re <<geeezus>>

bloomberg.com

Trump Promised a Manufacturing Boom, But Industries Aren’t Sure

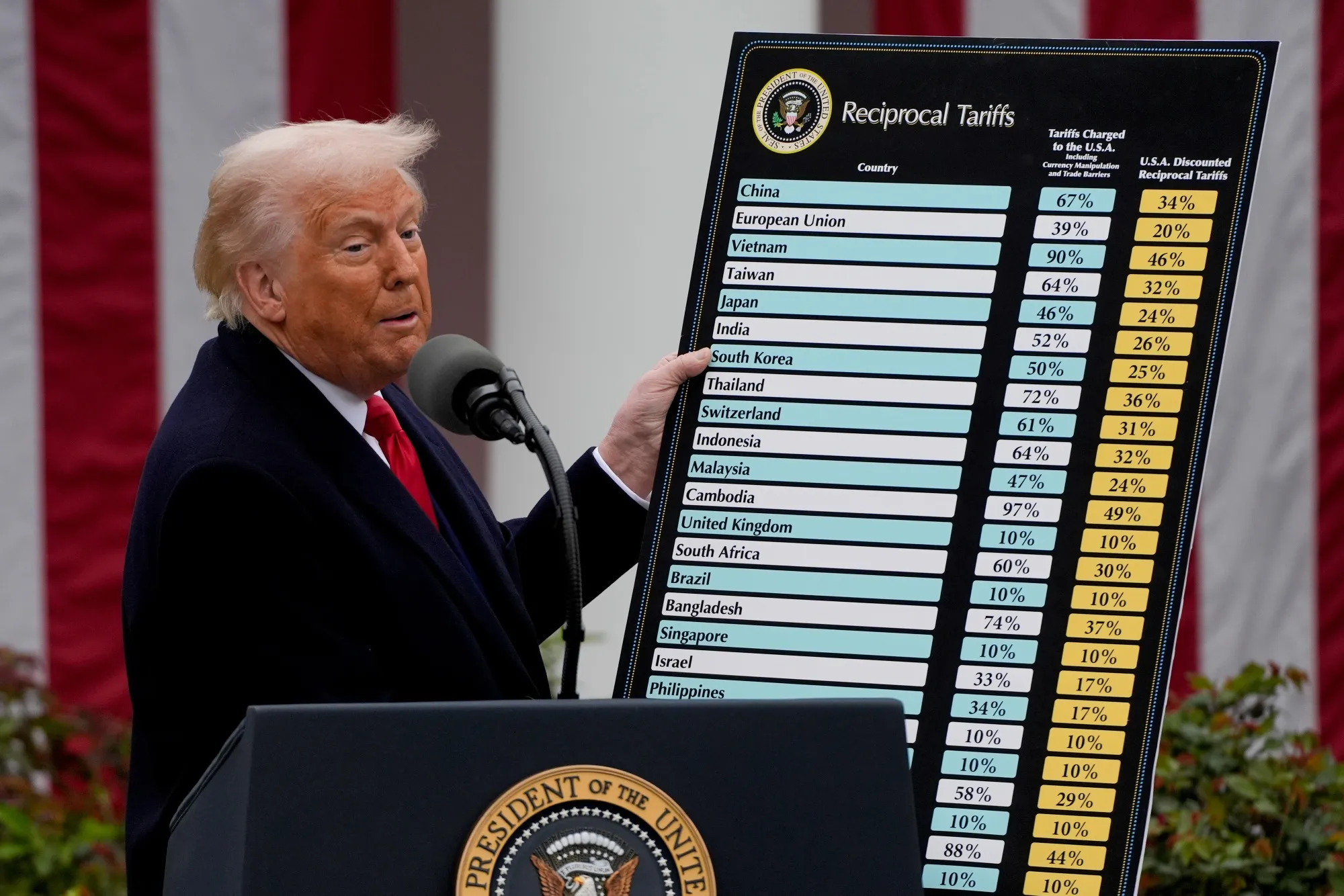

Donald Trump holds a reciprocal tariffs chart in the Rose Garden on April 2.Photographer: Kent Nishimura/Bloomberg

By Catherine Lucey

5 April 2025 at 22:00 GMT+8

President Trump's tariff strategy is questioned by manufacturing advocates and economists, who argue that it may not lead to a resurgence of domestic manufacturing due to supply chain issues, high costs, and workforce needs.

Summary by Bloomberg AI

Trump's approach is seen as a gamble, with potential short-term pain outweighed by the promise of a restructured US economy, but critics argue that the tariffs may not be enough to convince companies to move operations to the US.

Summary by Bloomberg AI

The tariffs have already sparked uncertainty and criticism from manufacturers, with some seeking exemptions and others warning of the impact on investment, jobs, and supply chains.

Summary by Bloomberg AI

President Donald Trump has vowed his historic tariff blitz would revive domestic manufacturing, but industry worries about his approach are raising fresh doubts about whether he can deliver on his promise of an economic boom.

