re <<great up day for gold>> ... and so we must guess that last Friday was a mind-f*ck

below find start of day download from behind the curtain, and I vote for 3,600 intra-year 2025

zerohedge.com

Goldman Raises Gold Price Forecast As Central-Bank Demand Soars, Lease Rates Explode

BY TYLER DURDEN

WEDNESDAY, FEB 19, 2025 - 03:45 AM

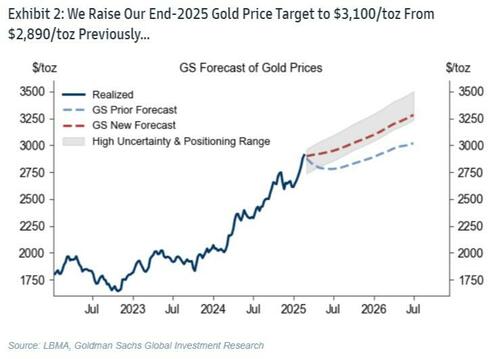

"Structurally higher central bank demand" has pressured Goldman Sachs Precious Metals Research team to shift their year-end 2025 gold price forecast dramatically higher, from $2890 to $3100/toz with Lina Thomas and the team reiterating their 'long gold' trading recommendation.

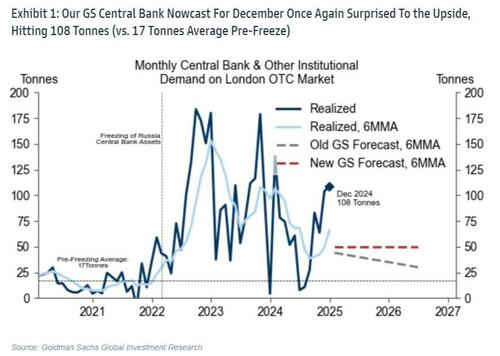

The December reading of our GS nowcast of central bank and other institutional gold demand on the London OTC market came in strong at 108 tonnes in December (vs. pre-2022 average of 17 tonnes) (Exhibit 1).

China was again the largest buyer, adding 45 tonnes. We thus upgrade our central bank demand assumption to 50 tonnes per month (vs. 41 tonnes prior).

[url=] [/url] [/url]

We estimate that structurally higher central bank demand--averaging 50 tonnes per month going forward--will add 9% to the December 2025 gold price.

This, combined with a gradual boost to ETF holdings as our economists expect the Fed to cut twice this year (+ 2%), should outweigh the drag from normalizing positioning (-4%), assuming uncertainty diminishes.

[url=] [/url] [/url]

Additionally, Goldman highlight that fears of US tariffs on gold are reshaping gold flows.

Normally, the exchange-for-physical (i.e. COMEX-London) arbitrage entails that 400oz London bars are sent to Switzerland, melted into 100oz bars, and then shipped on commercial airplanes to the US.

However, with rising tariff concerns, traders are now shipping both 100oz bars via Switzerland and 400oz bars directly from the UK to the US to bypass a potential import duty.

In a sign of the strain on some market players, the interest rate to borrow gold has rocketed.

Manufacturers that use gold are losing money and struggling to price their products as a result, said Wade Brennan, chief executive of Kilo Capital, a firm that lends to commodities companies.

“The situation is very profitable in the short term for some players - the clearing banks and refiners in particular,” Brennan said.

[url=] [/url] [/url]

As The Wall Street Journal explains, investors, banks, miners and jewelers trade the contracts on New York’s Comex exchange, one of the gold world’s twin axes. The U.K., meanwhile, has been the go-to place to buy physical bullion for centuries.

The two markets mostly move in lockstep. When they don’t, traders know they can fly gold to wherever prices are higher.

Banks run big offsetting positions, owning gold bars in London, lending them out to earn a return and hedging the risk that prices fall by selling futures in New York.

JPMorgan and HSBC, which clear gold transactions and store bullion for other banks in London, are the biggest players in this trans-Atlantic market.

The trade appears almost risk-free as long as prices on both sides of the Atlantic are close to each other.

But when prices on the Comex surged above those in London late last year, baking in possible tariffs, contracts that the banks had sold in New York were suddenly underwater.

Adding to the urgency, large losses—even on paper—would require banks to set aside additional capital on their commodities desks, crimping their ability to operate profitably for years.

Banks could close the trade by buying futures in New York, but such a move would mean crystallizing those losses.

Another alternative: flying the physical gold they owned in London to New York and delivering it to the futures contracts’ owners instead, said Robert Gottlieb, a retired gold-trading executive whose LinkedIn posts on the disarray have become required reading in the market.

Once they covered their open positions, the banks had a chance to win big. How? Lock in higher prices in New York through futures and ship even more gold.

JPMorgan alone said it planned to deliver $4 billion of gold this month, according to Comex filings.

How much of the shipment was to cut losses and how much was to make money wasn’t clear.

The risks to Goldman's new gold price forecast remain to the upside on net.

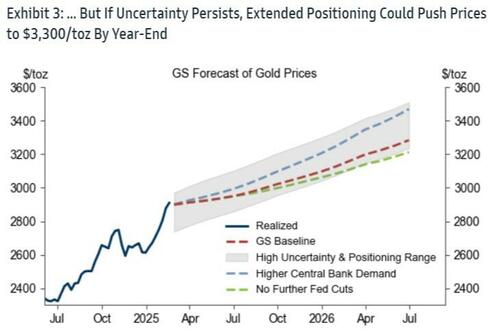

We estimate that if elevated policy uncertainty, including tariff fears, persists, speculative positioning could push gold prices as high as $3,300/toz by year-end, i.e. the top of our high uncertainty & positioning range (Exhibit 3, in gray).

[url=] [/url] [/url]

We also see upside risk to our gold price forecast from stronger-than-expected central bank demand on higher US policy uncertainty. If purchases average 70 tonnes per month (vs. our baseline of 50 tonnes), gold prices could reach $3,200/toz by end-2025 (assuming positioning normalizes).

In contrast, if the Fed kept the funds rate flat, we would expect the gold price to reach $3,060 by end-2025.

We reiterate our 'Go for Gold' trading recommendation.

While a potentially faster decline in positioning-- currently at percentile 87 in a sample since 2014--on a reduction in uncertainty implies some tactical downside price risk, we see significant hedging value in long gold positions because of a potential increase in trade tensions--putting gold prices at the top of our high uncertainty & positioning range--, or rises in Fed subordination risks, financial or recessionary risks.

Finally, Goldman estimates a 5% additional rise in gold prices by December 2025 to $3,250 if concerns over US fiscal sustainability were to grow.

Rising fears of inflation and fiscal risks could drive speculative positioning and ETF flows higher, while US debt sustainability concerns may push central banks, especially those holding large US Treasury reserves, to buy more gold. |