Eggs, cars, solar cells, copper, … toilet paper … misery …

All seem to be headed up

Dunno about the merit of having the entire cabinet / executive branch steered by very extremely wealthy people who never really think before buying daily needs.

I remain agnostic for as long as gold also heading up, ideally at faster pace, especially interesting that as demand from Team USA drops for daily needs the daily goods should experience deflation on this side of the pond, all playing to rise of all have and drop of all needs, in so far as pricing goes.

bloomberg.com

Trump Tariffs on Canada Lumber Risk Pinching Toilet Paper Supply

Trump Says He Is Reevaluating Canada Tariff Plans

By Mathieu Dion and Thomas Seal

27 March 2025 at 19:30 GMT+8

The Trump administration's plan to increase tariffs on Canadian softwood lumber to 27% (with the possibility of additional levies pushing the rate to over 50%) may disrupt the supply chain of toilet paper and paper towels.

Summary by Bloomberg AI

The US relies heavily on Canadian northern bleached softwood kraft pulp (NBSK) for making toilet paper and paper towels, with about 2 million tons imported last year.

Summary by Bloomberg AI

The tariffs may lead to higher prices, supply constraints, and even toilet paper shortages, as well as a cascading effect on the supply chain, including reduced construction activity and a diminished supply of wood chips needed for pulp production.

Summary by Bloomberg AI

Watch

2:29

Trump’s Auto Tariffs, Threats on Allies Intensify Trade War

Supply Lines is a daily newsletter that tracks global trade. Sign up here.

President Donald Trump’s promised tariffs on softwood lumber risk disrupting the supply chain for something nobody wants to be caught without: toilet paper.

The Trump administration plans to almost double duties on Canadian softwood lumber to 27%, with the possibility of additional levies pushing the rate to more than 50%. While Trump advocates for new tariffs partly to bolster US manufacturing, they may also hit the availability of northern bleached softwood kraft pulp, or NBSK, a key component in making toilet paper and paper towels.

