on imports from the US and the US rate on imports from that country.

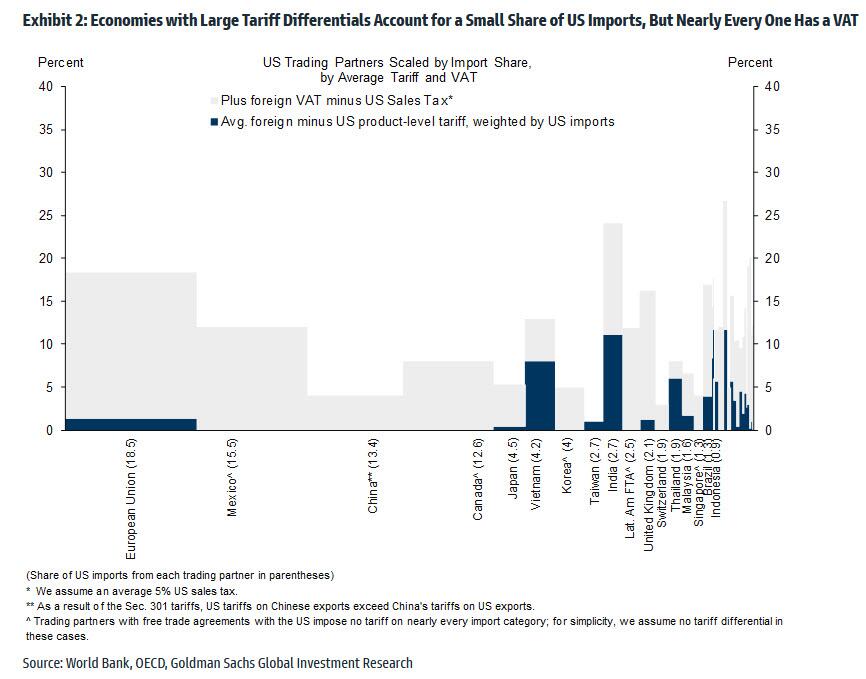

While some countries could face tariff increases of over 10%, most account for a small share of US import volume. Exhibit 2 shows the same product-level tariff differential from Exhibit 1, sized by US import share. A substantial portion of US imports would face no additional tariff under a reciprocal tariff plan, assuming that it does not impose further tariffs on imports from China, where the average US tariff rate already exceeds the average Chinese tariff rate following several rounds of Sec. 301 tariffs.

Exhibit 2 also shows the amount that each country's VAT exceeds the US sales tax. To be clear, VATs are roughly equivalent to sales taxes and apply to imports and domestically produced goods, and there is no reason a reciprocal tariff policy should include VATs in the calculation. However, President Trump and some of his advisors have criticized VATs in the past. If a reciprocal tariff policy also accounted for foreign VATs, it could add another 10% to the average US effective tariff rate.

It is unclear what authority President Trump would rely on to impose these tariffs. Until now, Trump had endorsed the Reciprocal Trade Act, a new version of which was recently introduced in Congress, but he had not alluded to unilateral action on reciprocal tariffs. That said, the Trump administration appears to take an expansive view of the president’s authority to impose tariffs under the International Emergency Economic Powers Act (IEEPA), which Trump relied on to impose tariffs recently on imports from China (and proposed but delayed tariffs on Canada and Mexico). It is possible that Trump might envision using that authority again.

Alternatively, he might rely on a never-used law, Sec. 338 of the Tariff Act of 1930, that allows the president to impose higher tariffs (up to 50%) on a product if a trading partner discriminates against US exports. While this law seems to contemplate policies that discriminate against US products relative to other countries (e.g., a higher tariff on US products than its standard rate) any country that has a free trade agreement with non-US trading partner might meet the criteria.

Neither law requires a formal investigation so the Trump administration could theoretically move to increase tariffs quickly. However, even the simpler country-level approach could take longer to implement than the few days between Trump’s announcement of tariffs on Canada, China, and Mexico and their scheduled implementation. Product-level reciprocal tariffs, particularly if they included the estimated effect of non-tariff barriers, would likely take longer to implement.

