re <<years long bear market unfolding>>

... there must ALWAYS be a bull market somewhere irrespective of however many bear markets there might be, especially if we are talking about sustained-bear slashing

The capital must seek salvation

GetMoreGold and ...

bloomberg.com

Hong Kong Tops India in Share Sales This Year, First Time Since 2021

By Bloomberg News

30 March 2025 at 09:00 GMT+8

Hong Kong has become the world's second-largest market for share sales this year, surpassing India, with first-quarter proceeds from initial public offerings, block sales, and share placements reaching over $16 billion.

Summary by Bloomberg AI

Chinese companies such as BYD Co. and Xiaomi Corp. have taken advantage of rebounding stock prices, contributing to Hong Kong's surge in share sales.

Summary by Bloomberg AI

The US, Europe, and India have seen varying levels of activity in their share sales markets, with the US experiencing a 10% decline, Europe seeing a 21% increase, and India's deals nearly halving to $6.9 billion.

Summary by Bloomberg AI

Watch

Hong Kong overtook India to become the world’s second-largest market for share sales this year, wresting the distinction for the first time since 2021 after Chinese companies such as BYD Co. and Xiaomi Corp. took advantage of rebounding stock prices.

First-quarter proceeds from initial public offerings, block sales and share placements in Hong Kong soared 11-fold from a year ago to more than $16 billion, trailing only the US, according to datacompiled by Bloomberg. Indian deals nearly halved to $6.9 billion, slipping below those of Japan and the UK as the subcontinent’s stock market slumped. The last time Hong Kong was No. 2 was in the second quarter of 2021.

Hong Kong Back on Top

HK overtakes India as Asia's top market for share sales

Source: Bloomberg

Note: Share sales include IPOs, block sales and share placements. Figures are as of March 29, HK time.

After years struggling with a drought of deals, Hong Kong has roared back as Asia’s most bustling financial center thanks to its buoyantstock market. With mega offerings like CATL’s potential $5 billion-plus listing around the corner, activity isn’t looking like it will slow down anytime soon.

“The market has returned in a very big way,” said Richard Wang, a partner and head of China equity capital markets at the Freshfields law firm. It’s been “really hot on both IPOs as well as follow-on offerings,” he said.

It’s a remarkable turnaround for a city that had suffered through a litany of woes over the years — including protests, some of the world’s harshest Covid-19 restrictions and China’s prolonged economic slump — which resulted in many bankers and lawyers to lose their jobs.

Chinese firms are now pouncing on the stock-market rally. Hong Kong’s Hang Seng Index has been one of the world’s best performers this year after the emergence of DeepSeek’s ChatGPT-like AI model reawakened global enthusiasm for China’s technology sector.

In March alone, electric-vehicle giant BYD and smartphone-to-EV maker Xiaomi together raised more than $11 billion in what were Hong Kong’s biggest share sales in years.

Investors couldn’t get enough. Chinese bubble-tea maker Mixue Group’s recent IPO was so popular that mom-and-pop day traders sought to borrow a record HK$1.8 trillion ($231 billion) to buy the stock — more than 5,000 times what was being offered. The Hong Kong regulator has since taken steps to curb such a frenzy.

A Mixue store in Beijing, China. Its IPO triggered a frenzy in Hong Kong this year.Photographer: Na Bian/Bloomberg“

The IPO market had been dormant for a while, and it’s waking up,” said Vikas Pershad, a fund manager at London-based asset manager M&G Investments, which bought Mixue shares as a cornerstone investor. “We see many more opportunities in China on the horizon.”

One of those opportunities will be Contemporary Amperex Technology Co. Ltd., the world’s largest EV-battery maker. CATL just clinched China’s approval to proceed with its Hong Kong listing, clearing a major hurdle to proceed with its share sale. CATL is a big reason why Bloomberg Intelligence is predicting Hong Kong IPO proceeds to double to more than $22 billion this year.

But risks remain. The Hang Seng Tech Index nearly slumped into a correction this week after recent earnings failed to impress investors.