In the Rose Garden on Wednesday, Trump declared “jobs and factories will come roaring back into our country” and predicted new “golden age” in America. Since then, he has stood by his decision to hike US tariffs to their highest levels in more than a century, even as the move sparked a global market meltdown.

Some manufacturing advocates and economists questioned Trump’s underlying logic, saying supply chain issues, high costs, workforce needs and the laborious process of moving production to the US stand in the way. Continued uncertainty about Trump’s long-term policy could also have a chilling effect, they said.

If the tariffs aren’t enough to convince companies to move operations to the US, it could mean Americans bear the heavy burden of the economic havoc Trump’s announcement unleashed without the promise of future benefits. That could heighten political risks for Trump and his fellow Republicans.

“While we certainly agree we should aggressively pursue any policy that helps us make things in America, the idea that you can move every part of the manufacturing process back to the US does not align with reality,” said Kip Eideberg, senior vice president for the Association of Equipment Manufacturers.

Eideberg, whose group represents makers of equipment used in construction, agriculture, mining, utilities and forestry, added that with businesses relying on components and labor from around the world, “you can’t just pick all that up and just move it over the US.”

Economists say companies are not going to commit to the time and investment required to reshore production to the US if they don’t think the tariffs are permanent, and Trump has vacillated between saying his policies will never change and he’s open to negotiations.

Economic gambles

“We remain very skeptical that tariffs will trigger a large wave of reshoring, given the huge labor cost savings available by producing goods overseas, as well as uncertainty about how long protectionist policies will last,” Samuel Tombs, chief US economist at Pantheon Macroeconomics, said in a note.

The White House pushed back on criticism Friday. Top Trump policy adviser Stephen Miller declared on Fox News that “changes in advanced manufacturing technology, 3-D printing, robotics, artificial intelligence” make it “more and more affordable to manufacture, produce and build at scale in the United States.”

With his tariff strategy, Trump is betting both economically and politically that any short-term pain over tariffs is worth it for a restructured US economy. Early in his presidency, President Joe Biden made a similar gamble, passing a series of infrastructure and pandemic relief bills that he said would eventually boost the economy even as Americans grappled with inflation.

Joe Biden signs the Infrastructure Investment and Jobs Act in 2021.

Photographer: Stefani Reynolds/Bloomberg

In Biden’s case, voters did not see impacts quickly enough to inspire them to hand control of Washington to Democrats in 2024. Trump is constitutionally prohibited from serving a third term. But if voters sour on his policies, that could spell trouble for his party in the 2026 midterm elections or the 2028 presidential race.

How long?

“It makes people nervous,” said Dennis Darnoi, a Republican strategist in Michigan, where there will be a race for an open Senate seat and governor in 2026. He said the question is where political moderates land on Trump’s policies. “How long are they going to give him before things start to sour?”

A CBS poll released before the tariff announcement showed that 55% of Americans though that the Trump administration was focused too much on tariffs and 64% thought they were not focused enough on lowering prices. That poll also showed that just 23% thought that Trump’s financial policies are making them financially better off.

Aftershocks were evident immediately for manufacturers after Trump rolled out his plan. Levies rose to 46% on Vietnam, a vital location for Apple Inc. and Nike Inc. Cambodia, where Abercrombie & Fitch Co. gets about one-fifth of its merchandise, faces a 49% rate. Indonesia, where Japan’s Panasonic Holdings Corp. operates, was hit with a 32% charge.

Jay Timmons, president of the National Association of Manufacturers said in a statement that the tariffs “threaten investment, jobs, supply chains and, in turn, America’s ability to outcompete other nations.”

Scott Paul, who heads the Alliance for American Manufacturing, a partnership of the steelworkers union and manufacturers, was more bullish.

“There will be adjustment. This will take more than hours or days. It will take more than weeks months or longer,” he said. “I actually think moving forward that things are going to get better, not worse.”