While reciprocal tariffs would increase US prices, there are two possible silver linings to this development.

- First, Trump’s comments on Feb. 7 suggest that he appears to envision these tariffs as an alternative to an across-the-board tariff: “reciprocal tariffs where a country pays so much or charges us so much, and we do the same, so very reciprocal because I think that's the only fair way to do it that way nobody's hurt. They charge us, we charge them. It's the same thing, and I seem to be going in that line as opposed to a flat fee tariff.” To the extent that this actually represents an alternative to an across-the-board tariff, it would lower the odds of a substantial tariff rise (e.g., a 10% or 20% universal tariff) as US tariffs would rise only to the existing level of foreign tariffs if there is no foreign retaliation.

- Second, a reciprocal tariff could potentially lead to lower tariffs on US exports over time, and commensurate reductions in US tariffs. For example, the EU already seems to be readying a proposal to reduce its auto tariff rate, likely because of an expected rise in the US tariff on EU autos (or overall tariff rise on imports from the EU).

While there are potentially positive aspects of this latest shift in trade policy, there are still clear risks. The Trump administration might take a broad view of non-tariff barriers and include other countries’ VATs, which could lead to a much greater tariff hike and would be much less likely to lead to eventual foreign tariff reduction, even if there was a general desire to respond to the new US policy. More generally, while a reciprocal tariff approach seems incompatible with an across-the-board tariff and Trump seems to be envisioning it as alternative, there is no guarantee that he might not still opt for a broader tariff later on.

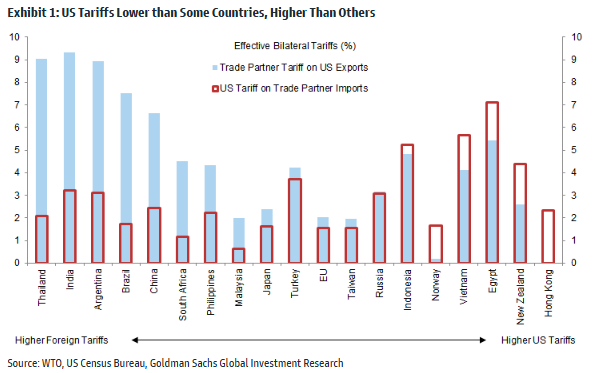

Separately, an illustration from a piece Goldman wrote in 2018 when the issue of reciprocal tariffs was also topical, shows that the gaps for Asian countries are generally still intact when compared with recent data from the WITS database. The two standout gaps in Asia are vs Thailand, India.

Meanwhile, Goldman continues to expect tariffs on "critical imports" and President Trump took a step in this direction on Feb. 10 in rescinding prior exclusions to the 2018 tariffs on steel (25%) and aluminum (10%) and raising the aluminum tariff to 25%. This change affects roughly $50bn worth of imports, most of which were excluded from the prior tariff, and that these changes will raise the US average effective tariff rate by around 0.4pp and should add around 4bps to core prices.

* * *

Next, we look at which countries would be impacted the most from reciprocal tariffs. For the answer we excerpt from a recent report ( also available to pro subs) by Deutsche Bank's chief FX strategist George Saravelos.

According to Saravelos, the bottom line is that the impact varies widely depending on how reciprocity is defined. Moreover, whether any announcements this week are presented as the opening or closing salvo of a global tariff approach will be of material importance.