Meanwhile, it’s been a reversal of fortune in India, where the benchmark NSE Nifty 50 Index had risen for nine consecutive years. But it started declining in late September amid an unexpected slowdown in economic growth and a slew of analysts downgraded their expectations for corporate earnings.

That put a damper on the country’s stock offerings, which prior to this year had topped Asia for seven straight quarters. The number of deals in India has dropped by 37% this year.

“There was more of an opportunity to take some money off from some of our positions,” said Nitin Mathur, an associate investment director at Fidelity International. His fund didn’t participate in any India IPOs this year, he said.

Mathur said things may pick up later in the coming months, when big deals are expected to hit the market. It’s a view shared by Pratik Loonker, Axis Bank Ltd.’s head of ECM, though he said he expects 2025 to ultimately be a down year for India.

“Even though India was somewhat muted in the first quarter, the engine remains powerful,” said James Wang, head of ECM for Asia, excluding Japan, at Goldman Sachs Group Inc.

A good barometer for investor appetite will probably come soon in the upcoming IPO of LG Electronics Inc.’s Indian unit, which may raise as much as $1.7 billion. Others in the pipeline include Prudential Plc’s Indian joint venture and Tata Group’s financial-services unit. —Dave Sebastian and Julia Fioretti

US

In the US, proceeds from share sales fell 10% to around $50 billion in the first quarter, as President Donald Trump’s tariff threats kept markets volatile and sapped investor appetite for risk. Some marquee IPOs flopped and half of the 10 largest debutants this year are now trading below what they sold their shares at.

“The reality is the discount is probably a little bit wider, the deal size a bit smaller and there may be a sense of conservatism going during a more volatile market,” said Neil Kell, Bank of America Corp.’s chairman of ECM for technology, media and telecommunications. “We feel pretty good about the quality of assets that are coming but it’s a question of how deals are structured.”

The market was dealt another blow when AI darling CoreWeave Inc., which was expected to open things up for tech deals, was forced to walk down its IPO ambitions. It ended its debut session exactly where it sold investors shares in a deal that brought in just $1.5 billion, compared with a $4 billion target weeks ago.

The choppy performances and tough backdrop has forced companies to rethink their entry to public markets. For example, Genesys Cloud Services, backed by Permira and Hellman & Friedman, postponed its planned listing until later this year.

Despite the rough start, some high-profile companies are gearing up to test the waters. Since mid March, Klarna Group Plc, StubHub Holdings Inc., EToro Group Ltd. and Ategrity Specialty Insurance Co. have made their listing plans public. If they follow through in the coming weeks that would bolster proceeds by billions of dollars.

Still, bankers are working to be nimble as companies keep a close eye on their publicly-traded peers and a choppy market.

“The environment has changed. You have to be reactive to that environment,” said Eddie Molloy, global co-head of ECM at Morgan Stanley. “Volatility tends to make us think a little more around what the right entry point is and we’re going to be navigating the timing on a bunch of deals.” —Bailey Lipschultz