Exemptions sought

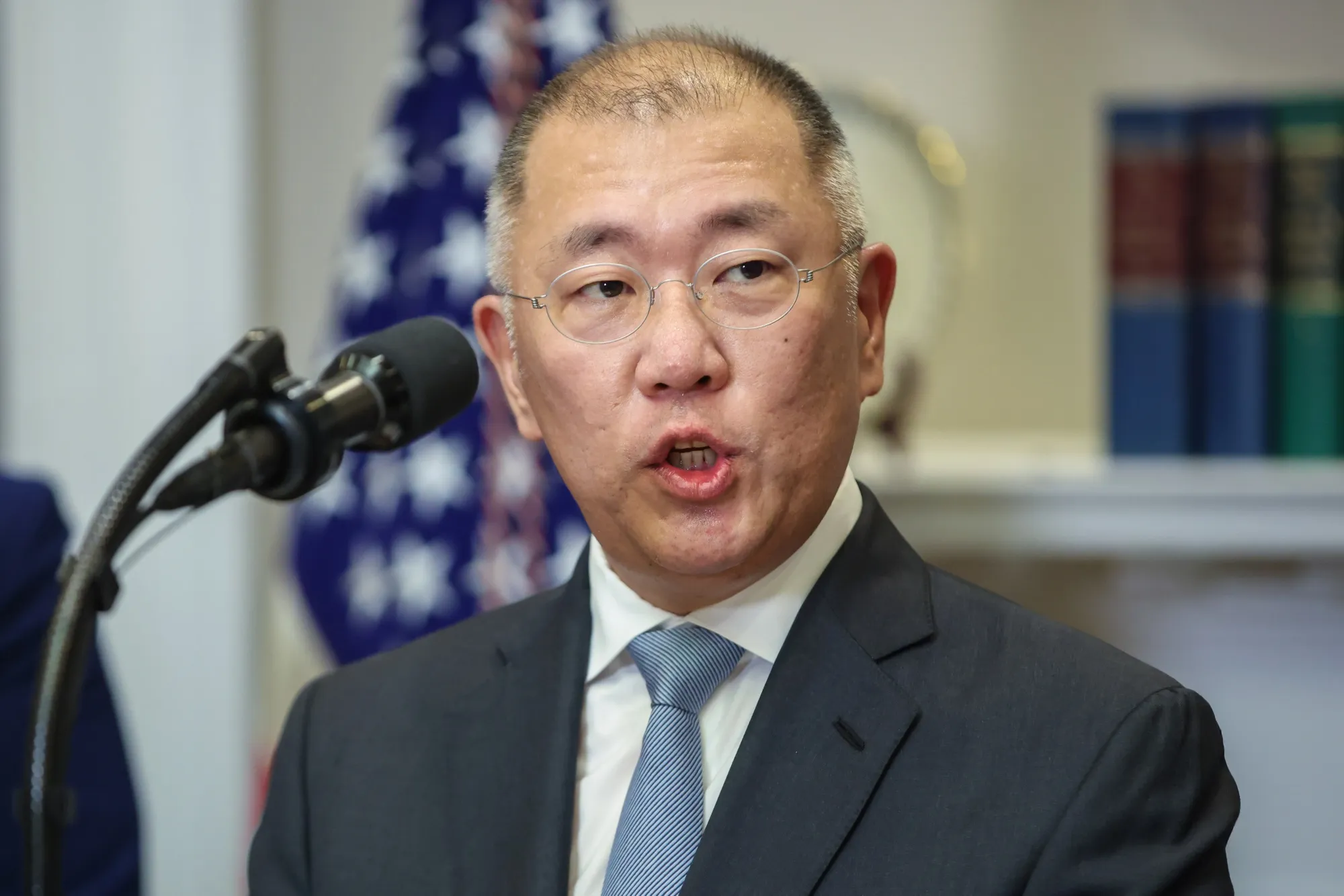

Before the tariff announcement, some companies sought to boost investments in the US. Hyundai Motor Co. announced plans to build a new steel plant in Louisiana last month and did an event with Trump at the White House.

Chung Euisun, chairman of Hyundai Motor Co., announces a new steel plant in Louisiana while speaking at the White House.

Photographer: Samuel Corum/Sipa/Bloomberg

White House spokesman Kush Desai cited investments from companies like Apple and Hyundai as “indicative of how this administration is working with the private sector while implementing President Trump’s pro-growth, pro-worker America First agenda of tariffs, deregulation, tax cuts, and the unleashing of American energy.”

Still, one emerging challenge to bringing manufacturing back is Trump’s own tariffs, companies say.

In recent months, businesses have filed hundreds of requests to the US Trade Representative for exemptions on China tariffs for machinery needed to set up US production lines and that they say cannot be sourced domestically.

Elon Musk

Photographer: Samuel Corum/Sipa/Bloomberg

Among them is Tesla Inc., led by Trump adviser Elon Musk. Tesla filed a series of requests for exclusions just two days before Trump announced his latest duties, arguing that exemptions would help them boost manufacturing in the US.

Another issue is whether the US has the workers to staff more manufacturing facilities. There were 482,000 open manufacturing jobs in February, according to the Bureau of Labor Statistics. In a survey of manufacturers conducted by NAM in the first quarter of 2025, 48.4% cited attracting and retaining a quality workforce as a challenge. And Trump’s crackdown on immigration could also slow labor force growth.

Looking ahead, Trump is hoping to further juice economic growth with an upcoming tax bill. But economists at the non-partisan Congressional Budget Office have cautioned that an extension of Trump’s 2017 tax cuts won’t yield much economic growth because it mainly lowers individual taxes, rather than business levies.

Republicans are still debating what will be included in the bill, but the legislation will likely heavily tilt toward rate cuts and deductions for households, rather than big reductions for corporations.

— With assistance from Shawn Donnan |