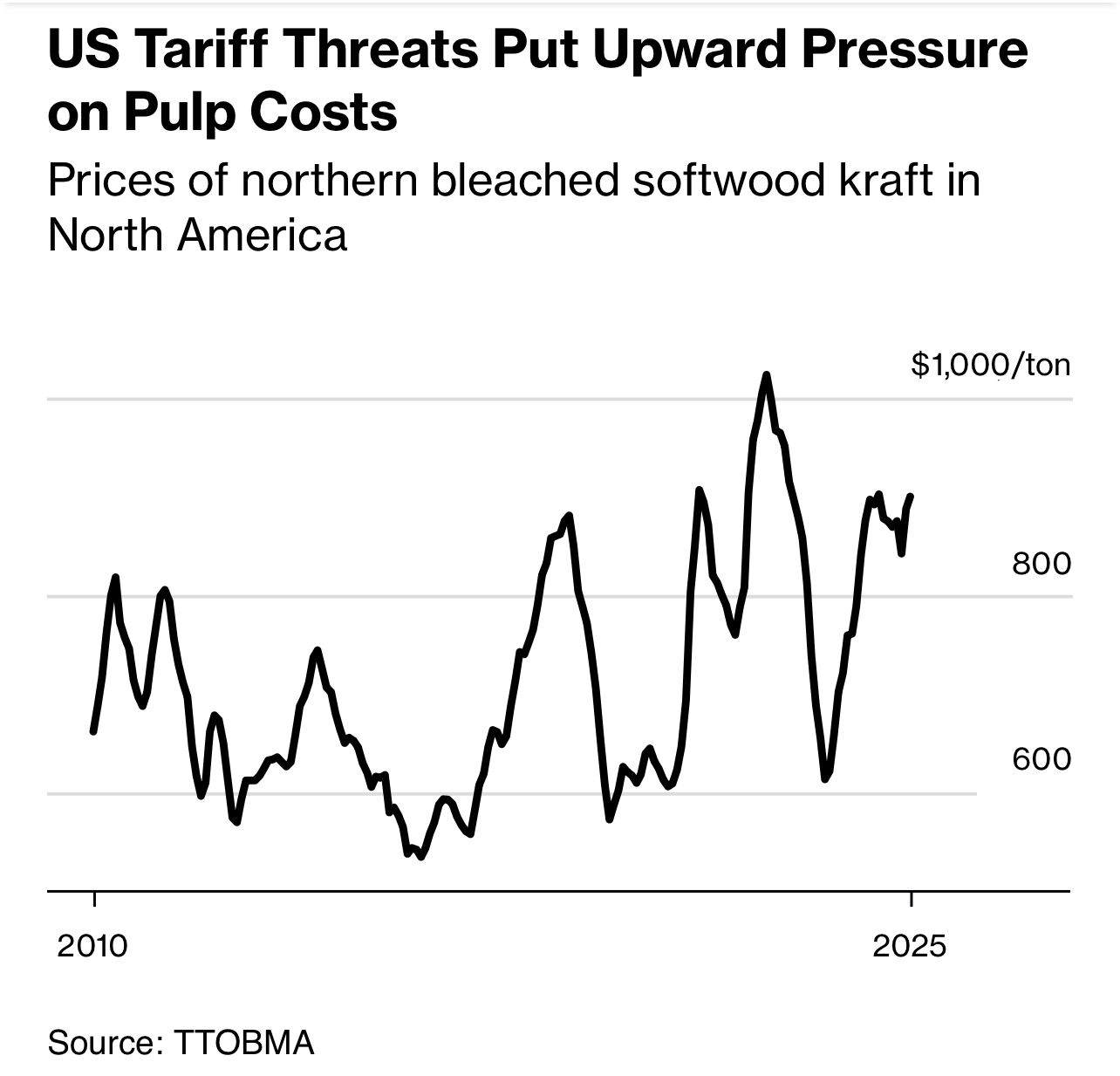

US Tariff Threats Put Upward Pressure on Pulp Costs

Prices of northern bleached softwood kraft in North America

Source: TTOBMA

NBSK constitutes about 30% of standard US bathroom tissue and half of a typical paper towel, and is currently sourced primarily from Canada, said Brian McClay, chairman of TTOBMA, which tracks the global pulp market. He added that the US imported about 2 million tons of Canadian NBSK last year, highlighting the longstanding reliance of American paper-goods producers on pulp from their northern neighbor.

“Some of these mills in the United States, some of the big branded products, not only want softwood pulp from Canada, they want softwood pulp from this particular mill — they’ve been using it for 30 years and they will not change,” McClay said.

“If Canadian pulp mills close because they don’t have the fiber supply, I can’t think of any other option for them — they just can’t switch the recipe around,” he said.

The scenario risks reviving painful memories of pandemic-era toilet paper shortages, when store shelves were stripped bare amid panic buying. Another possibility: higher prices at the checkout counter.

Empty shelves usually stocked with toilet paper at a grocery store in 2020.Photographer: Dan Brouillette/Bloomberg

Trump has long promoted tariffs as a tool to bring manufacturing back to the US, and he’s repeatedly said his country doesn’t need Canadian lumber. But that stance doesn’t account for the specific qualities of Canadian softwood pulp, which industry executives say can’t be easily substituted with American alternatives. NBSK is prized for its tensile strength.

“They don’t buy our products for our pretty eyes,” said Frederic Verreault, vice president of corporate affairs at Les Chantiers de Chibougamau Ltee., a Quebec wood processor. “They buy our products because they are the best and the most integrated into their factories.”

The tariffs also risk sparking a cascading effect on the supply chain. Higher lumber costs may lead to reduced construction activity, resulting in fewer trees being harvested and, consequently, a diminished supply of wood chips needed for pulp production. This shortage would potentially drive up production costs for tissue manufacturers and lead to supply constraints.

If import taxes on lumber exceed 50%, as they’re currently on track to, “that’s going to put some sawmills out of business, and that’ll reduce the supply of wood chips,” McClay said. “Because we don’t really cut trees for making pulp in Canada, we depend on residual chips from sawmills. It would certainly boost the cost and probably reduce output.”

Supply-Chain WoesSawmills are difficult to adjust so they typically run either full tilt or not at all, said Jean-Francois Samray, the head of the Quebec Forest Industry Council.

“It’s like pipelines, it’s like power grids: It’s all full, or all empty,” he said.

The softwood industry operates in a “pure and perfect competition market,” he said. “So in a market like that, there will be temporary closures, reduced production,” which will have an “effect on continental supply and demand.”

A tractor trailer carrying logs of wood near the Canada-US border.Photographer: Graham Hughes/BloombergJulie Landry, vice president of government affairs for the American Forest & Paper Association, said tariffs could “disrupt our complex cross-border supply chains” and that the industry cannot “predict outcomes should they fully go into effect.”

Amid a long-running trade dispute, the US currently applies duties totaling more than 14% on Canadian lumber. One of them is set to increase this year, taking the cumulative burden to almost 27%, according to a US Department of Commerce proposal. The White House’s threatened 25% tariffs on many Canadian goods would mean import taxes totaling about 52%.

And that’s before the conclusion of a Trump-ordered investigation into national security concerns around lumber imports, which could mean even more tariffs.

On April 2, a US delay in applying the 25% levies to goods covered under its trade deal with Canada is due to expire. The same day, Trump has pledged to unveil additional sweeping tariffs to make US trade with countries around the world “reciprocal.”

The escalating trade tensions have left industry giants such as Domtar Corp., which makes pulp and paper products on both sides of the border, watching closely.

“Free trade between Canada and the United States benefits consumers,” said Antoine Kack, a company spokesperson. |