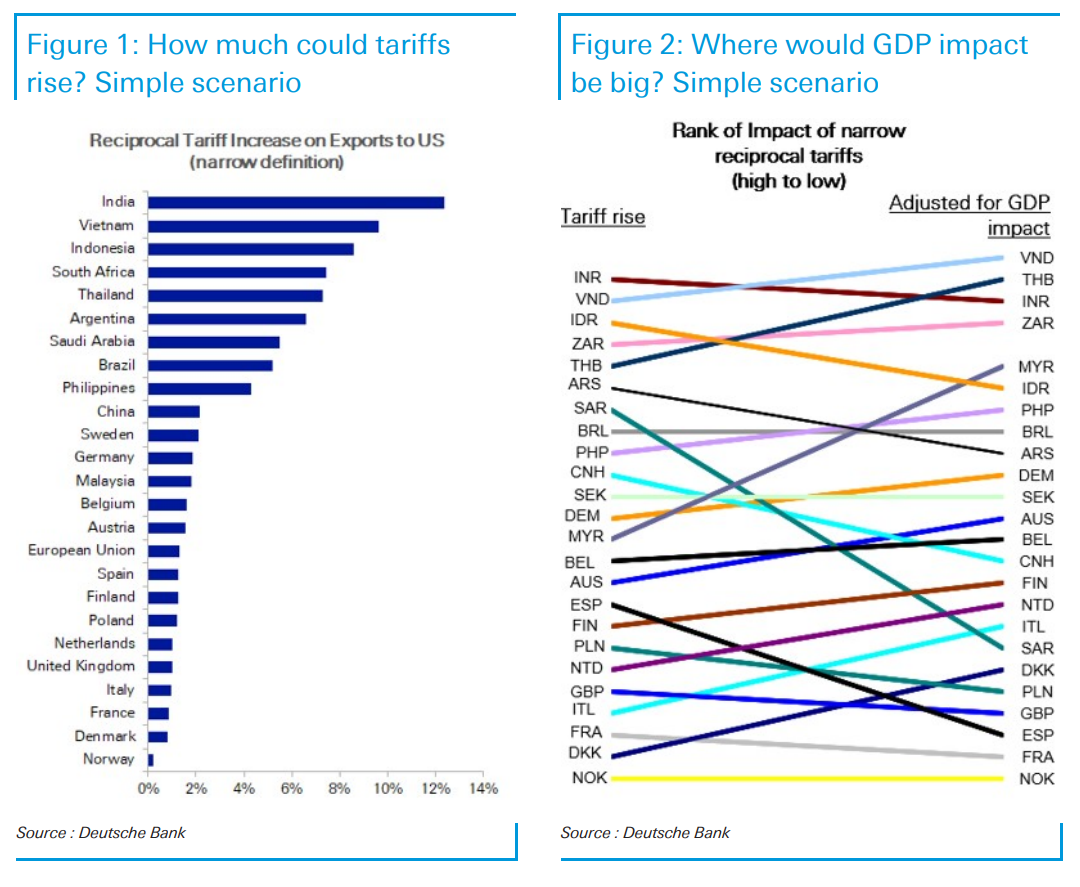

- "Narrow" reciprocity would have a very small impact. Taken as a literal interpretation of the US replicating other countries' tariffs on its own imports, DB calculates (using 10,000 tariff lines) that the average weighted increase in the US rate would be only 2%. The reason is simple: the starting point of global tariffs is already very low; even if the US matches the rest of the world, the impact would be minimal. Still, some countries would be impacted more than others. The charts below show where tariffs would go up the most, but we also need to adjust by the relative importance of US trade in that country's GDP. Vietnam, Thailand and India show up as the most vulnerable.