Europe

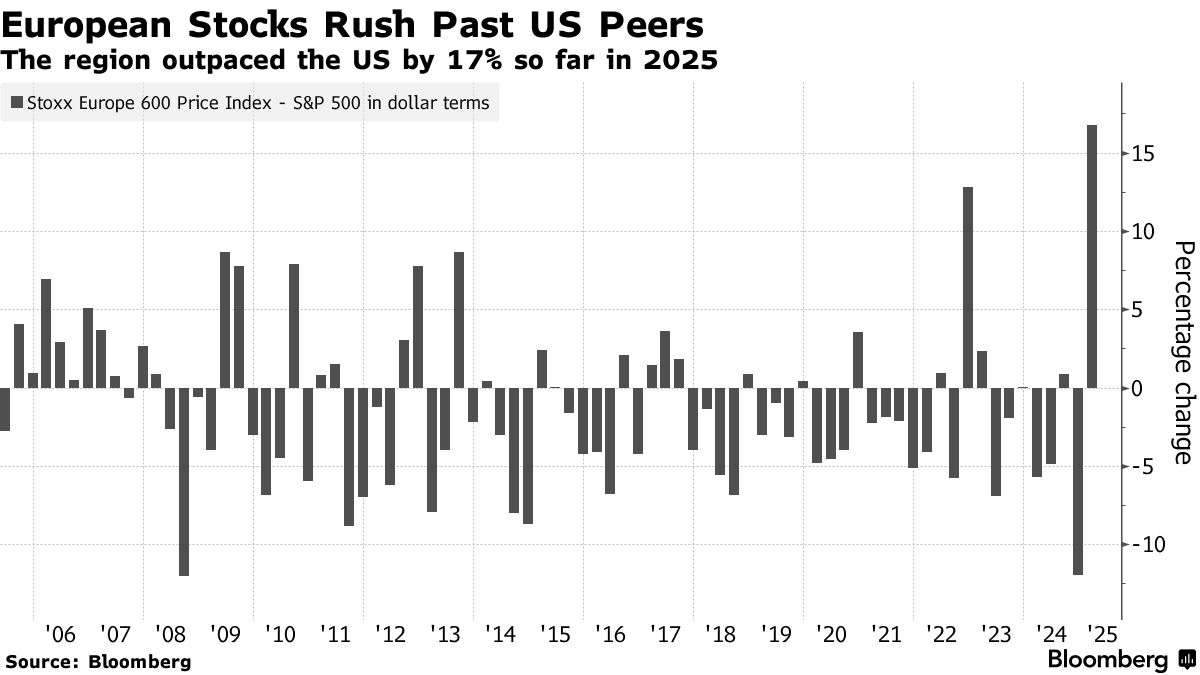

In Europe, share sales climbed 21% to more than $34 billion — the highest in years — after European stock markets outperformed the US this quarter, and places like Germany moved to unlock billions of euros in investments to revive its economy.

Block sales, in particular, stood out. They had their busiest start in the region in a decade, totaling $26.8 billion, according to data compiled by Bloomberg.

“If you’ve been underweight Europe, block trades are the easiest way to gain quick European exposure,” said Andrew Briscoe, head of ECM syndicate at Bank of America for Europe, the Middle East and Africa. “You’ve probably seen an uptick in interest from US and international investors.”

While optimism drove some of those deals, the opposite also held true as some cashed in on their gains. For instance, Switzerland’s Sandoz and Italy’s Agnelli family sold about $3 billion of stock in Novartis AG and Ferrari NV last month.

Things were quieter on the IPO front, with European first-quarter listings raising 35% less than they did a year earlier, according to Bloomberg data. And with big IPOs, their share performances have been a mixed bag. Asker Healthcare Group AB has surged 17% since its Stockholm debut last week, while Spain’s HBX Group International Plc is trading just below its issue price.

While the recent market turmoil was a catalyst for follow-on offerings, it also got in the way of the IPO plans of some companies backed by private equity. German drugmaker Stada Arzneimittelpostponed its planned Frankfurt listing until September due to volatility. Meanwhile, lender Oldenburgische Landesbank AGscrapped its IPO plans in favor of a tie-up with another bank.

Meanwhile, in the Middle East, two block trades – one involving Abu Dhabi’s national oil company selling a stake in its gas unit, and another where a Saudi tech investor exited from Rasan Information Technology Co. – raised around $3.1 billion combined.

Saudi Arabia was the region’s most active venue for IPOs this year, raising $1.1 billion across nine deals. The United Arab Emirates and Oman each saw only one, but there are several marquee listings lined up such as Abu Dhabi national carrier Etihad Airways PJSC.

“It’s been such a one-way trade into the US for quite some time at the expense of Europe and Asia,” Morgan Stanley’s Molloy said. “As the US becomes a bit more volatile and uncertain there’s more activity and focus around Europe and Hong Kong specifically given some of the stability out of China.” —Pablo Mayo Cerqueiro and Laura Gardner Cuesta |