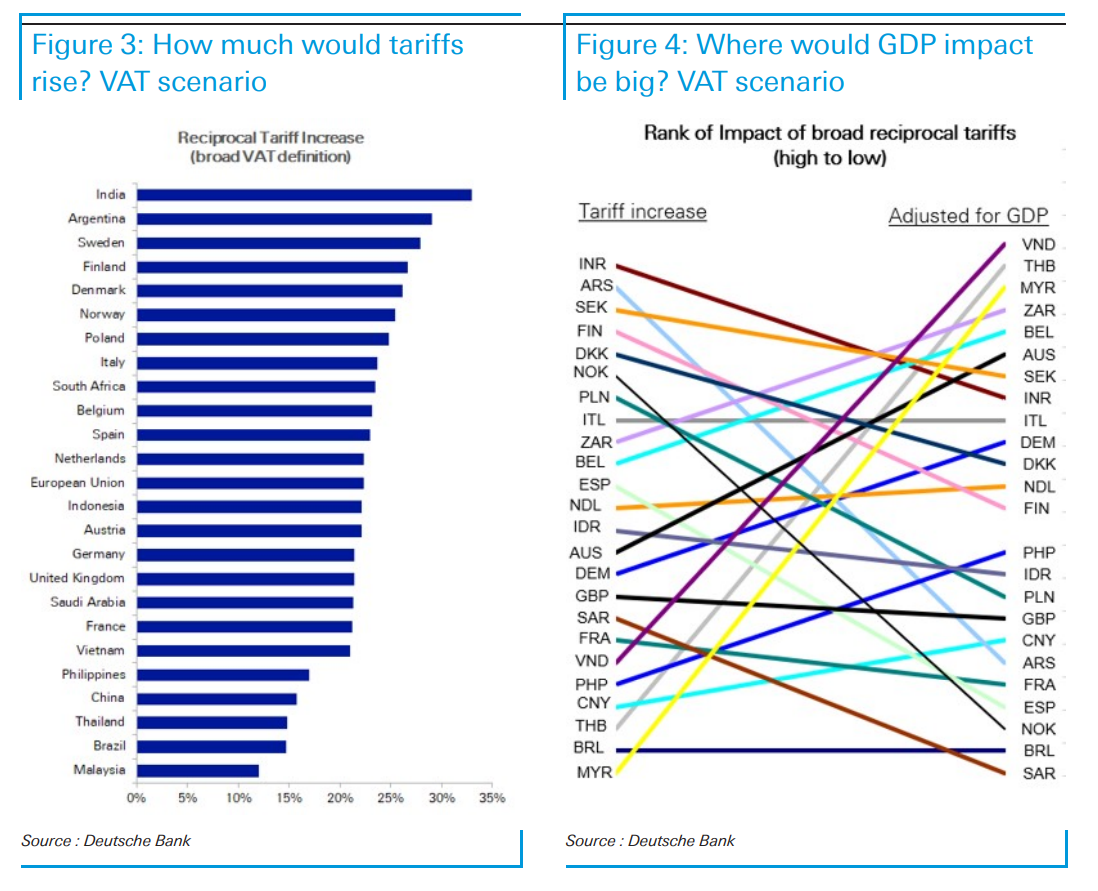

- A broad interpretation could be much more damaging. But are reciprocal tariffs more broadly defined? In an interview last week, NEC Chair Kevin Hassett emphasized the high burden of European taxation on US companies, with President Trump making frequent references to European VAT as well as non-tariff barriers. If reciprocal tariffs are applied on a VAT basis (note that a US importer does have to pay VAT at the point of entry), European countries would be much higher on the list of impacted countries given high consumption taxes. The overall US tariff rate would increase by more than 10% (figures below).

- Timeline unlikely to be immediate. Steel and aluminium tariffs will likely be based on Section 232 national security grounds, which place little restriction on executive authority and can be implemented immediately. They will affect only six countries (Canada and Mexico being the most impacted) given the US already applies such tariffs to the rest of the world. Broad-based reciprocal tariffs are most likely under a Section 301 investigation or Section 338 authority. Both routes were explicitly mentioned in the tariff memo issued on the first day of the administration. Given the preparatory work required, it would be surprising if immediate implementation is announced – and it would be a negative surprise if this were the case.

Tariffs and the market.

Throughout this year Saravelos had refrained from taking a strong view on what Trump will do and instead been discussing what the market is pricing in. That USD/CAD and USD/MXN are roughly unchanged over the last ten days without any tariffs going ahead is a useful validation of the conclusion that the market has not been pricing that much in. On DB's framework, EUR/USD tariff risk premium has risen modestly back up in recent days to 2 big figures – without tariffs, fair value is closer to 1.05 – sitting at the midpoint of the 1 - 3 big figure risk premium range seen this year.

Finally, does this week's potential press conference matter? Yes, for two reasons.

- First, because the potential range of outcomes is very wide, depending on how reciprocity is defined.

- Second, because it is notable that President Trump juxtaposed reciprocal tariffs against the universal alternative in Friday's press conference.

Whether this week's events are presented as the closing or opening salvo of the broader tariff approach will be important in any assessment of how much further tariff risk premium can be priced in. |